Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

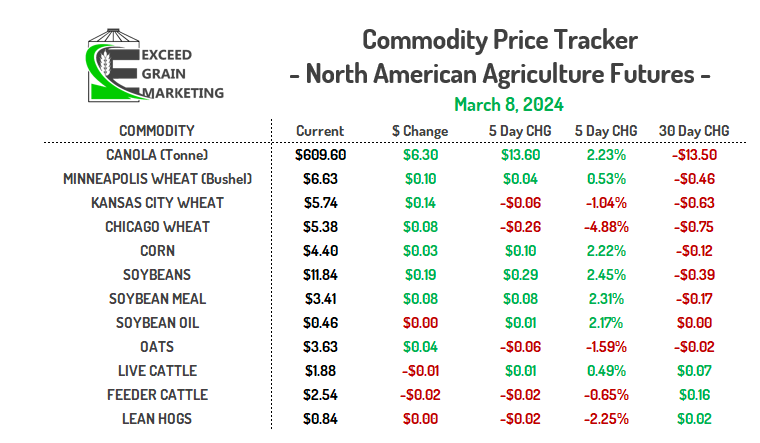

- Canola up $33 per tonne since its February lows and closes higher for the 2nd week in a row.

- Grains generally close out the week higher.

- Spring Wheat traded higher for 3 of the 5 trading days. Was down significantly on Tuesday and Wednesday before pulling higher into the close

- Canola had a great week, down $0.50 cents per tonne on Tuesday but made healthy gains for the other 4/5 days of trade.

- Corn and Beans closing on a couple good weeks of trades and both posting gains. Beans up $0.29 and Corn up $0.10 per bushel.

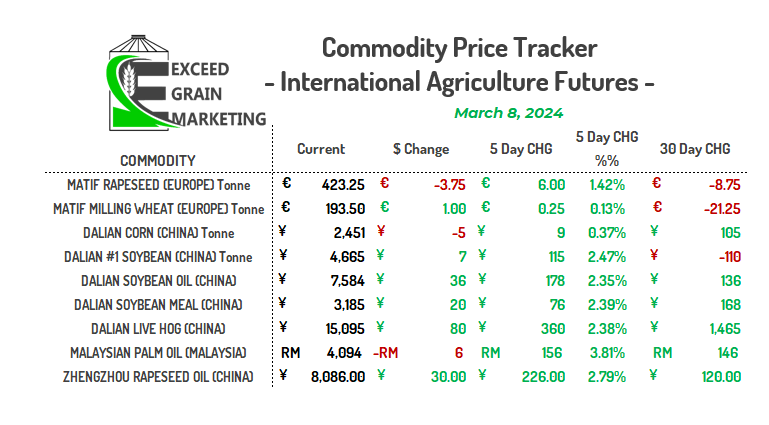

- MATIF Rapeseed had a lower trade on Friday but closed out the week higher.

- MATIF EU rapeseed never fell as hard as ICE Futures (Canadian) canola did. MATIF down $21 euro per tonne since beginning of December.

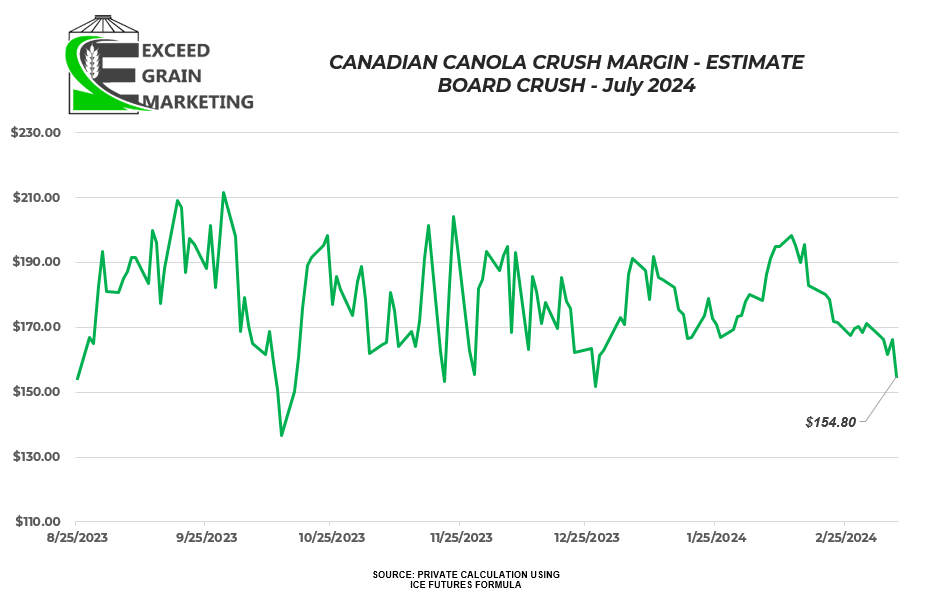

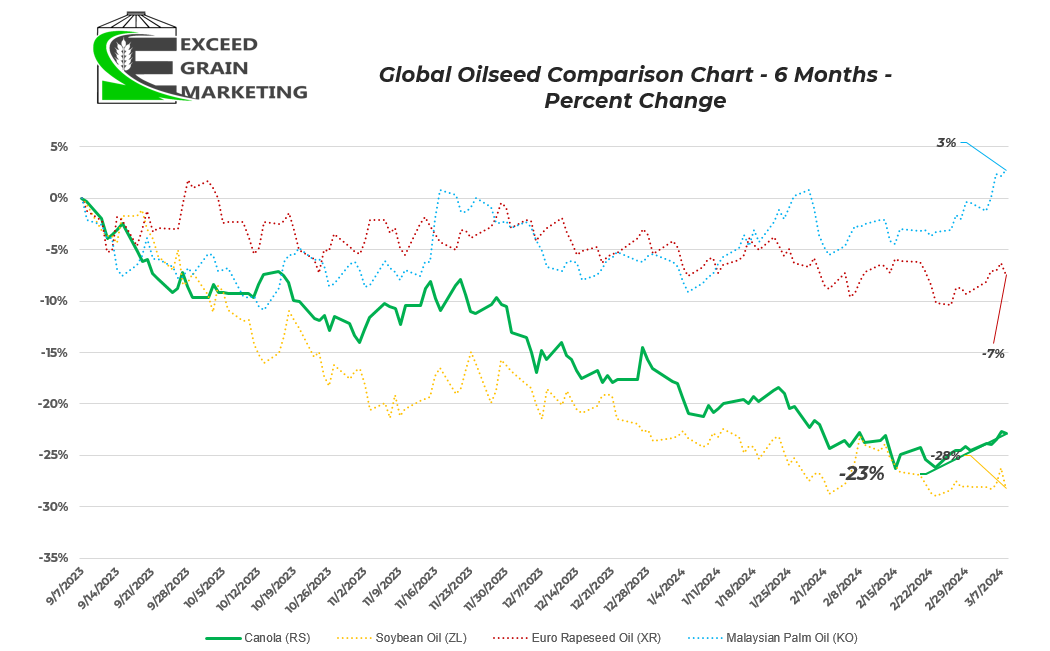

- Canola and Soybean oil really traded closely together here in the past few months while. Over the past 6 months, Palm Oil has actually appreciated in Value. See Chart below.

- Todays trade was really focused on the USDA WASDE:

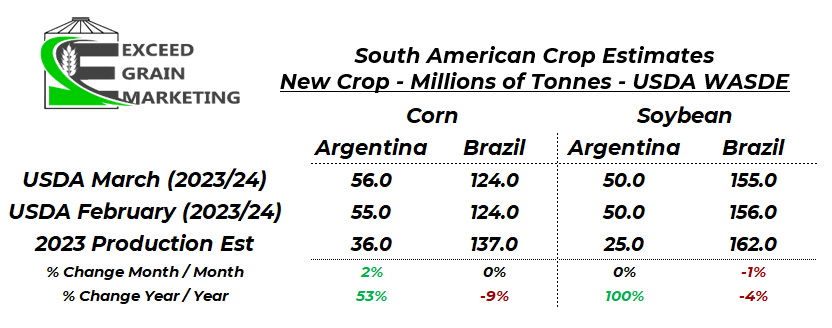

- – Brazil Soybean output lowered to 155 mmt from last months 156 mmt. Traders were hoping to see a cut to around 153mmt prior to the report being released.

-Argentinian soybeans left unchanged at 50mmt

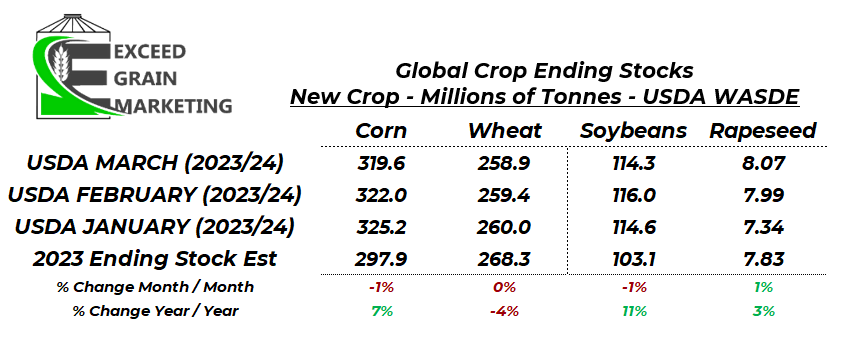

-Global Corn Ending Stocks were lowered to 319.6 mmt, down from 322mmt last report

-Soybeans were lowered to 114.3 mmt from 116 mmt last report

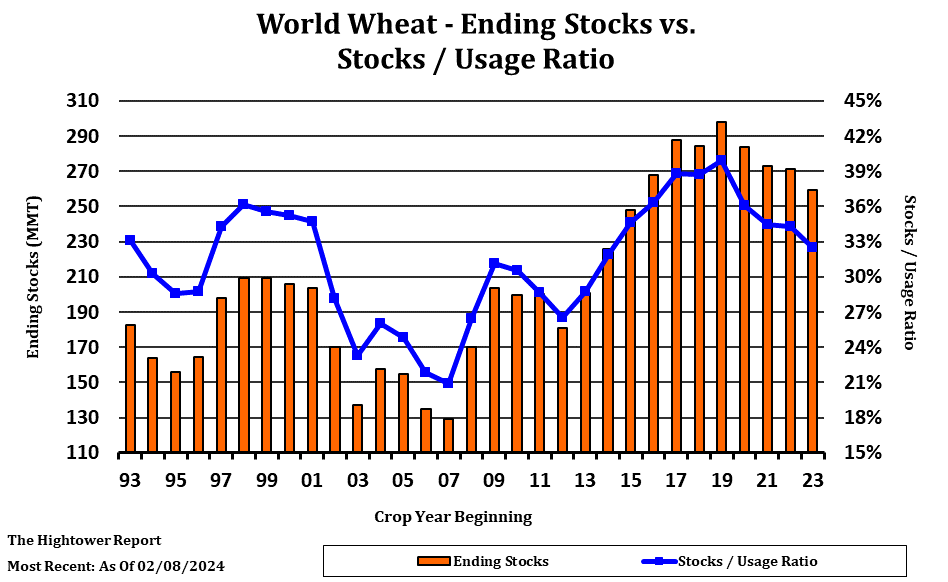

-Wheat lowered to 258.8 mmt down from 259.4 mmt last report

-Global Rapeseed/ Canola ending stocks relatively unchanged at 8.065 mmt vs 7.995 mmt last report.

- – Brazil Soybean output lowered to 155 mmt from last months 156 mmt. Traders were hoping to see a cut to around 153mmt prior to the report being released.

- Statistics Canada acreage estimates out the following Monday, March 11th

- We will have full coverage of the report next week with acreage.

- CONAB (Brazil) Will be released March 12th. We will be able to see if there is still a large divergence between their lower figures and the USDA.

- Some interesting notes:

- Canola posted its second weekly gain since January 15th

- Corn posted second weekly gain since December 4th

- Soybeans second weekly gain since October 30th.

- Soy Oil second weekly gain since Feb 5th.

- Western Canadian Producers can now access spring provincial crop insurance prices for the 2024 crop year. Saskatchewan was released last week while Alberta and Manitoba have been out for a few weeks now

- United States spring crop insurance prices released. Lowest coverage since 2020 in most cases.

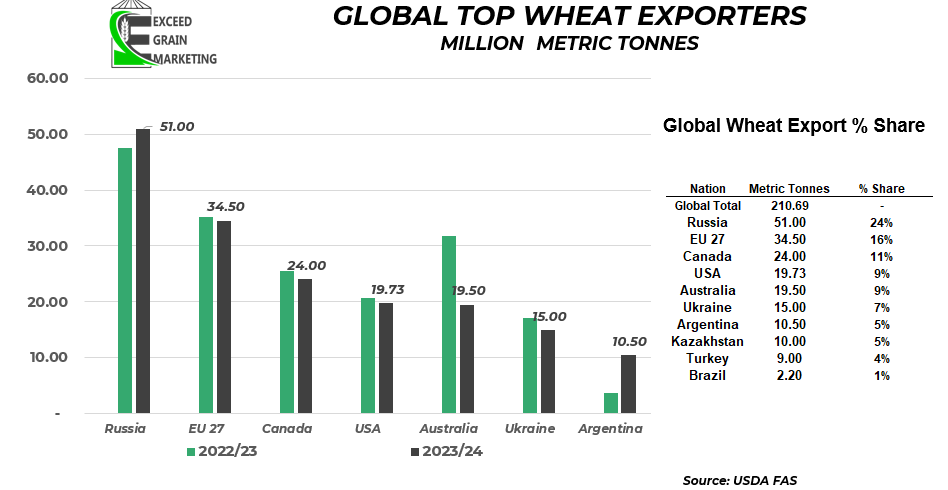

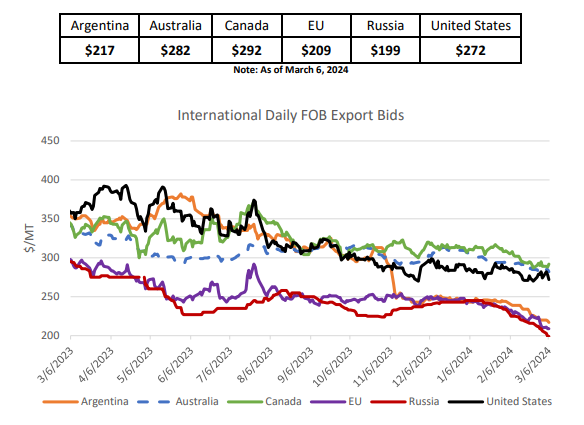

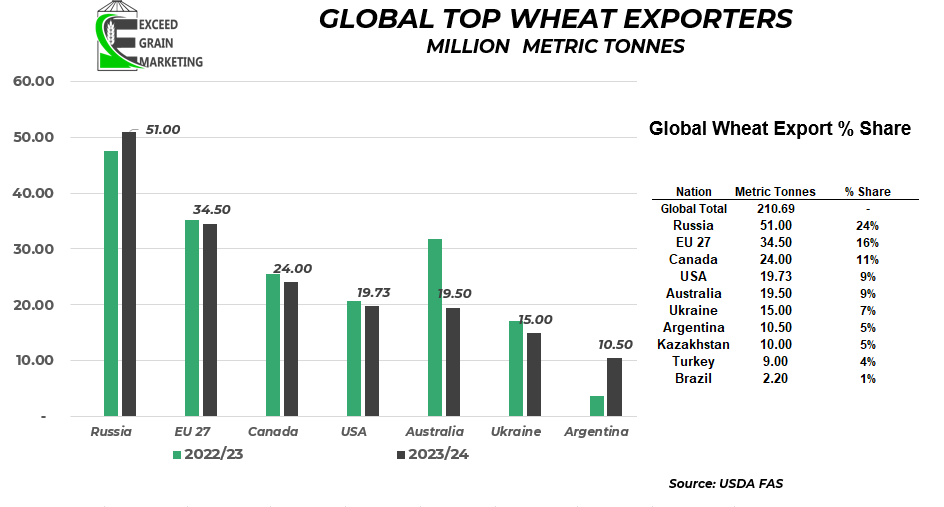

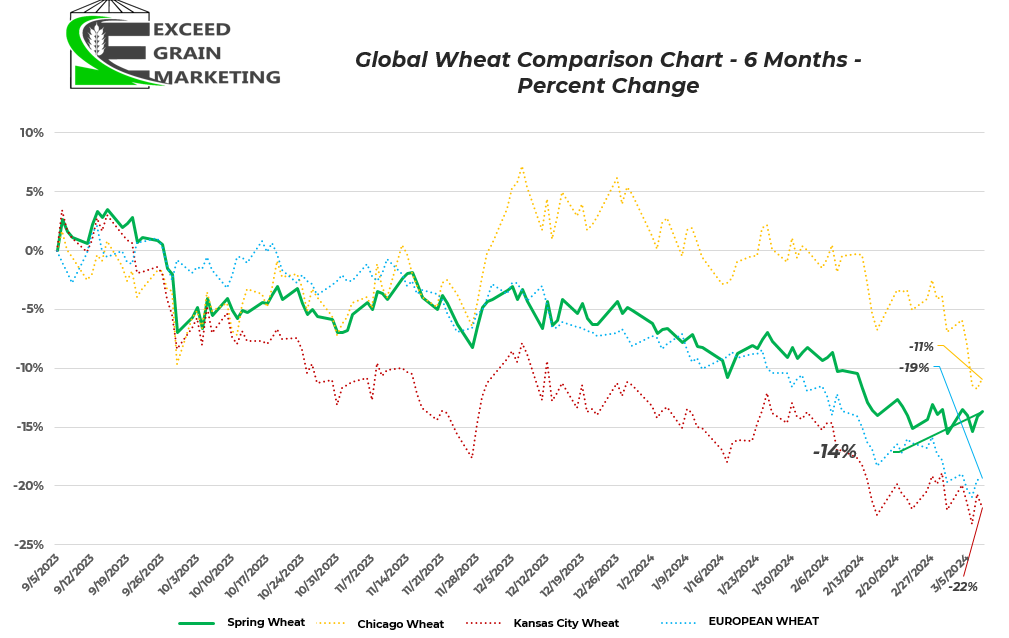

- Russia dumping wheat onto the Black Sea corridor this week with reports of some low protein bids coming in around the $200 USD per tonne mark for 11.5% protein. Higher values for better protein.

- This caused EU futures to slump near the tail end of the week and also drug down North American futures.

- French wheat rated at 68% Good to Excellent. Down from the 95% rating last year. Lowest level since 2020

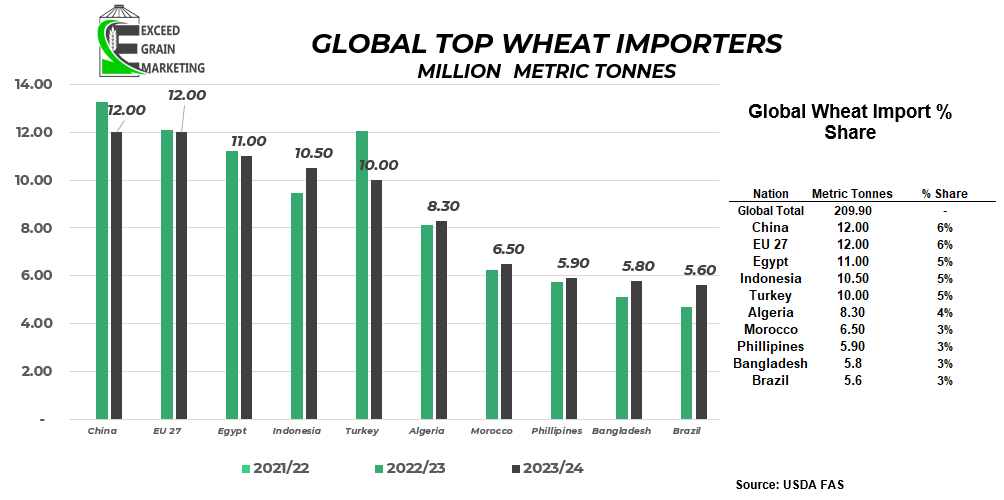

- Egypt also reporting that it has sufficient stocks for the next 3.5 months, further pushing back importer demand, weighting on prices.

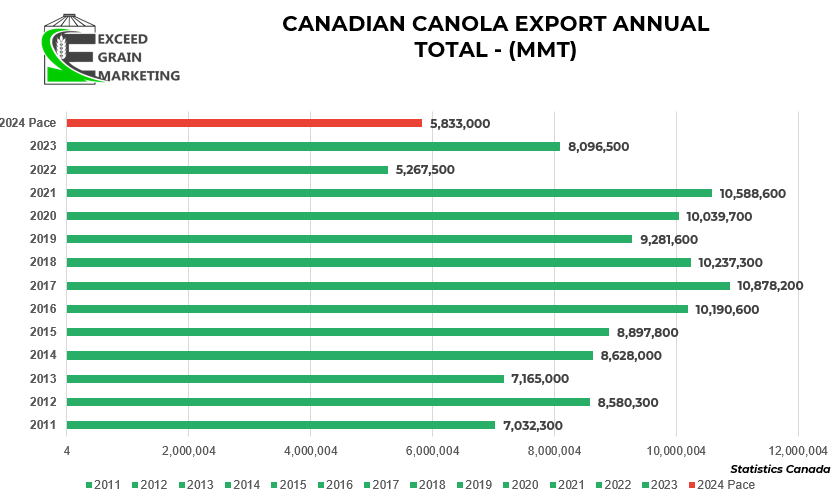

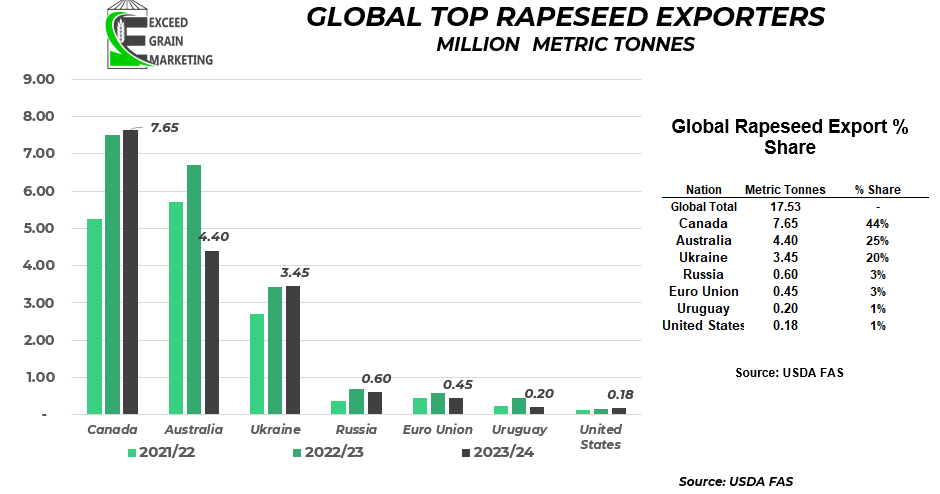

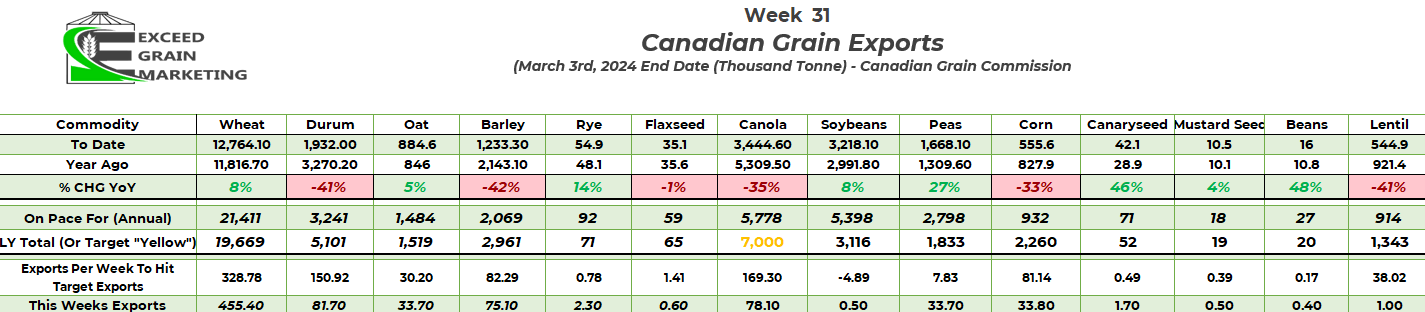

- Canadian exports post a mediocre week, especially for Canola. Not a major export week and still tracking on pace for 5.8 mmt. Markets still have the ability to reach the 7mmt tonnes most analysts are looking for.

- See chart below on export pace for Canadian canola. By this time last year we already exported 5.3 mmt.

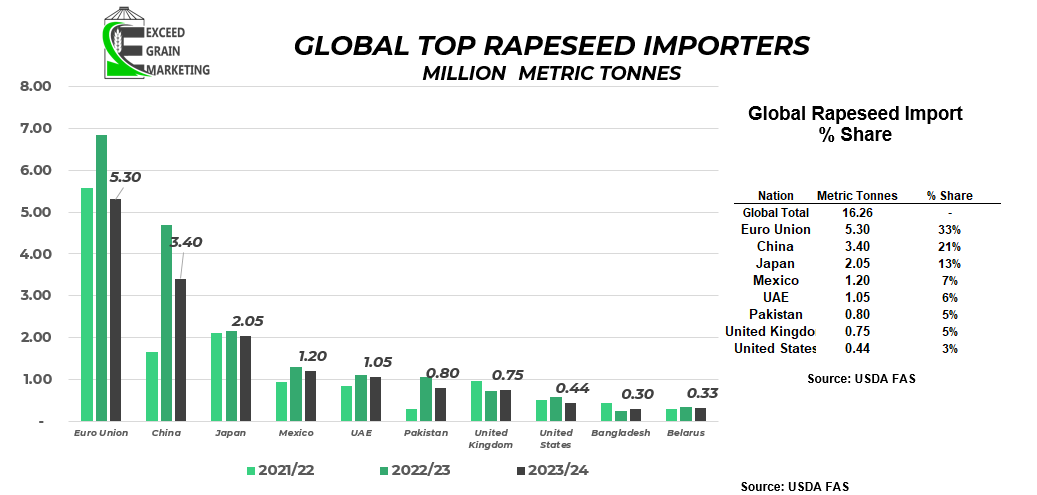

- Canadian canola able to price well into global export markets now following the price drop, maintaining relatively similar pricing to other export markets. Canola has lost most of its premium in the global market it has held for the past few years.

- China lowered its target breeding stock of sows to 39 million sows, down from 41 million sows in years past.

- The USDA Ag Outlook Forum placed initial acreage at the following mid February:

- Corn acres 91 million vs 91.8 pre report estimate

- Soybean acres 87.5 million acres vs 86.5 million pre report estimate

- Wheat acres at 47 million vs 47.5 pre report

- USDA WASDE February 8th Report Highlights (Month Prior)

- USDA’s Estimate at the Brazilian crop came in at 156.0 mmt, down from 157 mmt last month. The problem the market found with this number is that the market wanted to see more of a 153 mmt figure. Overall the report was seen as generally bearish.

- Global Corn Ending Stocks cut to 322.1 mmt down from 325.2 mmt in last months WASDE

- Global Soybean Ending Stocks bumped higher to 116 mmt from 114.6 mmt in the last WASDE

- Global Wheat Ending Stocks adjusted down very slightly by about half million tonnes and comes in at 259.4 mmt

- US ending stocks all higher for their crops

- The USDA kept Canadian canola exports at a 7.6 mmt export figure. We are tracking below 6 mmt on actual exports right now. There is a wide discrepancy in export figures here but it should be noted where other agencies stand.

- CONAB report out Thursday February 8th (March 12th next update)

- Cut soybean production to 149.4 mmt down from 155.3 mmt in the January report. Brazil also lowered its soy exports for the year to 94.2 mmt from 98.5 in the January report.

- Corn production also cut 7 mmt to 201 mmt total production

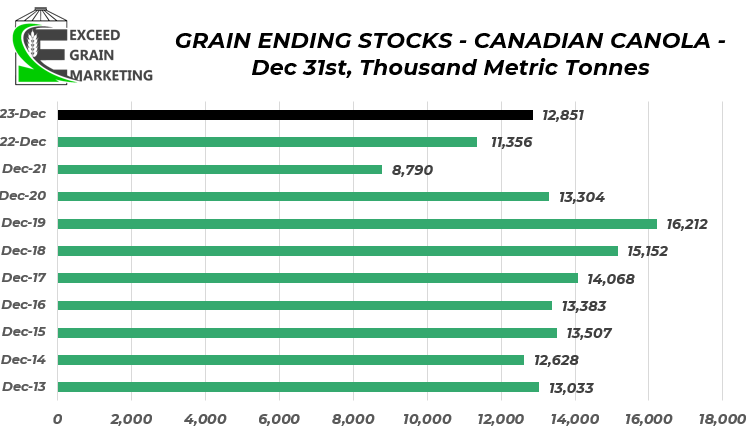

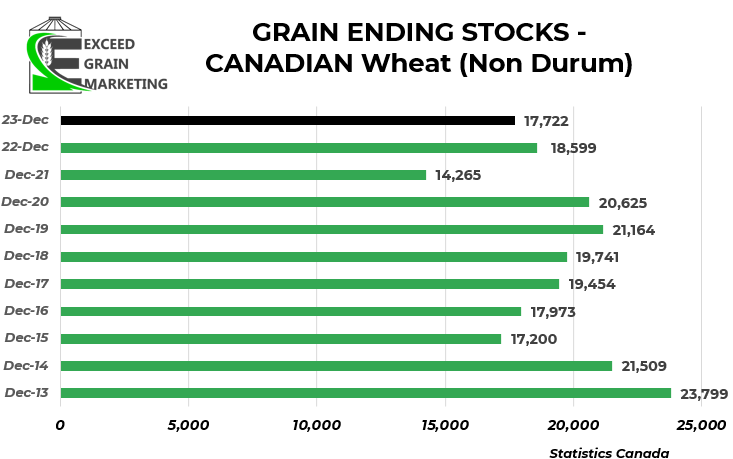

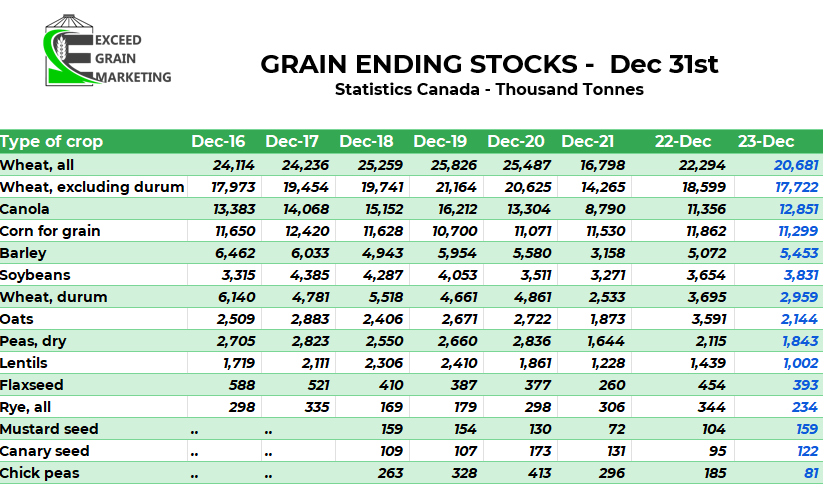

- Stats Canada canola December 31st stocks came in at 12.85 mmt vs expectations in the 13.0 mmt area. Higher for the time of year last year and the year prior, but the 4th smallest in a decade overall. Not exactly abundant as the market makes it out to be. The problem will be how accurate these numbers are first off and how our usage is through the end of the year. If exports continue to lag, then the figure will be of less significance. Something to keep an eye upon

- Interesting to note that some crops came in at the tightest in a long time. Oats were a crop that stood out as well. Aside from December of 2021, oat stocks came in at the tightest in a decade.

- Peas, Durum, Lentils all worth taking a look at as well. Big question remains demand. Durum needs to get more tender business which it has been loosing out upon. Need to pick up export pace for most crops

WESTERN CANADIAN CROP NOTES

Canola:

- Canola posted second weekly gain since January 15th.

- Crushers filling up domestically for the front months as producer selling took up much of the front month capacity. Most crushers bidding April or May onwards. If need crusher movement, need to build a plan around that.

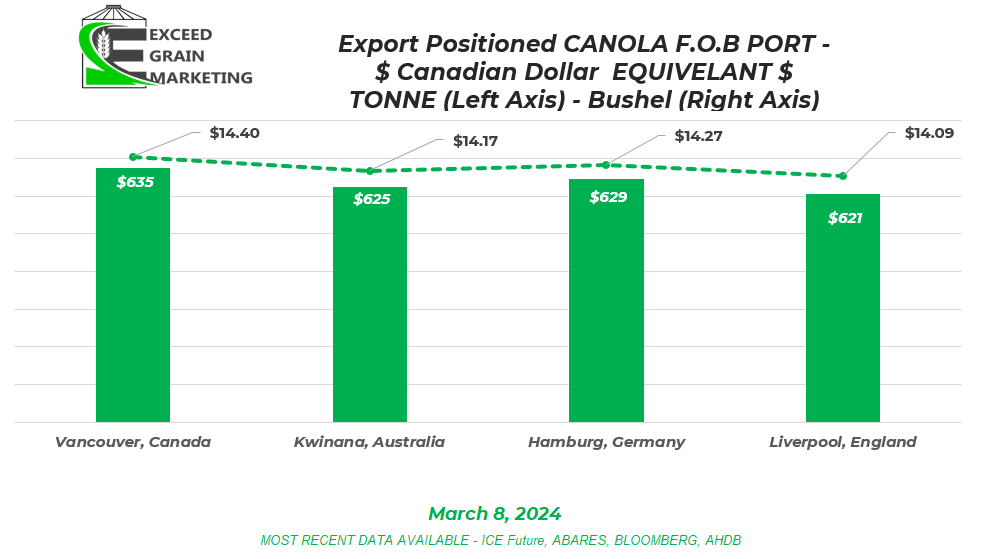

- Canola now pricing more expensive than Australian Canola after being cheaper than them for the past few weeks. The difference between exporter bids has narrowed up significantly in recent weeks. Canola carried such a premium to Australian canola and EU canola but the gap is very small now. Chart above shows most recent bids at some key export regions in Canada, Germany, Australia and England.

- Canola exports last week were not great, but not dismal. Importers would be wise to jump on these pricing opportunities to pick up crop at discounts. We are running a pace of 5.8 mmt. Need consistently good weeks through the end of the crop year to eat away at ending stocks. Current export pace of 5.8 mmt is not great and would be one of the lowest levels of exports in decades. See chart below for reference.

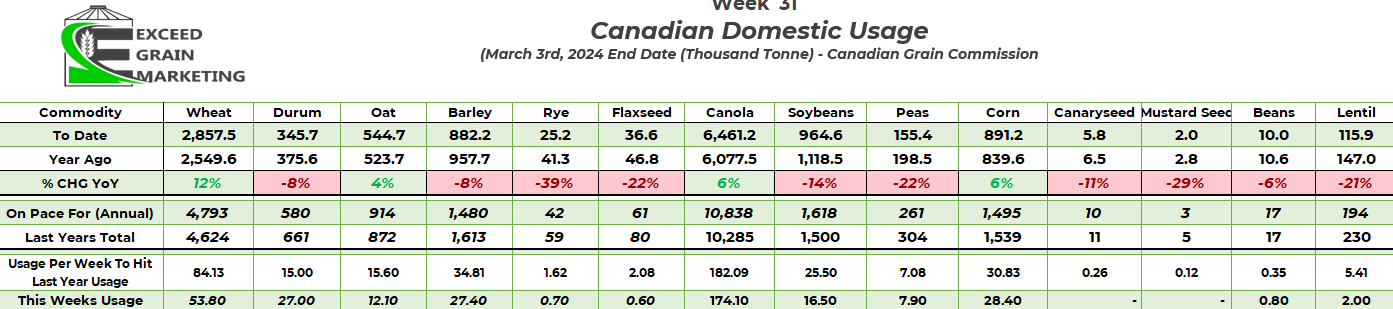

- Crush is running at a very impressive pace, could hit a 11mmt record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

- Canola will trade at the mercy of foreign veg oils for the time being (Palm, Soy, Rapa). Canola has been taking it a bit harder than its competitors although recently.

- South American harvest and export demand will dominate the trade headlines, Western Canadian weather will pick up more of the news come closer to spring.

- Crusher bids still dominate but are falling closer to exporter prices, depending on the month. Most exporters sit close to the $13.00+ mark today, depending on region and Basis levels. Crushers still hold the leading bids, but the regions are getting fewer and further between.

- For a more in depth analysis on Canola Specifically, check out our Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – Q1 2024

Spring Wheat:

- Global wheat values diminished here recently as Russian and Ukrainian origin grain pushing below that $220 per tonne level on some recent tenders. Some reports of Russian wheat trading for as low as $200 per tonne in recent days for low protein wheat 11.5%. This news took wheat lower on Tuesday and Wednesday before finding some support into the tail end of the week.

- Wheat domestically in Canada trading around that $8.50 mark for a #1 13.5% protein towards the end of the week. Fridays close of spring wheat drug down values. Some posted bids sub $8.00. Exporters having a bit more of a challenging time getting Canadian wheat to price globally. Bids highly variant depending on area. There can be a $0.50 per bushel swing in a couple hundred mile radius.

- Looks like Black Sea regions willing to dump grain here before summer. New crop will be in the system starting July 2024 so exporters looking to keep product moving.

- Canadian Wheat exports and domestic usage is still considered very strong. At the current pace of exports and domestic usage, rationing will be needed. This does not always mean price correlates accordingly, as we have seen in recent weeks. Prices have seen producers selling into them.

- Wheat exports expected to easily surpass last years levels at current pace and are on track for an 8% increase year over year. Likely not able to make that happen although as rationing will supersede this.

- Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

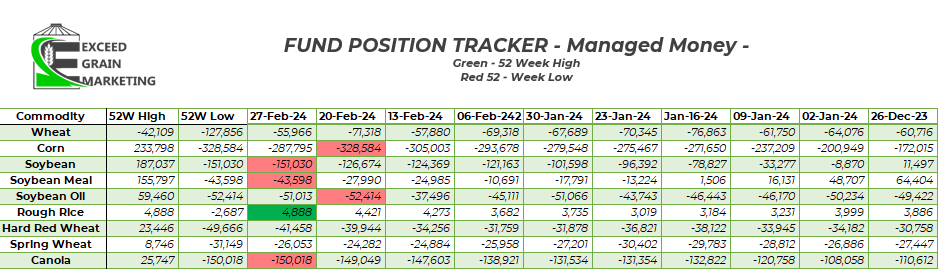

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part.

- Prices falling despite forecasted wheat global and domestic ending stocks coming in at the tightest levels since the 2015/16 crop year.

- Next thing market will be watching for is crop progress in the US and EU winter wheat crops and Spring Wheat planting conditions in Europe. This will be more relevant come April / May.

Special Crops

- Special crop markets closely going to be watching Mondays release on acreage estimates from Stats Canada.

- Turkey tendering for Durum March 11th. Markets expecting Tunisia to tender as early as next week as well. Canada will want to price into these if possible

- Canadian peas will face stiffer competition going forwards into China as some Black Sea peas able to price into the region.

- Canadian red lentils also competing with a larger Australian crop. Indian lentil harvest taking place here in the coming weeks and crop is expected to be of a healthy size. Looks like higher availability for global export market

- India reduced Yellow Pea import tariffs from 50% down to 0% was extended for another month until the end of April 2024. Was only in place until end of March but another month was added to get exports into the nation. Pea bids did show some strength about two weeks ago but have toned back in recent days as the exporters square up their positions ahead of key deadlines

- Durum exports lagging behind last years pace. Looks like Canadian durum has been missing out on some recent tenders into North Africa. Durum exports have somewhat disappointed traders as we missed some key export opportunities early on due to some better than expected Mediterranean crops. New crop Durum $9.50 to $10.00 roughly.

- Durum growing regions of Canada remain parched, producers somewhat hesitant to price aggressively on new crop.

- Red Lentil reduced import tariffs extended until March of 2025

- Yellow Peas buying interest falls from early January. Old crop yellows $13+ on the renewal of the tariff exemption. New crop $10+

- Flax Bids in the $15.00 central prairies. Some large divergence in bids so please look into where you are pricing.

- Feed Barley has picked up some ground. $5.00 bids more common than two weeks ago . Still competing heavily with US corn origination. New crop feed barley $4.75.

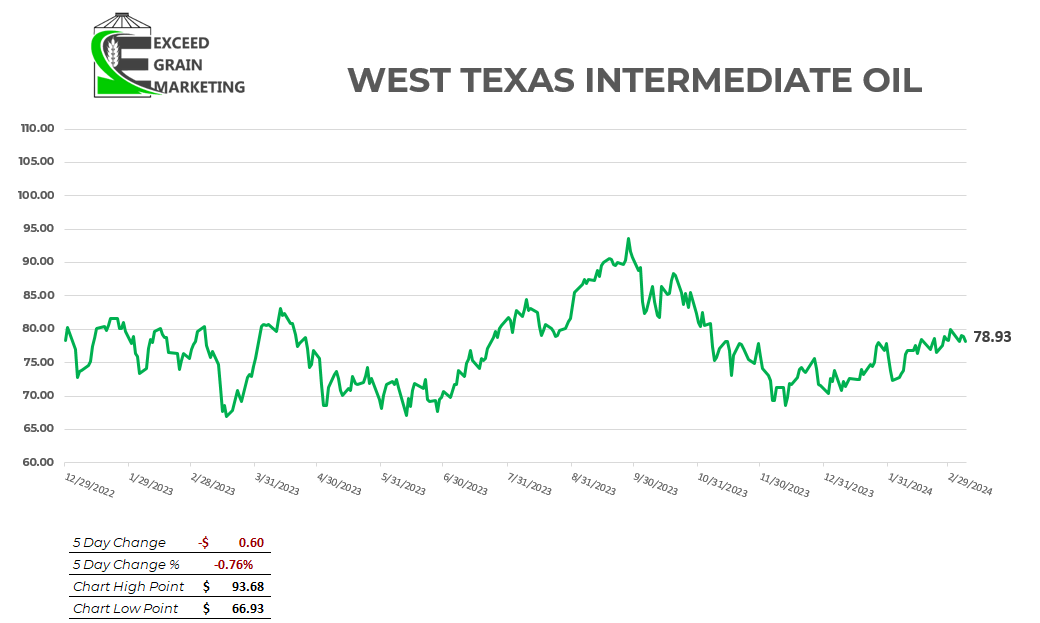

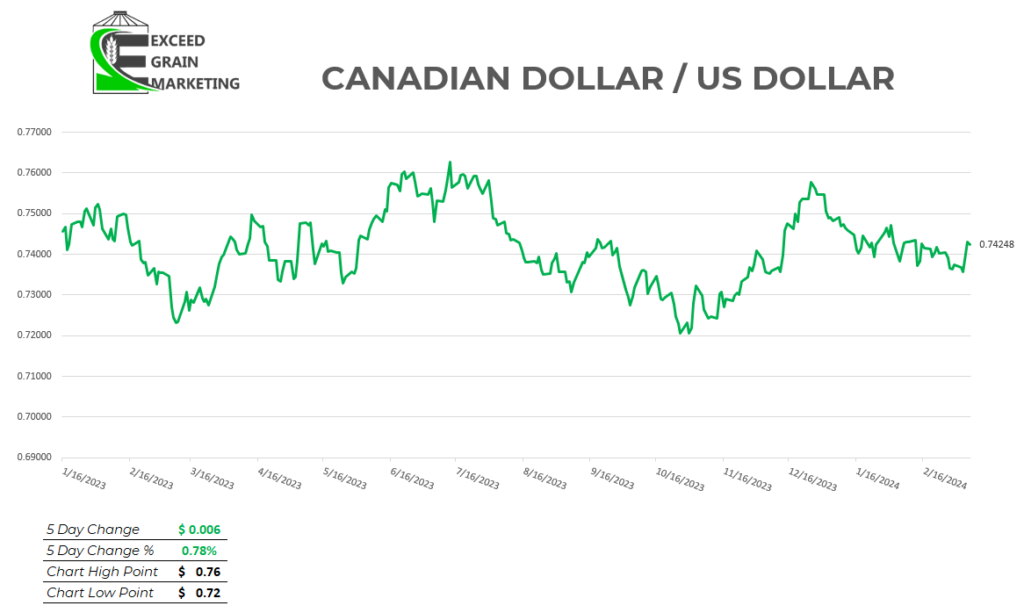

- Feed Barley at the mercy of US corn crop prices and Currency. Corn prices softening in the US and the Canadian dollar picked up a few pennies since fall time. Corn imports still pencil out into Canadian feeders.

Latest Key Fundamental Report Highlights

- STATS CANADA ( DECEMBER)

- March 11th we will get Principal Field Cropping Areas

- Stats Canada report came in and was mostly as expected but higher than the prior report released pre harvest.

- Canola- 18.3 mmt vs 18.3 mmt pre report estimate

- Spring Wheat – 24.7 mmt vs 24.0 mmt pre report estimate

- Barley 8.9 mmt vs 8.6 mmt pre report

- Oats 2.6 mmt vs 2.6 mmt pre report

- Durum 4.0 mmt vs 4.1 mmt pre report

- Corn 15.1 mmt vs 15.0 mmt pre report

- Soybeans 6.98 mmt

- Lentils 1.7 mmt vs 1.7 mmt pre report

- Peas 2.6 mmt vs 2.6 pre report

- Flax 0.272 vs 0.290 pre report

- Most of the production numbers are higher than they were in the early days of harvest when ideas for the canola crop were floating around a high 17’s number. Same could be said for Durum and a few other select crops.

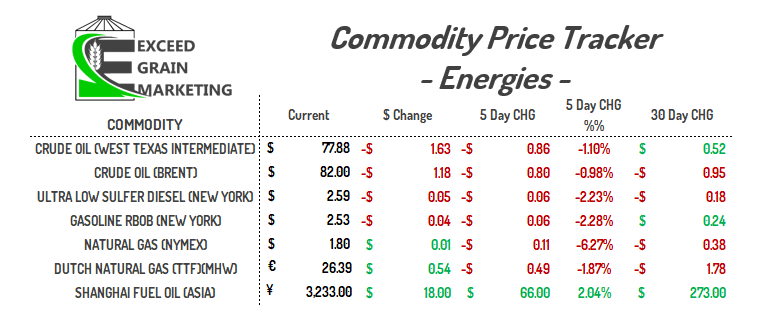

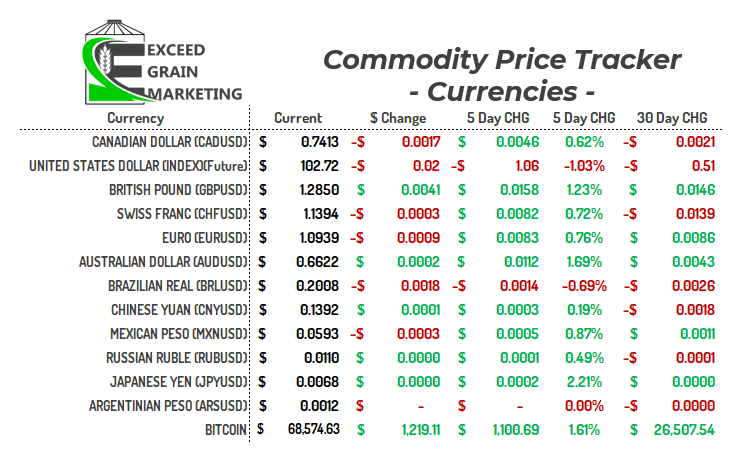

Currency – Energies – Fertilizer

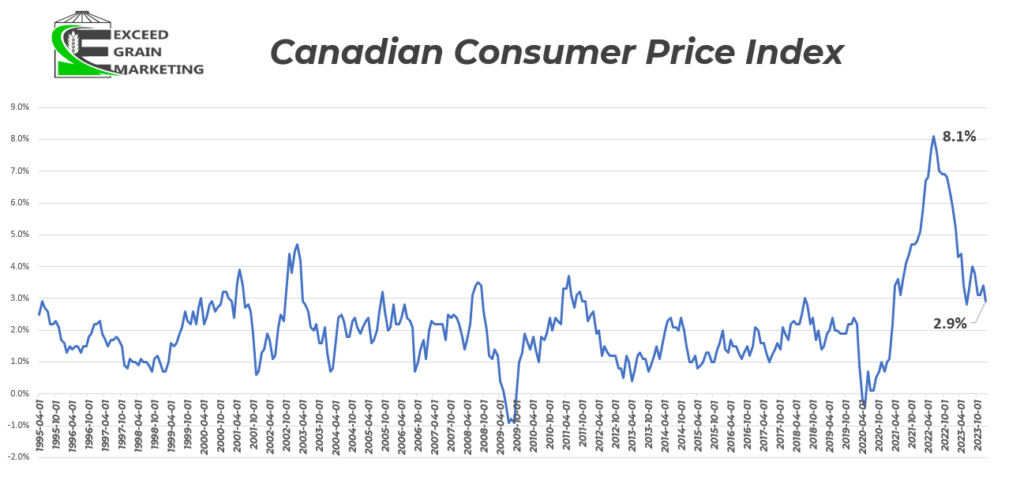

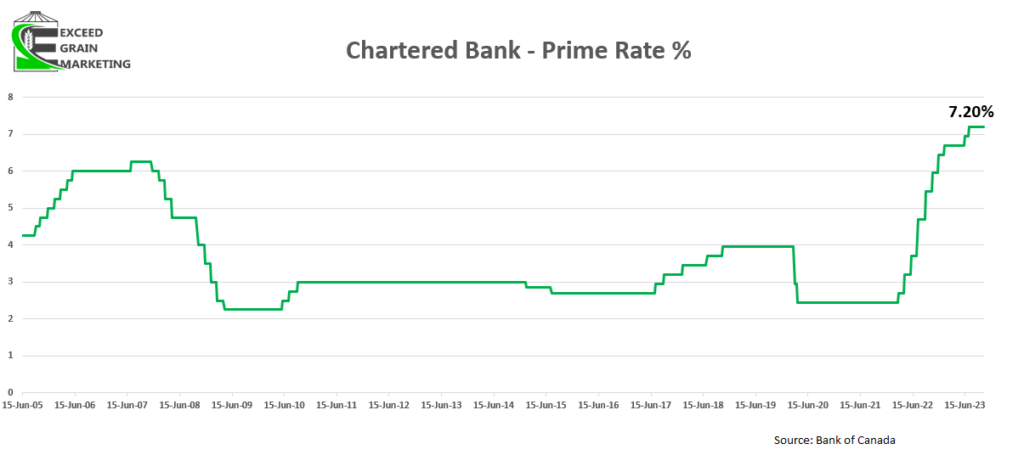

- Bank of Canada Stays Put with current interest rates at the January interest rate meeting. Prime sits around 7.2% at major Canadian banks. Hinted that we could be higher for longer. Cuts will not be significant if they do come. The Bank of Canada has also recently hinted that one could face another rate hike but it is hesitant to do so given that Canadians are feeling the pinch of higher rates.

- Canadian CPI Still “Sticky” and sits at 2.9% as of the latest announcement in February.

- March 6th is the next Bank of Canada interest rate announcement