Western Canadian Crop Market Update

Click Here To Access 2024/25 Crop Recommendations

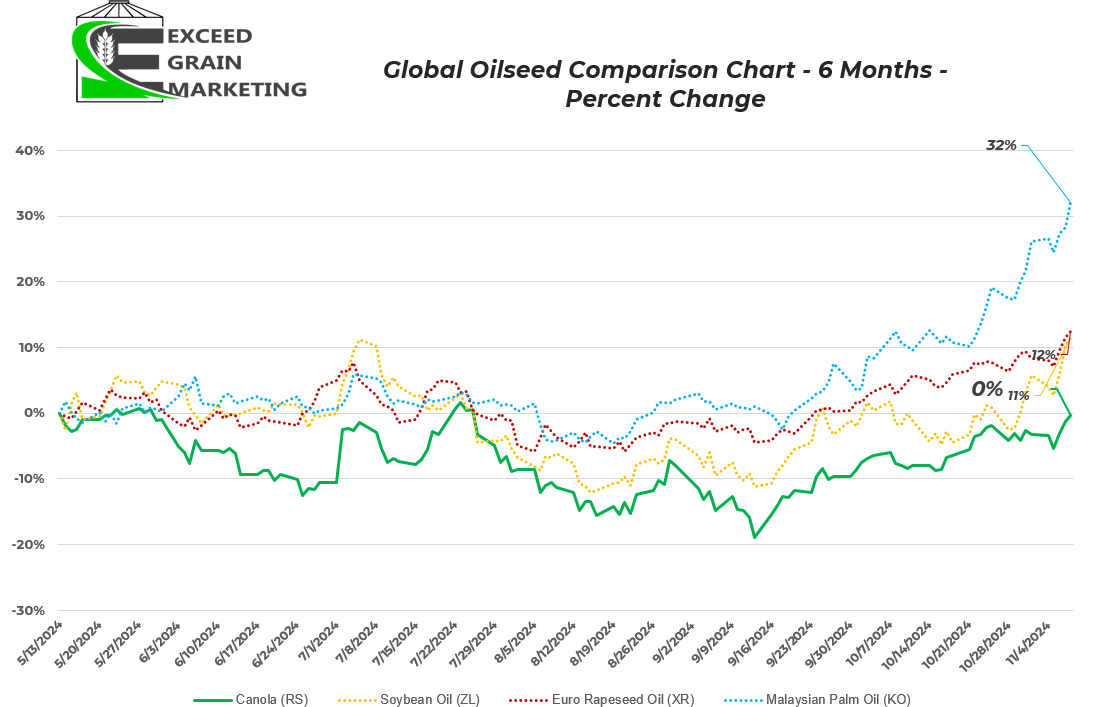

Canola

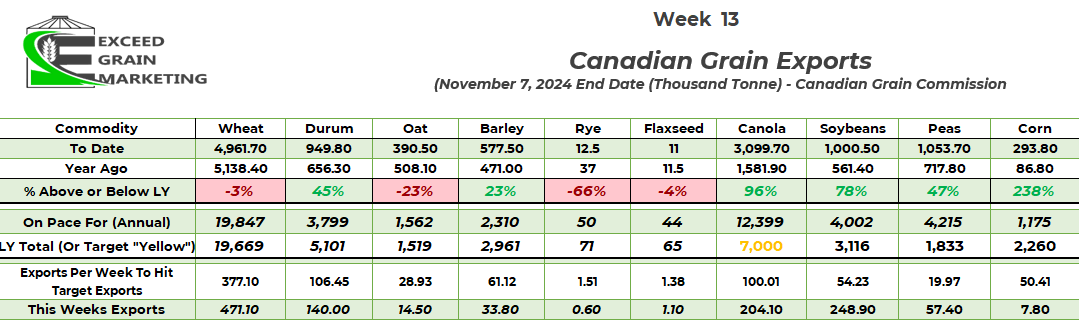

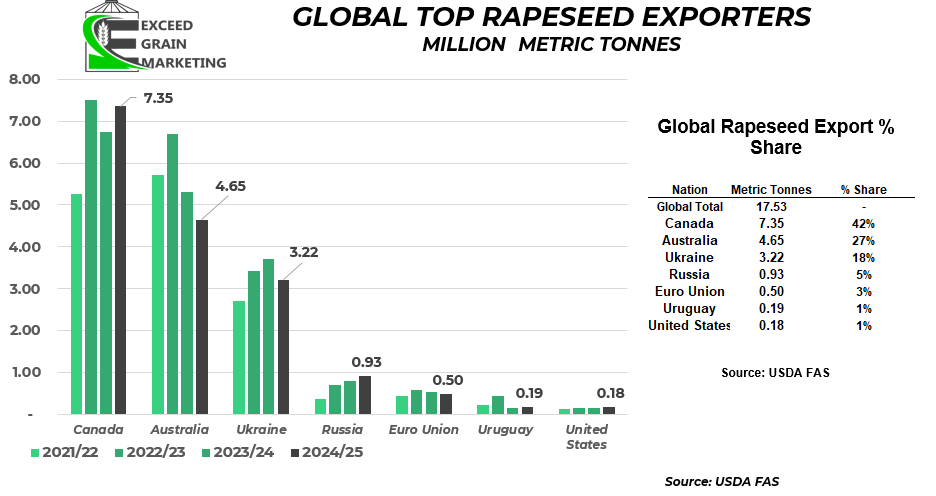

- Canadian grain exports for the week came in at 204,000 tonnes. Exports moving along at a very rapid pace and on pace for 12.4 mmt. This figure is unattainable in almost any scenario. Most private analysts expecting between 7.0 and 8.0 mmt in their early forecasts. USDA at 7.4 mmt in their estimates. Exports will be limited by supply.

- No major changes to Rapeseed / Canola balance sheet for the upcoming year.

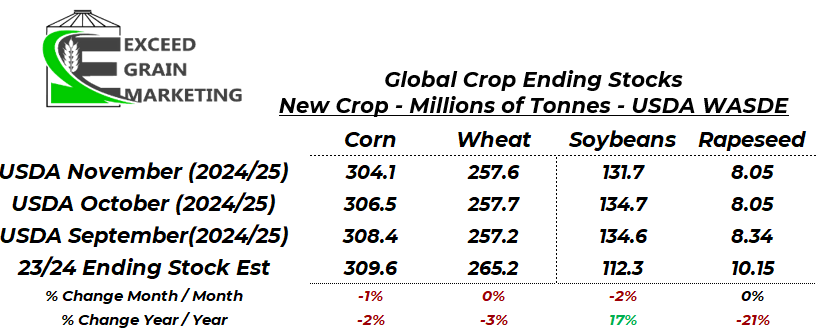

- Soybeans came in at 131.7 mmt for the 2024/25 global ending stocks. Down from 134.7 last month and estimates of similar figures. This provided a quick jump post WASDE in soybean markets

- USDA still holding Canadian production at 20mmt, although most private industry is lower with a figure in the 18+- range

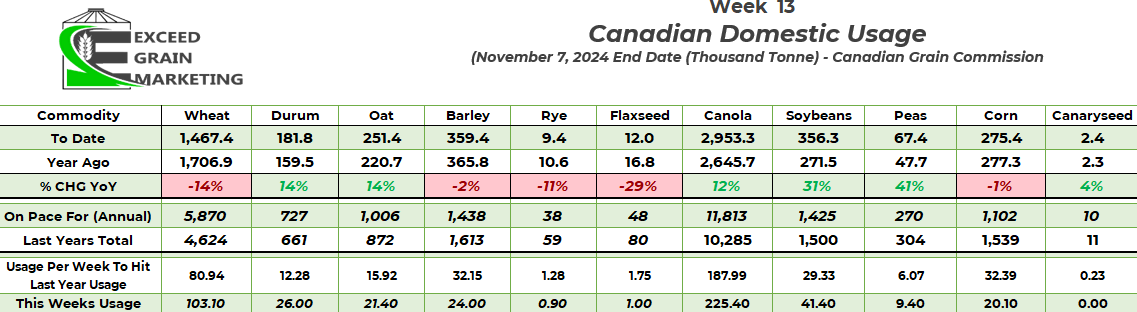

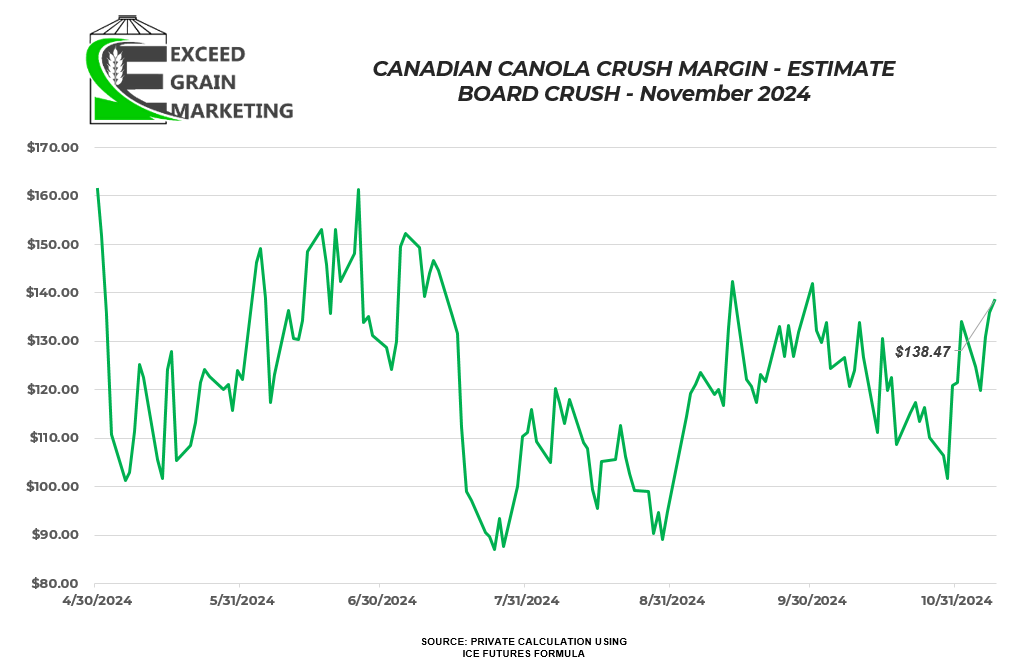

- Domestic Usage, which is a weekly proxy figure we can use to estimate Crush, sits 13% higher than the same time last year. Domestic usage on pace for 11.8 mmt

- Producer deliveries 1.2 mmt higher this year vs the same time last year on Canola. 5.6 mmt of Canola has been delivered into the Canadian grain handling system this year vs 4.3 mmt through the first 13 weeks of last year.

- China announced an antidumping investigation at the beginning of harvest pertaining to Canola imports in to China. Chinese Antidumping investigation is likely linked to the Electric Vehicle and US steel tariffs launched by Canada in late August.

- Canadian tariffs went into affect on October 1st on Chinese EV and Steel. Canada announced it would provide temp relief to tariffs to some Canadian businesses on tariffs although recently.

- Oil quantity came in at 42.3% for the harvest sample program canola. was 43.2% last year. 2% less than last years figure.

- US soybean cumulative sales are surpassing last years pace after a terrible start to the marketing year. Now 17% above last years pace.

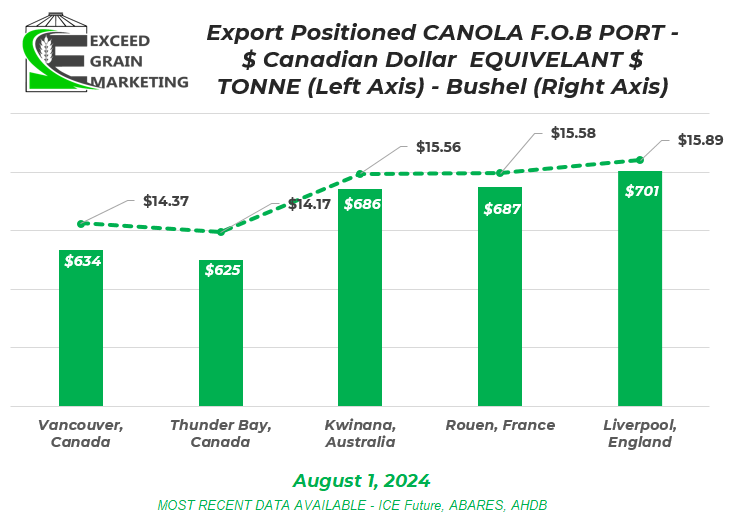

- United States soybeans FOB sitting at some of the cheapest values in the globe. North American grains in general considered cheap.

- For the short term, rallies need to be sold into if producer is undersold. Know your position and where you want to be sold. Opportunities will need to be capitalized upon in short order. Work with your advisor to “stickhandle” cashflow, logistical and other requirements. Ensure you are in the position you need to be and avoid cashflow issues.

- PRODUCTION:

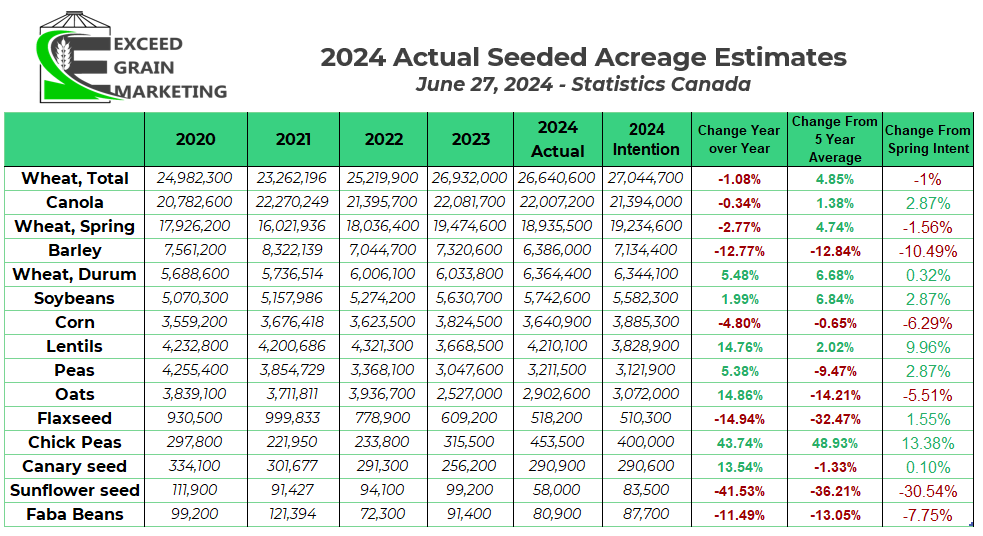

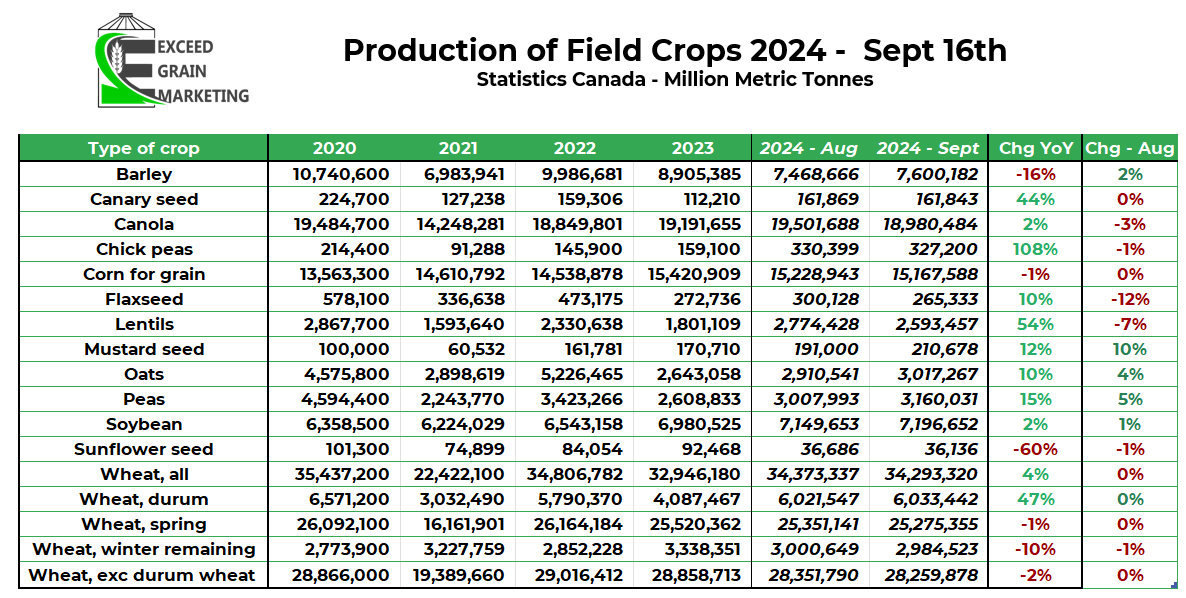

- Most private analysts have the crop at 18.5 mmt. Stats Canada sits at 18.9 mmt. Bias is to the lower side of this figure due to many western Canadian producers reporting much less than anticipated yields

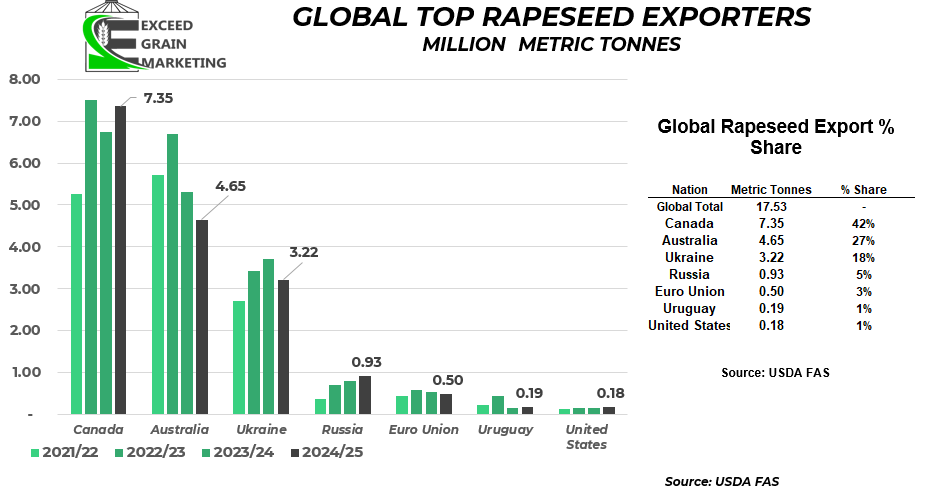

- Aussie Crop at 5.1mmt down from 5.9 last year and 8.3mmt year prior. More production believed to be at risk due to crop frost and some areas of dryness.

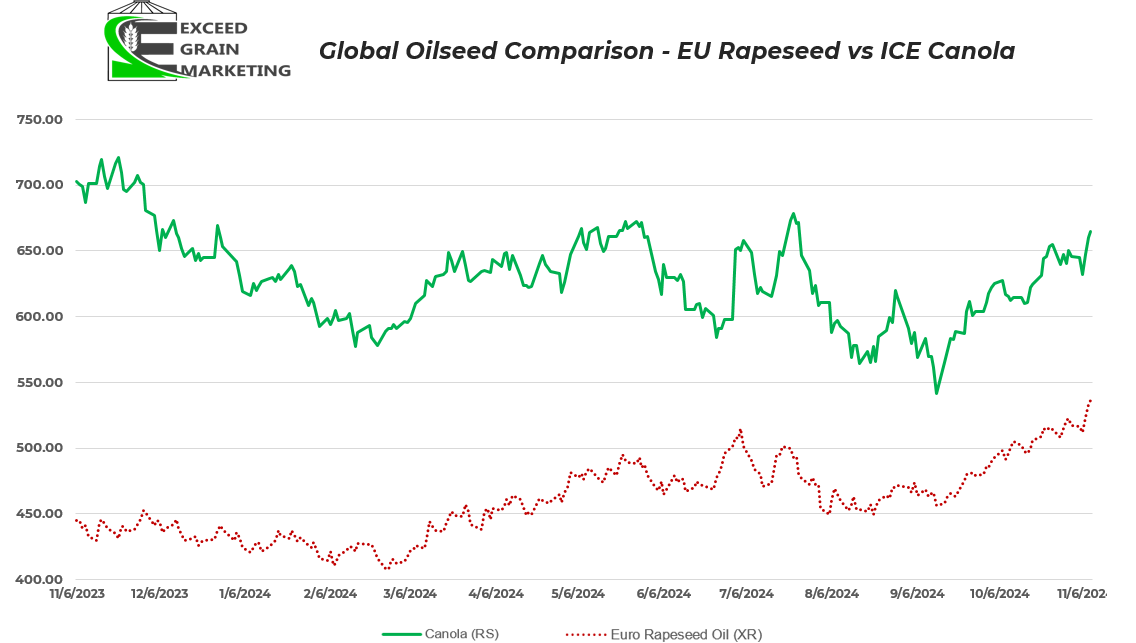

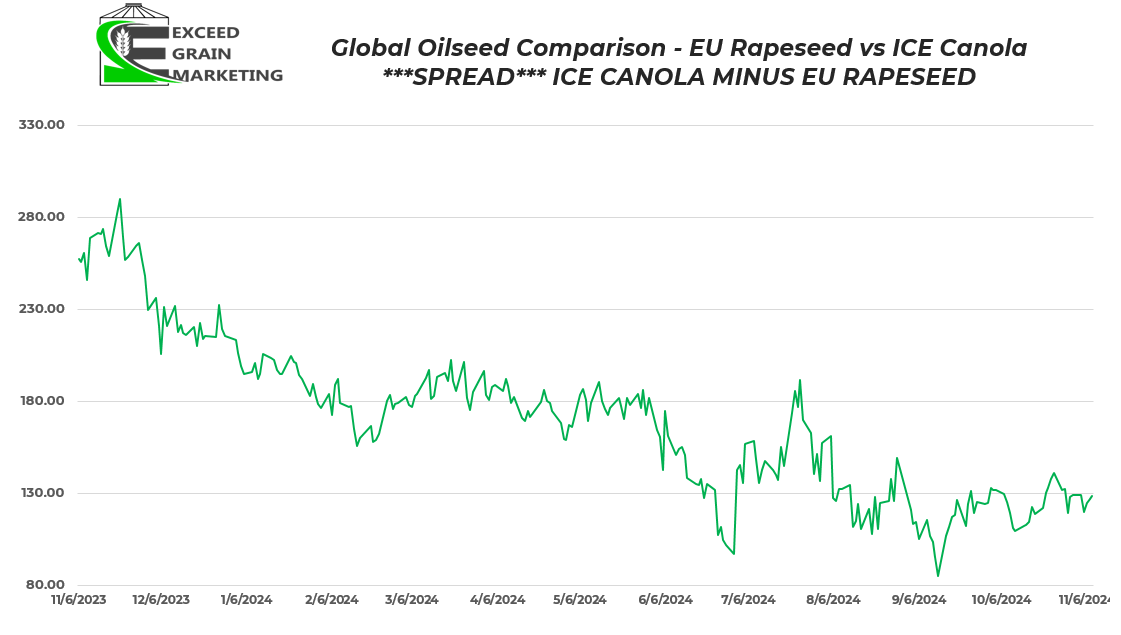

- Estimated EU Crop at 17.5 to 18.0 a month ago and was around the 20.0 mmt level last two years. USDA has it at 17.45 but some private analysts closer to that 17.0mmt now. 17.45 is a 250,000 tonne cut from last month

- Ukraine 4.7 mmt last year, 3.6mmt this year. a 100,000 tonne haircut from last month

- EXPORTS and USAGE:

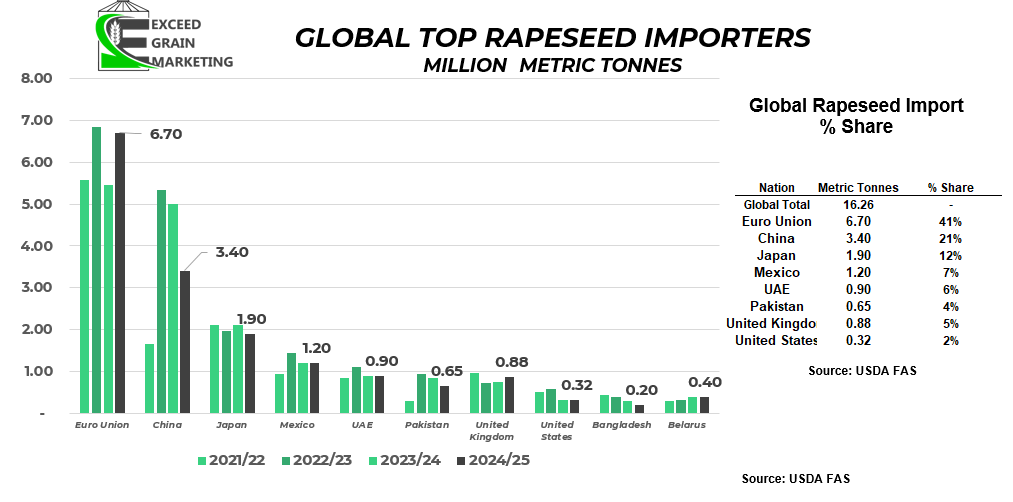

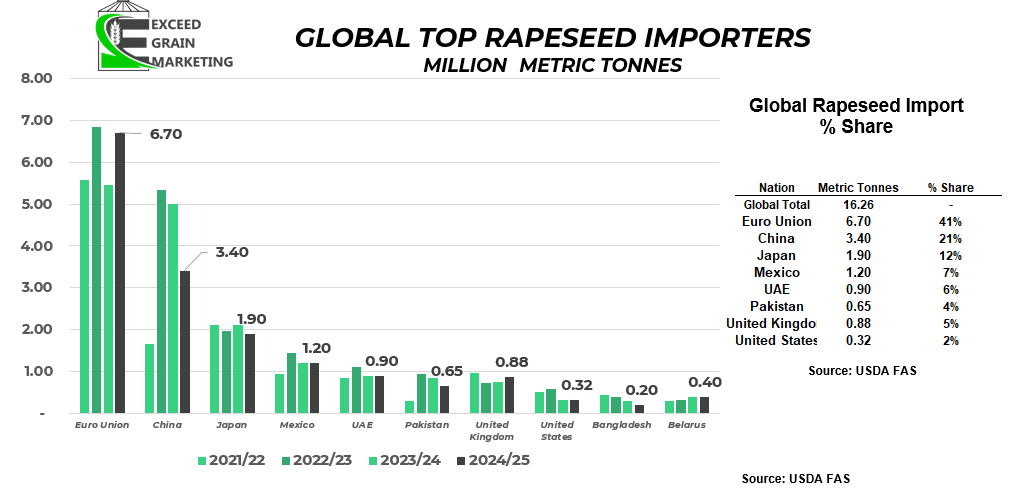

- EU needs around 25mmt total and larger imports will be required. Some carryover in the equation but USDA states they will need 6.7mmt. Canada exported next to nothing this past marketing year to EU. Last year we exported 103,000 tonnes to Belgium. Few years ago, it was not uncommon to do 500,000 to 1.5 mmt in years where EU faced crop shortfall.

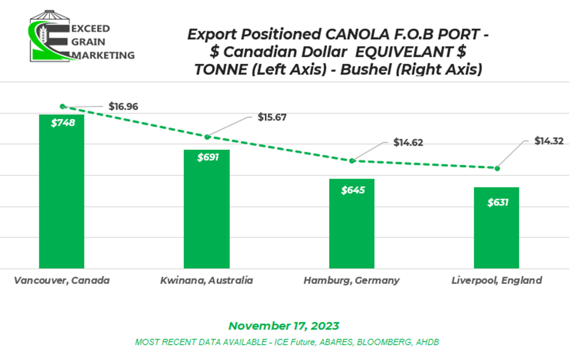

- OLD CROP: For the 2023/24 canola export program, Canadian canola was much to expensive to compete with Australian Canola for the first half of the export program. By early January, Canadian canola exports were only tracking for 6mmt of total exports, a dismal export number. It was not until exports picked up last half of the year where we came in right around 7mmt.

- AAFC has 2024/25 export forecast at 7.0 mmt. This is viewed as a conservative figure, many private analysts sit around 8.0 mmt assuming Japan, Mexico and European Union will likely be in for more crop, time will tell. USDA has CDN canola exports at 7.3mmt. Chinese demand is in question. Will they place tariffs on CDN imports or will they import their requirements before taking action?

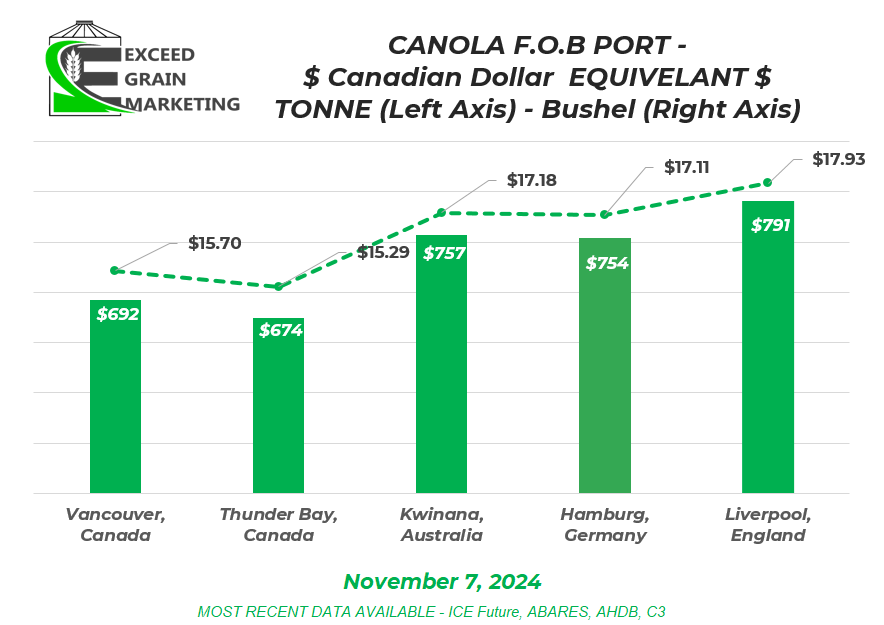

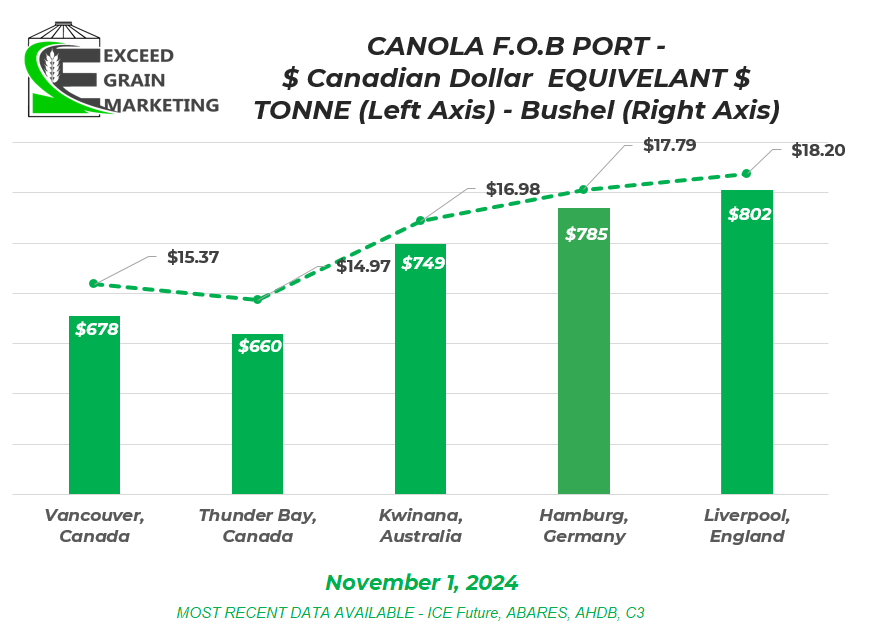

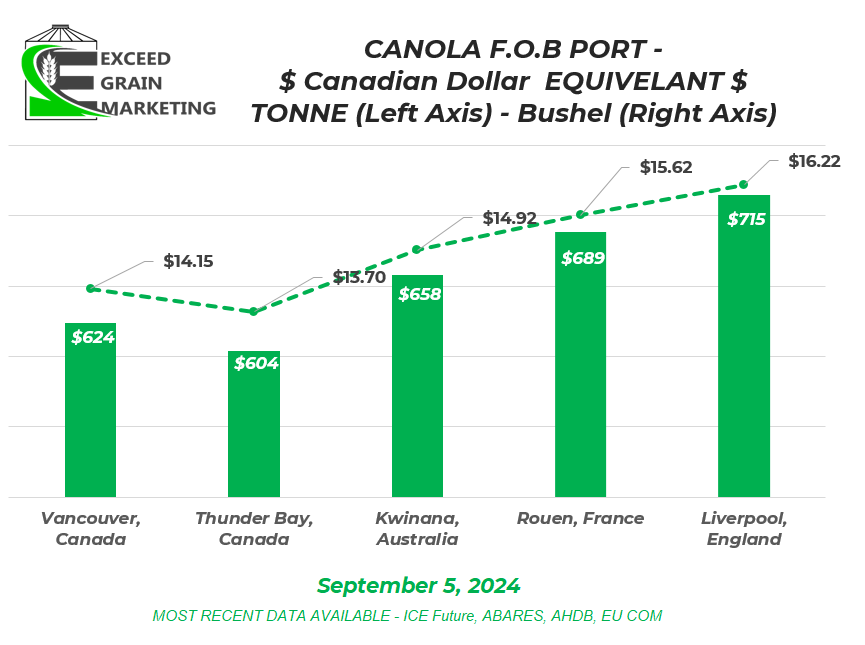

- See Global FOB canola prices chart above and historic ones below.

- GOING FORWARDS:

- Western Canadian Harvest is wrapped up. It is key that traders get a good start to the canola export program. Which shows great promise so far. Chinese trade spat has ability to cause logistical headaches going forwards. Global Rapeseed and Canola balance sheet has potential to tighten up longer term, ending stocks already shaping up 19% smaller than last year according to USDA figures. Will mostly depend on what Canadian canola crop comes in at. We know other global production regions well enough already as harvest wrapped up in Canada / Europe. Aussie crop coming in Mid October to Early December.

- Australian crop the wildcard here, although their crop is expected to be 200,000 tonnes smaller than last year. This crop is in the ground and will be harvested Nov/Dec.

Spring Wheat

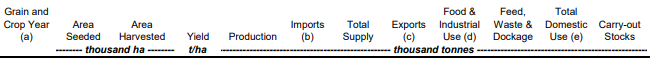

- Global wheat ending stocks came in 800,000 tonne above initial estimates. Similar to last months figures. 257.6 mmt

- Some better rains set to hit Dry US Midwest winter wheat regions getting ready for dormancy

- Some 2025/26 Black Sea wheat crop estimates place it in the 82 – 84 mmt range. So similar to estimates this year but down from the 90+ mmt figures of years past.

- Thoughts in the marketplace that potential black sea export tariffs could actually increase Russian wheat supply in the short term in order to move more grain upfront to avoid export tax increases.

- Delayed EU wheat planting. EU wheat regions in France and Germany have been plagued once again with excess moisture, causing difficulty to get the crop in. Excess rains hampered old crop wheat supplies in France and Germany last year causing quality and supply issues.

- Canadian wheat exports still coming out strong through week 13 just slightly below last years initial pace. See chart above. On pace for a 19.5mmt export figure

- Challenges with wheat yields were apparent in pockets of eastern Alberta and some southern Sask regions. Other areas reporting quite strong yields so the wheat appears to be more of a mixed bag vs canola which is being reported lower across the board.

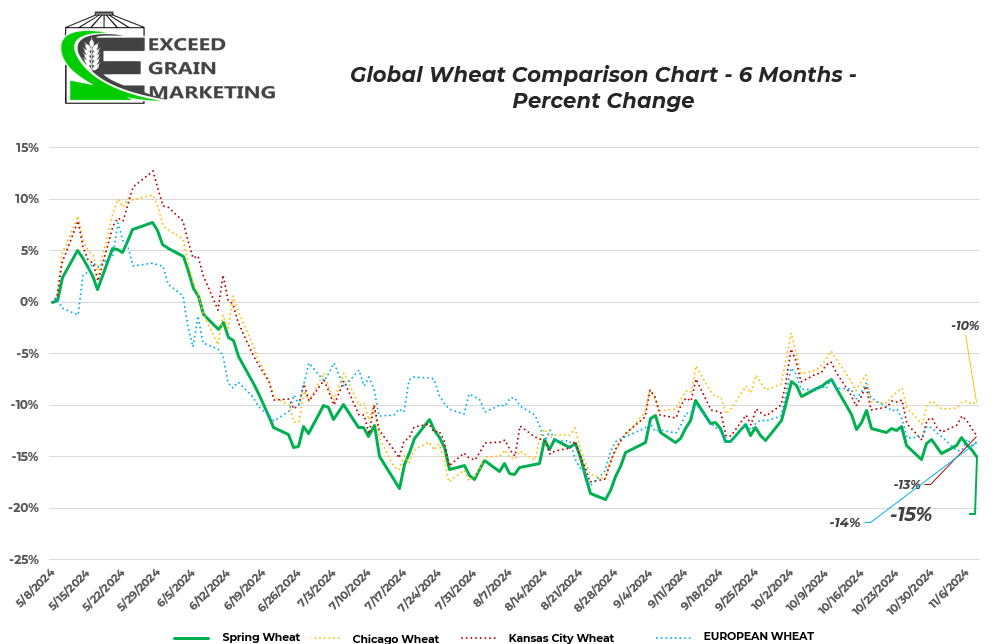

- Markets in general have been in a downwards trend since the end of May. Past month has started to shift this notion. All growing season, no weather stories and quite likely a record yield from North Dakota, the largest Spring Wheat producing state in the USA

- For the short term, rallies need to be sold into if producer is undersold. Know your position and where you want to be sold. Really work closely with your advisor on your general marketing plan, decide what crops need to move and what crops we are keeping at home. Weight the risk and reward of each decision.

- PRODUCTION:

- Canadian non durum wheat crop expected to be large. 1.2 mmt larger than last years crop. Around 29MMT is expected to be produced according to AAFC’s latest stab at the crop size. Looks like ending stocks could be more burdensome than earlier forecasted as well.

- Wheat will come down to quality. Premiums being paid for very high protein wheat into certain markets.

- Across the pond, wheat quality of the harvested crop was questionable at best. Some multi decade low wheat yields being reported in Germany and France Plenty of low protein wheat came off fields in Russia, Ukraine, Germany, France, Poland. Grading issues a concern over rains at harvest especially in France and Germany.

- French wheat is forecasted by private analysts at around 25 mmt. Last year the crop was closer to 35mmt

- EXPORTS and USAGE:

- Global balance sheet for wheat actually tightest in several years. Ending stocks of 258 million tonnes vs 260 to 285 mmt range in recent years. Balance sheet amongst key exporters even tighter.

- Canadian exports last year were particularly strong, not due to cheapness, but due to the quality of the crop. We need some good new crop quality coming into the system to give us the blending capacity we need. Canadian crop was blended and fit a gap in the market. Exporters looking to hit the same niche this year and push wheat exports as strong as they were last year.

- AAFC has 2024/25 export forecast at 20.5 mmt. This is viewed as a strong year and will keep ending stocks in check.

- GOING FORWARDS:

- Harvest is wrapping up, wheat prices coming off of some of the lowest levels in 4 years. We are 30% sold new crop overall and will await quality results before making next cash sale move.

Corn

Soybeans

Oats

- Western Canadian oat production came in on the light side. Weight was a concern with this oat harvest having trouble hitting spec for 2CW. 3CW and 4CW is prevalent.

- Oat prices are sit at $4.25 to $4.75 new crop across the prairies. $4.50 quite common and $4.75 moreso for the glyphosate free market but bids have been strengthening. Oats were anticipated to have been heavily sold by producers early in the production year. Seeing bids pick up here in recent weeks due to lack of good quality oats. Oat bids about $0.50 to $0.75 from its lows already.

- North East Sask and Western Manitoba will call the shots on this crops balance sheet. Expect a tight balance sheet if demand stays steady.

- Front end demand is largely covered off for oats although and pricing will depend on post harvest demand and how this crop actually shakes out. AAFC is calling for a carryout of just 350,000 tonnes which would be considered very tight. Private analysts are higher but adjusting balance sheets lower in recent weeks. Not much wiggle room in the domestic oat balance sheet. Exports will dictate how tight we get.

Barley

- End users / Maltsters came out of the gate early with bids and appear to have covered off front demand. Maltsters still looking for some crop to round out their inventories towards tail end of marketing year.

- Corn is the Achilles heel to feed barley pricing. Corn is very cheap and even with barley values about 40% lower year over year, it still struggles to find competitiveness into feed rations. Barley is pricing into Alta feedlots competitively right now, but walks a fine line with corn.

- Exports are not expected to be anything special as we largely lost a pile of market share to the Australian market exporting into China. Still moving some into China but how many boats we get remains top issue.

- Malt has been the play so far this year and grade will dictate price sentiment. Early malt bids are still holding place, flattening in recent weeks.

Pulses

- Lentil Balance sheet revisions will be made lower than they were in summer. Some small pockets reporting way above average yields but more common than not to see less than anticipated yields. Some grade issues, disease. Lentil bids increasing to $0.34 and are commonplace in central prairie locations

- Global demand will be the key factor here. A few key sales to export markets will dictate the balance sheet massively come the end of the marketing year.

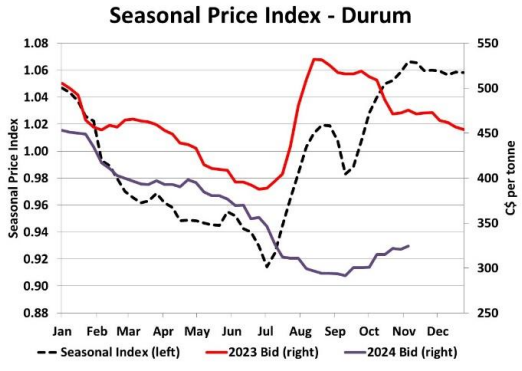

Durum

- Durum harvest well understood in western Canada. Yields leaning to the disappointing side from prior estimates and light weights are commonplace. Disease showing itself this year as some rains fell at prime time for disease timing. Crop easily smaller than July estimates. Grade will be the stickhandling part of marketing this crop. Durum bids picking up and getting closer to that $9.50 level central prairies.

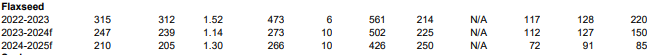

Flax

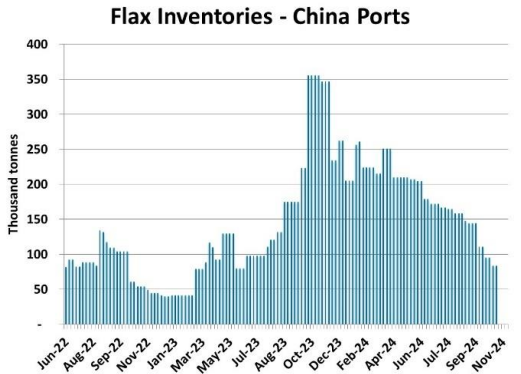

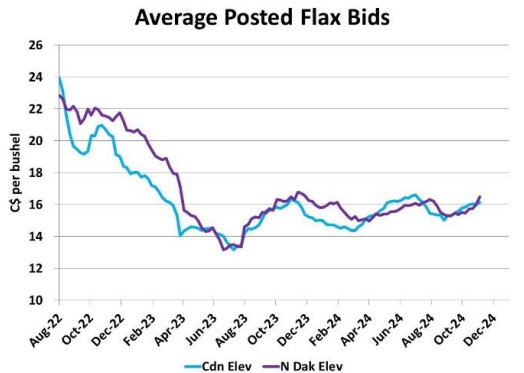

- Flax production is forecasted to be quite small this year with less acreage going into the ground. In fact, Flax acres are the smallest since the mid 1940’s. Flax prices will be influenced by EU demand. Russia’s flax crop will be challenged to move into EU borders this year due to new import tariffs that began on July 1st for flax which will be scaled up in the coming years. Some $18.00 bids out there. Up from $15.00 earlier in the marketing year.

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.