Western Canadian Crop Market Update

Click Here To Access 2024/25 Crop Recommendations

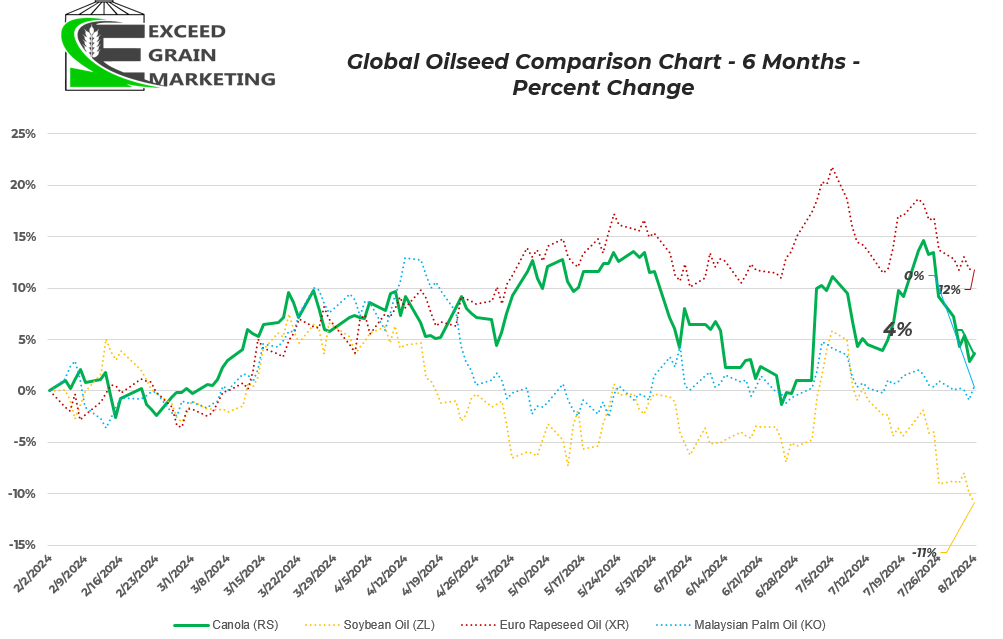

Canola

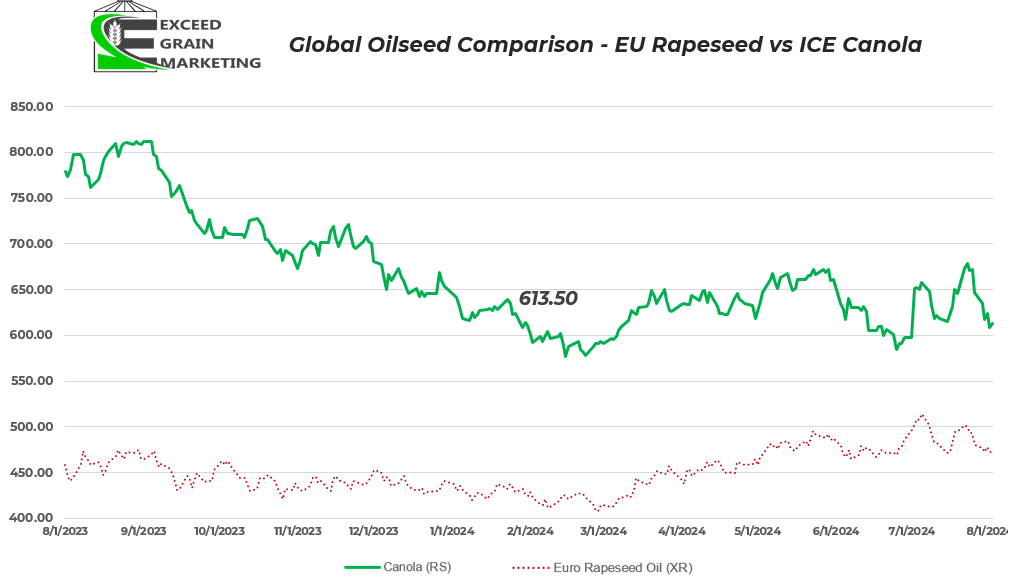

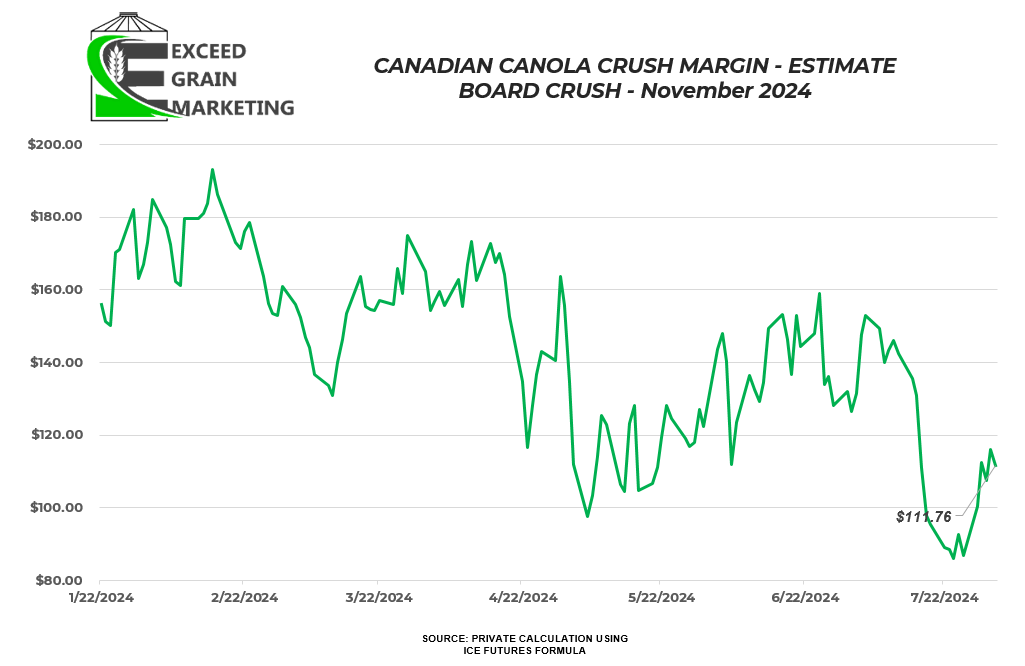

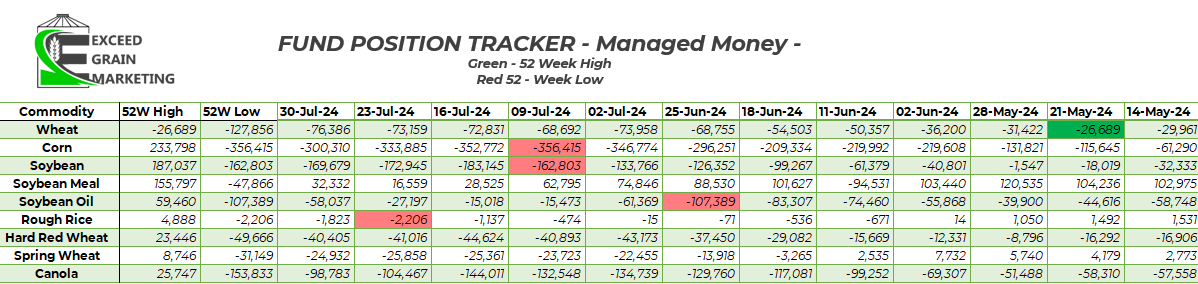

- Canola volatile trade in the past week. $73 per tonne trade range in the past two weeks

- Canola values sitting about $21 per tonne above their February contract lows

- For the short term, rallies need to be sold into if producer is undersold. These rallies will be more challenged as we get closer to harvest. Know your position and where you want to be sold.

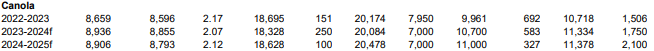

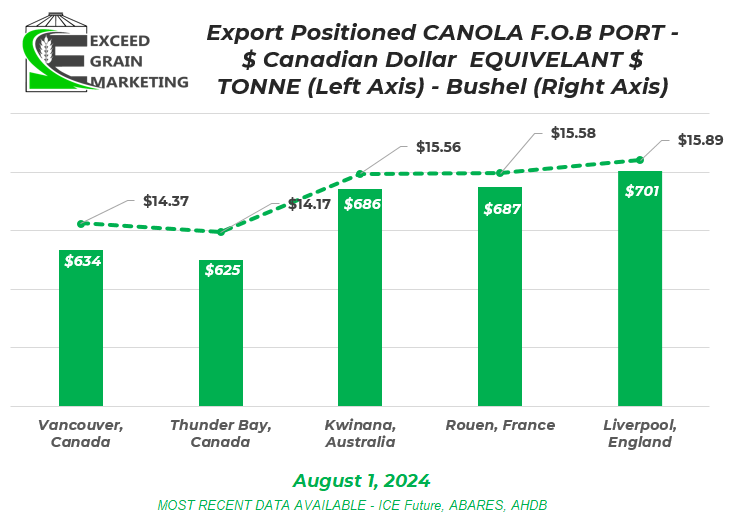

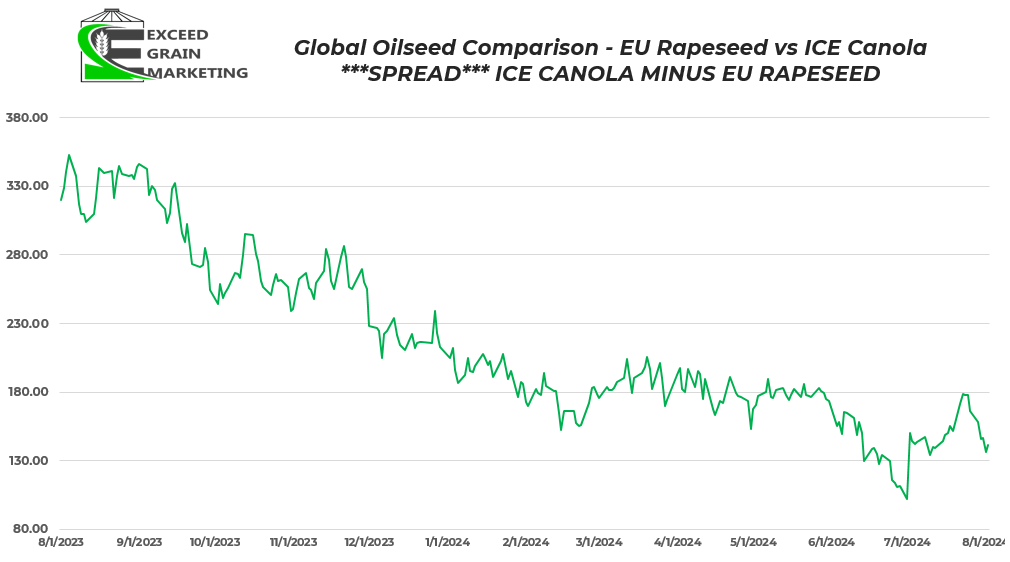

- Canadian Canola sitting cheaper than competitors and compared to last year – See graphic below

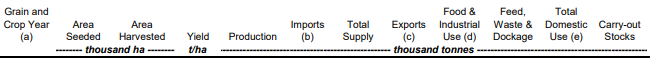

- PRODUCTION:

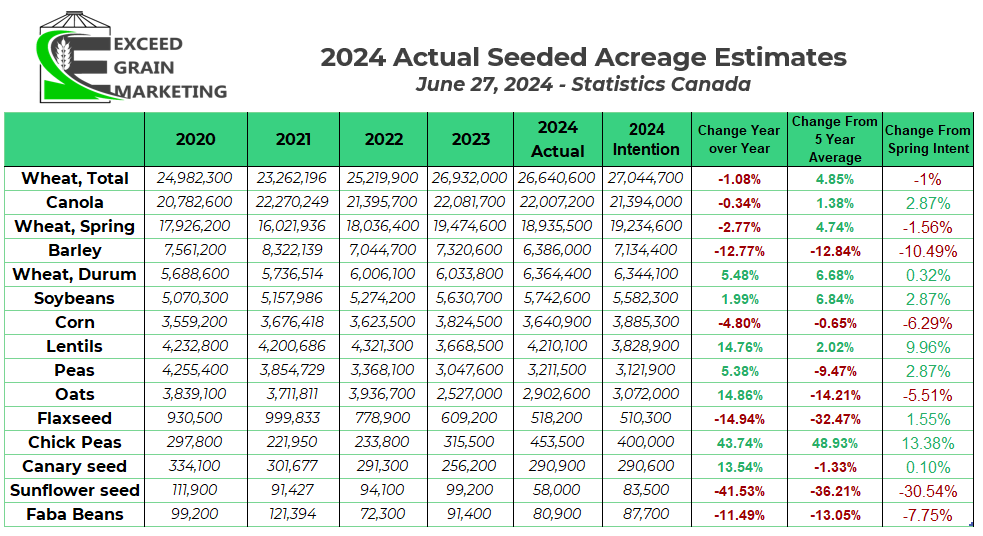

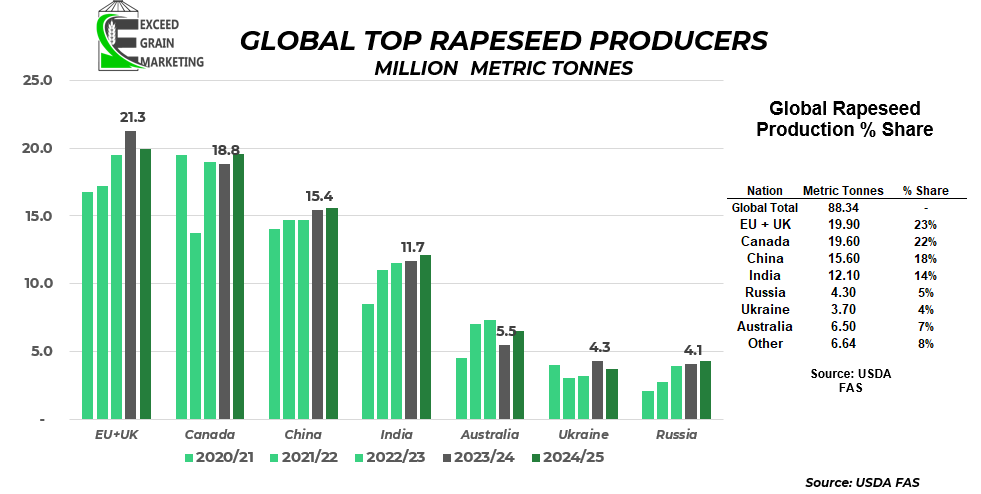

- Western Canadian Crop forecasted to be larger than last year. USDA forecasting a 20mmt crop for Canada

- JULY 22nd Agriculture and Agri-food Canada has the crop at 18.6MMT

- Crop will likely end up in between somewhere. There are some regions with high production potential at this time yet but with July’s heat and rain, the top end yield has been trimmed. Many producers reported a great start to the crop but things dried out in the past 4-6 weeks and heat came intensely during this same timeframe.

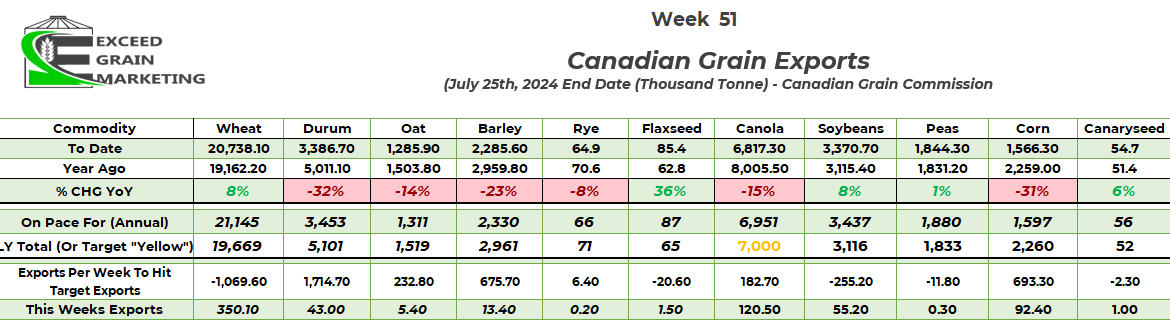

- EXPORTS and USAGE:

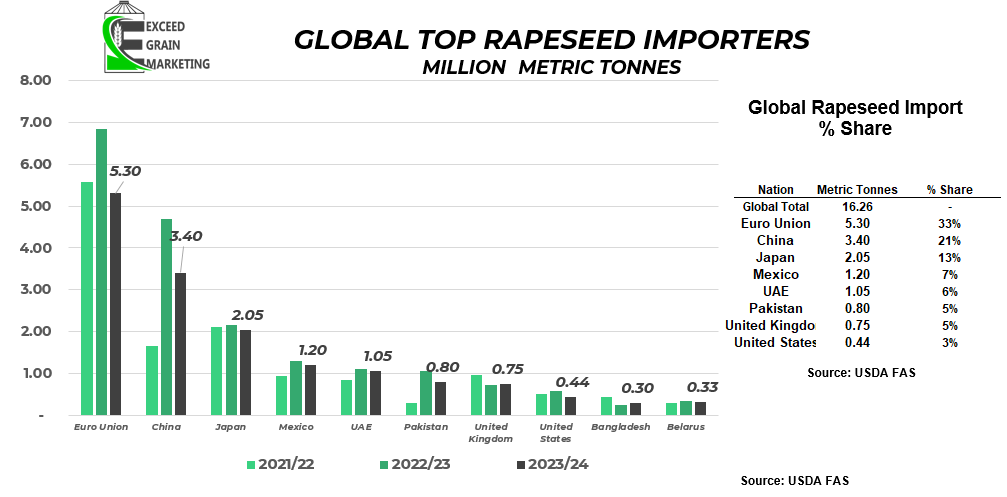

- European Union forecasting a smaller crop than last year and harvest is underway at time of writing. Crop estimates from government agencies state around 19mmt crop. Private sources call the crop closer to 18mmt. EU needs around 25mmt total and larger imports will be required. Canada exported next to nothing this past marketing year to EU. Through the first 11 months of the crop marketing year, we exported 103,000 tonnes to Belgium. Few years ago, it was not uncommon to do 500,000 to 1.5 mmt in years where EU faced crop shortfall.

- OLD CROP: For the 2023/24 canola export program, Canadian canola was much to expensive to compete with Australian Canola for the first half of the export program. By early January, Canadian canola exports were only tracking for 6mmt of total exports, a dismal export number. It was not until exports picked up last half of the year where we came in right around 7mmt.

- AAFC has 2024/25 export forecast at 7.0 mmt. This is viewed as a conservative figure, many private analysts sit around 8.0 mmt assuming Japan, Mexico and European Union will likely be in for more crop, time will tell.

- See Global FOB canola prices below

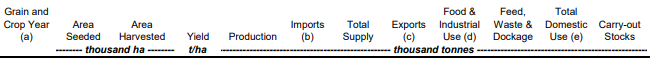

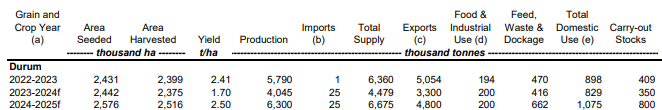

- AAFC Charts below from July 22, 2024 report.

- GOING FORWARDS:

- Harvest will be taking full force here shortly, It is key that traders get a good start to the canola export program. Talks of a CN and CPKC rail strike mid August is a major threat to early grain movement. Global Rapeseed and Canola balance sheet has potential to tighten up longer term, ending stocks already shaping up 9% smaller than last year according to USDA figures. Will mostly depend on what Canadian canola crop comes in at. We know other global production regions well enough already as harvest underway. Early yield reports will be closely watched.

- Australian crop the wildcard here, although their crop is expected to be 200,000 tonnes smaller than last year. This crop is in the ground and will be harvested Oct/Nov/Dec.

Spring Wheat

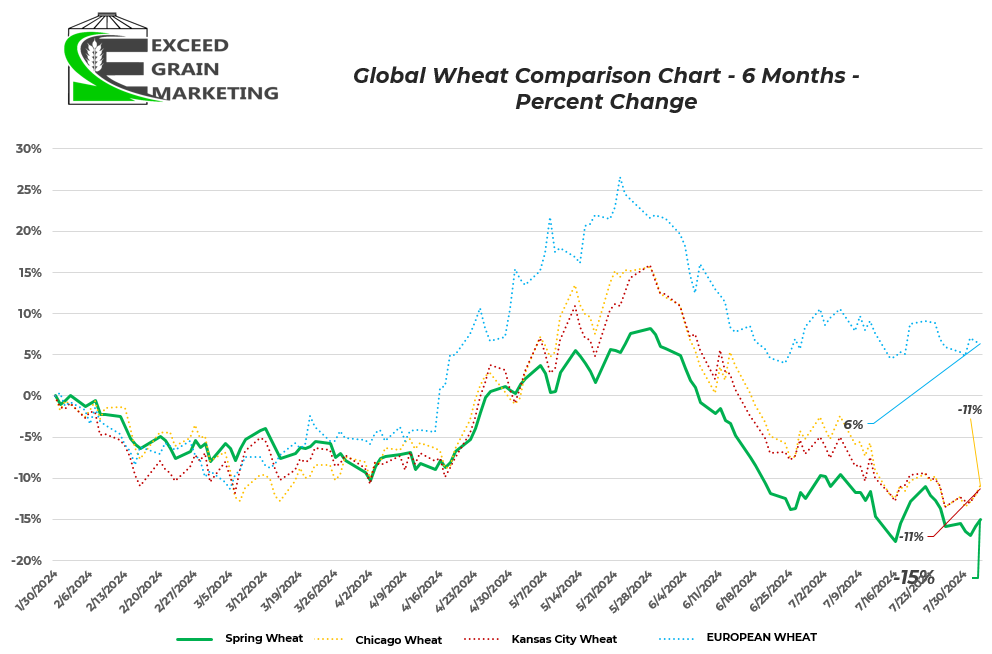

- Spring Wheat values gain 6 cents for the past five trade days on the September contract

- Spring Wheat futures still sit about $1.80 USD per bushel from their late May peak

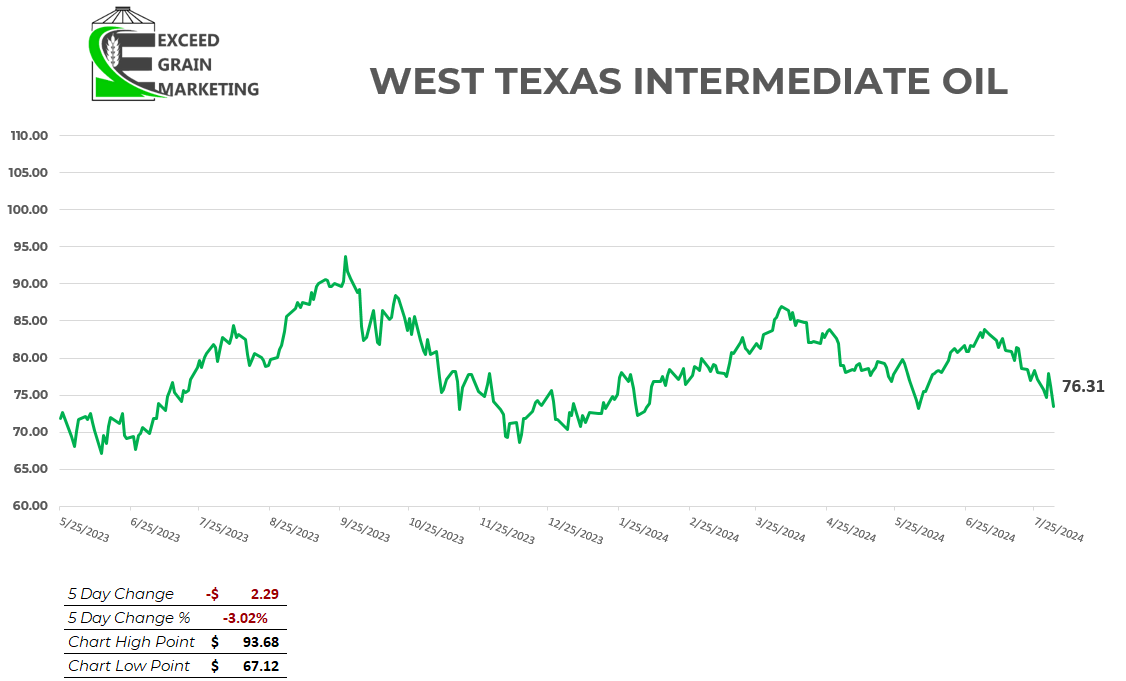

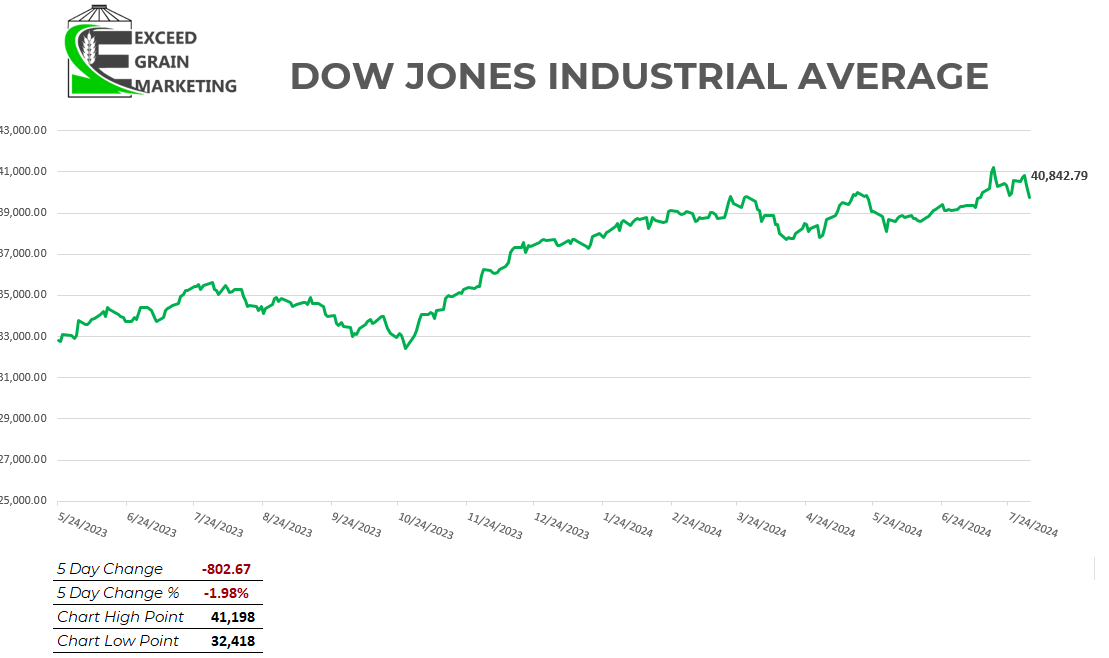

- Wheat, Corn and Soybeans all sitting near levels last seen in 2020

- Markets have been in a downwards trend. Down in 7 of the last 10 weeks

- For the short term, rallies need to be sold into if producer is undersold. These rallies will be more challenged as we get closer to harvest. Know your position and where you want to be sold.

- PRODUCTION:

- Canadian non durum wheat crop expected to be large. 1.2 mmt larger than last years crop. Around 29MMT is expected to be produced according to AAFC’s latest stab at the crop size.

- Wheat will come down to quality. Protein levels and quality will be closely watched. Plenty of producers concerned about potential fusarium infection due to rains around heading and anthesis.

- Global production – Winter wheat crop is mostly off in the United States. Quality was quite good and plenty of good yields reported. US Spring wheat harvest will commence shortly but majority of fields will be ready to go mid August. Market expects a good crop, private tours are touting it to be a record yield in North Dakota.

- Across the pond, wheat quality is questionable at best. Plenty of low protein wheat coming off fields in Russia, Ukraine, Germany, France, Poland. Grading issues a concern over rains at harvest especially in France and Germany.

- EXPORTS and USAGE:

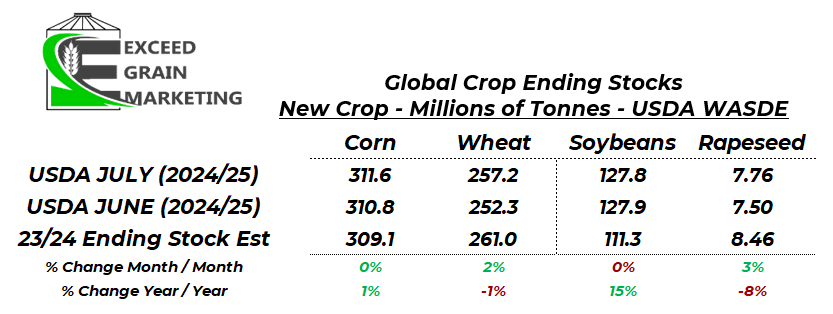

- Global balance sheet for wheat actually tightest in several years. Ending stocks of 257 million tonnes vs 260 to 285 mmt range in recent years.

- Canadian exports last year were particularly strong, not due to cheapness, but due to the quality of the crop. Canadian crop was blended and fit a gap in the market. Exporters looking to hit the same niche this year and push wheat exports as strong as they were last year.

- AAFC has 2024/25 export forecast at 20.5 mmt. This is viewed as a strong year and will keep ending stocks in check.

- AAFC Charts below from July 22, 2024 report.

- GOING FORWARDS:

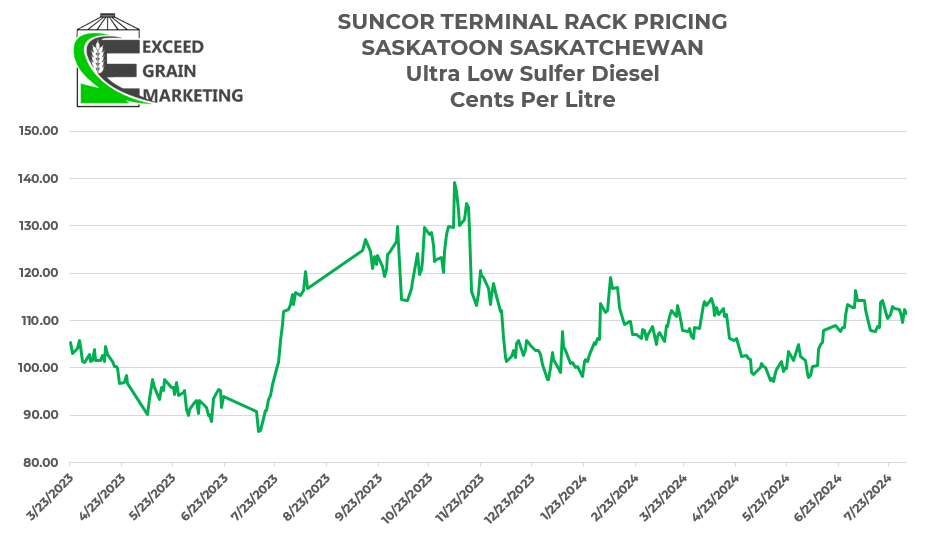

- Harvest will be taking full force here shortly, wheat prices are at some of the lowest levels in 4 years. Harvest pressures may last longer than anticipated especially if there is any rail strike or logistical issues. We are 30% sold new crop overall and will await quality results before making next cash sale move.

Oats

- Oat prices are sit at $3.75 to $4.50 new crop across the prairies. The $4.50’s belong to the glyphosate free market. Oat market prices have followed other ag commodities lower. Oats were anticipated to have been heavily sold by producers early in the production year when values were about $0.50 to $1.00 per bushel higher than todays values.

- Oat crops loosing top end yield with the heat and dryness. Producers beginning to mention worried about test weight with lack of any precipitation towards the end of the filling period.

- Lowered yield in recent weeks should keep oat inventories in check. Front end demand is largely covered off for oats although and pricing will depend on post harvest demand and how this crop actually shakes out. AAFC is calling for a carryout of just 350,000 tonnes which would be considered very tight. Private analysts are about double that figure as private industry anticipates more oat acres were planted than government agencies reported this spring.

Barley

- End users / Maltsters came out of the gate early with bids and appear to have covered off front demand. Malt supply never is truly understood until harvest. Barley acreage down slightly year over year, but export demand has shifted lower than in a few prior years.

- Corn is the Achilles heel to barley pricing. Corn is very cheap and even with barley values about 40% lower year over year, it still struggles to find competitiveness into feed rations.

- Exports are not expected to be anything special as we largely lost a pile of market share to the Australian market exporting into China.

- Malt is the play this year and grade at harvest will dictate price sentiment.

Pulses

- Lentil stocks could get heavy this year and private analysts and gov agencies calling for a sizeable growth in carryout. Global demand will be the key factor here. A few key sales to export markets will dictate the balance sheet massively come the end of the marketing year.

- Pulse producers could be set for nice yields although some early season flooding rains knocked out a few acres

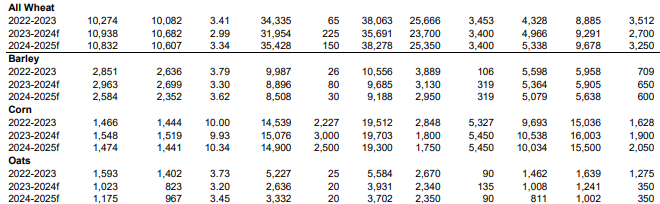

- AAFC July 22nd Report Chart Below

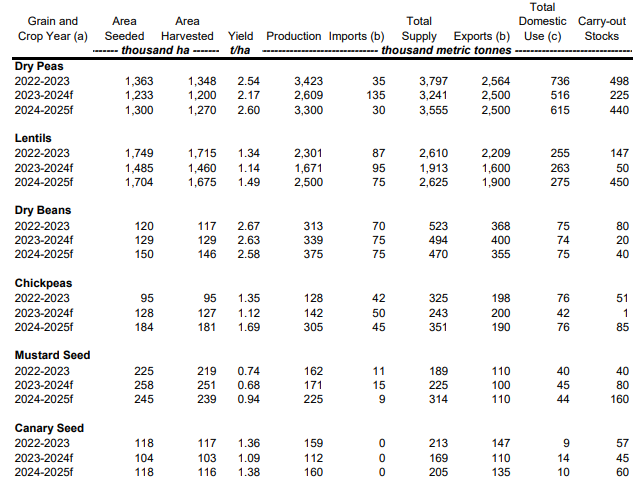

Durum

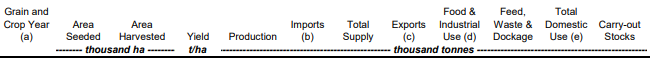

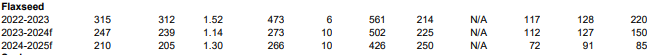

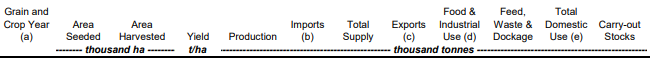

Flax

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.