Western Canadian Crop Synopsis – June 2024

June 7, 2024

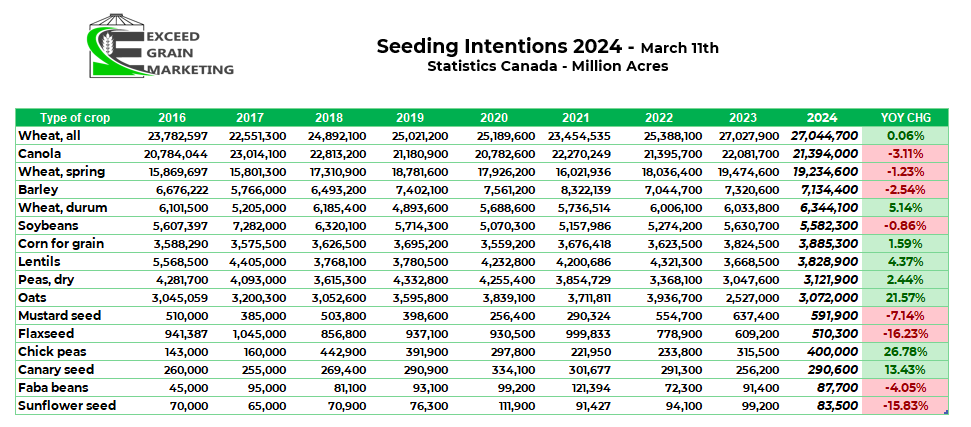

Western Canadian markets have been in for some interesting trades in recent weeks. Canola and Wheat in particular, both futures traded crops spent most of the Month of May appreciating in Value, before starting an ugly path downwards for the first few trading days for the Month of June. Canola futures seen some excellent recovery on Wednesday June 6th, the question remains how the rest of the week and into the midway point of June will turn out for the trade. Wheat futures looking for a recovery level to hit, but unfortunately faced its 7th day lower on the 6th of June for the Spring Wheat contract.

Non futures traded crops, and Oats, have been facing a bit more of a stable path in the past month. Pulses, Canary, Flax, Barley and Oats have been trading narrower ranges for western Canadian Producers. In todays report we will briefly provide a quick glance at cropping and market conditions across the Canadian prairies and a quick synopsis into the crop with a bullet point that could affect this crop heading forwards.

Current Cropping Conditions

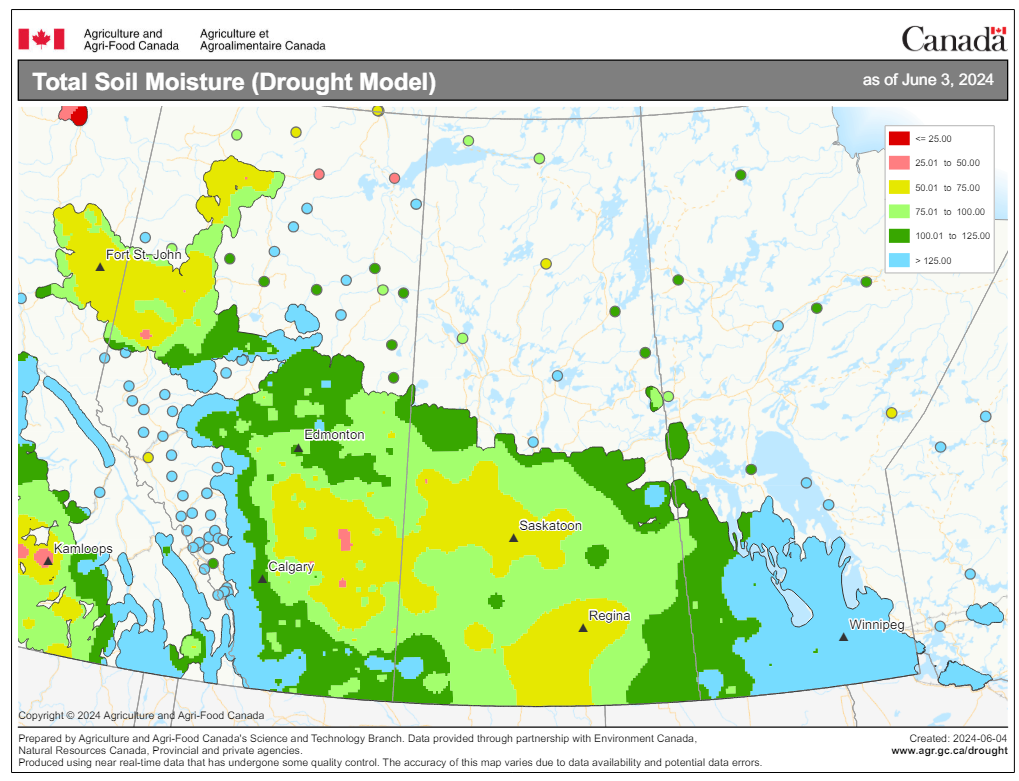

Most of the Western Canadian crop is in across the prairies. There are a few areas that have received some troublesome rains which would extend primarily into Western Manitoba and North Eastern Saskatchewan which have delayed planting progress. These areas have to much precipitation and could hamper yield in the other direction due to crop stress for the seeds that are in. Western Canada has been lacking the spring heat it has seen in other years. Generally temperatures have been running a cooler bias and has left crops a bit late to germinate.

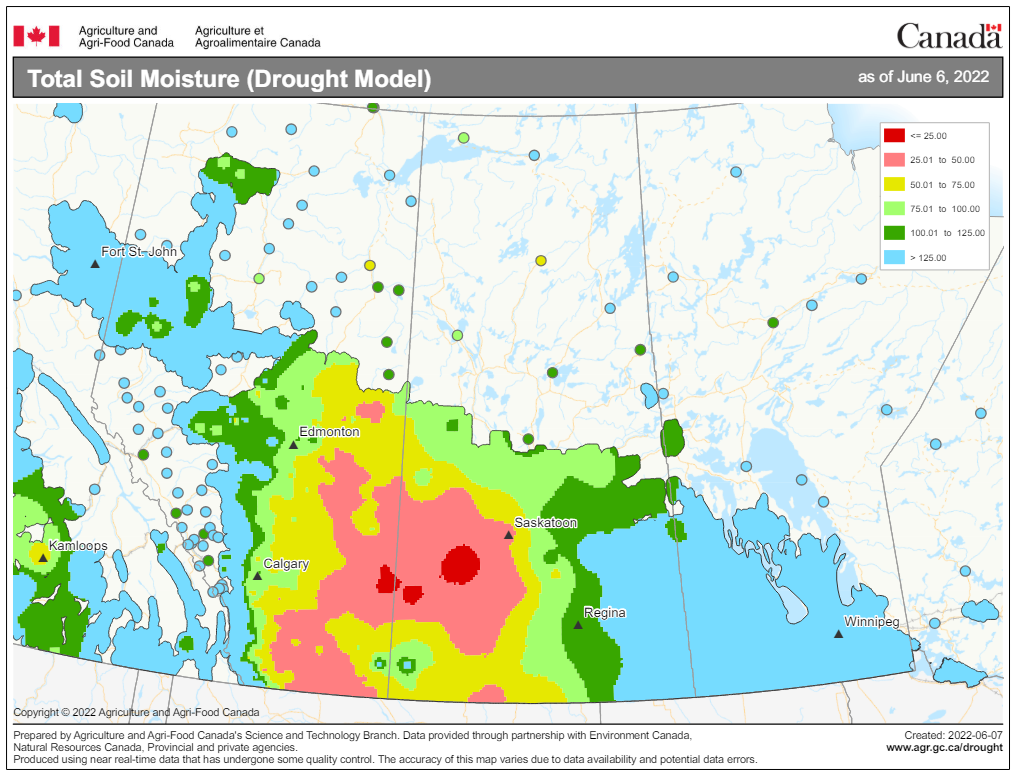

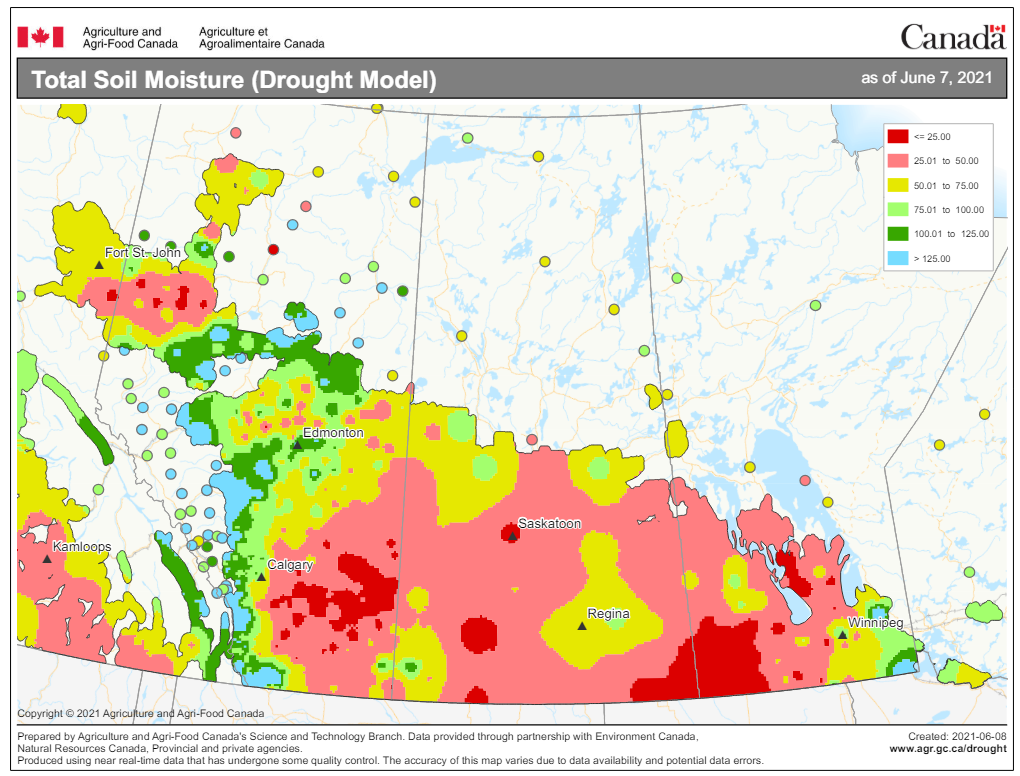

Soil Moisture is better than in recent years for a wide swath of the prairies, and the market understands this. The crop is a far shot from being off the field and could really go either way at this point, it is important to note that the market is not generally concerned about the Canadian crop for the time being, although this sentiment can change quickly if weather turns to quick in either direction.

Primary Cropping Regions

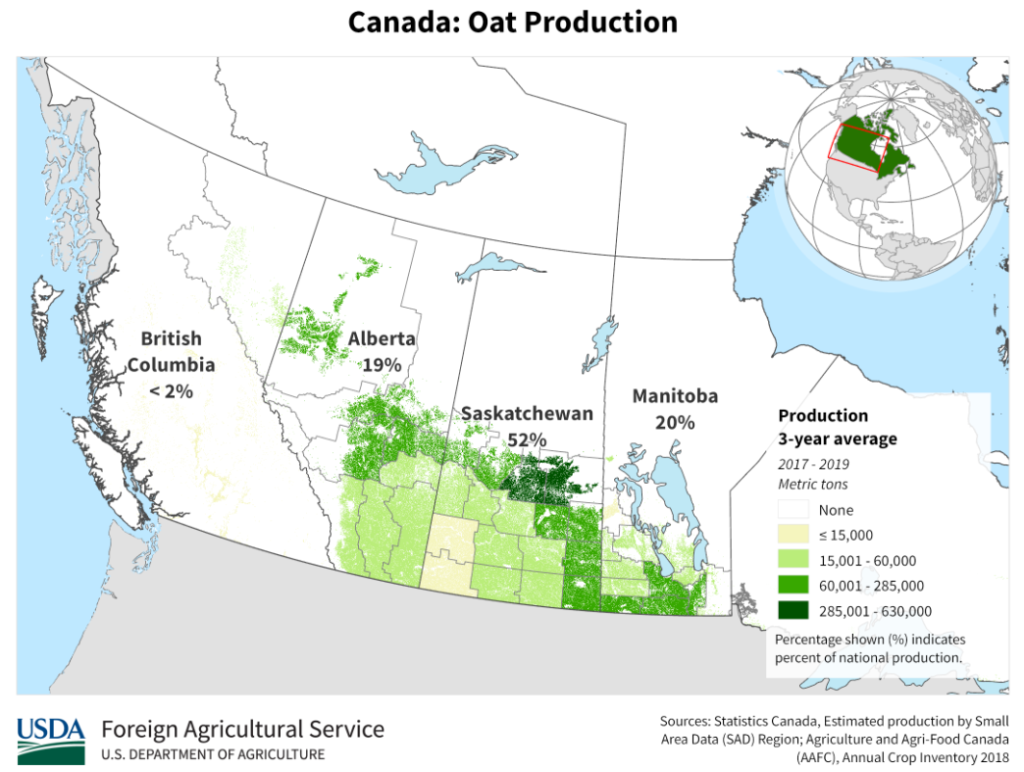

Oats

Markets stuck in a weather market. End users appear satisfied with their new crop position for the time being and markets made their larger moves in winter. Short term likely not to see any large moves and this will become a weather market. Oat production region later than anticipated planting but soil moisture is adequate.

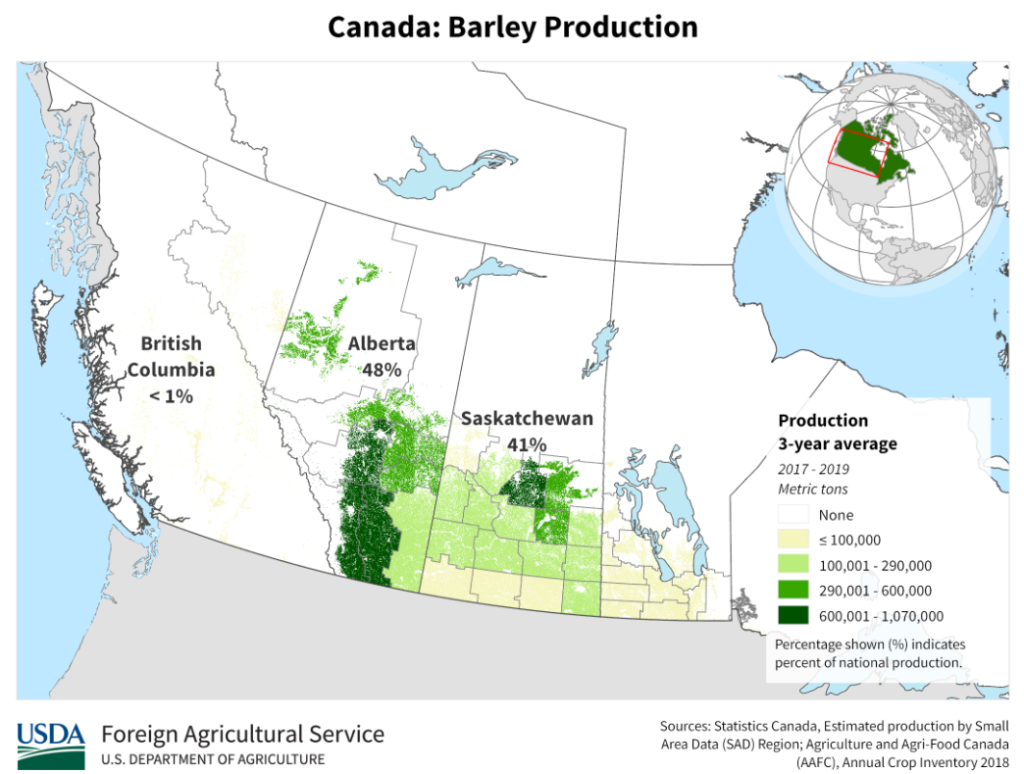

Barley

End users / Maltsters came out of the gate early with bids and appear to have covered off front demand. Malt supply never is truly understood until harvest. Barley acreage down slightly year over year, but export demand has shifted lower than in a few prior years. Barley production regions have ample moisture and we will provide a more in depth analysis at a later date.

Pulses

Lentil and Pea acres both anticipated to be higher year over year. Pea growing region looking good, lentil production region has good soil moisture conditions after years of drought. Disease could become a concern if weather patterns hold. Pea and lentils have both had some trade barriers into India relaxed in recent months. Further updates at a later date once the crop is established and crop prospects are better understood. For the time being, the crops are in and moisture is ample.

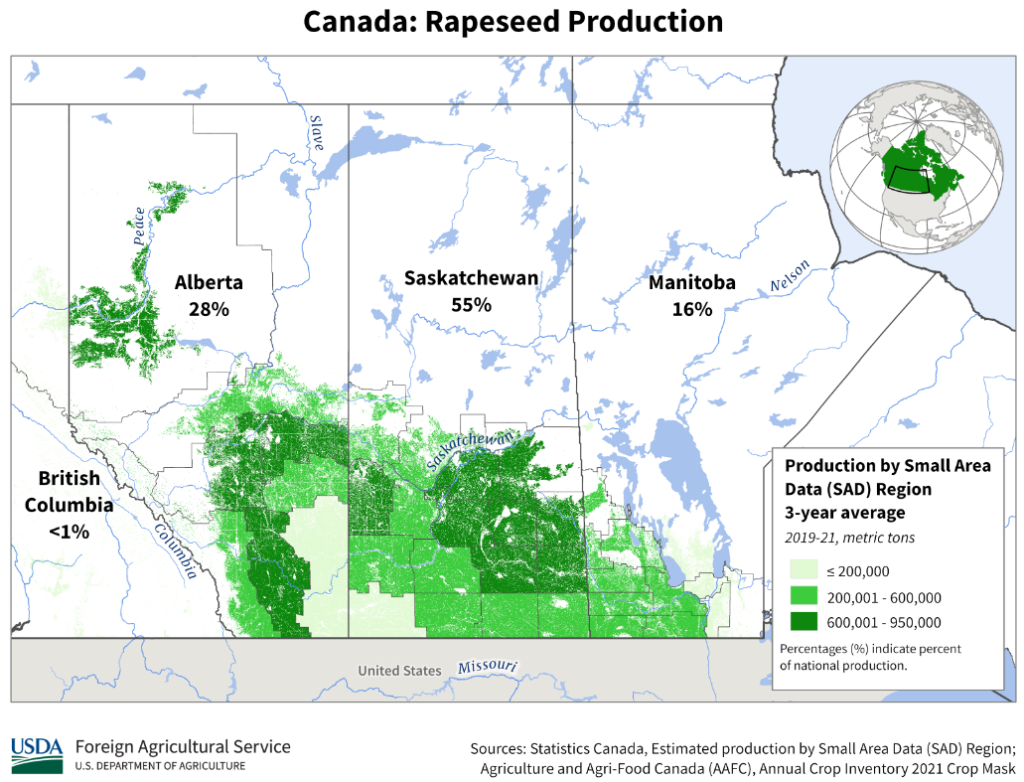

Canola

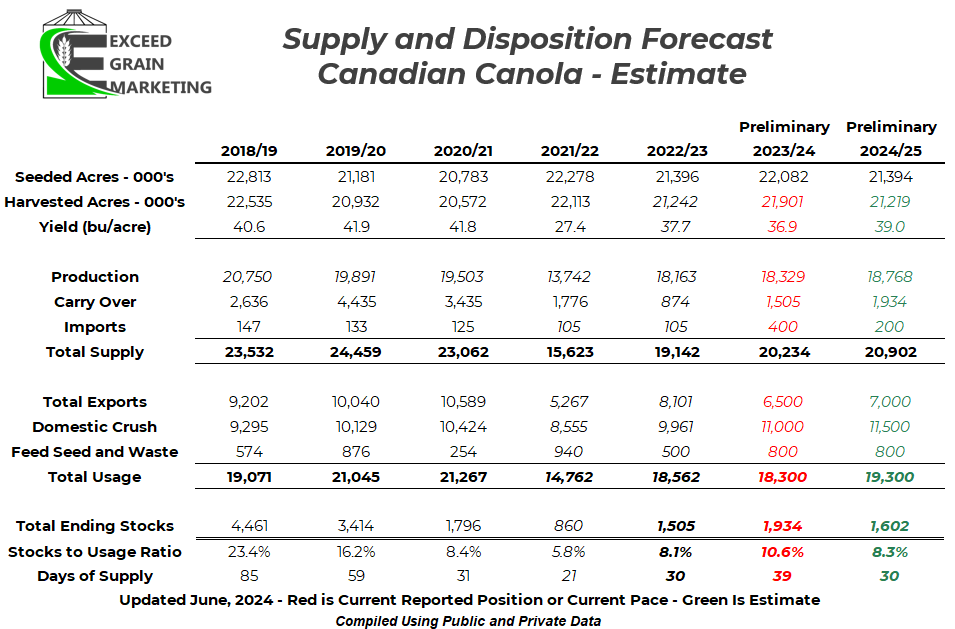

Canola markets have faced a volatile start to June. Below we have a simple supply and disposition chart. These are to serve as examples only. Red figures are “reported or on pace for” and green is more forward looking. The green is for 2024/25, we understand where planted acreage is but one does not know final 2024/25 crop yields. Use as a tool, but understand when forward looking, it is an art and not a science. The export pace and crush pace should easily be attainable, especially with more crush coming online for the marketing year.

Going Forwards: Canola will rely on the Western Canadian weather market to find its primary direction. Markets will secondarily influenced by the upcoming European rapeseed crops harvest beginning in the next few weeks. By July most of that crop should be harvestable. Recent reports have that crop at under 18mmt from private analysts. Last year the crop was right around 20mmt. EU will need imports. Who fills it? Australia? Canada? Global FOB pricing important to pay attention to going forwards. Australian Canola production is top of mind as well. This crop is in the ground and will be harvested Oct/Nov/Dec. Canola will look for direction as well and keep an eye on its other Vegoil counterparts, Malaysian Palm Oil, MATIF Rapeseed, Soybean Oil.

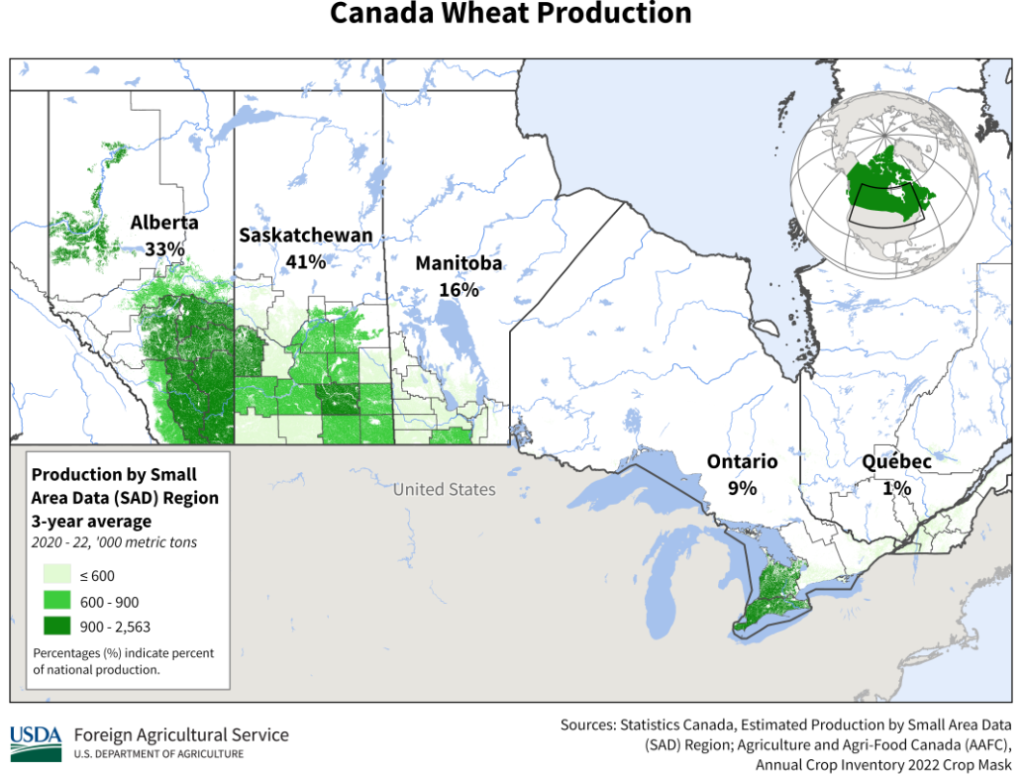

Spring Wheat

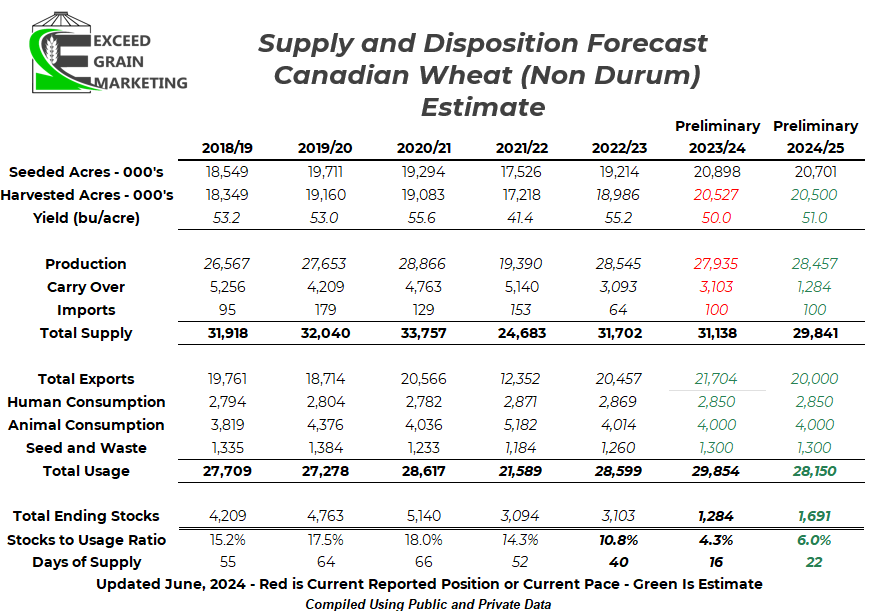

Spring wheat, alongside other wheat markets appreciated significantly through the month of May, but was faced with drifting towards the beginning of June. Spring Wheat, the futures contract most Canadian wheat is priced upon has traded lower for 7 consecutive sessions, taking away some of the gains of Mays rally. Below we have a simple supply and disposition chart. These are to serve as examples only. Red figures are “reported or on pace for” and green is more forward looking. The green is for 2024/25, we understand where planted acreage is but one does not know final 2024/25 crop yields. Use as a tool, but understand when forward looking, it is an art and not a science. The export pace and crush pace should easily be attainable, especially with more crush coming online for the marketing year.

Going Forwards: Spring Wheat and the wheat market in general will look to the global markets for its primary direction. Canadian wheat is less of an influence in the global wheat markets at this particular point in time. Most eyes are on the Black Sea crop and the US winter wheat harvest taking place in Texas, Oklahoma and working its way north. The Russian / Black sea production issues have brought us to where we are and will be the market factor to move us from here, whether the story becomes more bullish or bearish. The Russian crop will begin harvesting here late June and into July. Market will look at these influences first and there is not a major weather story in the Canadian Prairies

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.