Western Canadian Crop Market Update

Market Notes:

- Strong Week in western Canadian commodities:

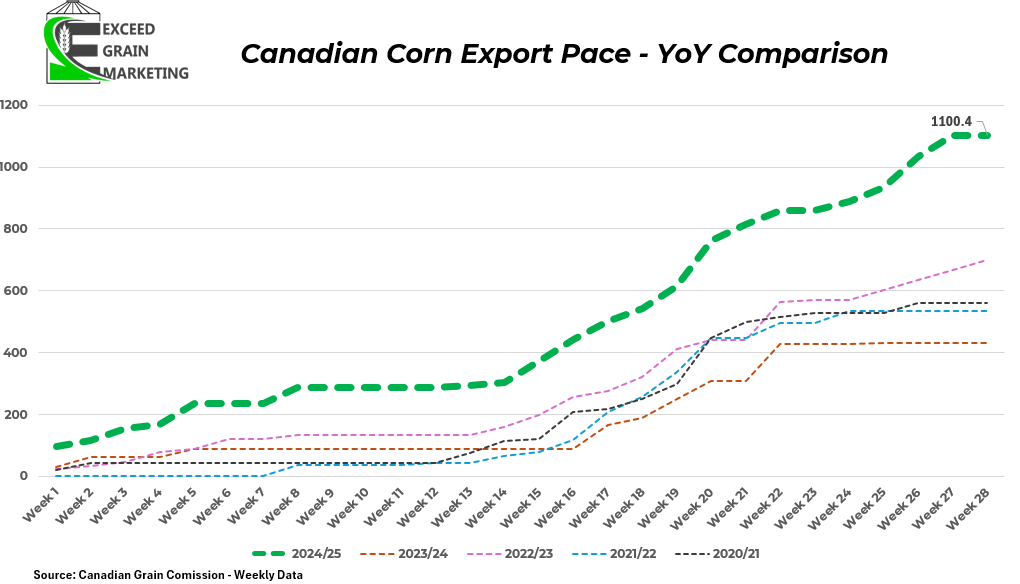

- Corn domestic values continue to trend higher in western Canada

- Soybean values rangebound with stronger values later on

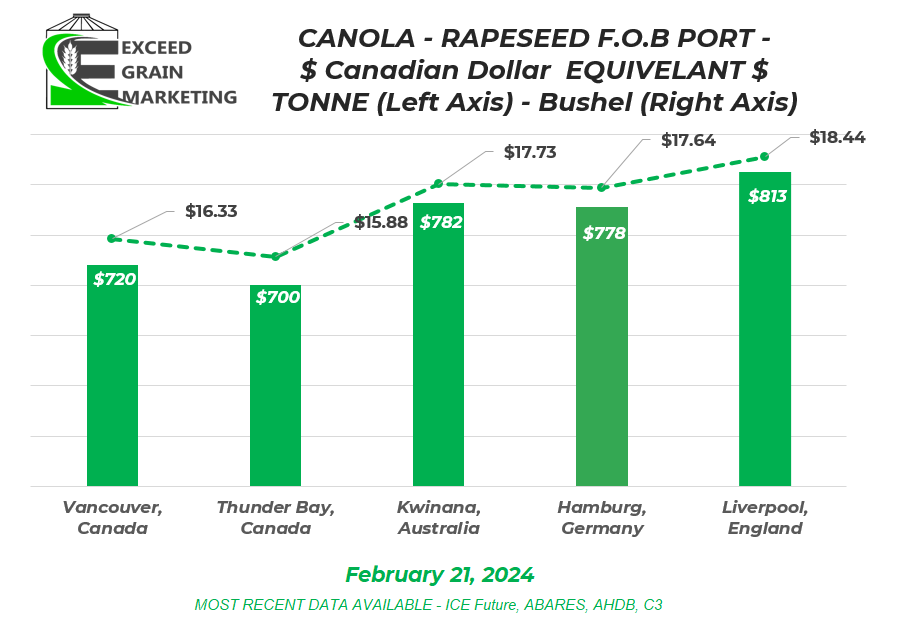

- Canola has spent most of February trading higher with old crop values seen approaching $15.00 per bushel again.

- Spring wheat values touching $8.50+ old crop in plenty of regions. $8.00 bids quite common in most areas of prairies.

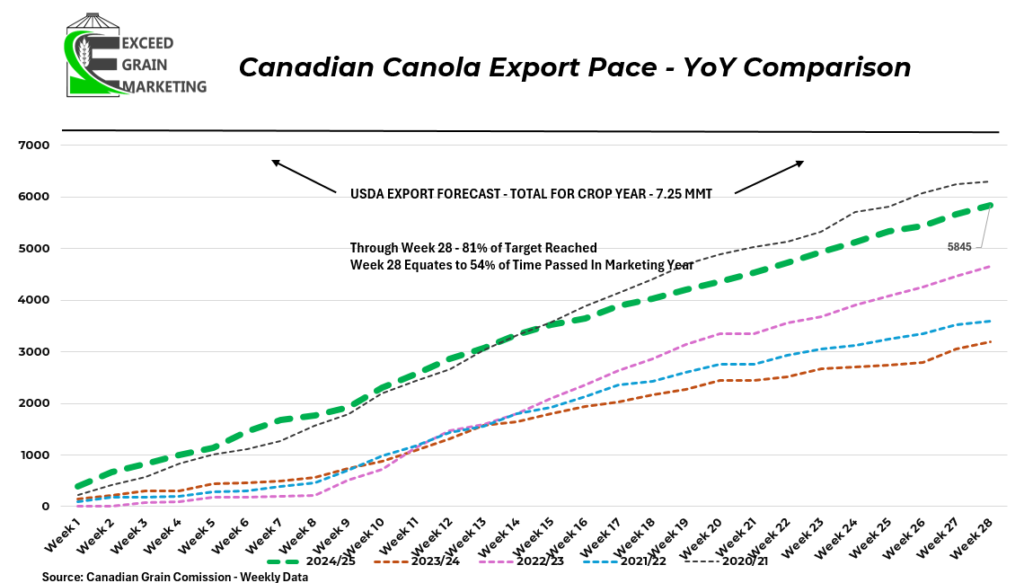

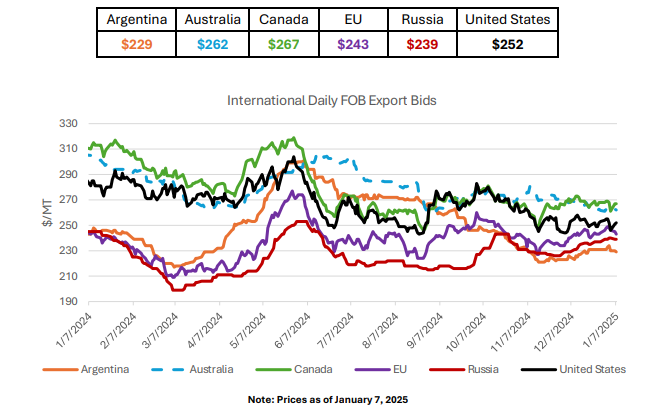

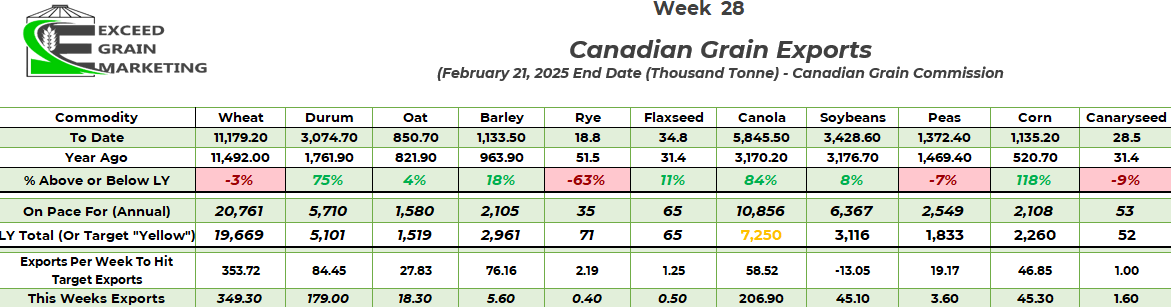

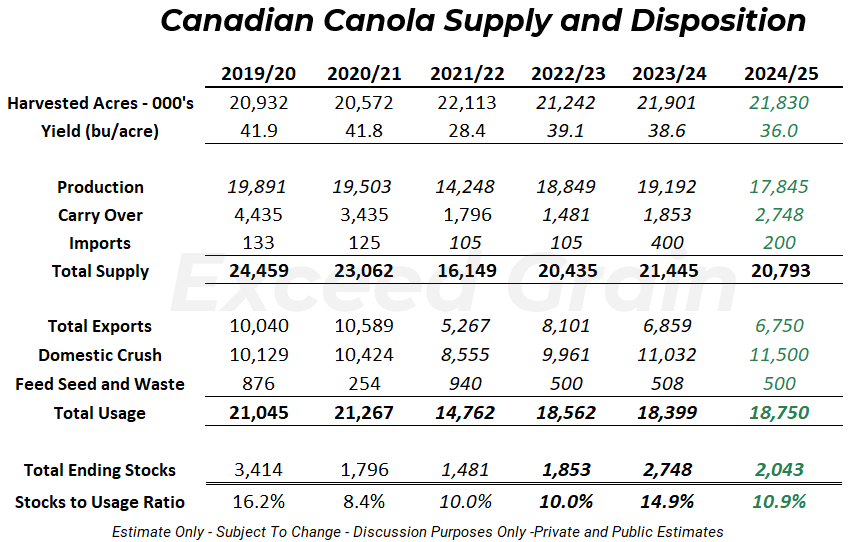

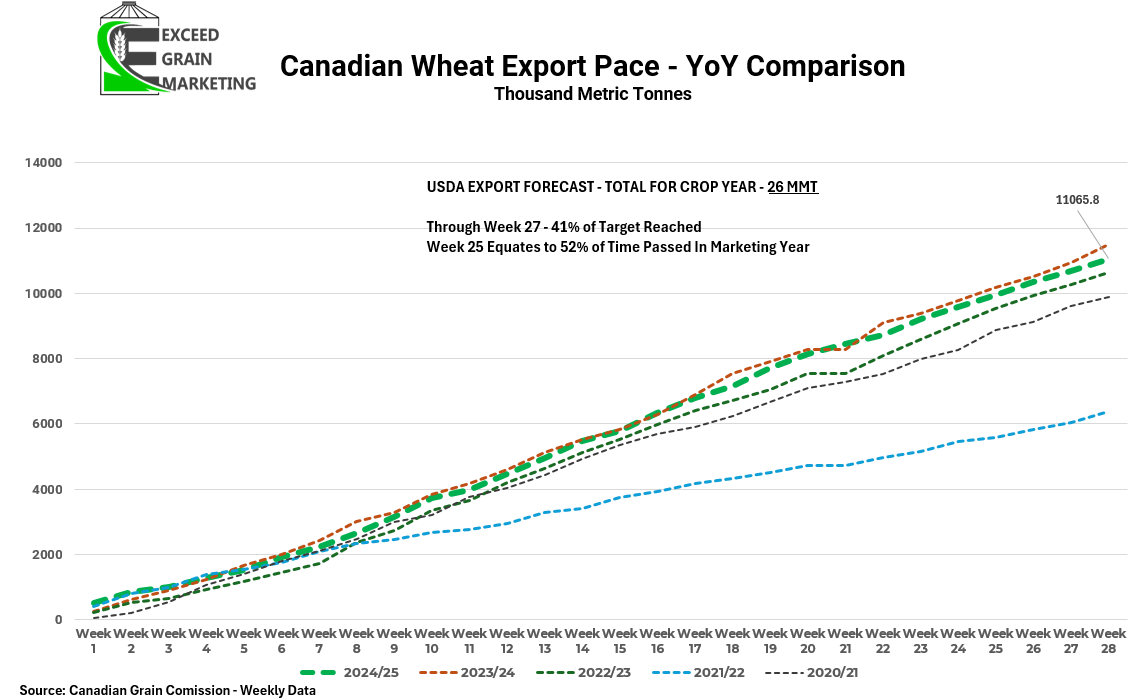

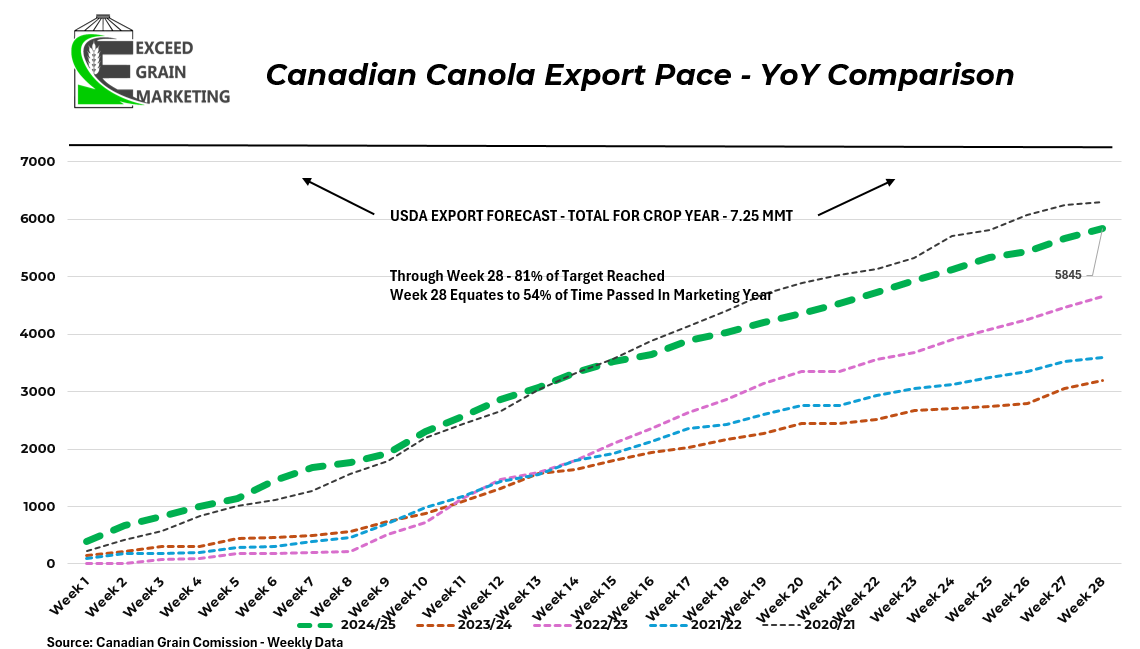

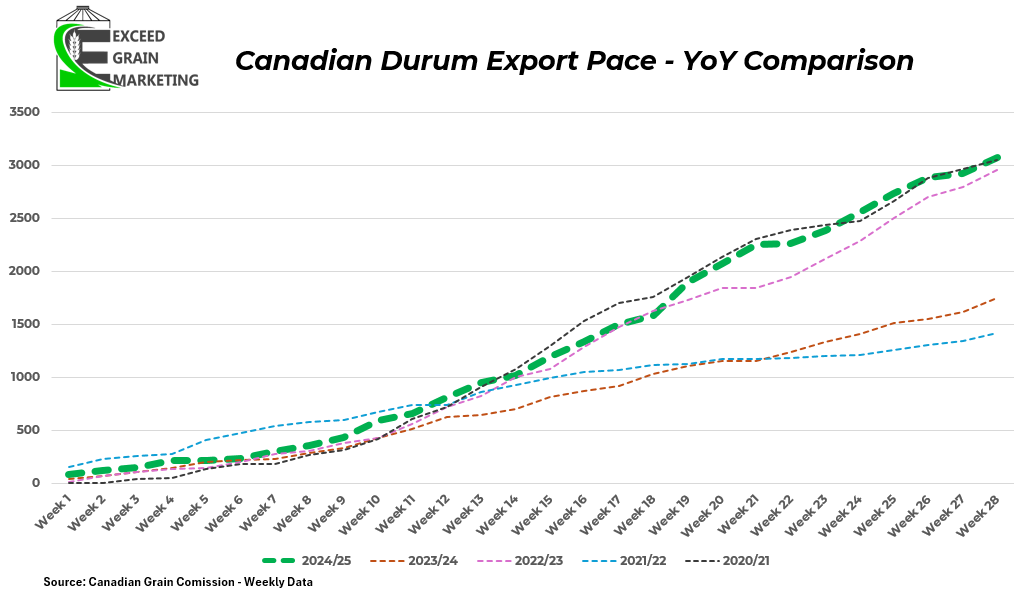

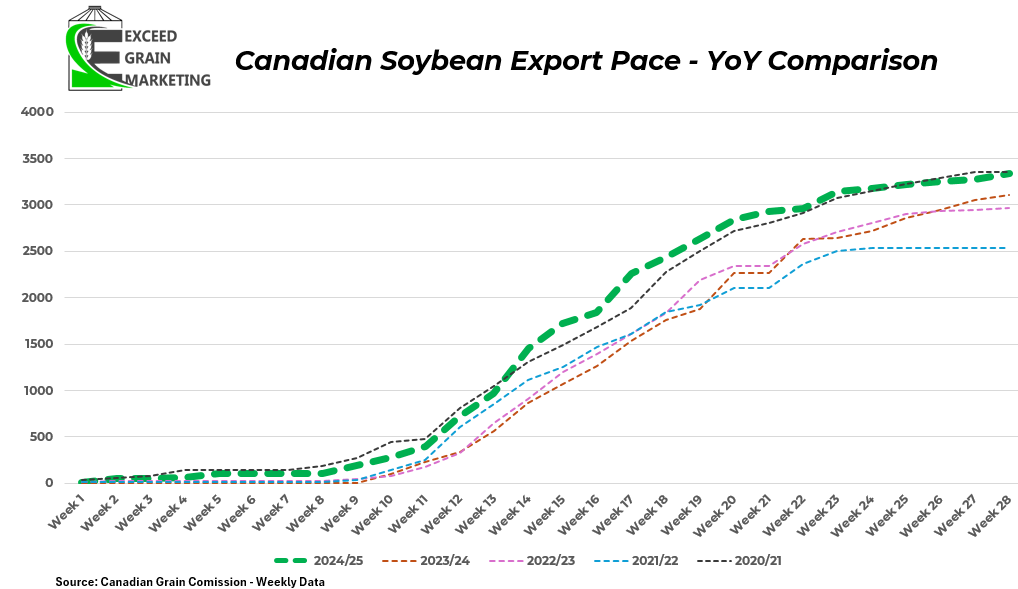

- Export movement on certain crops continue to exceed expectations. Durum exports very strong. Wheat exports maintaining a strong pace in the weekly sales. Canola exports strong. 170,000+ tonnes of canola shipped out this past week again. Canola exports tracking on pace for 10.9mmt.

- We have exported 5.85 mmt and 340,000 tonnes are sitting in export position with an additional 895,000 sitting in elevators waiting to be moved out. With these statistics we have already somewhat disposed of close to 7.1 mmt of Canola. Unless crop size is adjusted upwards or carry in was higher than anticipated, it is shaping up to be a very tight balance sheet for old crop. Pricing is beginning to reflect that.

- Political risks in play include potential tariffs or trade action from China or United States but much of the story has been told on old crop and fundamentals are the key thing to watch here.

- Overall a strong week for commodities with Canola, Wheat, Corn all posting strong gains.

- Corn sitting sitting above the $5.00 per bushel level for the first time since May of last year.

- Spring Wheat futures at the highest level since October 2024

- Canola futures at their highest level since July of 2024 and up $12.40 per tonne for the week. Canola played with the $680 per tonne futures level in July 2024. May canola closed at $679 per tonne today

- Markets focus remains on the following:

- South American harvest pace

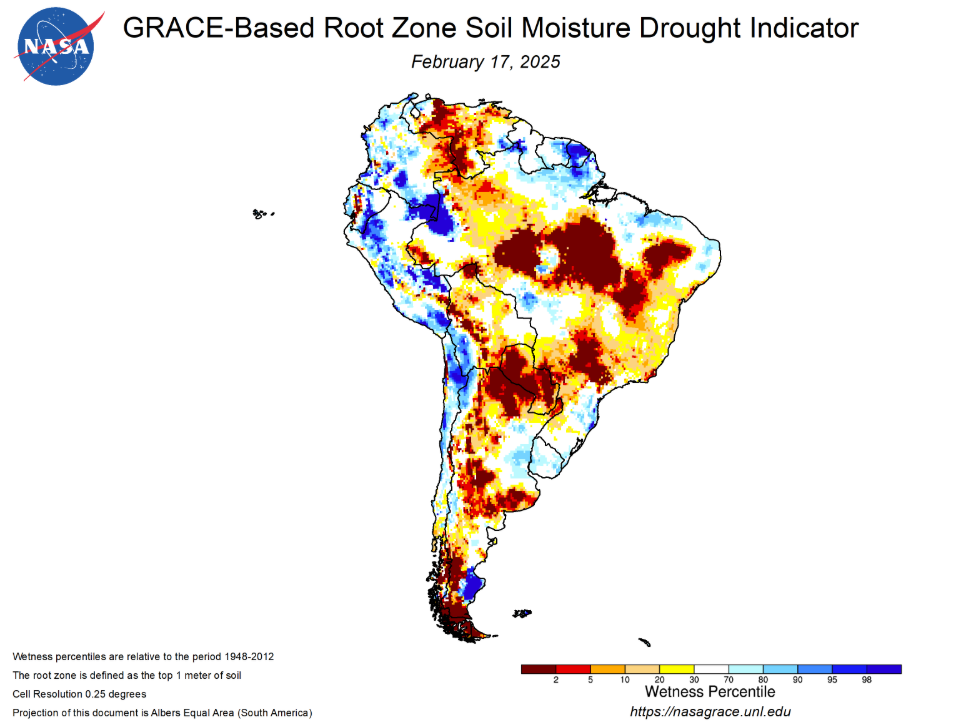

- Argentina faced some early dryness in their campaign and crop for soybeans is being suggested in the 47mmt range by local analysts while the USDA has it at 49mmt.

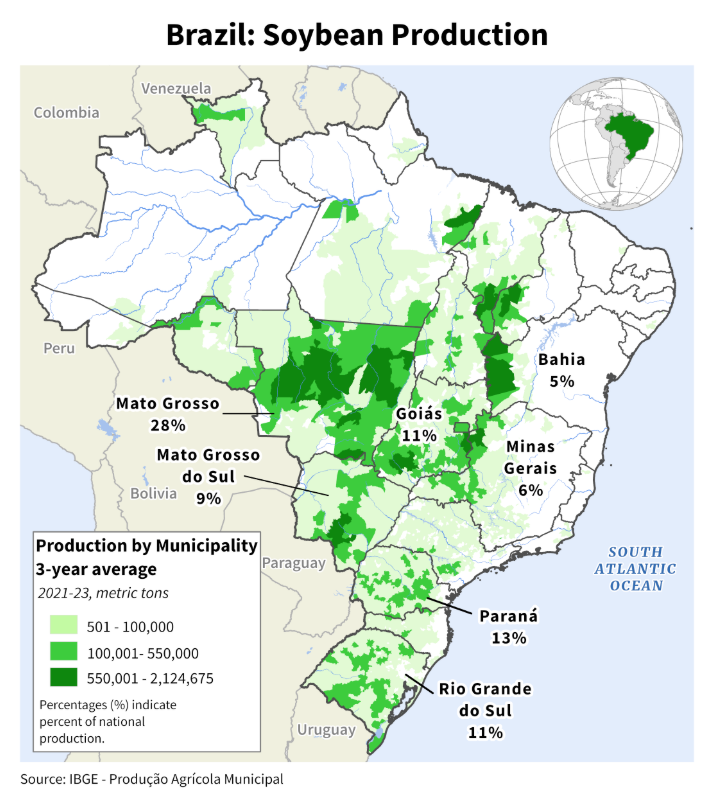

- Brazilian crop is 28% harvested and is catching back up to normal pace after a slower start due to rains. Some quality issues there but crop should still come in around the 169 mmt level. Large crop has been believed to have been priced in a while back as Brazil had limited in season issues.

- Trade issues / Tariffs:

- In the back of headlines this week, but as we approach March we will likely see Tariff Chatter arise again.

- North Hemisphere weather:

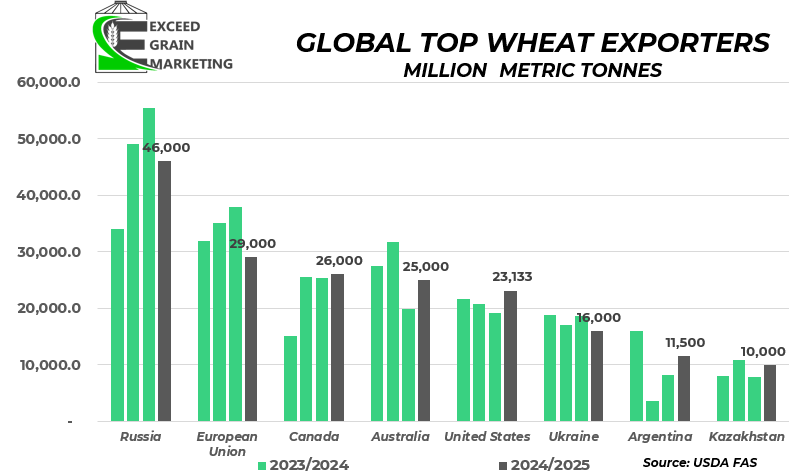

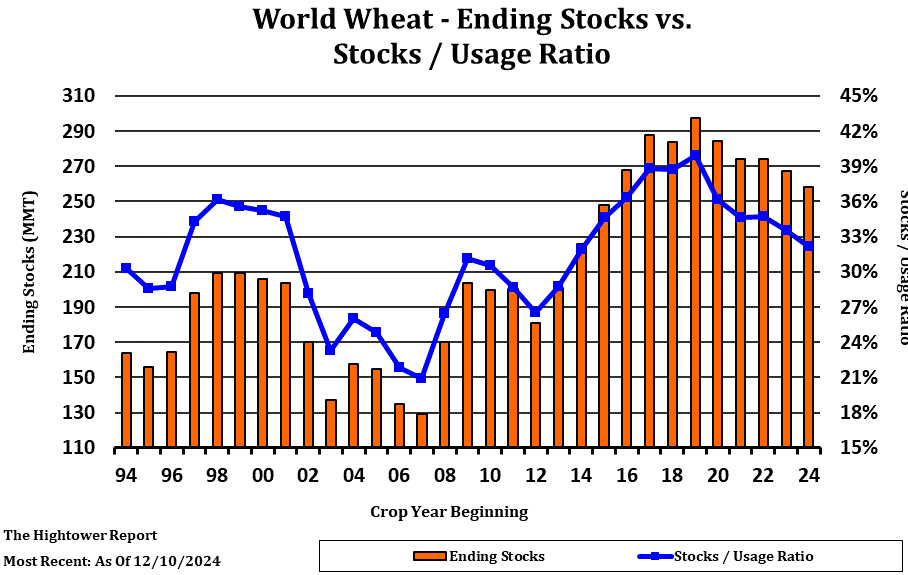

- We will start to focus on Northern Hemisphere shortly as US comes out of dormancy and European Union / Black Sea wheat crops start to come out of Dormancy within the next month or so. Recent action in wheat has been attributed to cold snaps in these regions, any threat to production on an already tighter looking global balance sheet for wheat.

- South American harvest pace

- Other Headlines:

- USDA WASDE:

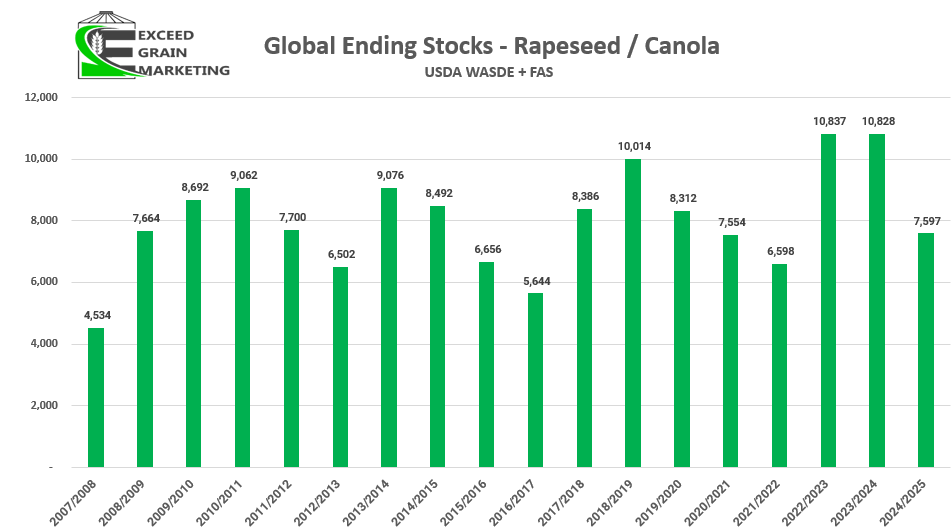

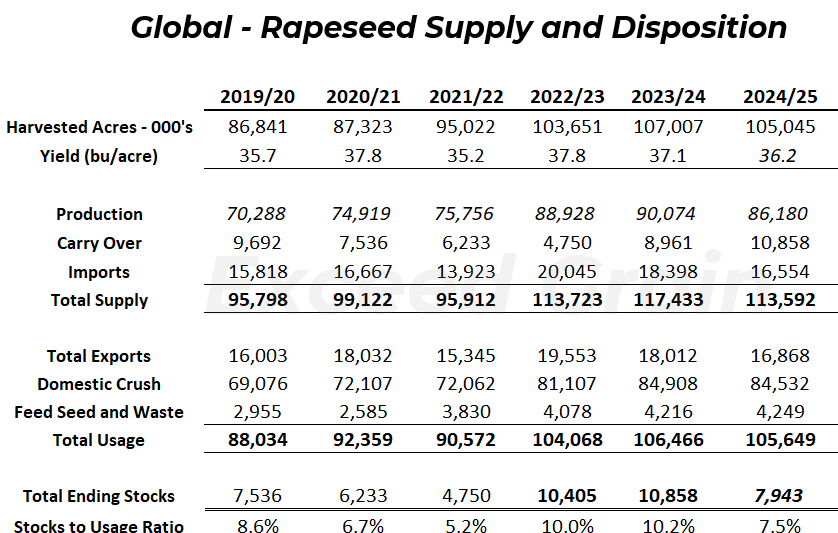

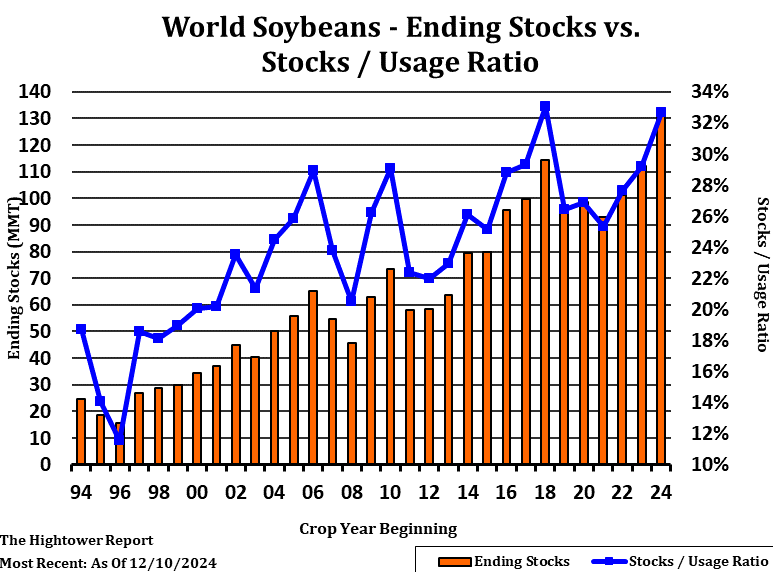

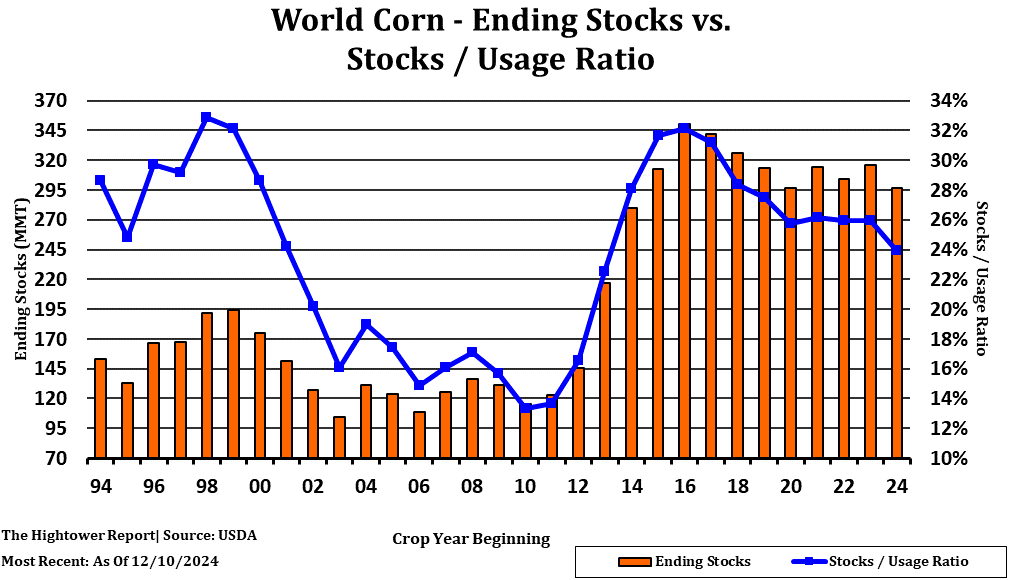

- Report had global soybean and corn ending stocks coming in less than anticipated. USDA has global rapeseed ending stocks down to 7.597 mmt vs last years 10.828 mmt. Canola / rapeseed ending stocks estimated to come in at the tightest level since right around the 2020 timeframe.

- 3.2 Million tonne cut from last year. See chart below for year over year comparisons on Rapeseed / Canola ending stocks globally

- South America:

- Mato Grosso and other areas of Brazil harvest is underway

- Crop looks good but delays and some slight quality issues due to wet weather. Recent analyst projections are keeping the crop at a record size and the market has mostly priced this action in.

- Argentina still critically dry in some major production regions. 15% of the soybean crop is considered to be in “good shape” with 36% of it in Poor shape. Corn similar story with 16% of the crop in good shape and 33% in poor shape.

- USDA cut Argentinian corn estimates by 1mmt and Brazil by 1mmt due to the planting delays in Brazil

- Soybean estimates were cut by 3mmt in Argentina and left untouched in Brazil

- Together South America’s two largest producers still set to put out big crops despite the recent “haircut”

- USDA anticipating 176 mmt of corn vs 172 mmt last year

- For Soybeans, 218mmt of crop between the two nations this is compared to 201 mmt last year. So the recent trimmings once again are more of a haircut.

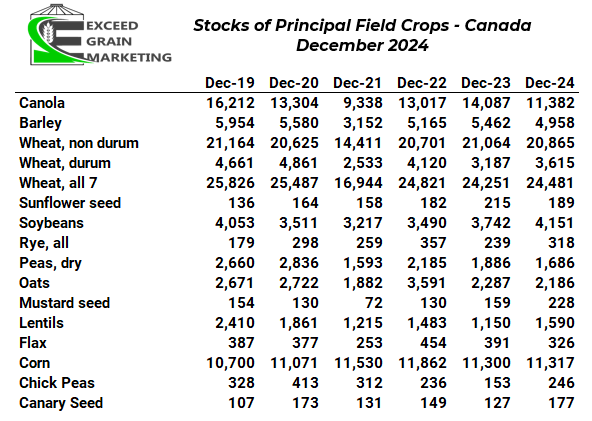

- Statistics Canada December Ending Stocks

- Report released last Friday

- Canola stocks December 31st were the tightest since December of 2021 and just 11.4 mmt were avaliable to the supply chain as of December 31st.

- Wheat stocks a shade below last years levels, Oat stocks at 2.2 mmt – close to last years levels

- Mustard inventories highest in several years.

- March 1st is the US imposed Tariff Deadline for Canada and Mexico to implement further border control issues. In reference to the threatened US tariffs, the following crops exports to the United States last year were as such. USA took said % of the following crop exports:

- Canola Oil – 90% of oil goes to the United States. This is 2023 full year data. It fluctuates by month but US is by far largest canola oil export destination

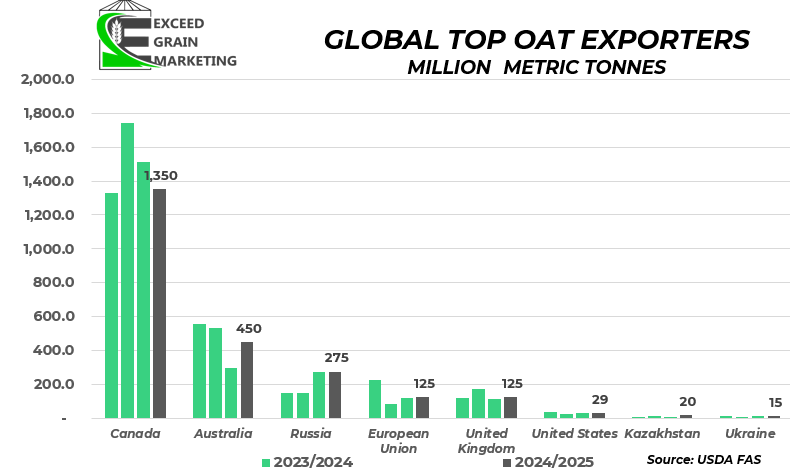

- Oats – 74% of oats to the United States – Mexico took 11% last year

- Durum – 13%

- Mustard – 95%+

- Flax 68%

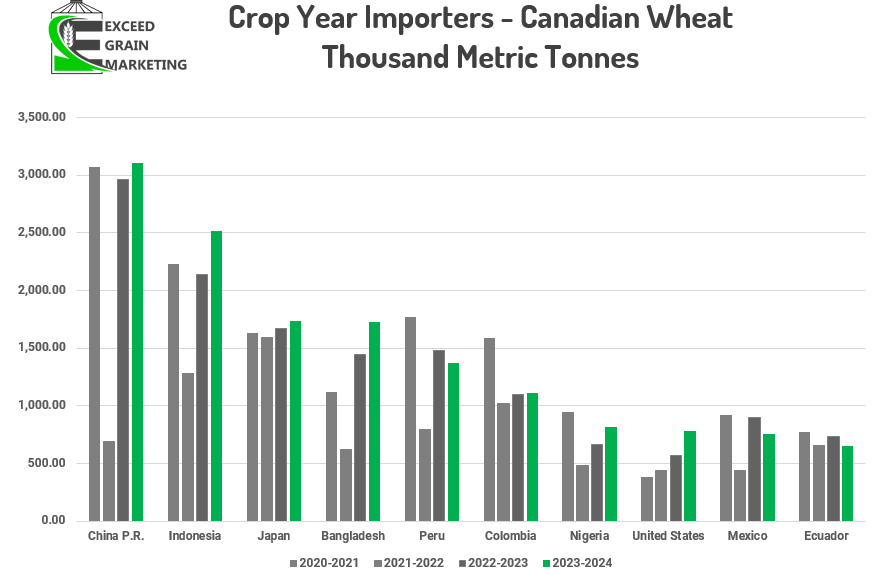

- Wheat 4%

- Mexico is a massive importer of US corn so need to watch trade relations going forwards.

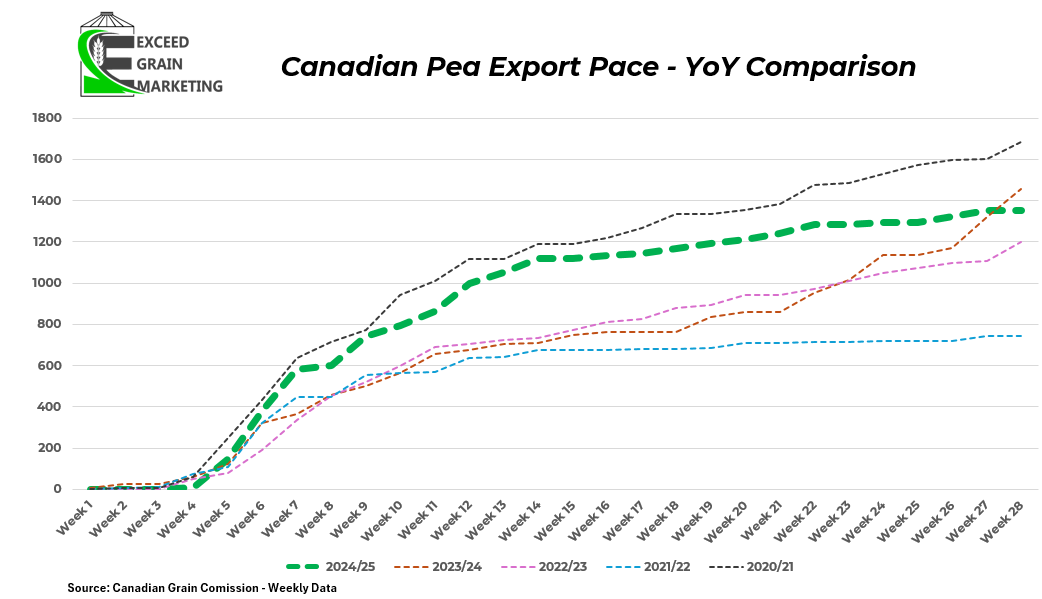

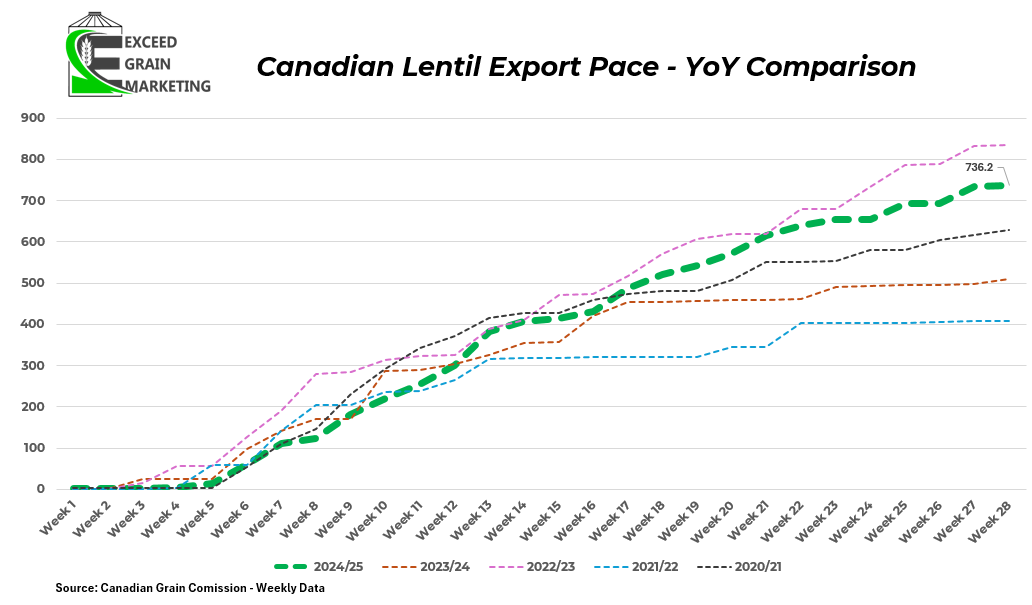

- India extended its pea tariff exemption until end of February 2025. Lentils exempt through March 2025. We will be closely watching any developments in this

- Durum:

- Seeing Italian Durum prices coming off of lows. Supportive in nature

- Special Crops:

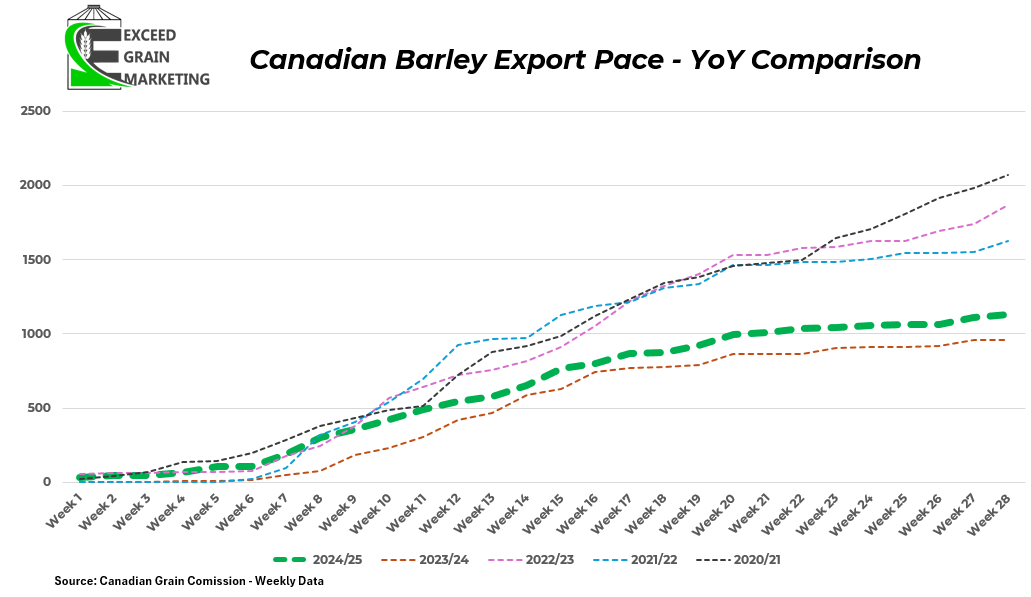

- Feed Barley demand strengthening seeing $5.50 bids and malt around $6.00 central sask. Malt to Feed spread narrow

- Yellow pea pricing into China softening following their lunar new year Holiday

- Lentil bids remain stable. Seeing $0.35 central prairies.

Corn Futures – Barchart

Canola Futures – Barchart

Spring Wheat Futures – Barchart

Canadian Supply and Disposition Estimates – For Reference Only – USDA FAS Most recent Update January 2025. For Wheat and Canola Supply and Dispositions – Refer to Daily Email Service for the Tabs

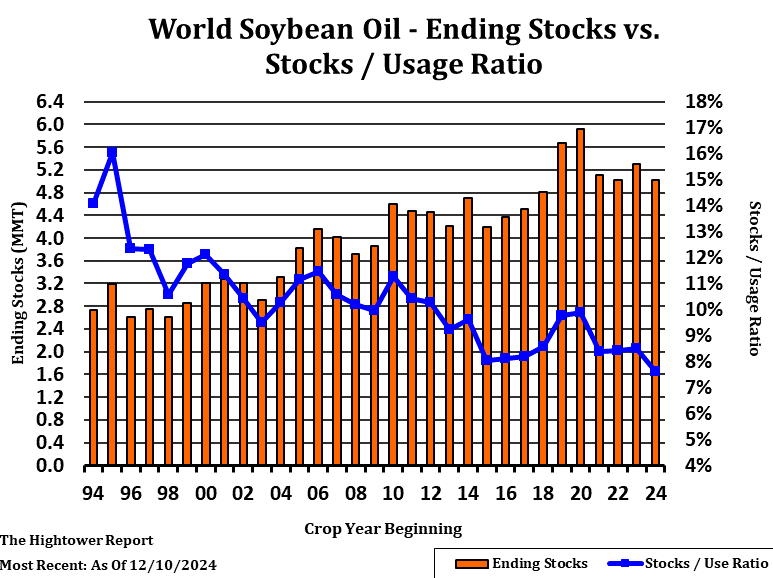

World Ending Stocks – Stocks to Usage Ratios – CME GROUP

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.