Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

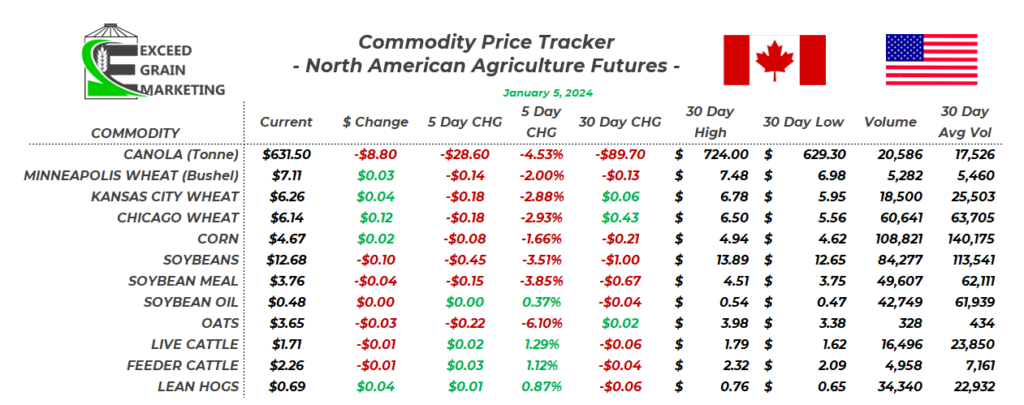

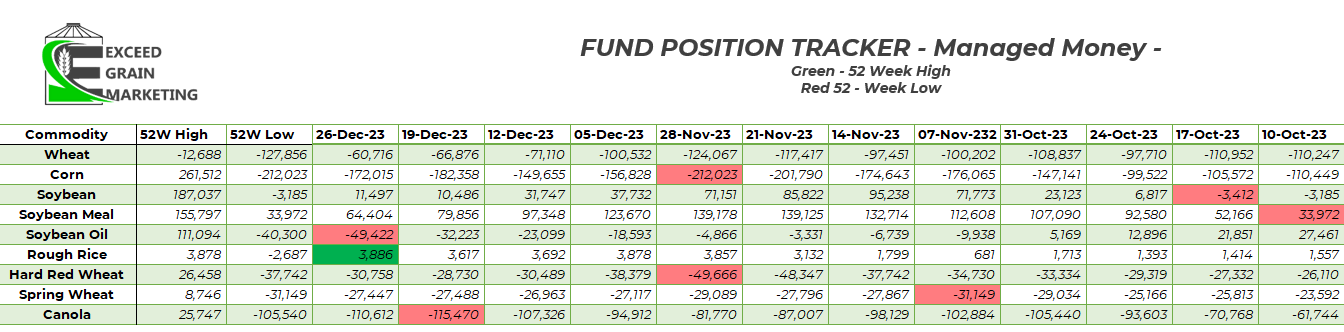

- Futures facing another tough week with more fund and farmer selling into lows not seen in close to 8 months. Late May and early June was the last time we seen the markets sitting near these levels.

- We have some key reports coming up next week. CONAB (Brazil) will be out on Wednesday with their figures and USDA WASDE will be the most watched release locally and globally as the January 12th (Friday) report will provide bulls and bears some fodder to chew upon. We will get final 2023 crop production numbers for the USA, Global Demand and Production Numbers. Lastly we will get updated global ending stock estimates and Q4 final US grain stocks.

- Markets sentiment heavily weighted upon Brazilian / South American weather happenings. Markets also looking for any signs of strong global demand. This past weeks US global export figures all came in at marketing year lows, although normal for holiday trade.

- This provided more room for bears to run with the market and keep any bulls at bay for the time being.

- Fund rebalancing expected in the week ahead, analysts expecting to see some fund buying but to what extend will they take the market. Key thing to take note of will be the funds sentiment heading into the reports even. Will they want to be short headed into possible cuts? Or are they comfortable with the position being held?

- Aside from this, there is limited fundamental news to trade upon. Bears holding the market hostage partly due to the lack of any immediate supply concerns or bull stories for the immediate trading situation.

- Non Futures traded commodities in western Canada holding their own quite well. Wheat and Canola bouncing around withe the futures but we have seen some great selling opportunities recently, notably peas. Flax bids are warming up from their pre christmas lows and seeing some action on a few other special crops, further details below.

WESTERN CANADIAN CROP NOTES

Canola:

- Stuck near its 2023 futures market lows and has run itself into a bearish trade. Canola has been at the mercy of fund selling and has been trading lower in lockstep with soybean oil.

- Exports are lagging and crush is running at a very impressive pace, could hit a 11mmt record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

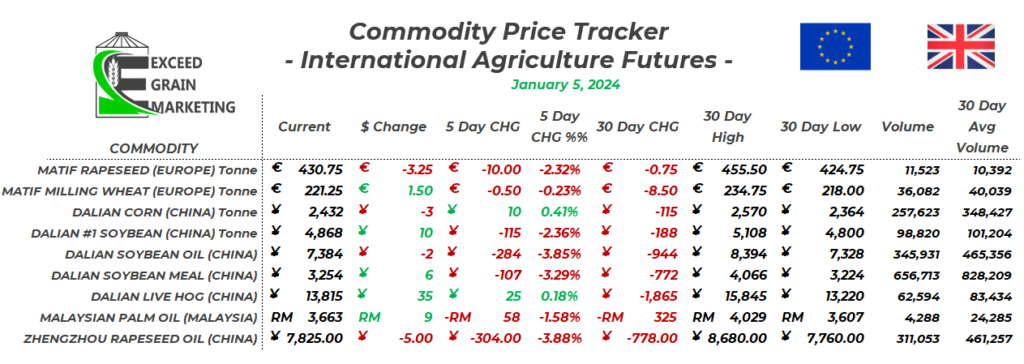

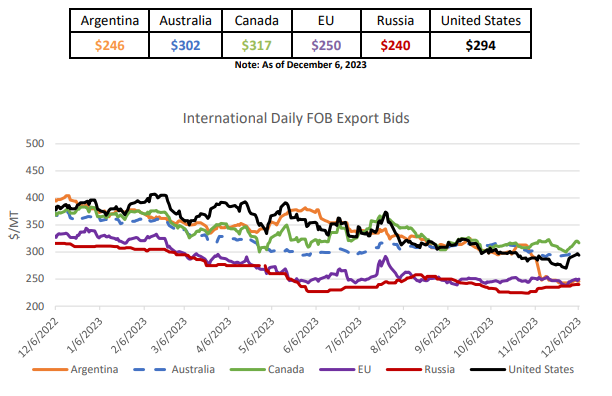

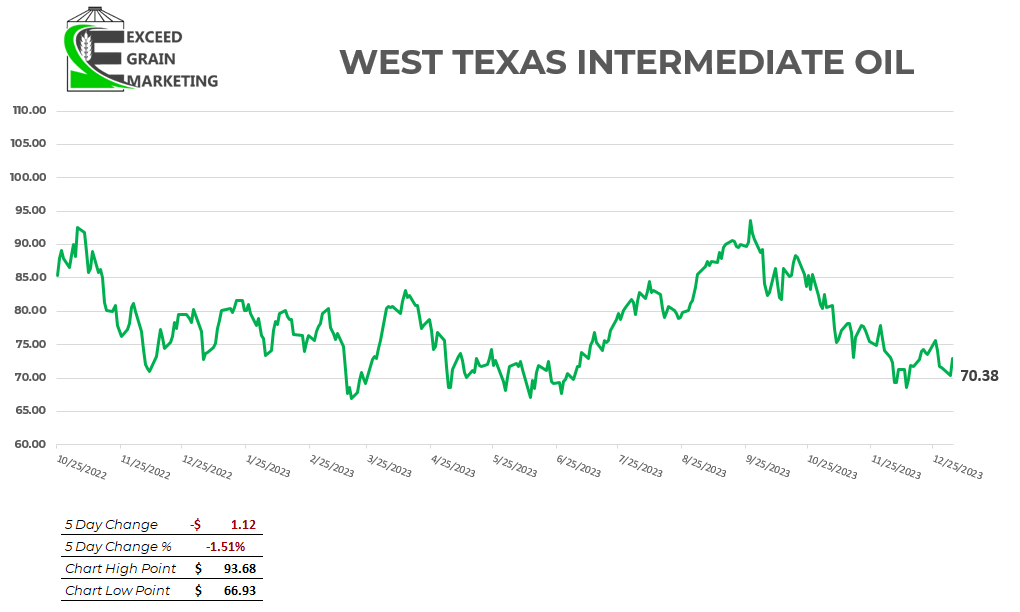

- Canola will trade at the mercy of foreign veg oils for the time being (Palm, Soy, Rapa).

- South American harvest and export demand will dominate the trade headlines, Western Canadian weather will pick up more of the news come closer to spring.

- Crusher bids still dominate and hold close to the $14.00 mark today.

- For a more in depth analysis, check out our special report by clicking here: Canadian Canola Market Fundamentals – Q1 2024

Spring Wheat:

- Canadian Wheat exports and domestic usage considered very strong. At the current pace of exports and domestic usage, rationing will be needed.

- Wheat market has been held up by relatively strong basis in Western Canada throughout the fall

- Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

- HRSW bids still posting $9.00 in select locations. $8.75 in weaker basis regions.

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part.

- Next thing market will be watching for is crop progress in the US and EU winter wheat crops and Spring Wheat planting conditions in Europe. This will be more relevant come April / May.

Special Crops

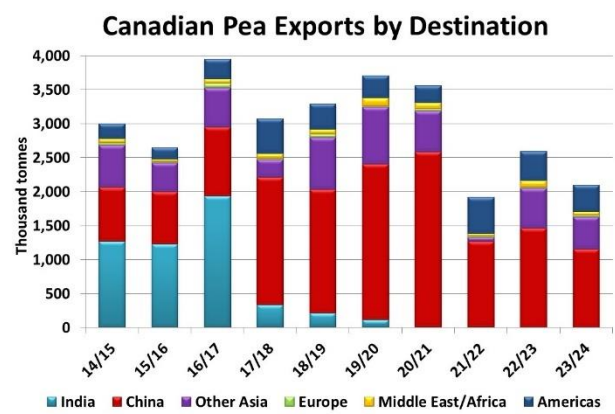

- Biggest special crop news recently has been India’s adjustment of import tariffs on Yellow Peas. The nation reduced import tariffs on yellow peas from 50% down to 0% until March 31st, 2024

- India is looking to fill some short term need until their new crop is harvested. The exemption is expected to have worked well as domestic bids in India fell after the announcement

- Red Lentil reduced import tariffs extended until March of 2025

- Yellow Peas still around $13.00

- Green Peas $17.50

- Red lentils around $0.38 per bushel

- Canary Seed $0.41 FOB most locations western Canada

- Flax Bids in the $15.50 to $16.00 range FOB

- Feed Barley $5.50 range.

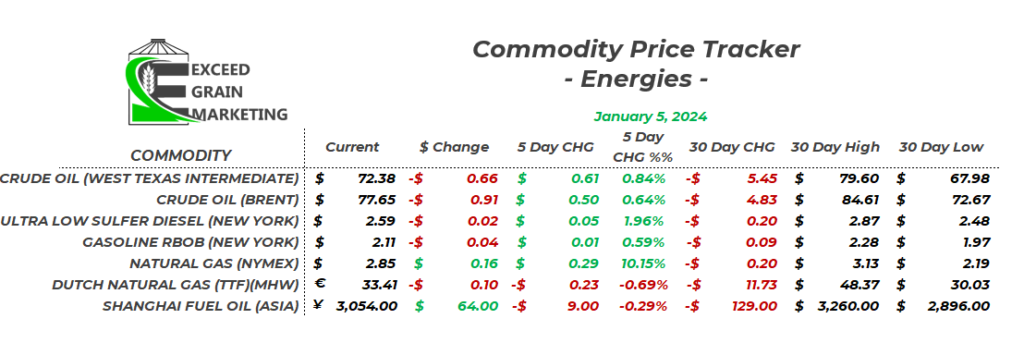

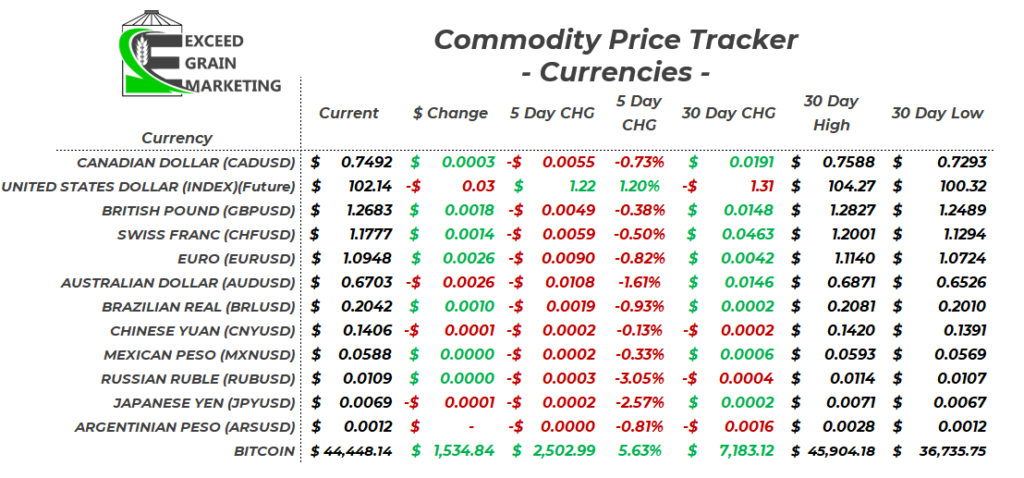

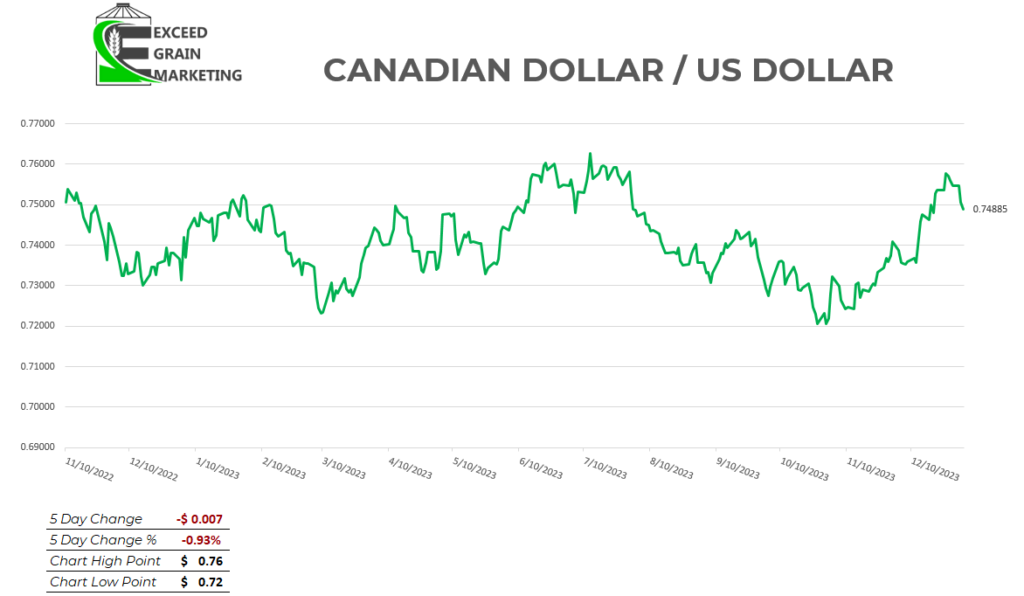

- Feed Barley at the mercy of US corn crop prices and Currency. Corn prices softening in the US and the Canadian dollar picked up a few pennies since fall time. Corn imports still pencil out into Canadian feeders.

- Durum prices in key global markets trending sideways. The Turkish exports that hit the market a few months ago still being chewed through. No indication of any significant price swings either way for the short term. Durum sits in the $12.50 range.

Latest Key Fundamental Report Highlights

- USDA WASDE ( DECEMBER)

- Global Ending Stocks

- Corn: 315.2 mmt vs 315 last report. Market was looking for the 313.4 range

- Soybeans: 114.2 mmt vs 114.5 last report. Market was looking for 112.8 mmt.

- Wheat: 258.2 mmt vs 258.7 mmt last report. Market was looking for 258.9 mmt

- US stocks came in pretty close to expectations

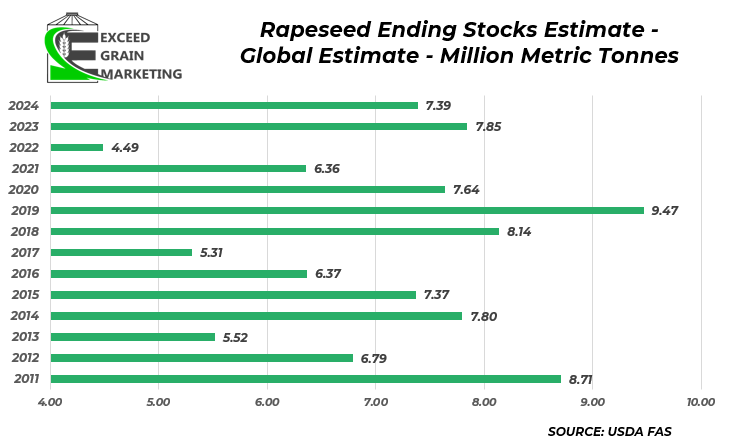

- USDA added 1 mmt to the Canadian canola crop to land it at 18.8 mmt. Put Domestic consumption (mostly crush) at 11.05 mmt and exports at 7.7 mmt. Ending stocks at 1.65 mmt

- USDA cut Brazil bean to 161 mmt from 163 mmt

- Wheat ending stocks down 500,000 tonnes and the lowest global carryout since 2015/16.

- AUSTRALIAN ABARES (DECEMBER)

- Australia came out with its ABARES report on December 5th. The report was slightly bearish, especially for canola as they tacked on a few hundred thousand tonnes since their September report. 5.5 mmt is the figure they are going with as it appears the crop grew in size as they got into harvest.

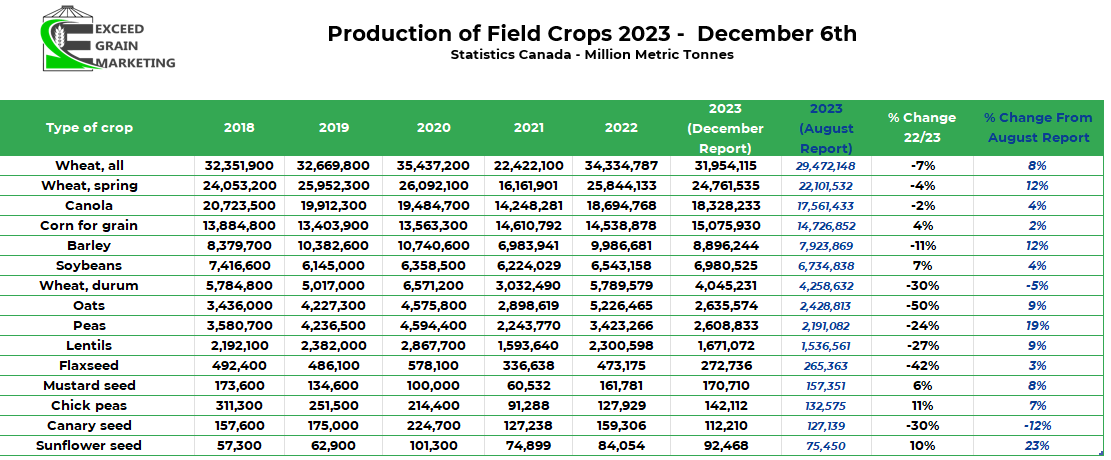

- STATS CANADA ( DECEMBER)

- Stats Canada report came in and was mostly as expected but higher than the prior report released pre harvest.

- Canola- 18.3 mmt vs 18.3 mmt pre report estimate

- Spring Wheat – 24.7 mmt vs 24.0 mmt pre report estimate

- Barley 8.9 mmt vs 8.6 mmt pre report

- Oats 2.6 mmt vs 2.6 mmt pre report

- Durum 4.0 mmt vs 4.1 mmt pre report

- Corn 15.1 mmt vs 15.0 mmt pre report

- Soybeans 6.98 mmt

- Lentils 1.7 mmt vs 1.7 mmt pre report

- Peas 2.6 mmt vs 2.6 pre report

- Flax 0.272 vs 0.290 pre report

- Most of the production numbers are higher than they were in the early days of harvest when ideas for the canola crop were floating around a high 17’s number. Same could be said for Durum and a few other select crops.

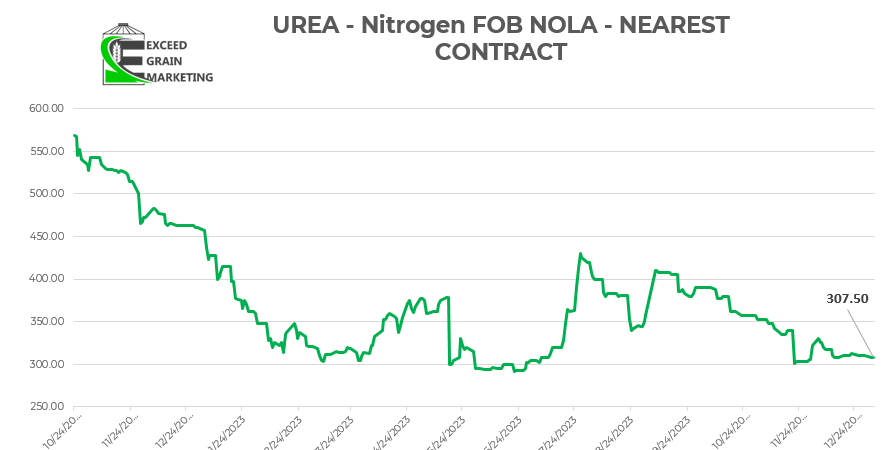

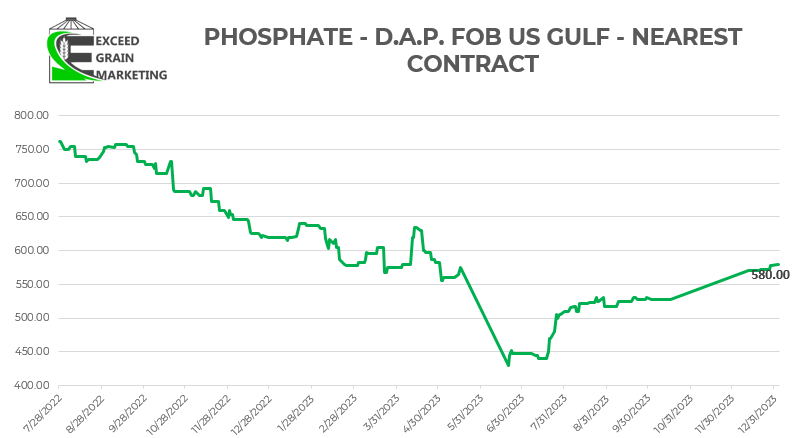

Currency – Energies – Fertilizer

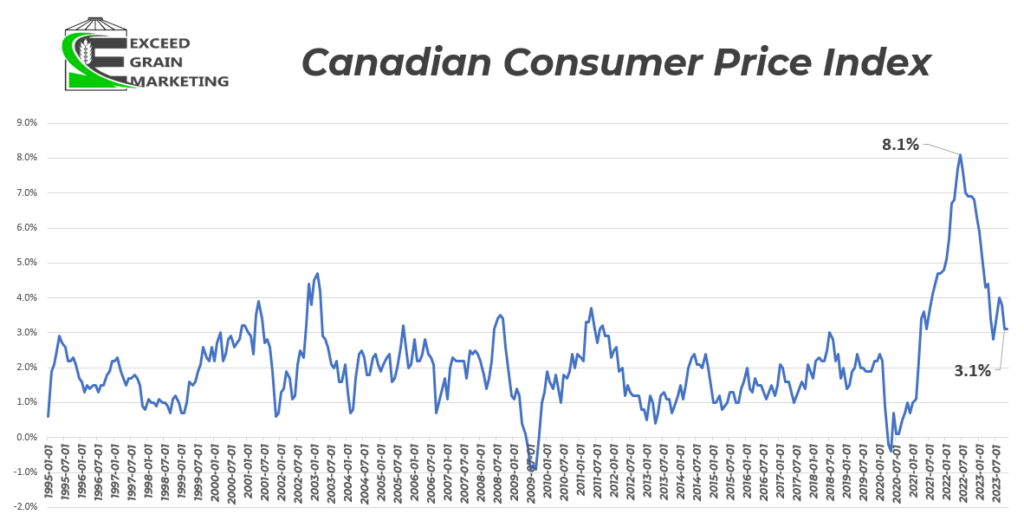

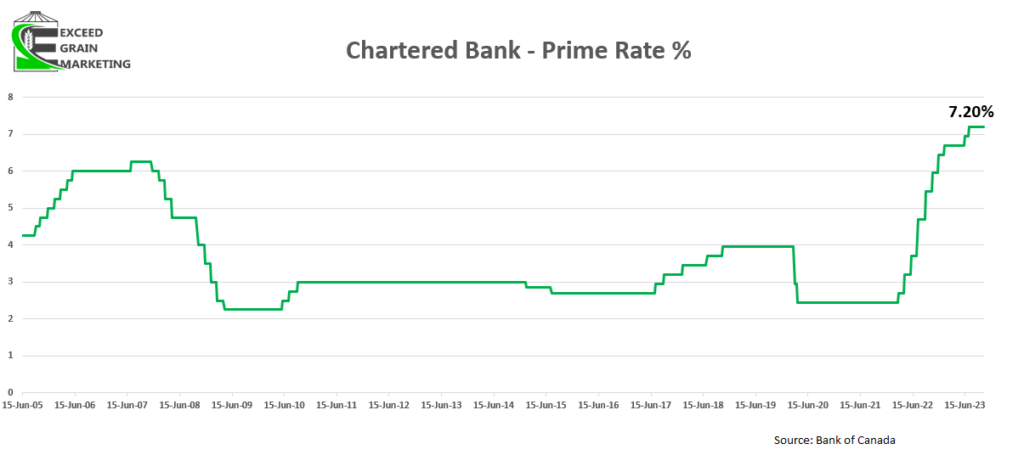

- Bank of Canada Stays Put with current interest rates at the December 6th meeting. Prime sits around 7.2% at major Canadian banks.

- January 24th is the next Bank of Canada interest rate announcement

- Reminder: Some important CEBA Repayment deadlines coming up here very shortly. This is the stimulus loan provided to Canadian businesses back in 2020. Speak with your financial institution for further details on how to repay.

CROP RECOMMENDATIONS

2022-23 Crop Recommendations – CLICK HERE

2023-24 Crop Recommendations – CLICK HERE

2024-25 Crop Recommendations – CLICK HERE

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content of our reports for making financial decisions without such professional advice is at the sole risk of the user.