Western Canadian Crop Market Update

Click Here To Access 2024/25 Crop Recommendations

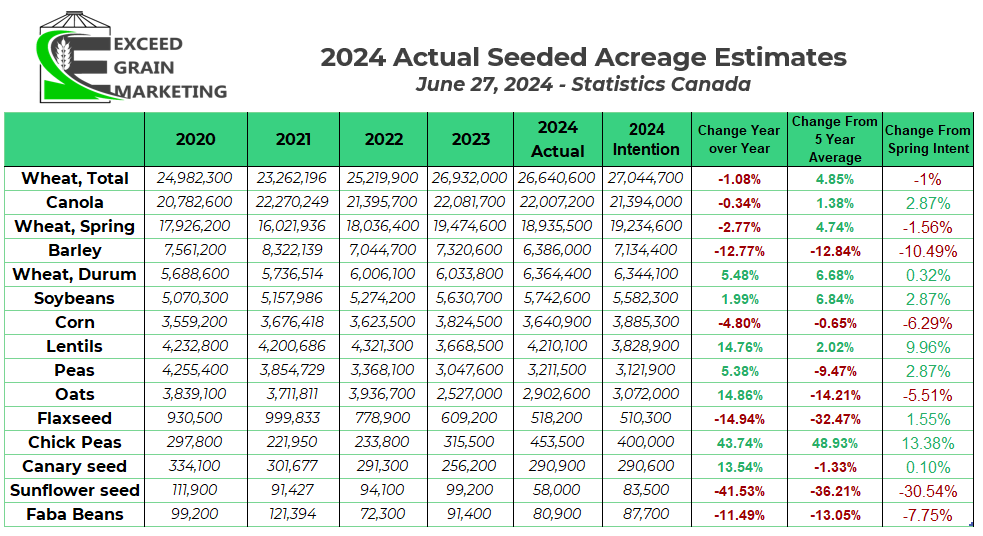

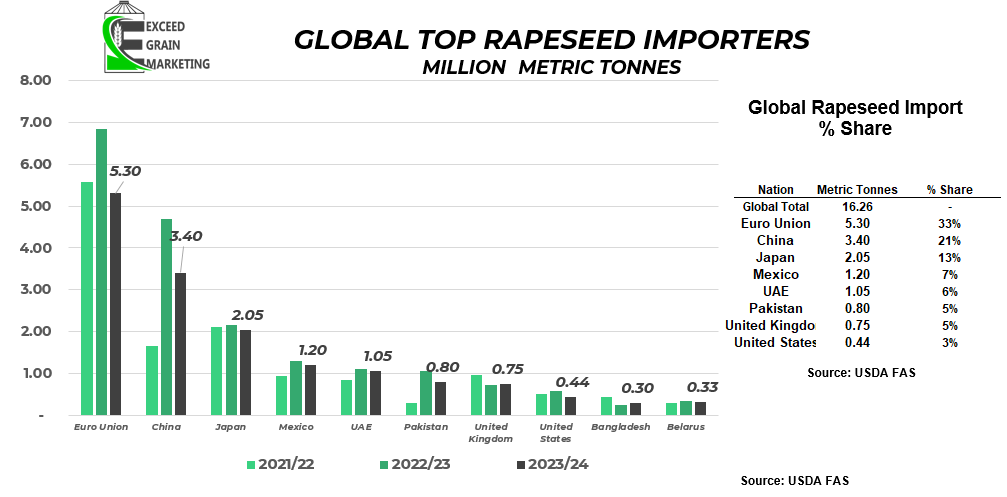

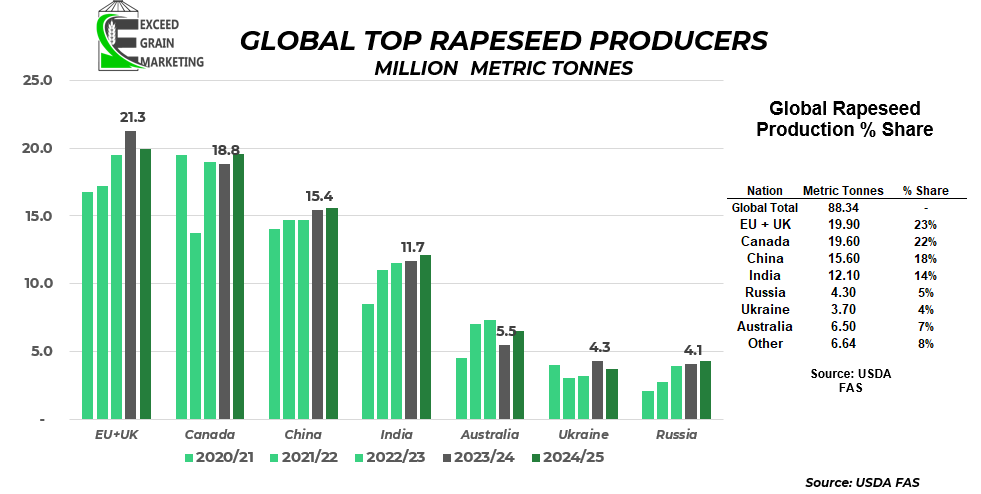

Canola

- Canola closed below $600 for the week at $592.10 for the trade week.

- Canola was trading as high as $607 per tonne for the Friday session.

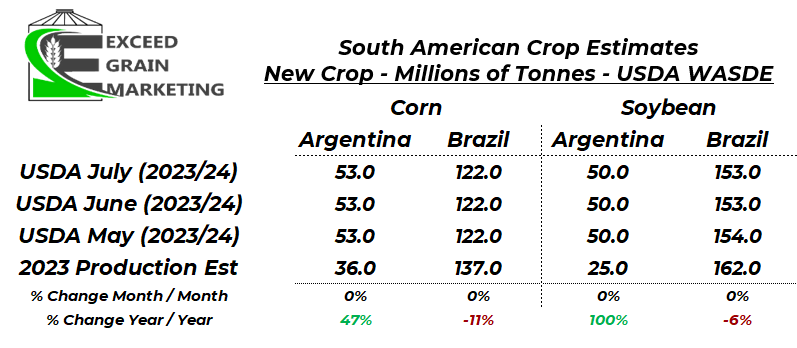

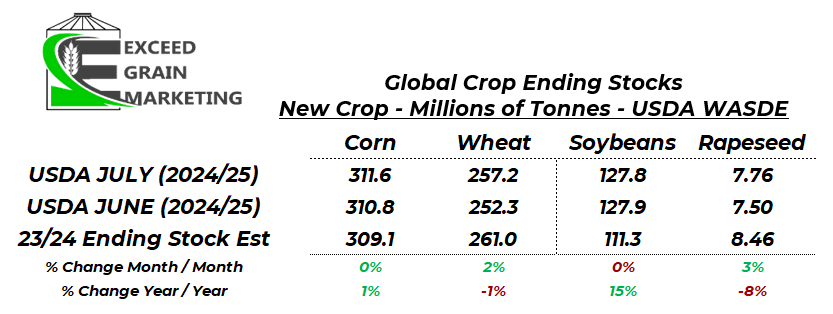

- Weighted by prospects of an anticipated bearish USDA WASDE report to be released on Monday morning.

- United States soybeans FOB sitting at some of the cheapest values in the globe.

- Western Canadian front bids at lowest levels since mid February. Not being helped is the potential for a rail strike affecting both CN and CPKC railways in Canada. The strike could start as soon as August 22nd. August 15th we will know more about a potential strike.

- August 6th, November canola made contract lows at $585 per tonne. Overall sentiment towards ag commodities has been negative with Corn and Soybeans both hitting contract lows in recent sessions as well.

- For the short term, rallies need to be sold into if producer is undersold. These rallies will be more challenged as we get closer to harvest, especially with a looming rail strike upcoming. Know your position and where you want to be sold. Opportunities will need to be capitalized upon in short order.

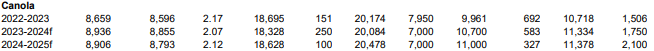

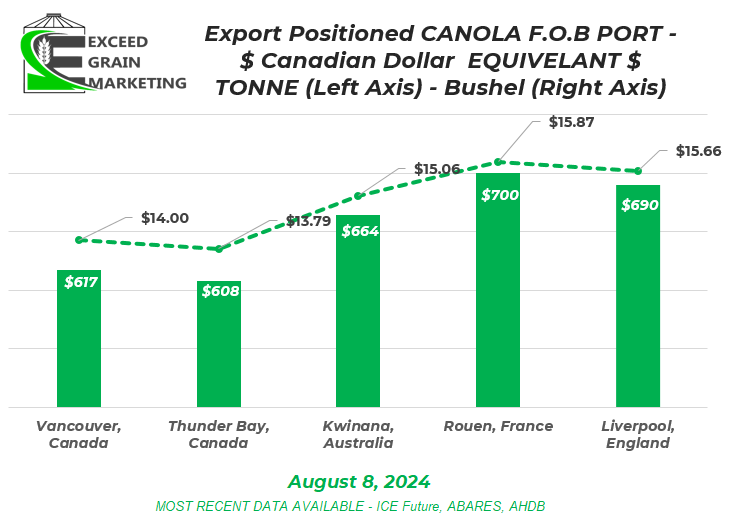

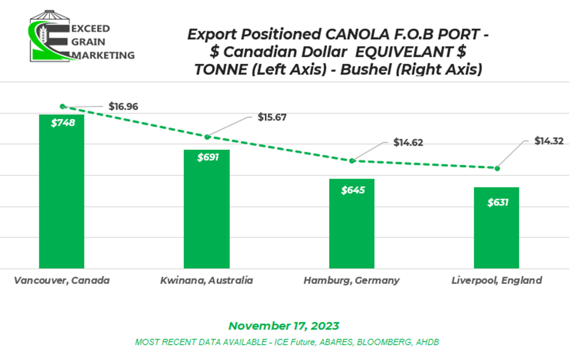

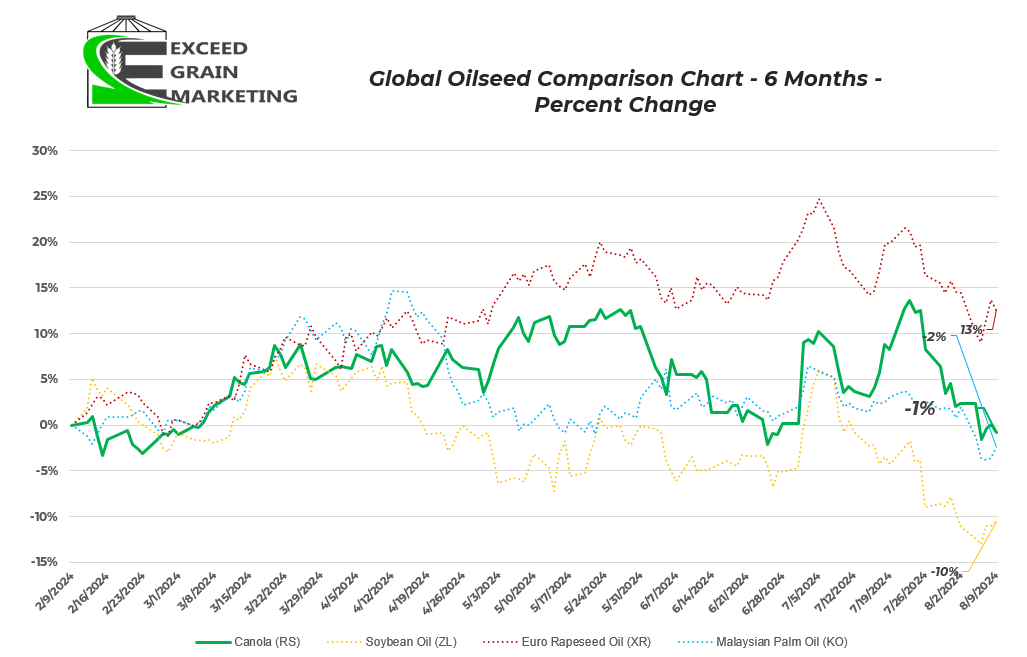

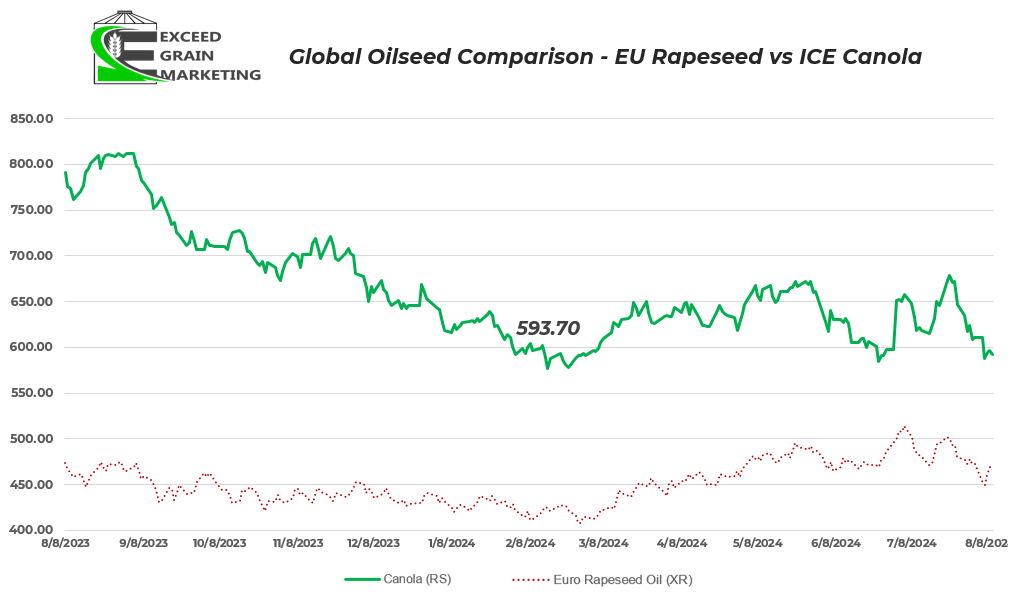

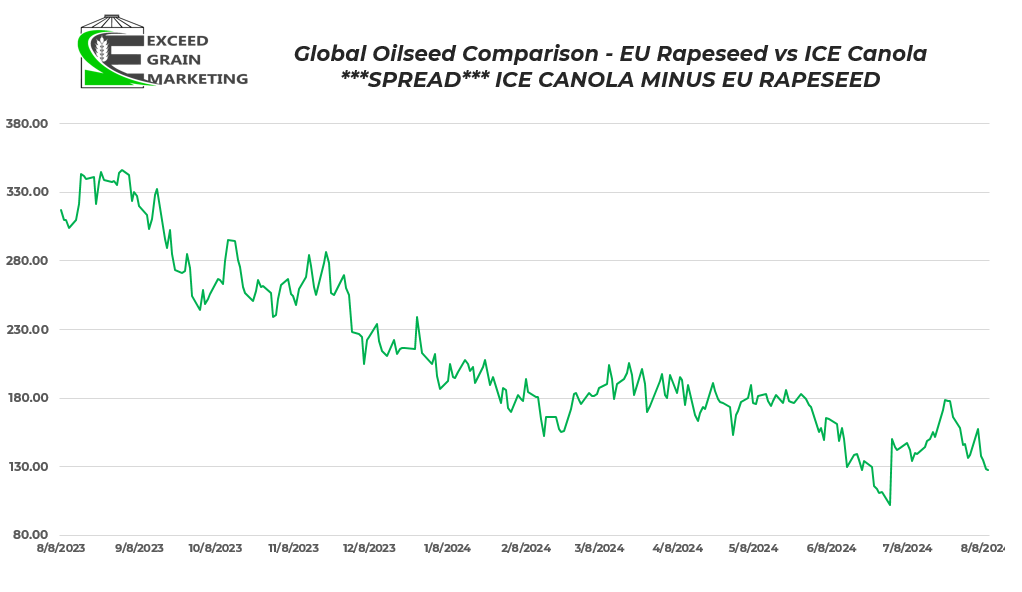

- Canadian Canola sitting cheaper than competitors and compared to last year – See graphic below

- PRODUCTION:

- Western Canadian Crop forecasted to be larger than last year. USDA forecasting a 20mmt crop for Canada. We will see updated FAS USDA figures on Monday. Most private analysts have the crop at 19.5mmt or smaller.

- JULY 22nd Agriculture and Agri-food Canada has the crop at 18.6MMT

- Crop will likely end up in between somewhere. There are some regions with high production potential at this time yet but with July’s heat and rain, the top end yield has been trimmed. Many producers reported a great start to the crop but things dried out in the past 4-6 weeks and heat came intensely during this same timeframe.

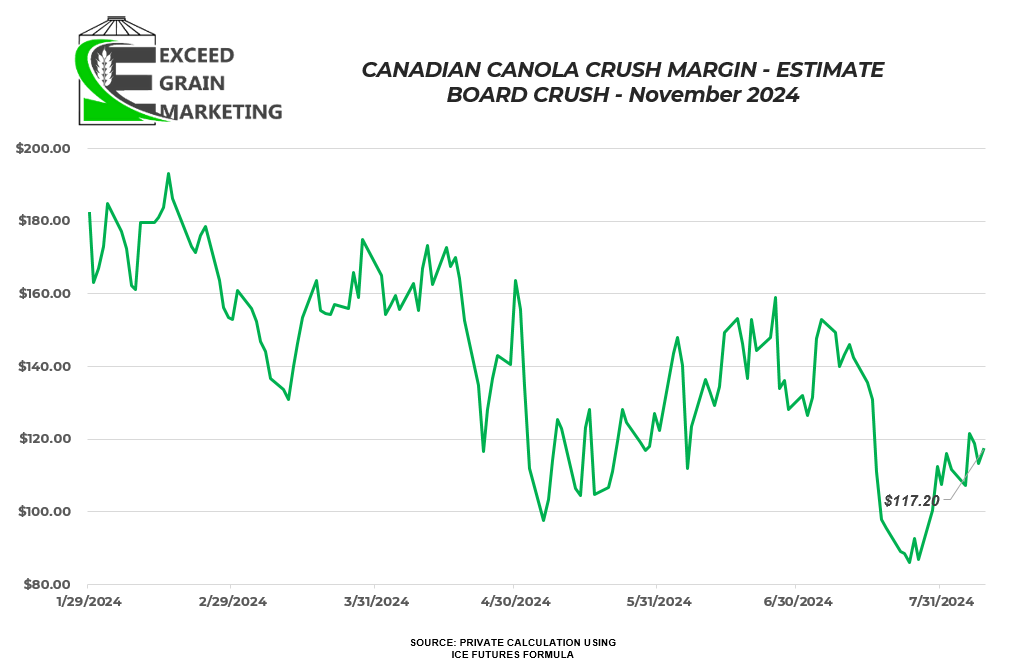

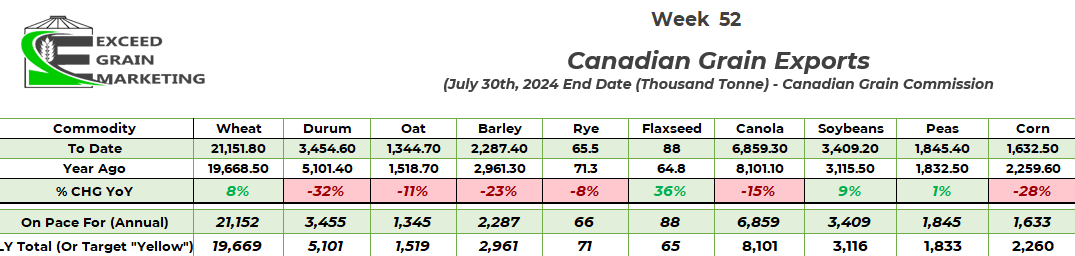

- EXPORTS and USAGE:

- European Union forecasting a smaller crop than last year and harvest is underway at time of writing. Crop estimates from government agencies state around 19mmt crop. Private sources call the crop closer to 18mmt. EU needs around 25mmt total and larger imports will be required. Canada exported next to nothing this past marketing year to EU. Through the first 11 months of the crop marketing year, we exported 103,000 tonnes to Belgium. Few years ago, it was not uncommon to do 500,000 to 1.5 mmt in years where EU faced crop shortfall.

- OLD CROP: For the 2023/24 canola export program, Canadian canola was much to expensive to compete with Australian Canola for the first half of the export program. By early January, Canadian canola exports were only tracking for 6mmt of total exports, a dismal export number. It was not until exports picked up last half of the year where we came in right around 7mmt.

- AAFC has 2024/25 export forecast at 7.0 mmt. This is viewed as a conservative figure, many private analysts sit around 8.0 mmt assuming Japan, Mexico and European Union will likely be in for more crop, time will tell.

- See Global FOB canola prices below

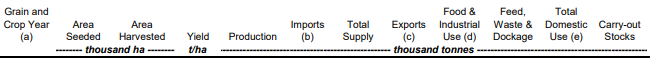

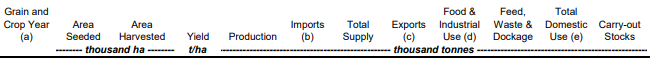

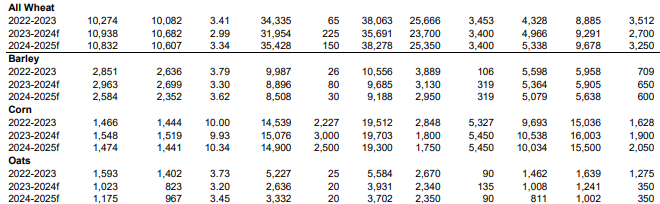

- AAFC Charts below from July 22, 2024 report.

- GOING FORWARDS:

- Harvest will be taking full force here shortly, It is key that traders get a good start to the canola export program. Talks of a CN and CPKC rail strike mid August is a major threat to early grain movement. Could start August 22nd is the estimated date. Global Rapeseed and Canola balance sheet has potential to tighten up longer term, ending stocks already shaping up 9% smaller than last year according to USDA figures. Will mostly depend on what Canadian canola crop comes in at. We know other global production regions well enough already as harvest underway. Early yield reports will be closely watched. Some frosts reported first week of August 2024 in Saskatchewan. Damage is unknown at this point.

- Australian crop the wildcard here, although their crop is expected to be 200,000 tonnes smaller than last year. This crop is in the ground and will be harvested Oct/Nov/Dec.

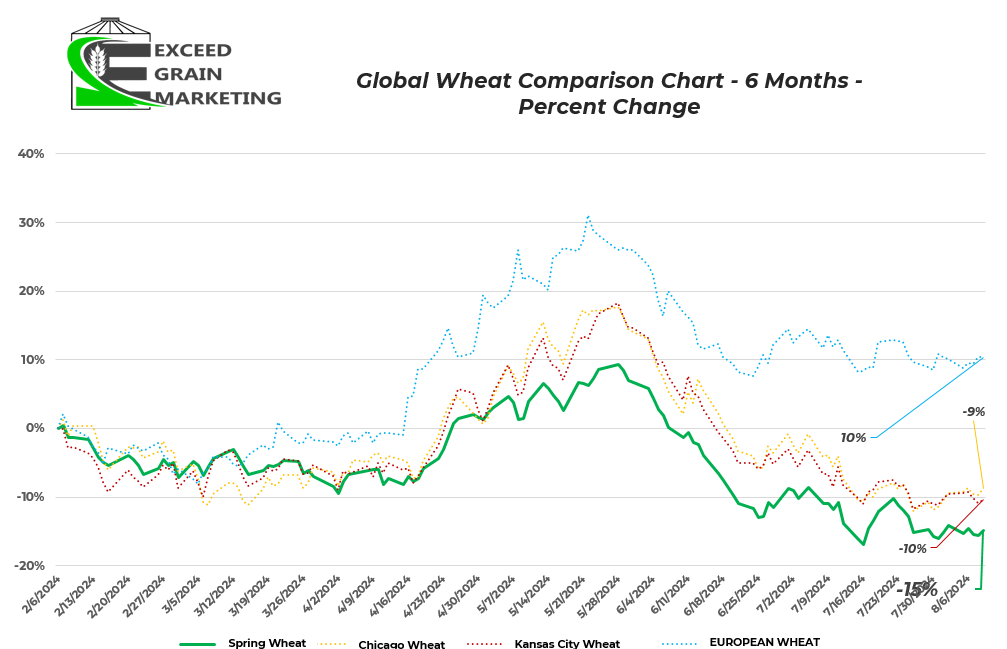

Spring Wheat

- Spring Wheat values lower for the week but has posted rangebound trade since July 17th

- Spring Wheat futures still sit about $1.80 USD per bushel from their late May peak

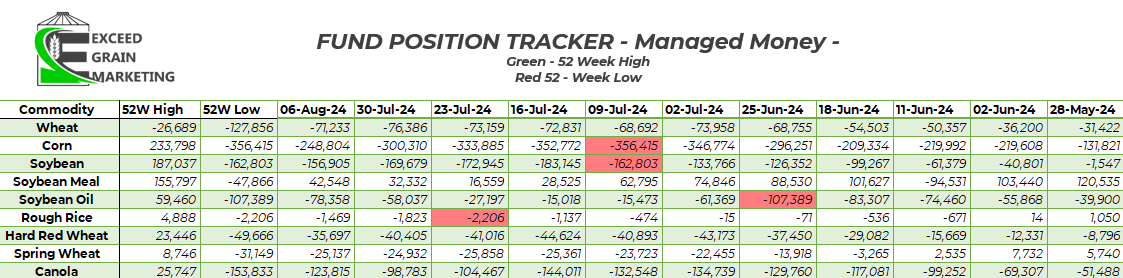

- Wheat, Corn and Soybeans all sitting near levels last seen in 2020 and making new contract lows.

- Markets have been in a downwards trend since the end of May. No weather stories and prospects of a potential record yield from North Dakota, the largest Spring Wheat producing state in the USA

- For the short term, rallies need to be sold into if producer is undersold. These rallies will be more challenged as we get closer to harvest. Know your position and where you want to be sold.

- PRODUCTION:

- Canadian non durum wheat crop expected to be large. 1.2 mmt larger than last years crop. Around 29MMT is expected to be produced according to AAFC’s latest stab at the crop size. Looks like ending stocks could be more burdensome than earlier forecasted as well.

- Wheat will come down to quality. Protein levels and quality will be closely watched. Plenty of producers concerned about potential fusarium infection due to rains around heading and anthesis.

- Global production – Winter wheat crop is mostly off in the United States. Quality was quite good and plenty of good yields reported. US Spring wheat harvest will commence shortly but majority of fields will be ready to go mid August. Market expects a good crop, private tours are touting it to be a record yield in North Dakota.

- Across the pond, wheat quality is questionable at best. Plenty of low protein wheat coming off fields in Russia, Ukraine, Germany, France, Poland. Grading issues a concern over rains at harvest especially in France and Germany.

- French wheat is forecasted by private analysts at around 25 mmt. Last year the crop was closer to 35mmt

- EXPORTS and USAGE:

- Global balance sheet for wheat actually tightest in several years. Ending stocks of 257 million tonnes vs 260 to 285 mmt range in recent years. Balance sheet amongst key exporters even tighter.

- Ukraine entered Russia’s Kursk region this week, first true offensive onto Russian soil since the war began.

- Canadian exports last year were particularly strong, not due to cheapness, but due to the quality of the crop. Canadian crop was blended and fit a gap in the market. Exporters looking to hit the same niche this year and push wheat exports as strong as they were last year.

- AAFC has 2024/25 export forecast at 20.5 mmt. This is viewed as a strong year and will keep ending stocks in check.

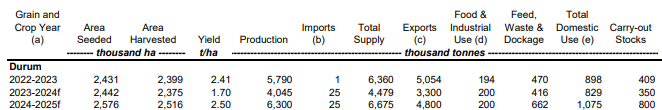

- AAFC Charts below from July 22, 2024 report.

- GOING FORWARDS:

- Harvest will be taking full force here shortly, wheat prices are at some of the lowest levels in 4 years. Harvest pressures may last longer than anticipated especially if there is any rail strike or logistical issues. We are 30% sold new crop overall and will await quality results before making next cash sale move.

Oats

- Oat prices are sit at $3.75 to $4.50 new crop across the prairies. The $4.50’s belong to the glyphosate free market. Oat market prices have followed other ag commodities lower. Oats were anticipated to have been heavily sold by producers early in the production year when values were about $0.50 to $1.00 per bushel higher than todays values.

- Oat crops loosing top end yield with the heat and dryness. Producers beginning to mention worried about test weight with lack of any precipitation towards the end of the filling period.

- Lowered yield in recent weeks should keep oat inventories in check. Front end demand is largely covered off for oats although and pricing will depend on post harvest demand and how this crop actually shakes out. AAFC is calling for a carryout of just 350,000 tonnes which would be considered very tight. Private analysts are about double that figure as private industry anticipates more oat acres were planted than government agencies reported this spring.

Barley

- End users / Maltsters came out of the gate early with bids and appear to have covered off front demand. Malt supply never is truly understood until harvest. Barley acreage down slightly year over year, but export demand has shifted lower than in a few prior years.

- Corn is the Achilles heel to feed barley pricing. Corn is very cheap and even with barley values about 40% lower year over year, it still struggles to find competitiveness into feed rations.

- Exports are not expected to be anything special as we largely lost a pile of market share to the Australian market exporting into China.

- Malt is the play this year and grade at harvest will dictate price sentiment. Early malt bids are still holding place, Malt game will be well understood within the next two weeks.

Pulses

- Early lentil yields are coming in across western Canada. Early results are mixed. Most sentiment is lower than anticipated with the early results for yields.

- Pulse producers could be set for nice yields although some early season flooding rains knocked out a few acres

- AAFC July 22nd Report Chart Below

- Lentil stocks could get heavy this year and private analysts and gov agencies calling for a sizeable growth in carryout. Global demand will be the key factor here. A few key sales to export markets will dictate the balance sheet massively come the end of the marketing year.

Durum

- Durum beginning to be harvested in western Canada. First few samples off in last day or two. Give it another 10 days before having a widespread handle on the crop. Durum carryout could be on the heavy side if yield prospects stack up. Disease will be closely watched this year as some rains fell at prime time for disease timing.

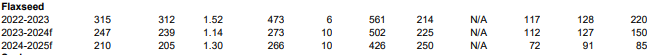

Flax

- Flax production is forecasted to be quite small this year with less acreage going into the ground. In fact, Flax acres are the smallest since the mid 1940’s. Flax prices will be influenced by EU demand. Russia’s flax crop will be challenged to move into EU borders this year due to new import tariffs that began on July 1st for flax which will be scaled up in the coming years.

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.