Each day, our team of experts meticulously analyze the latest market fundamental data, giving you a comprehensive understanding of the intricacies of the market. Whether you’re a farmer, investor, or industry stakeholder, our insights are designed to guide your decisions, helping you navigate challenges and capitalize on opportunities. Stay informed, stay ahead, and transform the way you engage with the agricultural market.

GLOBAL WHEAT MARKET – SUPPLY AND DEMAND FUNDAMENTAL REPORT

MARKET HIGHLIGHTS

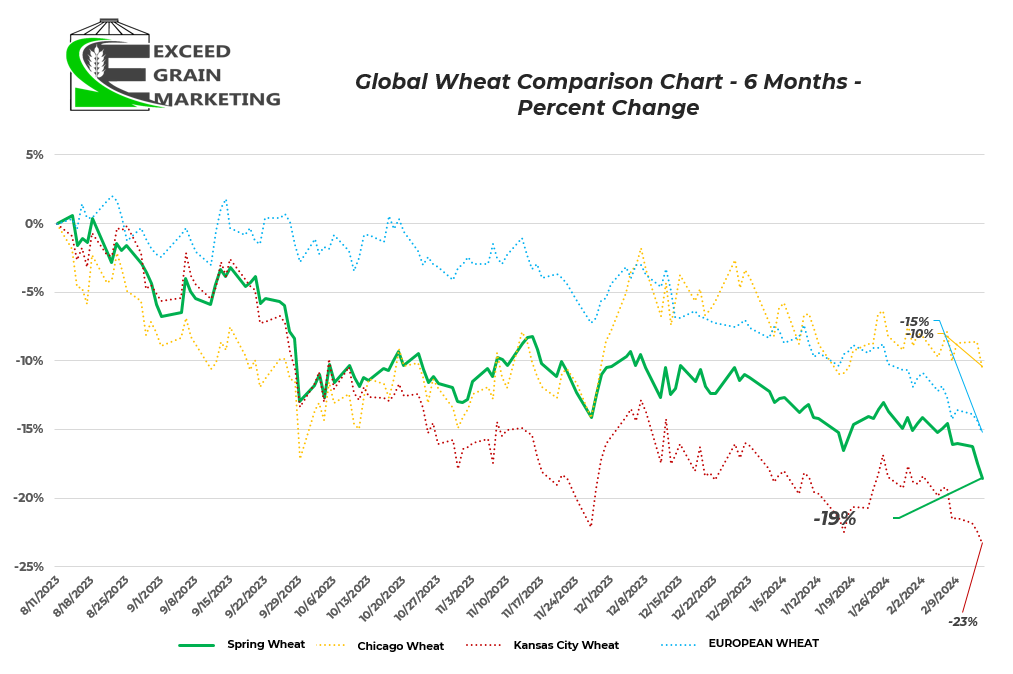

- Futures facing tough trade on Friday, after a strong open, futures started to soften up closer to the end of the trading session. Relatively quiet trading day general amidst a week of 3 key reports.

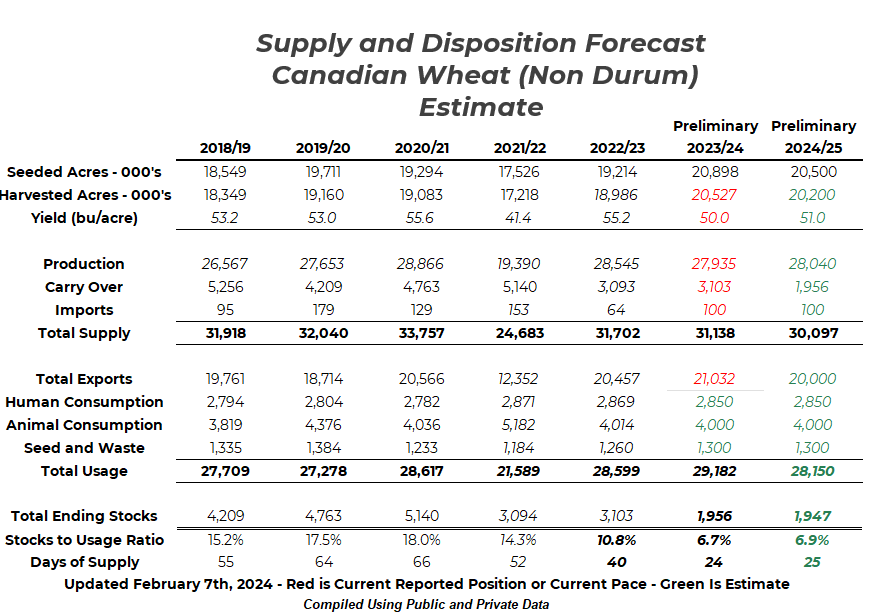

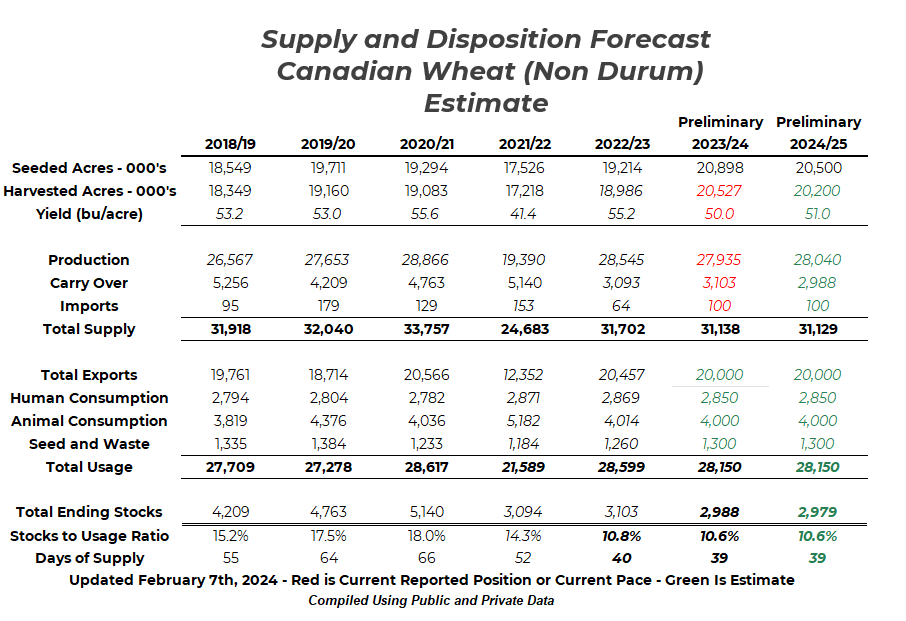

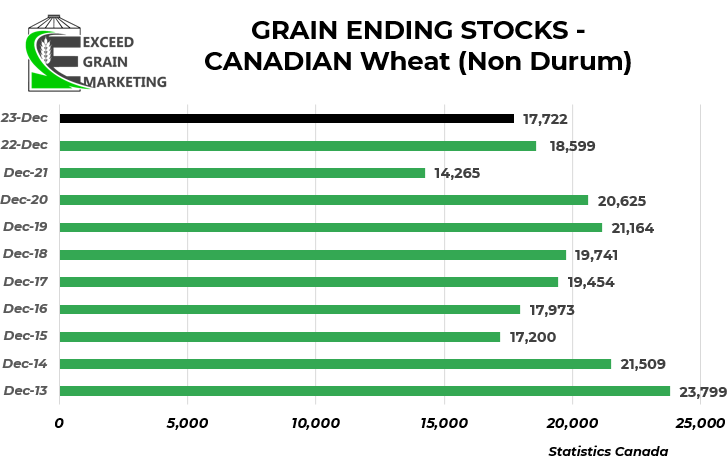

- Demand is such a important issue right now and it looks like higher than originally anticipated ending stocks globally and within North America than when we began the marketing year.

- No USDA Sales announcements this morning

- Looks like some nice rains coming into the prime cropping regions of Argentina

- Markets big ticket items it is looking for is signs of stronger demand from North American sourced grains. Closely watching how Brazil’s crop comes off and how beneficial rains might be in Argentina over the coming weekend.

- Brazil well into its soybean harvest. 20% completed roughly.

- Argentina in the midst of its rain sensitive time. Bean flowering heading into filling time. Harvest still few weeks away.

- USDA Ag Outlook Forum next Thursday and Friday (15th 16th).We will see some of the first acreage estimates from the United States Department of Agriculture for the 2024 planting season

- Chinese New Year celebrations this weekend.

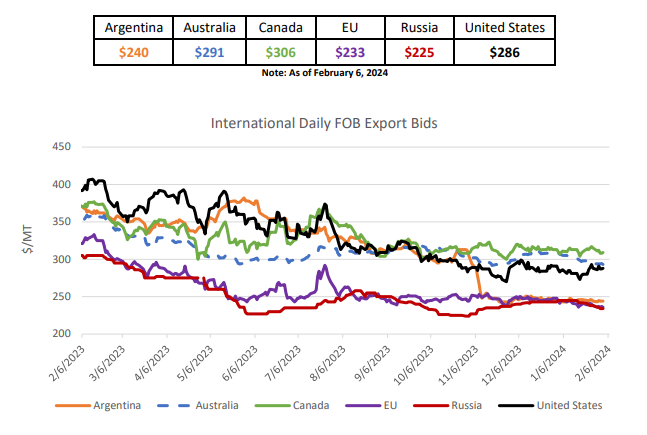

- Canadian Canola at export position traded below Australian export positioned canola at mid week this week. Canadian canola trading about $5 per tonne below its Australian counterpart, something not usual for this time of year, but also signals that Canadian grain has been grinding its way lower to fit itself into competitive export values. Canola at Vancouver track export position reported by ICE Futures Canada at $635.70 CDN on Thursday.

- USDA WASDE February 8th Report Highlights

- USDA’s Estimate at the Brazilian crop came in at 156.0 mmt, down from 157 mmt last month. The problem the market found with this number is that the market wanted to see more of a 153 mmt figure. Overall the report was seen as generally bearish.

- Global Corn Ending Stocks cut to 322.1 mmt down from 325.2 mmt in last months WASDE

- Global Soybean Ending Stocks bumped higher to 116 mmt from 114.6 mmt in the last WASDE

- Global Wheat Ending Stocks adjusted down very slightly by about half million tonnes and comes in at 259.4 mmt

- US ending stocks all higher for their crops

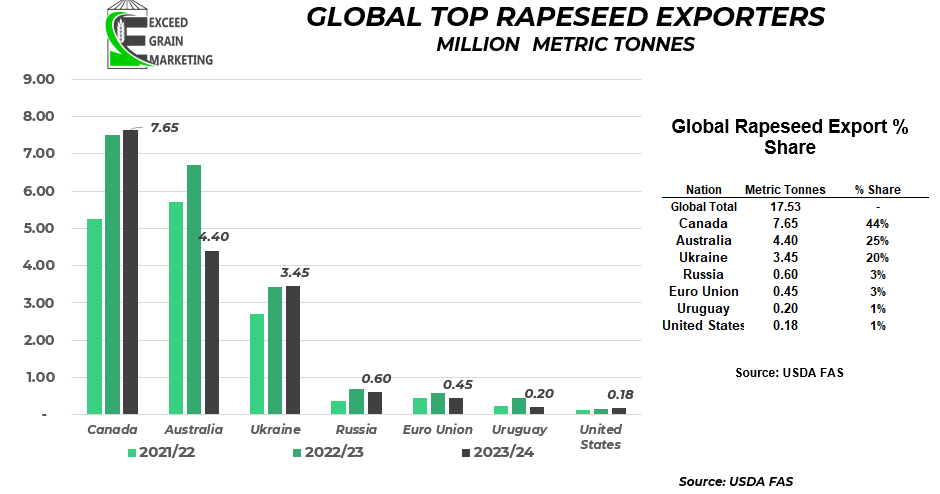

- The USDA kept Canadian canola exports at a 7.6 mmt export figure. We are tracking below 6 mmt on actual exports right now. There is a wide discrepancy in export figures here but it should be noted where other agencies stand.

- CONAB report out Thursday February 8th

- Cut soybean production to 149.4 mmt down from 155.3 mmt in the January report. Brazil also lowered its soy exports for the year to 94.2 mmt from 98.5 in the January report.

- Corn production also cut 7 mmt to 201 mmt total production

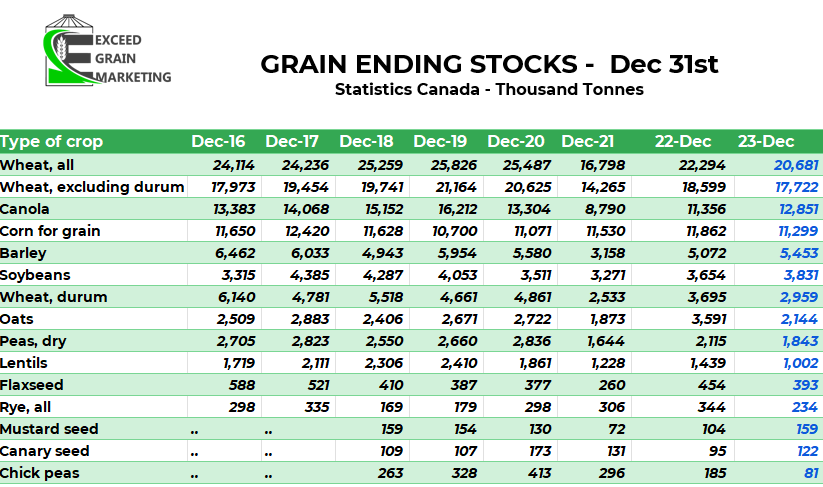

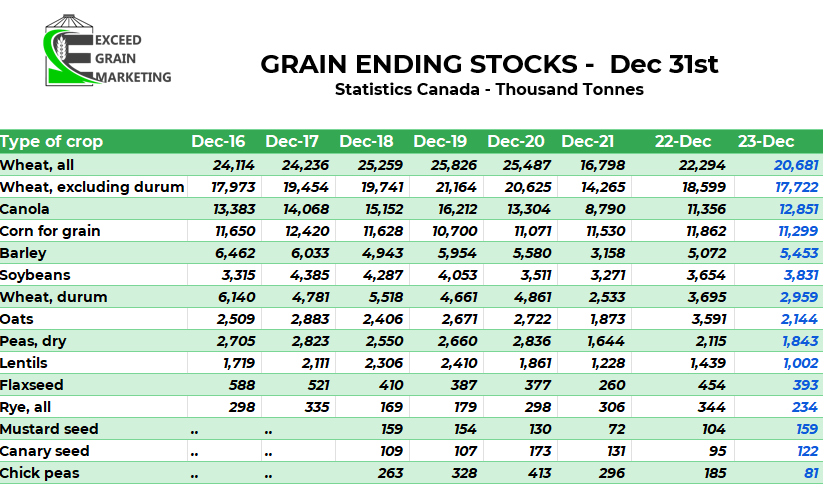

- Stats Canada canola December 31st stocks came in at 12.85 mmt vs expectations in the 13.0 mmt area. Higher for the time of year last year and the year prior, but the 4th smallest in a decade overall. Not exactly abundant as the market makes it out to be. The problem will be how accurate these numbers are first off and how our usage is through the end of the year. If exports continue to lag, then the figure will be of less significance. Something to keep an eye upon

- Interesting to note that some crops came in at the tightest in a long time. Oats were a crop that stood out as well. Aside from December of 2021, oat stocks came in at the tightest in a decade.

- Peas, Durum, Lentils all worth taking a look at as well. Big question remains demand. Durum needs to get more tender business which it has been loosing out upon. Need to pick up export pace for most crops

- Aside from this, there is limited fundamental news to trade upon. Bears holding the market hostage partly due to the lack of any immediate supply concerns and there is a lack of bull stories for the immediate trading situation.

WESTERN CANADIAN CROP NOTES

Canola:

- Stuck near its 2023 futures market lows and has run itself into a bearish trade. Canola has been at the mercy of fund selling and has been trading lower in lockstep with soybean oil.

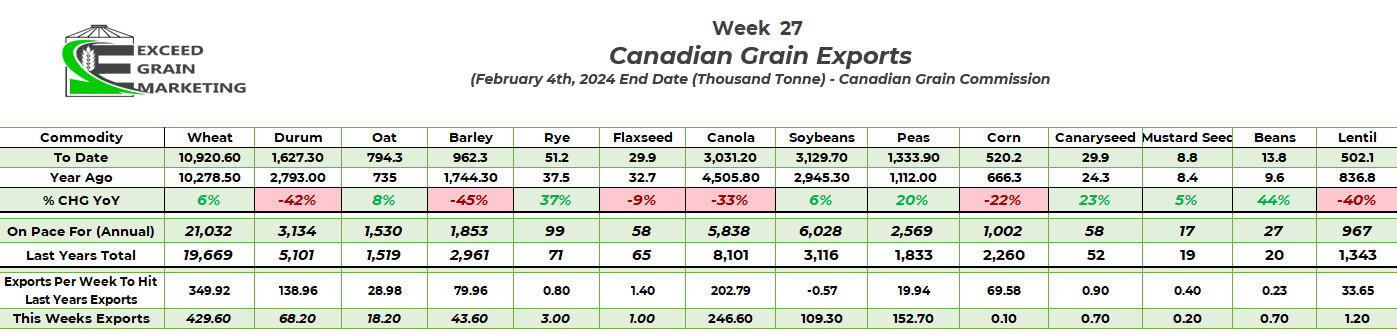

- Very strong week for canola exports, one of the best of the year for the week ending February 4th. Did 247,000 metric tonnes of Canola exports this week. 61,000 tonnes (abysmally low) last week.

- Exports are lagging and crush is running at a very impressive pace, could hit a 11mmt record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

- Canola will trade at the mercy of foreign veg oils for the time being (Palm, Soy, Rapa).

- South American harvest and export demand will dominate the trade headlines, Western Canadian weather will pick up more of the news come closer to spring.

- Crusher bids still dominate and hold close to the $13.25 – $13.75 mark today in some instances, depending on region and Basis levels.

- For a more in depth analysis on Canola Specifically, check out our Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – Q1 2024

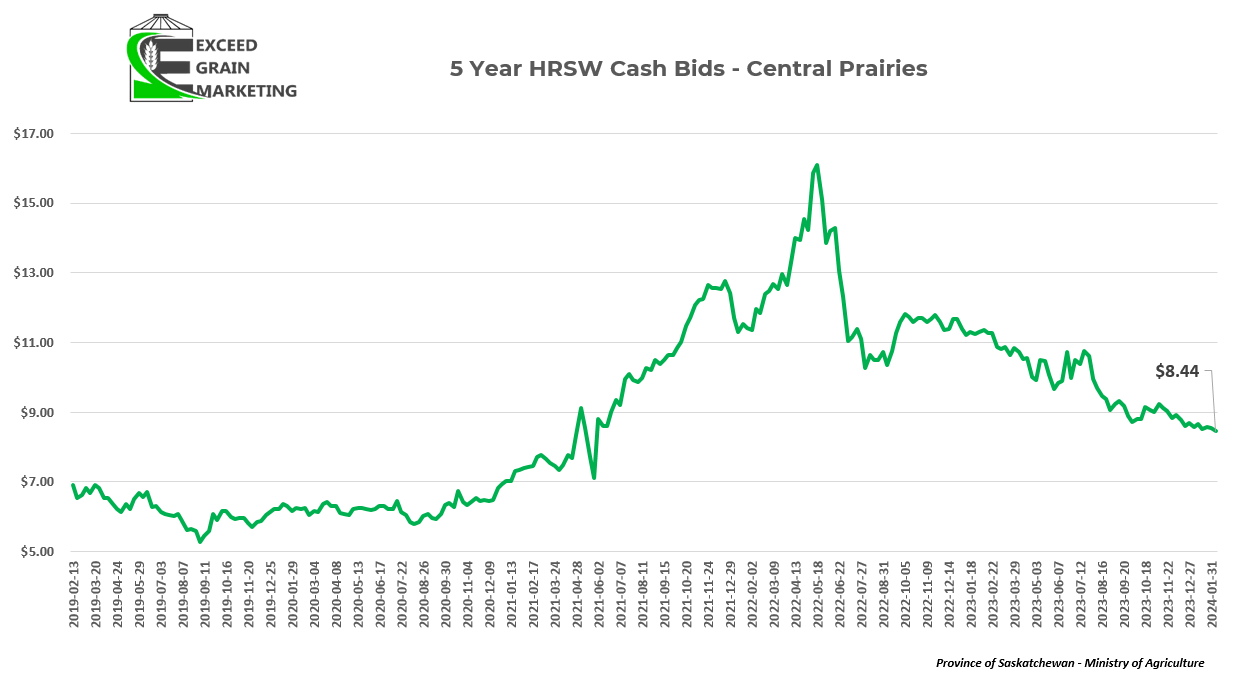

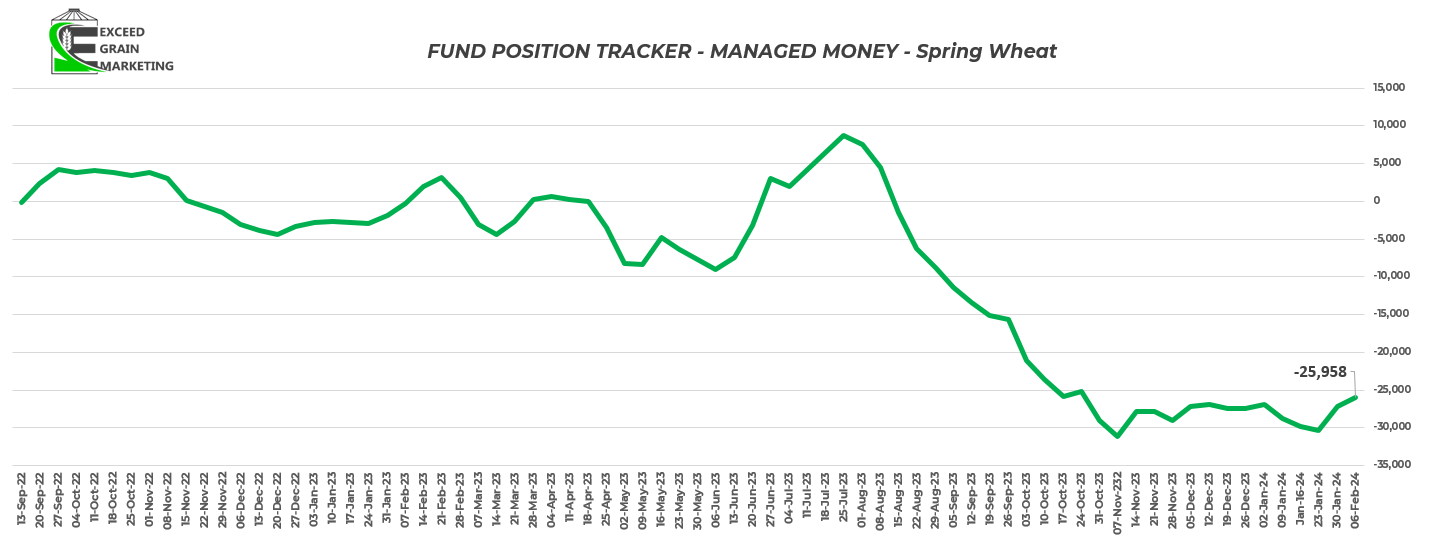

Spring Wheat:

- Canadian Wheat exports and domestic usage considered very strong. At the current pace of exports and domestic usage, rationing will be needed. This does not always mean price correlates accordingly

- Wheat exports expected to easily surpass last years levels at current pace

- Wheat market has been held up by relatively strong basis in Western Canada throughout the fall. Weakness in the futures recently has put basis to the test although as it can not make up for its shortcomings.

- Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

- Old Crop HRSW bids still posting $9.00 in select locations. $8.50 in weaker basis regions.

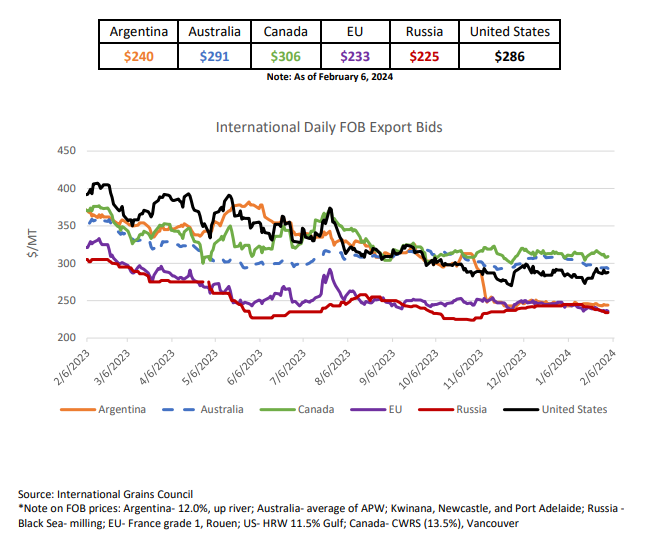

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part.

- Next thing market will be watching for is crop progress in the US and EU winter wheat crops and Spring Wheat planting conditions in Europe. This will be more relevant come April / May.

Special Crops

- India reduced Yellow Pea import tariffs from 50% down to 0% until March 31st, 2024. Most of the significant buying for these deliveries has tapered off over the past week as exporters need to get the peas into export position. Peas that set sail this past week were 152,000 metric tonnes vs 33,000 the week prior, signaling a few more shipments headed out

- Durum exports lagging 42% behind last years pace. Looks like Canadian durum missed out on the latest February Tunisian Durum tender. Russian or Turkish origin is what was anticipated to have took it. Canadian durum bids still hanging in around $11.00 in recent trading days Central Sask. Was $12.50 December / early January

- Red Lentil reduced import tariffs extended until March of 2025

- Yellow Peas buying interest falls from early January. Still some $11.50 to $12.00 bids available. New crop sitting at $10.00 +

- Green Peas $17.50

- Red lentils around $0.33 per bushel

- Canary Seed $0.39 FOB most locations western Canada. $0.41 delivered

- Flax Bids in the $15.50 to $16.00 range FOB

- Feed Barley drops. Sub $5.00 to start February out. Was $5.50 at start of January. Still competing heavily with US corn origination

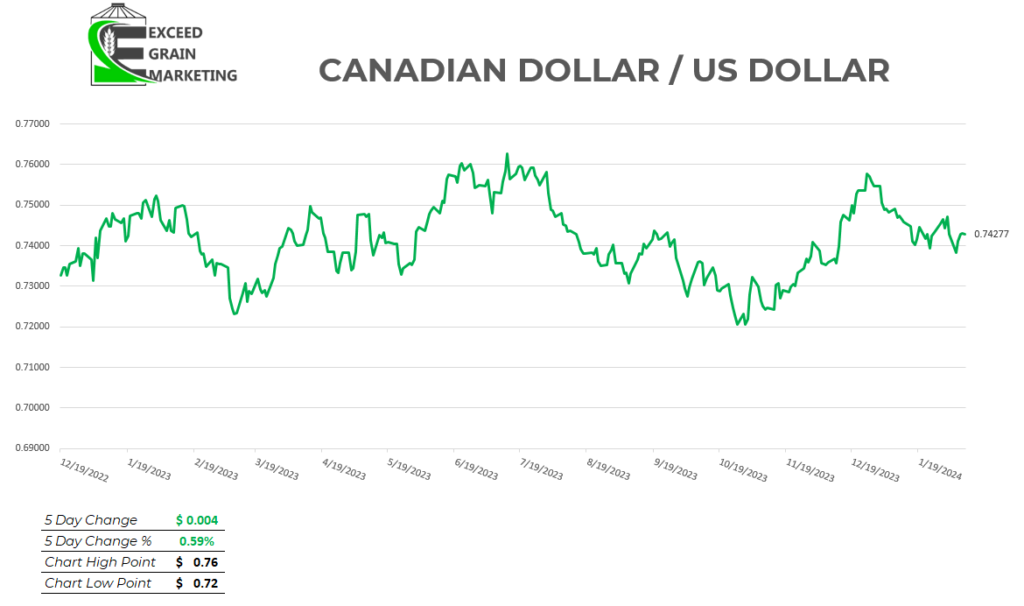

- Feed Barley at the mercy of US corn crop prices and Currency. Corn prices softening in the US and the Canadian dollar picked up a few pennies since fall time. Corn imports still pencil out into Canadian feeders.

Latest Key Fundamental Report Highlights

- AUSTRALIAN ABARES (DECEMBER) Next report is March 5th, 2024

- Australia came out with its ABARES report on December 5th. The report was slightly bearish, especially for canola as they tacked on a few hundred thousand tonnes since their September report. 5.5 mmt is the figure they are going with as it appears the crop grew in size as they got into harvest.

- STATS CANADA ( DECEMBER)

- March 11th we will get Principal Field Cropping Areas

- Stats Canada report came in and was mostly as expected but higher than the prior report released pre harvest.

- Canola- 18.3 mmt vs 18.3 mmt pre report estimate

- Spring Wheat – 24.7 mmt vs 24.0 mmt pre report estimate

- Barley 8.9 mmt vs 8.6 mmt pre report

- Oats 2.6 mmt vs 2.6 mmt pre report

- Durum 4.0 mmt vs 4.1 mmt pre report

- Corn 15.1 mmt vs 15.0 mmt pre report

- Soybeans 6.98 mmt

- Lentils 1.7 mmt vs 1.7 mmt pre report

- Peas 2.6 mmt vs 2.6 pre report

- Flax 0.272 vs 0.290 pre report

- Most of the production numbers are higher than they were in the early days of harvest when ideas for the canola crop were floating around a high 17’s number. Same could be said for Durum and a few other select crops.

Currency – Energies – Fertilizer

- Bank of Canada Stays Put with current interest rates at the January interest rate meeting. Prime sits around 7.2% at major Canadian banks. Hinted that we could be higher for longer. Cuts will not be significant if they do come. The Bank of Canada has also recently hinted that one could face another rate hike but it is hesitant to do so given that Canadians are feeling the pinch of higher rates.

- Canadian CPI Still “Sticky” and sits at 3.4% as of the latest announcement.

- New CPI data out February 20th

- March 6th is the next Bank of Canada interest rate announcement

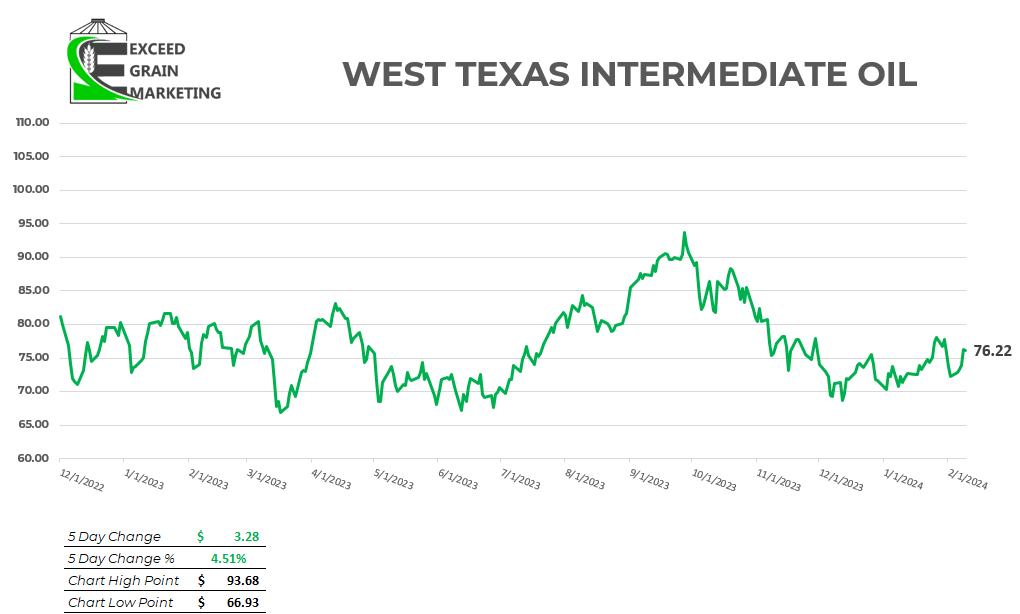

- Crude oil has had a tremendous week. Up over $3.00 in the past five trading days.