Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

- Link to Latest Canola Fundamentals Report

- 2024/25 Crop Year Recommendations – Click Link

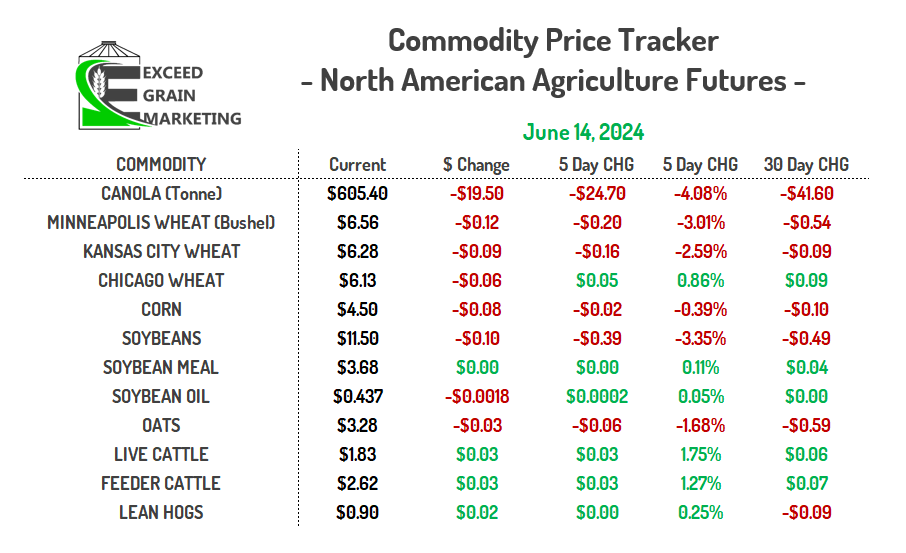

- Ags close out the week lower.

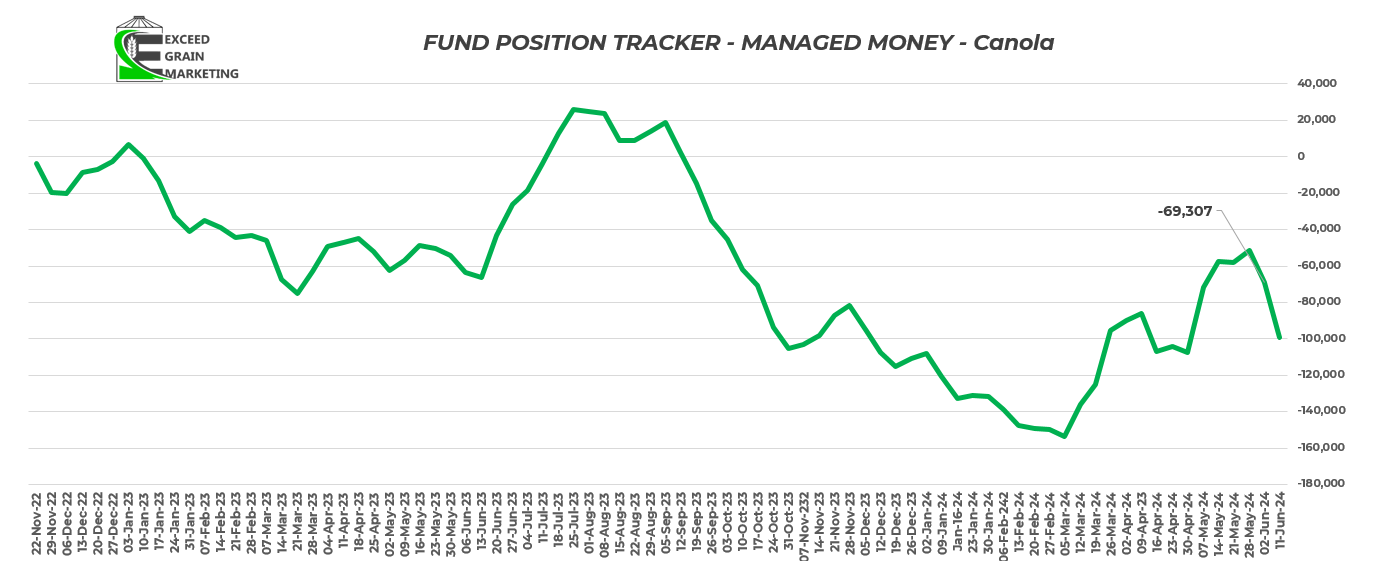

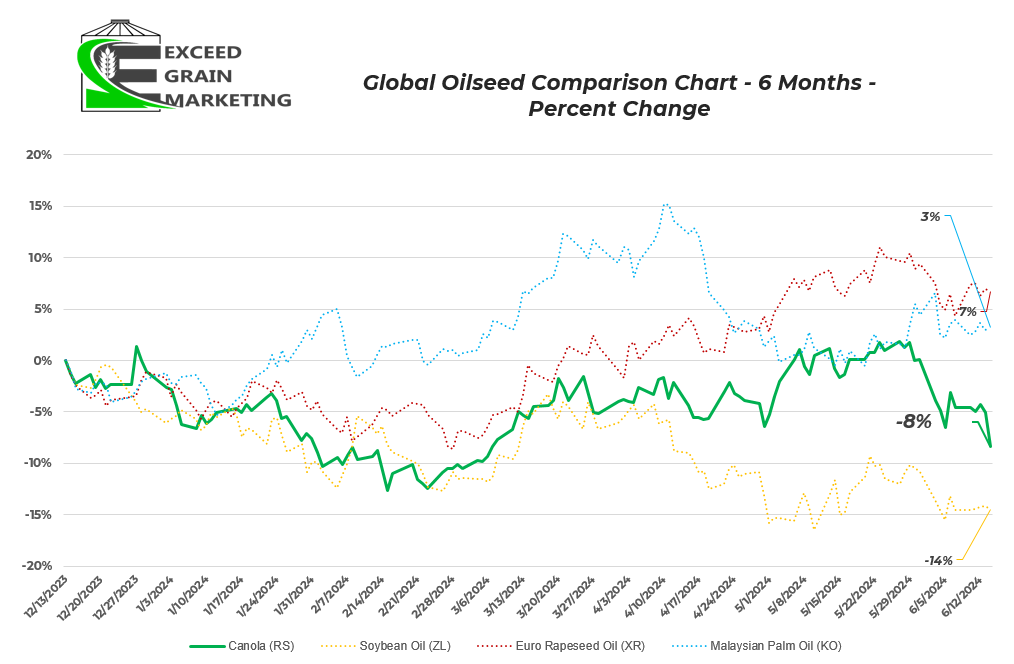

- Canola takes a big hit towards the end of the trading session. Old crop canola contracts on the July facing the most pressure. Some producer selling here as well as canola needs to be prices or rolled on some old crop contracts in the coming days/weeks. Canola traded down the most severe here today when compared to its global counterparts, Rapeseed, Palmoil and Soybean Oil.

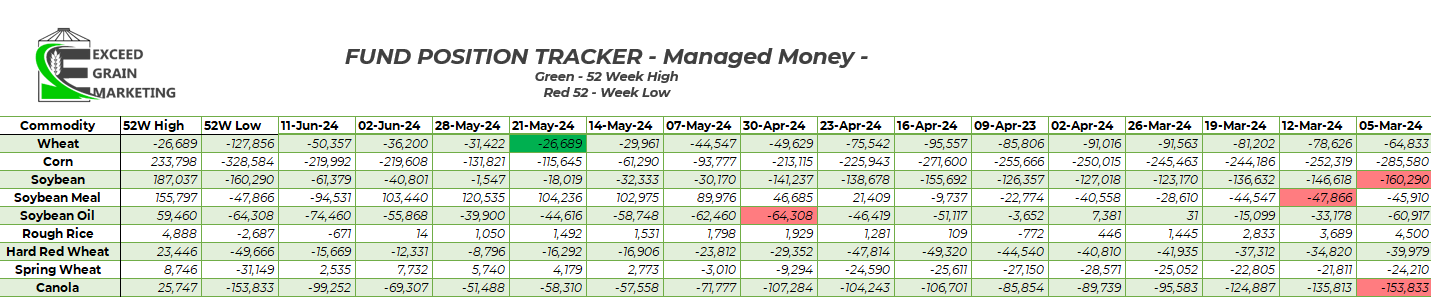

- Funds were sellers for the first part of June as well, take a look at commitment of traders report below. Canola funds move back close to that -100,000 mark as of June 9th and likely surpassed that level this week as well.

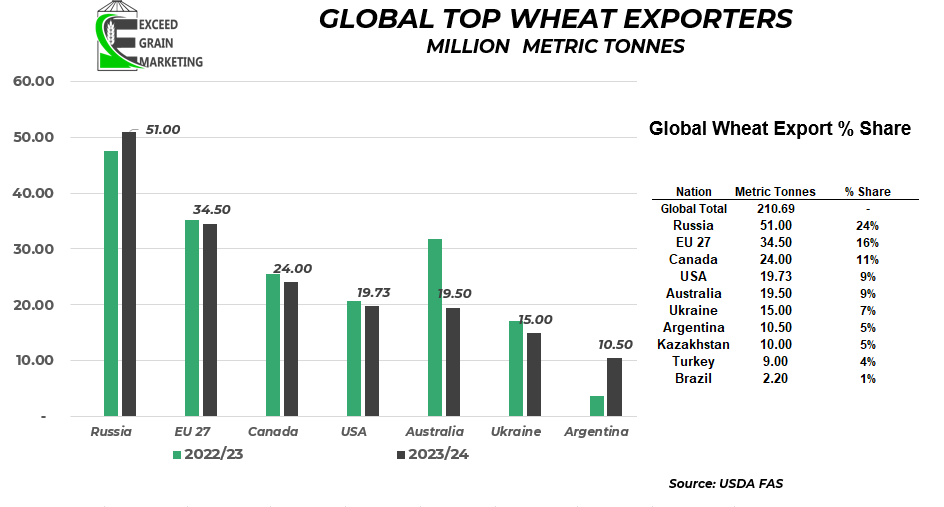

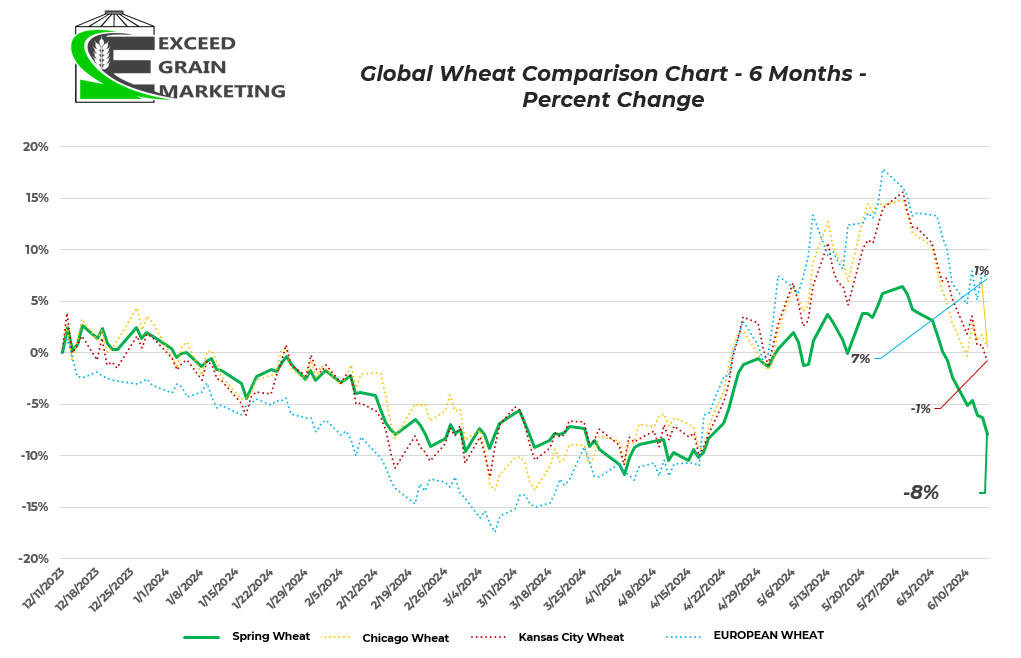

- Wheat markets continue to pullback as the news of the Russian winter wheat crop fades. The harvest will be in full swing in a few weeks and traders will be looking to grab initial yield information to influence their direction.

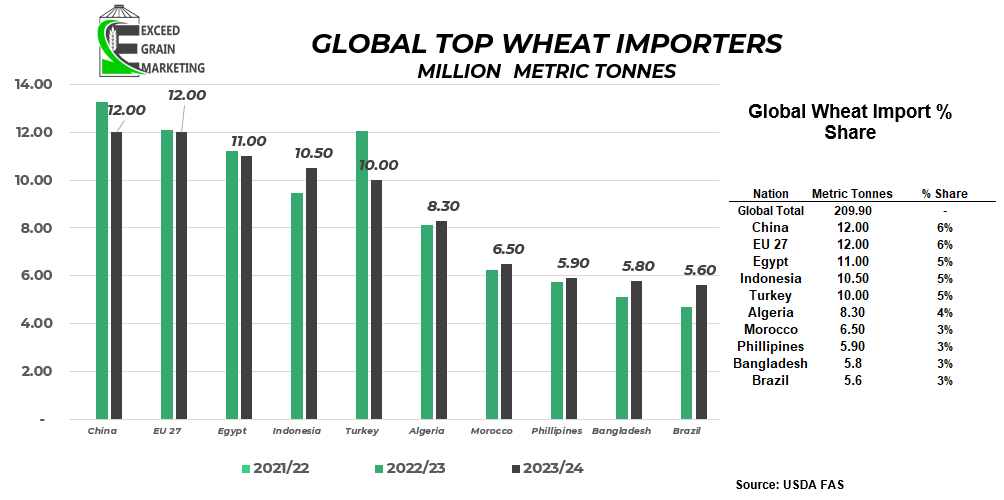

- India announced it will not need to reduce tariffs on wheat to entice additional imports to keep market supplies sufficient. Markets were highly anticipating that India would need to do so for short term coverage

- Turkey banning wheat imports until October to help control domestic prices. Turkey is typically Russia’s largest wheat importer.

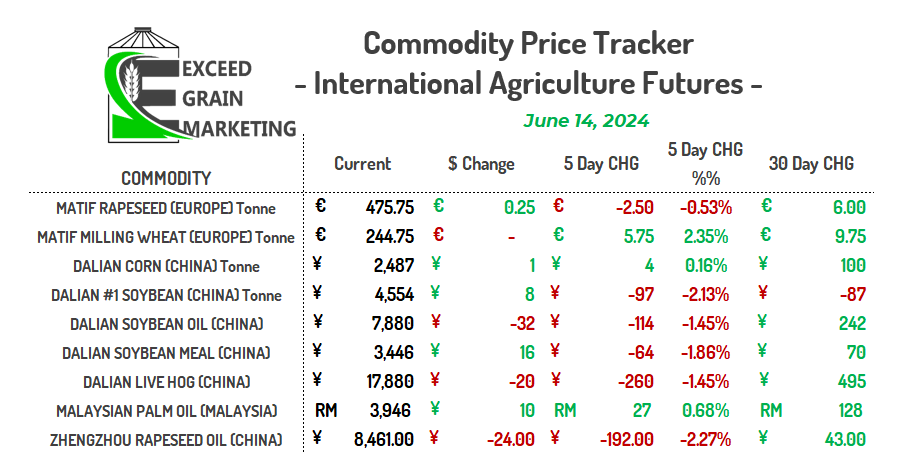

- China getting hot and dry in the northeastern region of the Mainland. Some temperatures of over 40 Celsius in top corn and soybean production regions. More on this as it develops.

- US eastern corn and soybean regions under a heatwave this week. Worries of shallow roots after the wet spring

- US beans pricing better than Brazil beans right now, rumors of China interested in some old crop US supplies for old crop yet to fill some gaps in supply.

- Russia imposed a “State of Emergency” last week for the 10 regions affected by the Frost and Drought earlier in May. This is what drove the markets higher for the month of May and has been put on the backburner for the time being as markets pullback. Russian crop will start being harvested here by the end of June / early July.

- US wheat crop coming off in Kansas, Oklahoma regions. The crop coming off with better yields than other years, some disease issues but the crop is mostly coming in as expected.

- Western Australia did end up receiving some critical rains in the past week. Over an inch fell in some of the driest areas. The crop is just finished up planting and was a “million dollar rain” as the adage recites.

- French wheat conditions sit at 62%, Was 91% last year.

- European Union released their tariff guidelines yesterday for Russian and Belarussian grain imports. As of July 1st it is being reported that cereal crops (wheat, barley, ect) will be subject to a 95 euro per tonne tariff into the EU and oilseeds will be 50% tariff.

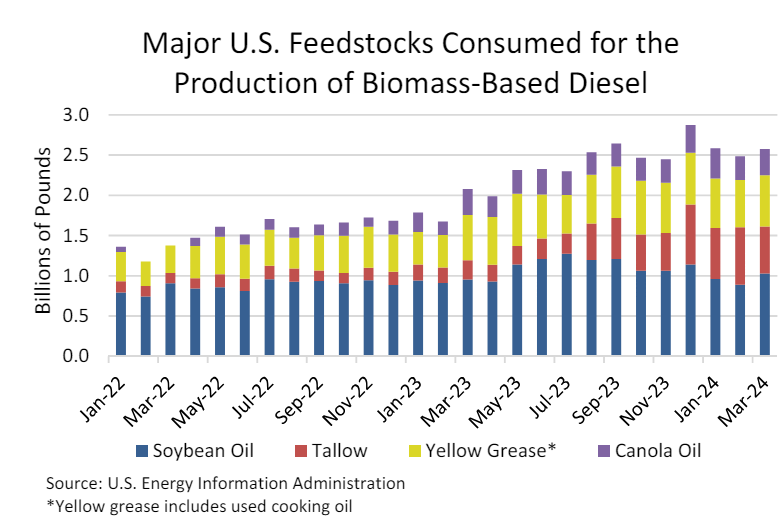

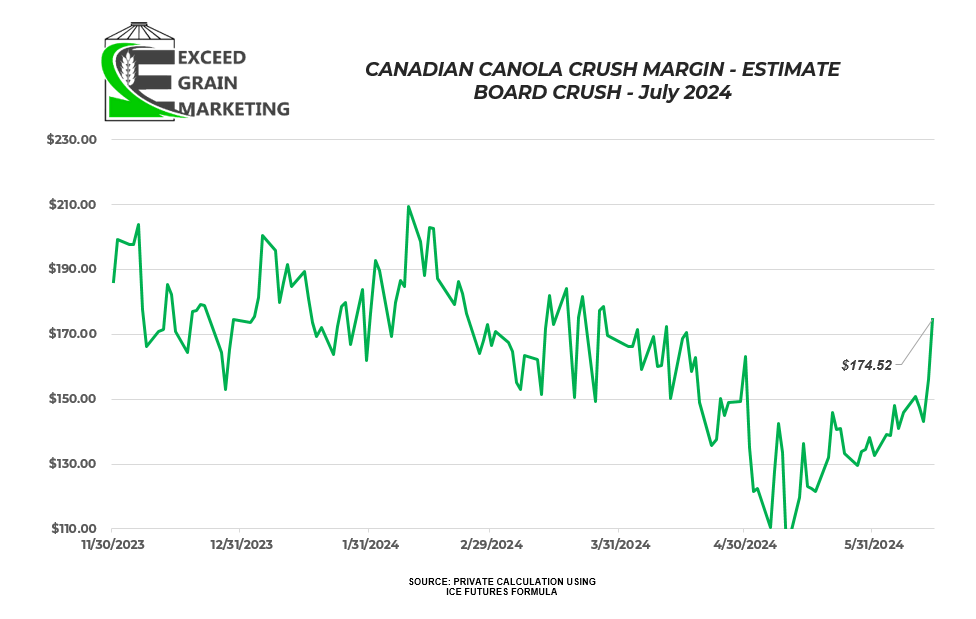

- Canadian April crush (latest monthly report) came in at 958 thousand tonnes. On pace for a record crush year. 8.3 mmt have been crushed through end of April, about 1mmt more than the long term average pace. Exports on pace for 6.5mmt

- CN and CPKC railway employees,

Canada’s two major rail systems have voted to start striking as of May 22nd if their contract is not renewed to their standards. This would be very significant to export movement if not resolved before that time.Update to this story below:- Federal Government Minister Seamus O’Regan has asked the Canadian Industry Relations Board to look into the safety implications of the strike. A strike can not begin until a decision has been made. late June or July would be the estimated earliest possible strike being reported.

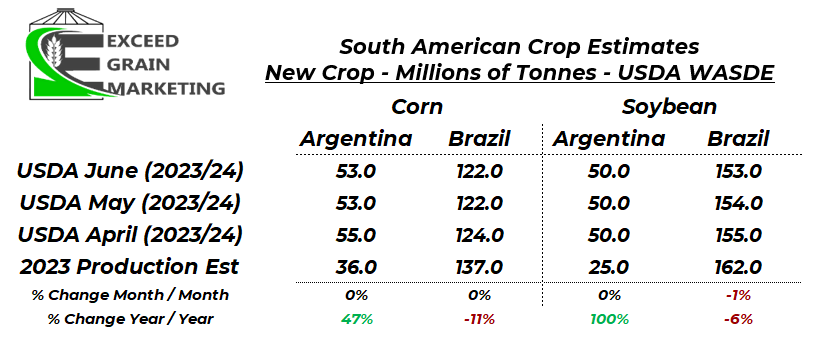

- Reports the market will loose around 3 million tonnes of soybeans in RGDS state of southern Brazil due to the historic flooding of April / May/ Quality reported to be of very poor condition. The tonnage will be there, just the quality is questionable at best after spending significant time in water logged conditions.

- North American producers will welcome India’s extension of the Yellow Pea tariff exemption. Yellow pea imports will remain exempt from import duties until October 31st, 2024. Moving the exemption into the new crop season. Domestic yellow pea bids have increased as a result.

- Desi chickpeas will now be exempt from tariffs until March 2025.

- Australia has turned to planting more Desi Chickpeas this year, especially in Western Australia. Acres up 80%

- Australia is expected to plant a record 885,000 acres of lentils

- Frost in parts of Germany and Poland late April / Early May has private analysts down to around 17.8 mmt. Last year around 20mmt

- The narrative has already begun that EU will need to import around 6mmt of Rapeseed/Canola for the upcoming campaign. This past year Canada missed out on most EU business in favor of Ukraine and Australian origin of cheaper origin. Market will be watching this closely as to how it will develop from here forwards.

- Recommendations Page Updated at Bottom of Report

WESTERN CANADIAN CROP NOTES

Canola:

- Canola moves seasonally lower in recent weeks. Markets appear satisfied with the state of the current Western Canadian crop despite some heavy rains in particular areas such as Northeastern Saskatchewan and northwestern Manitoba.

- We hit some important sales targets for our grain marketing clients in past few weeks due to the recent run up in futures from the February lows. See recommendation section below. July Canola is now the front month for marketing purposes.

- Be sure to be looking at important dates for rolling forward any basis if required. Mid June is often when many grain buyers need to know if rolling or pricing.

- Crushers filling up domestically for the front months as producer selling took up much of the front month capacity. Most crushers bidding July onwards. If need crusher movement, need to build a plan around that. July/August is where most capacity lies within the crush. Be cognizant of export and crush capacity as we get closer to the dates.

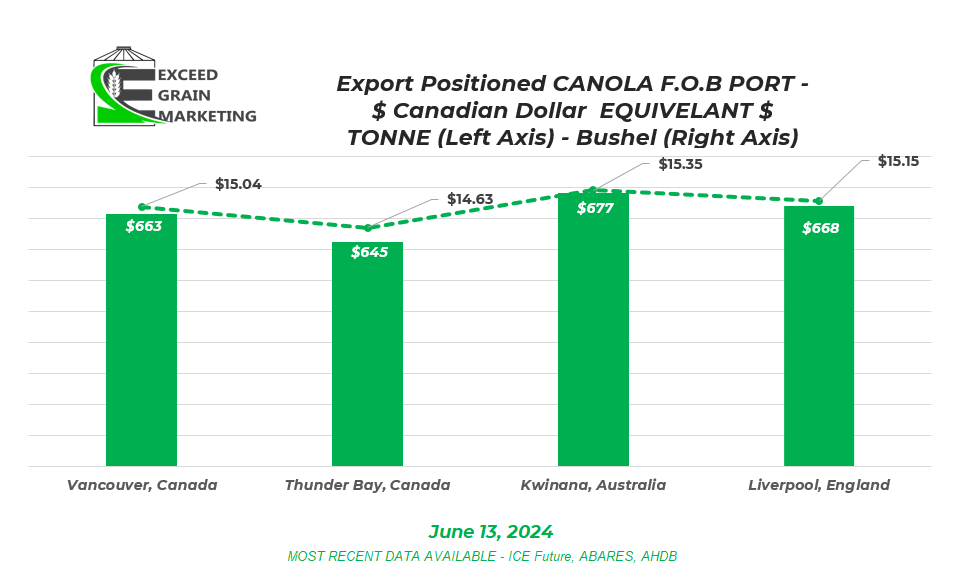

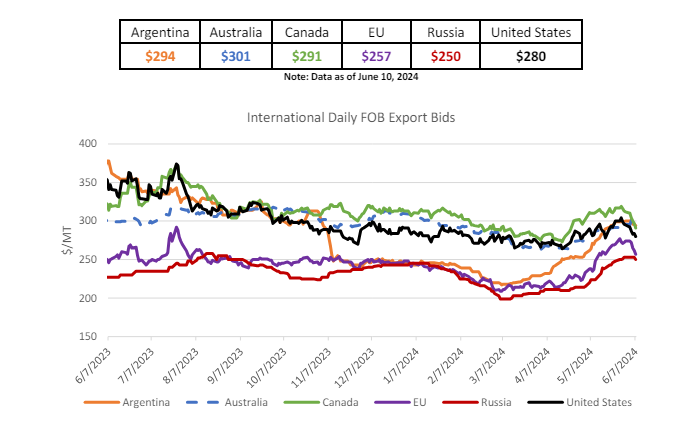

- Canola global pricing below. Canadian Canola moved cheaper than Australian FOB.

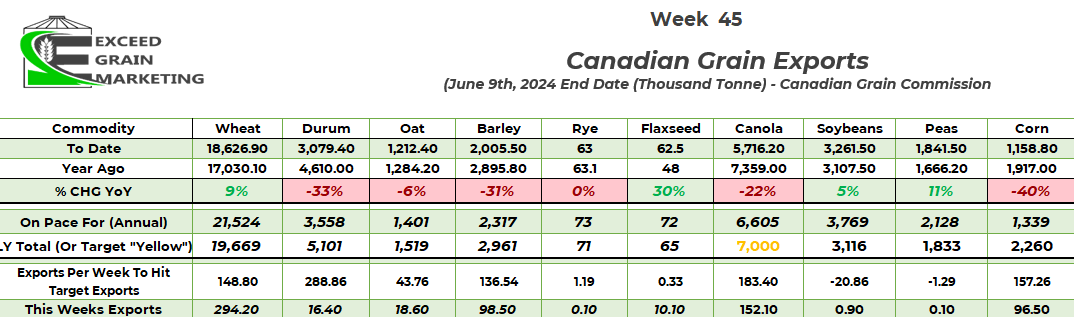

- Canola export current pace of 6.5+ mmt is not great overall and would be one of the lowest levels of exports in decades. See chart below for reference

- We need to grab exports on the tail end of the marketing year to maintain a reasonable carryout in the market. We have 10 weeks of export left in this marketing year. Need consistent movement here on forwards

- Crush is running at a very impressive pace, looks like we will surpass and hit a 11mmt + record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

- Crusher bids still dominate but are falling closer to exporter prices, depending on the month. Crushers hold the winning bid for new crop 2024 harvest

- For a more in depth analysis on Canola Specifically, check out our June 2024 Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – June 2024

Spring Wheat:

- Wheat markets focused on the ongoing US Winter Wheat crop harvest which is progressing well and looks like it will come in as expected. No major surprises as of yet.

- For the Majority of May, Russia / Black Sea weather was the driver of wheat markets. Some significant frosts in Russia in first half of May causing some havoc with crop conditions. Now dryness in the same regions have been drying and lack of rainfall during some critical crop growth periods. The wheat crop in the region typically starts its harvest early July.

- Private analysts calling the crop anywhere from 79 to 85 mmt. Was closer to 93mmt earlier in the year. The USDA posted 91.5 mmt last years crop, the year prior was argued to have been higher and closer to that 100 mmt mark unofficially. So important context when looking to compare crop sizes.

- Indian stockpiles of wheat lowest in 16 years. This week the nation stated that they will not remove import tariffs and will look to bridge the gap in other ways. It was widely speculated up until a few days ago that India would enact certain measures to entice more wheat into the country.

- Kansas wheat tour wrapped up Mid May posting an estimated yield potential of 46.5 bushel per acre. This would put the Kansas winter wheat crop at 290 million bushels vs the 268 million bushels the USDA had in its latest estimate. Five year average is 44.2 bpa for the Kansas crop.

- US winter wheat harvest is beginning in its infancy stages in Texas and Oklahoma. To early to call yield prospects. Sounds like some quality issues with the Oklahoma crop early on

- Russia’s ministry of agriculture reporting that 830,000 hectares or over 2 million acres of crop were lost due to the multiple frost events of the first half of May. Privates saying at least double this. Russia called a state of emergency in many states to help producers have easier access to funding.

- Reports of Russian farmer selling slowing down due here recently. New crop will be off beginning in July and the anecdotal sentiment is towards producers willing to sit on inventories for the time being.

- Wheat exports expected to easily surpass last years levels at current pace and are on track for an 7% increase year over year. Likely not able to make that happen although as rationing will supersede this.

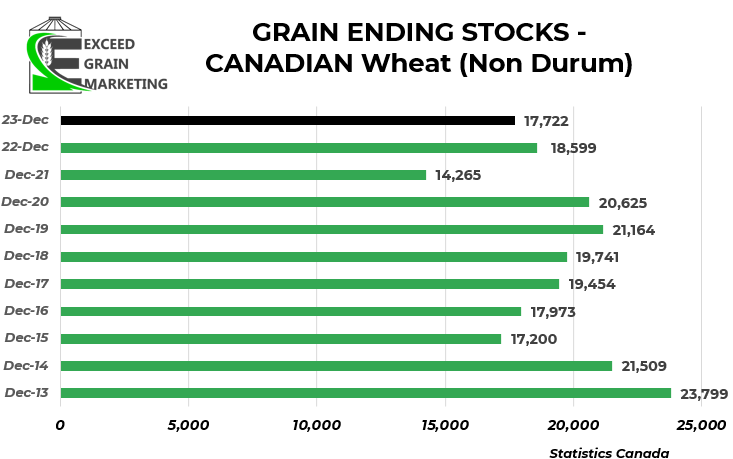

- 2023 Old Crop Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

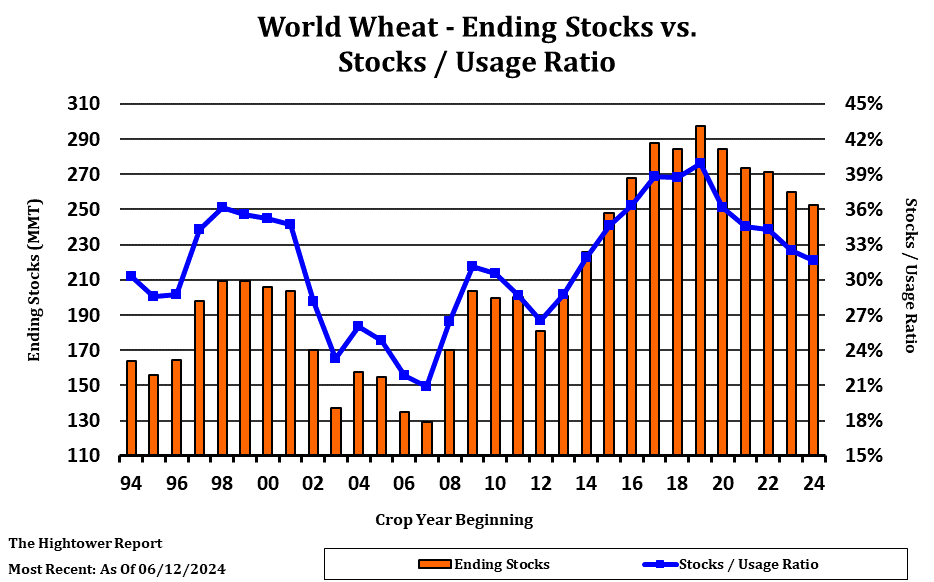

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part. Better known once get into Black Sea crop

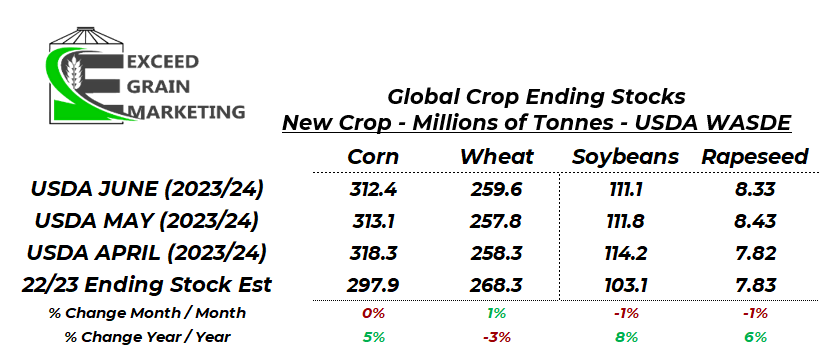

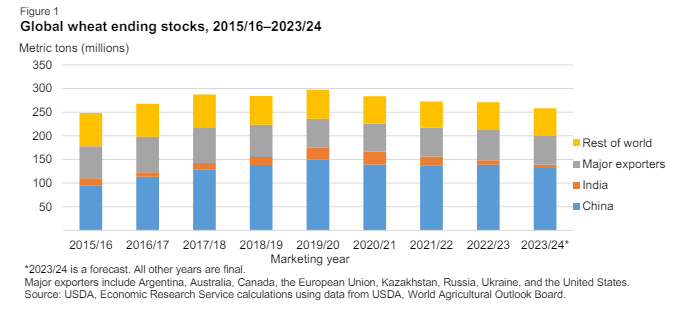

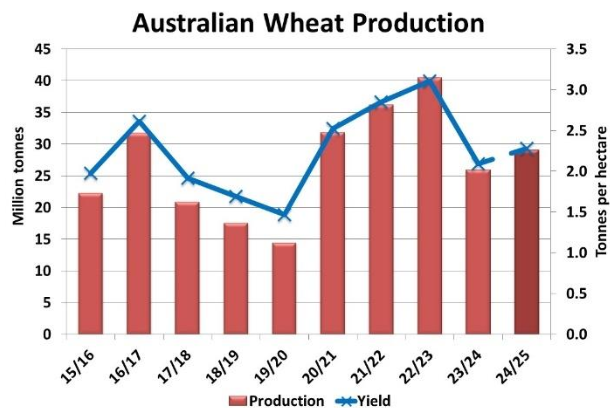

- Forecasted wheat global and domestic ending stocks coming in at the tightest levels since the 2015/16 crop year.

- Keep an eye crop progress in the US and EU winter wheat crops and Spring Wheat crop conditions.

Special Crops

- Mediterranean region durum harvest underway.

- Special Crop analysts have a good feeling on what went in for crops this spring. Looking to end of June acreage reporting to confirm figures.

- Yellow Pea and Lentil Acreage expected to grow in Canada for the marketing year. The pulse crops are showing some excellent return potential for the 2024 cropping season if producers can bring it to yield at harvest.

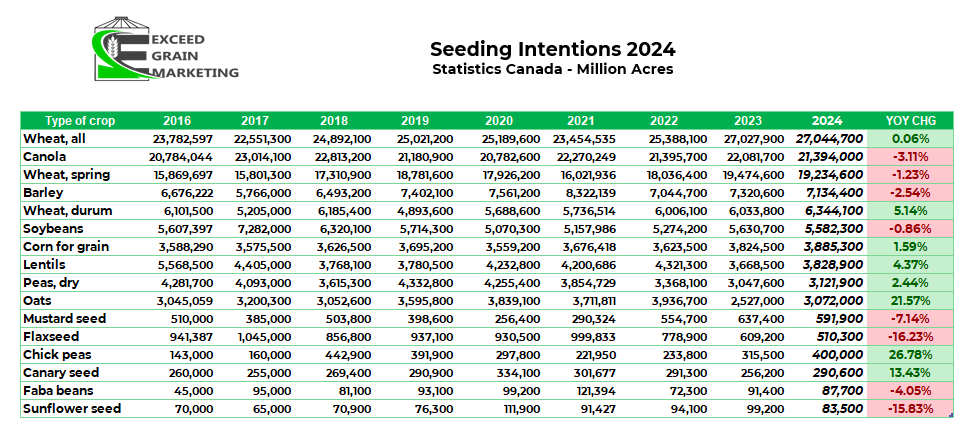

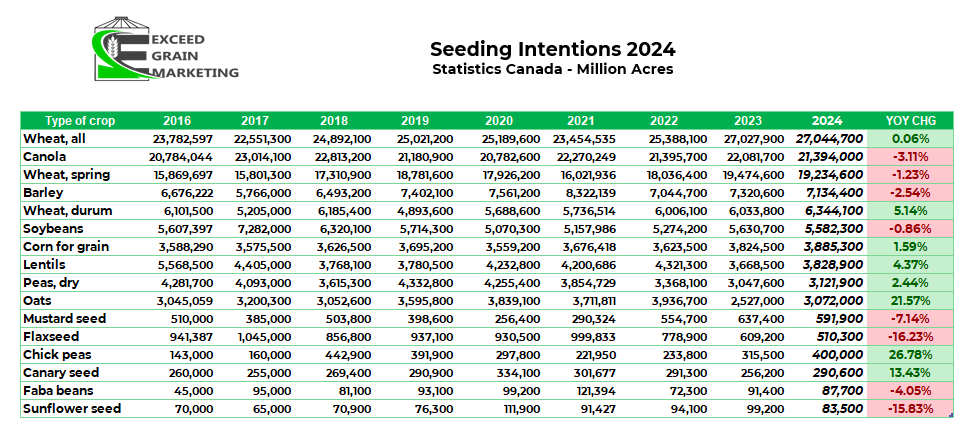

- Special crop markets closely watched Marchs release on acreage estimates from Stats Canada.

- Barley acreage drops to 7.1 million acres. Fits in line with some trendline averages

- Barley prices lower than last year, as with many crops. Some $5.00+ feed opportunities available central Sask. Greater as you move closer to Feed centers. Add $1.25 to $1.50 for Malting.

- Durum acres up 5% year over year. One of the largest acreage estimates in recent years

- Lentil and Pea acres up year over year but still not out of line with recent history.

- One thing to note from this report is that it was collected from December to January 15th. Lots has changed in this timeframe.

- Canadian peas will face stiffer competition going forwards into China as some Black Sea peas able to price into the region. Some of these peas were affected by early May frosts.

- India reduced Yellow Pea import tariffs from 50% down to 0% was extended for several months and now sits at October 31st, 2024. Was only in place until end of March but another month, and then another, was added to get exports into the nation.

- Durum growing regions of Canada have got some recent precipitation but will be dependent upon some key rains following planting, producers somewhat hesitant to price aggressively on new crop. EU prices are rising for the crop but Canadian bids appear to have plateaued for short term.

- Red Lentil reduced import tariffs extended until March of 2025

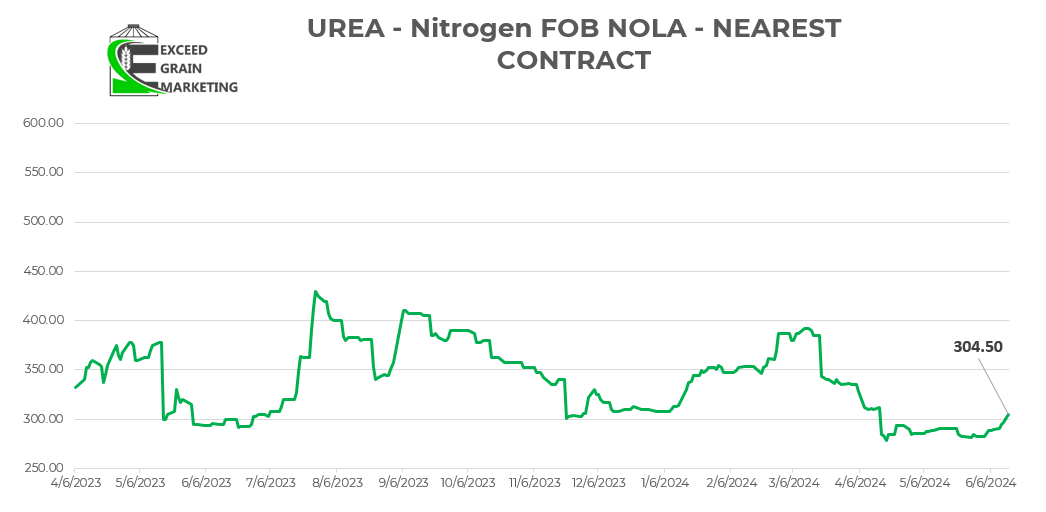

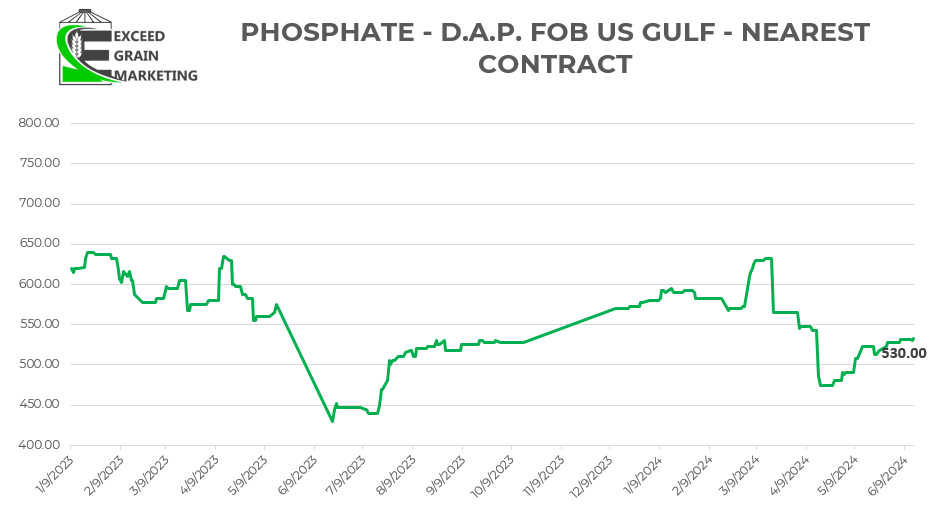

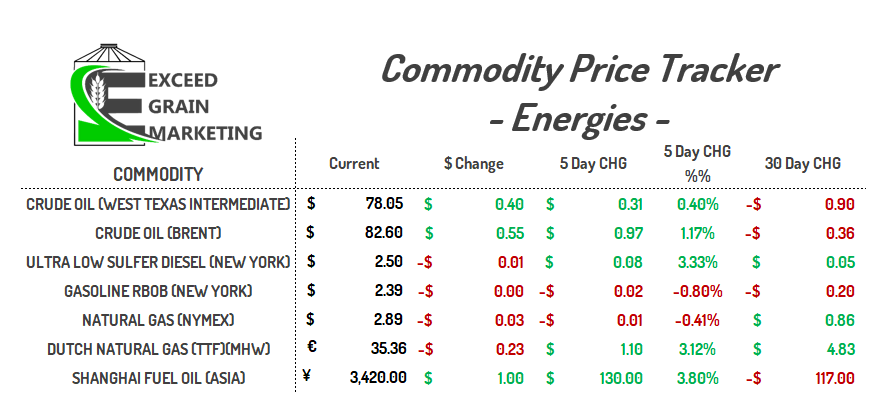

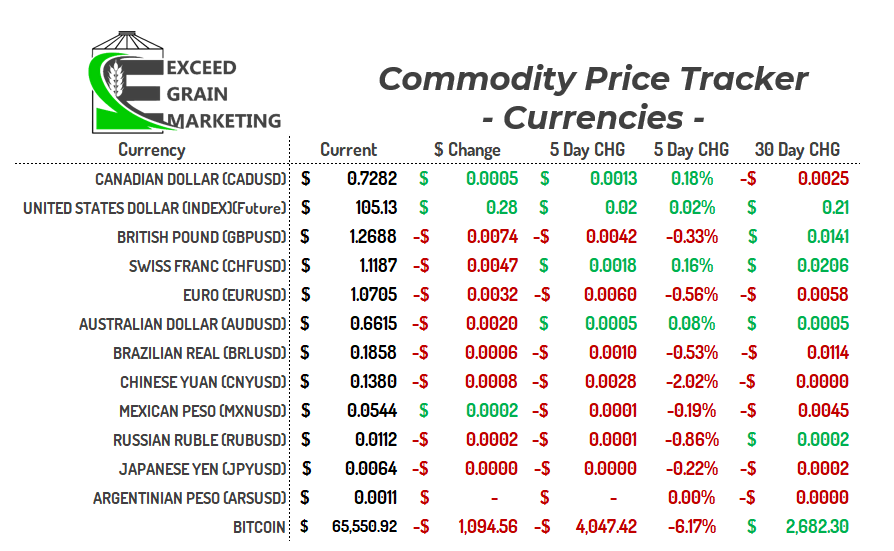

Currency – Energies – Fertilizer

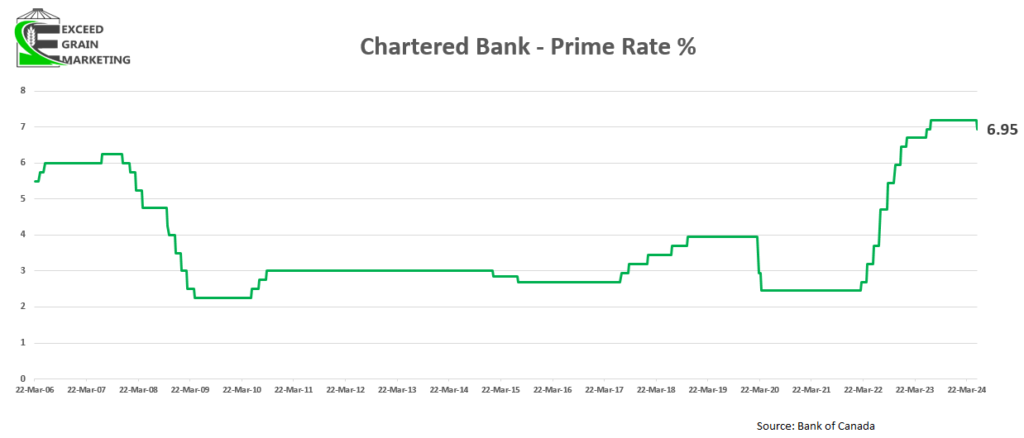

- Bank of Canada Stays Put with current interest rates at the latest interest rate meeting. Prime sits around 7.2% at major Canadian banks. Hinted that we could be higher for longer. Cuts will not be significant if they do come. The Bank of Canada has also recently hinted that one could face another rate hike but it is hesitant to do so given that Canadians are feeling the pinch of higher rates.

- Analysts split if we get a rate cut in June.