Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

- 2024/25 Crop Year Recommendations – Click Link

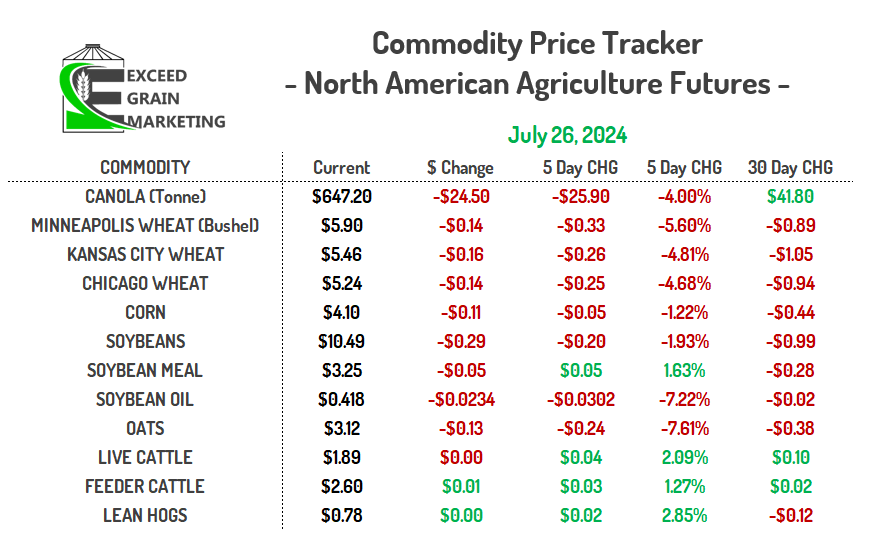

- We advanced and cleaned up old crop wheat sales at the beginning of the week and were able to capitalize upon $8.25 central Alberta and Manitoba while Closer to the $7.90 level in central Saskatchewan. Opportunity as well at the beginning of the week to catch up to Canola recommendations or make additional sales if fit.

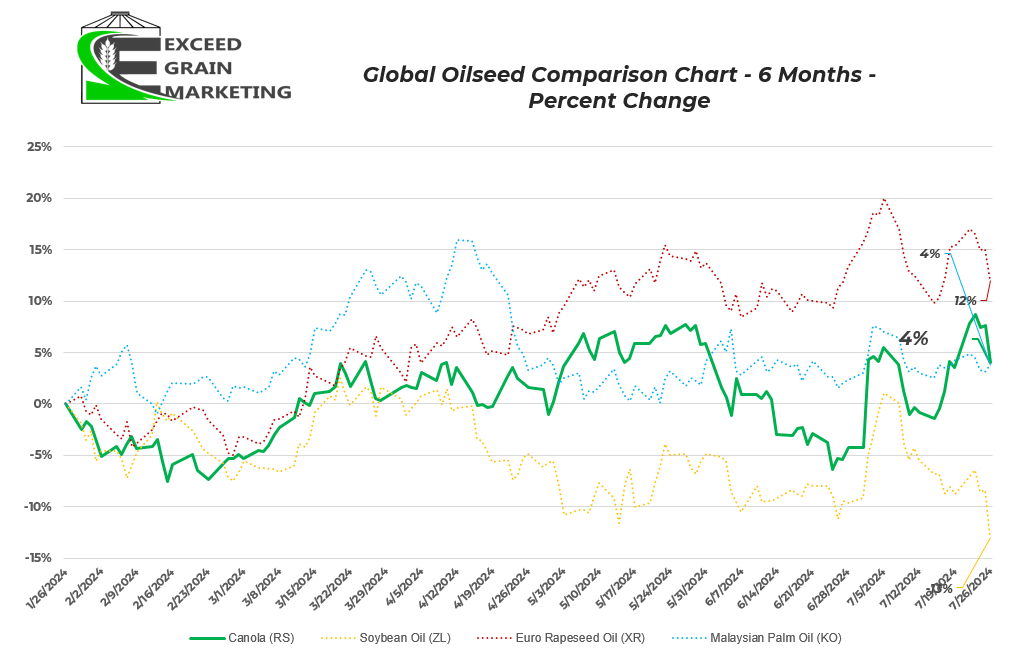

- Oilseed markets were on pace for a strong week of progress on the futures charts before Fridays trade action took away the positive price action we seen Monday onwards.

- North American and European futures fell hard on Friday. Profit taking on the trade desks, combined with some farmer selling helped bring down prices on Friday. Money flows big part of this weeks trade and positions were adjusted heading into the weekend.

- Part of the reasoning for the drop is US weather forecast looks less threatening as we jump into the beginning of August. Parts of the US corn belt now looking slightly cooler than previously forecasted and some precipitation is on the way for some, but not all of the corn belt. Essentially, weather forecast became less threatening.

- Western Canadian crops going backwards according to many boots on the ground reports. Many western Canadian crops without rain for the last few weeks and fields are turning dry with the heat. Some heat blast will be prominent in certain areas. Harvest is set to begin on crops such as Durum and Lentils in the coming weeks so heat going forwards will have less of an affect on “filling” of the crops. Top end yield potential likely took off in many areas. Areas with late seeded canola still watching the forecast intensely.

- Central Alberta likely dealing with some of the drier areas of the prairies.

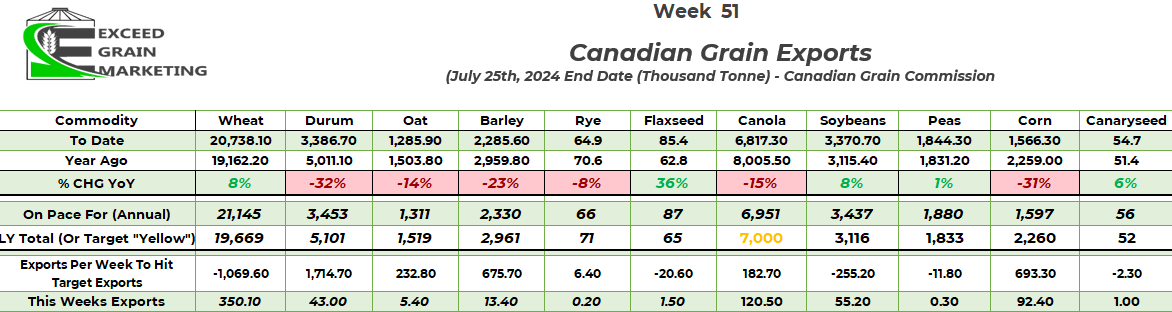

- Last week of Canadian Grain Export season is among us. Canola looking like it will hit the 7mmt pace we were looking for mid January to early February when prices and exports were at their most dismal pace. Late December the export pace was closer to 6mmt.

- US Spring Wheat crop estimated to be a record size according the the US Wheat Associates spring wheat tour that took place this week. The crop is slated to come in at 54.5 bushel per acre vs last years 47.4 bpa.

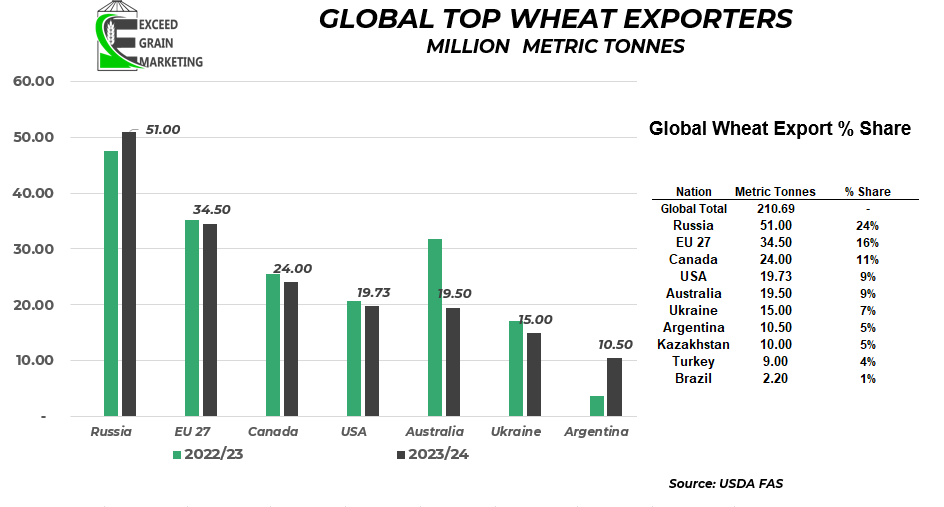

- Russian wheat crop – Private estimates around 85mmt. Down from last years 92mmt crop but up from the 80 mmt we seen when frost fears were at their worst.

- European Comission lowered their wheat crop estimates to 120.8 mmt from 121.9 mmt last report. Last year the crop was a 125.5 mmt crop.

- Quality is the big concerns this year. Germany, France and Poland all dealing with lower protein and generally lower quality as rains hampered early harvest progress. French wheat sits at 50% good to excellent rating which is the lowest in 8 years and down 2% from last week even.

- USDA WASDE Report out last Friday July 12th – Highlights:

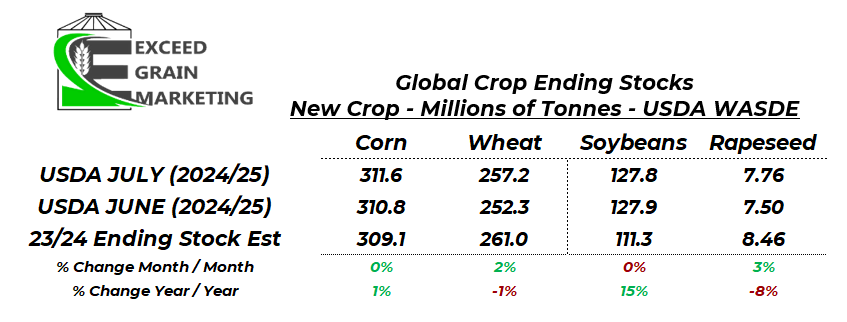

- World Corn Ending Stocks Up slightly from Junes WASDE but close to estimates – 311.6 mmt vs 310.8 mmt last report

- World Soybean Ending Stocks Down slightly from last month and about 1mmt more than estimates heading into the report. 127.8 mmt vs 127.9 mmt June.

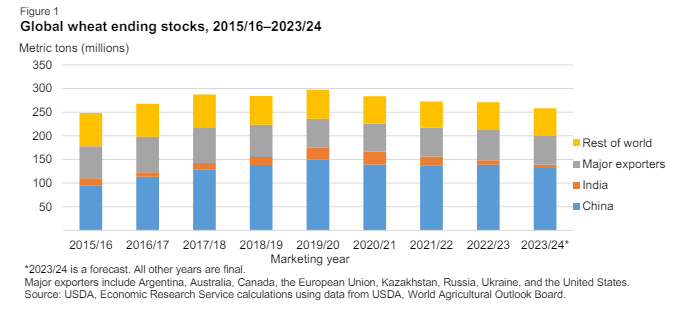

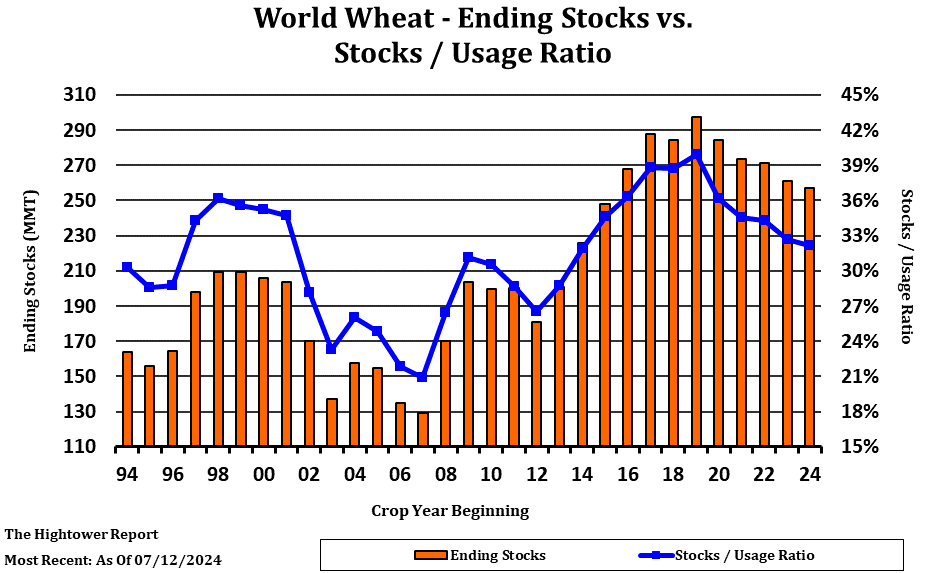

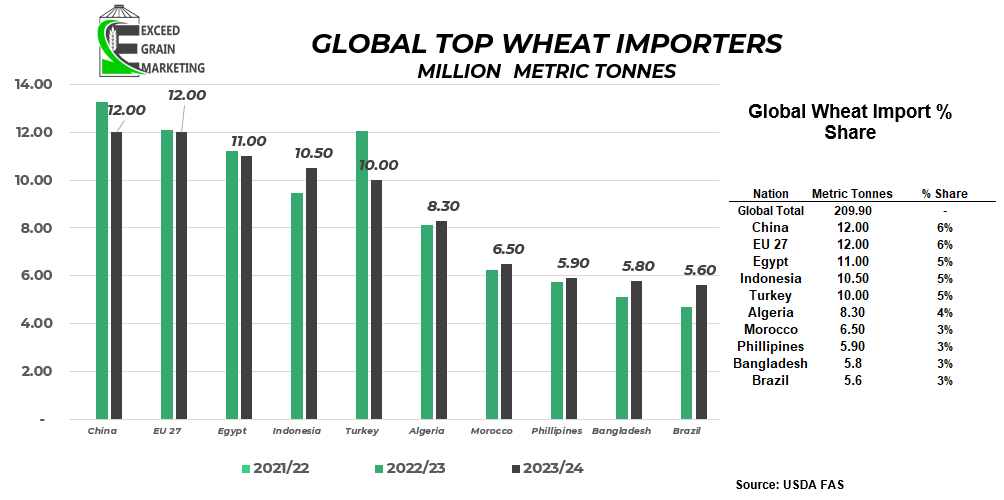

- World Wheat Ending Stocks up big time and was the “surprise” of the report. Junes USDA has wheat stocks as 252.3 mmt and estimates were around 252.1mmt. 257.2 mmt was the published number from the USDA for the July report

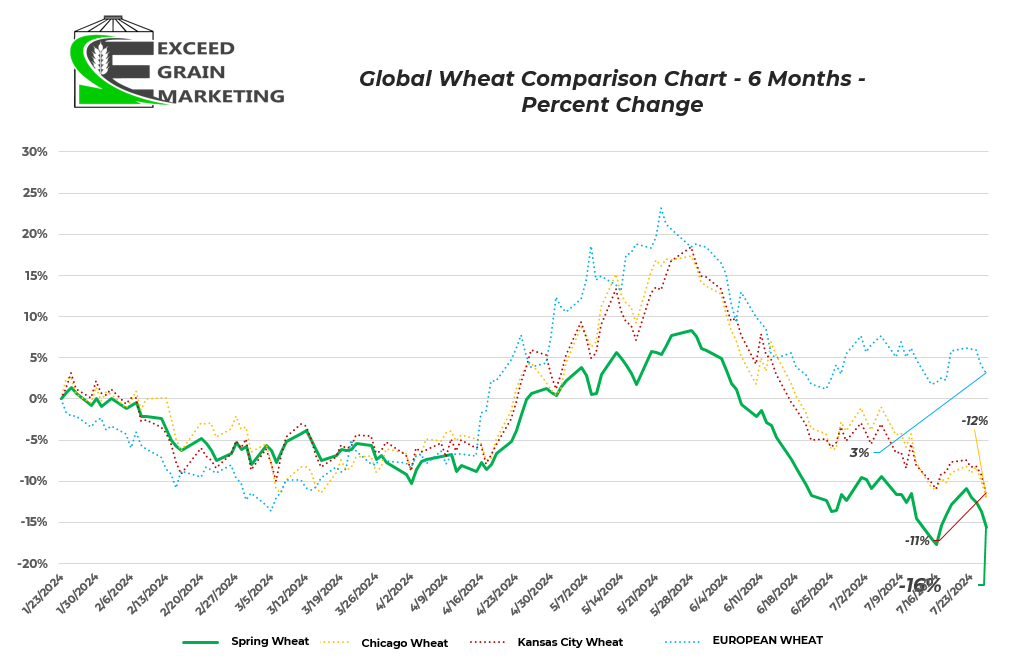

- Wheat traded lower immediately following the reports release and other grains were mixed. By the time the market close drew near, all grains were trading lower with the exception of Corn and Oats picking up a few pennies despite nothing really bullish for the corn market.

- USDA Left Ukraine and Russian wheat production untouched. 19.5 mmt and 83.0 mmt respectively.

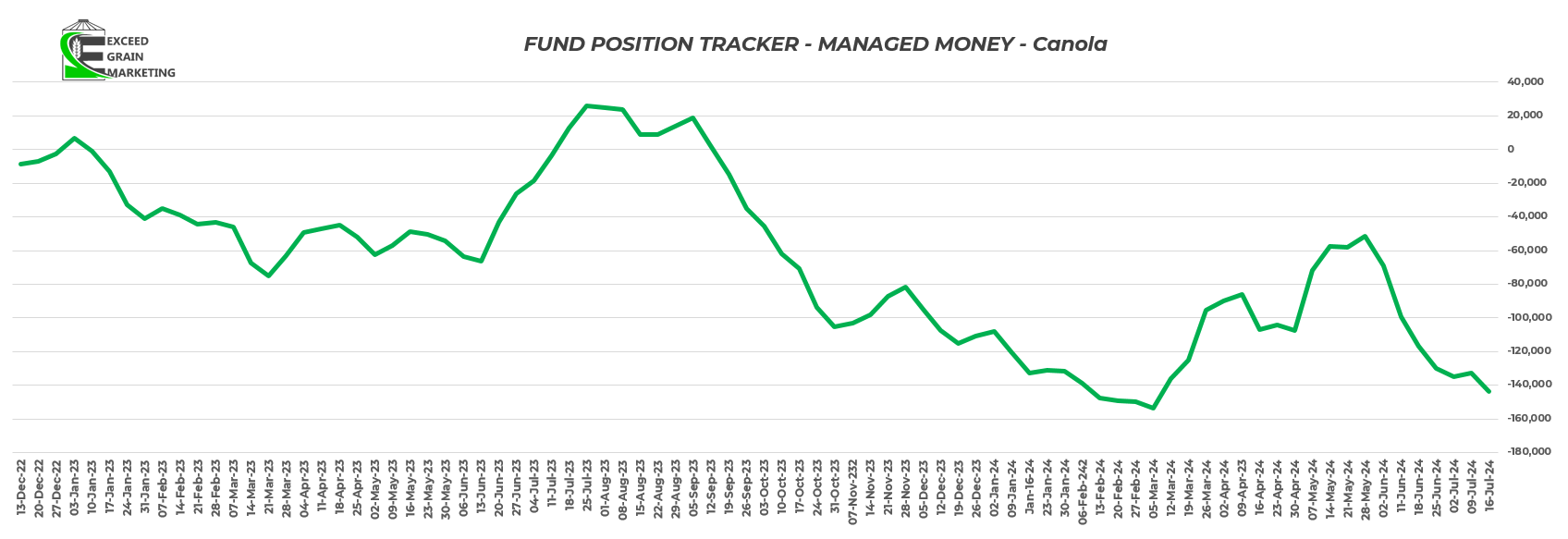

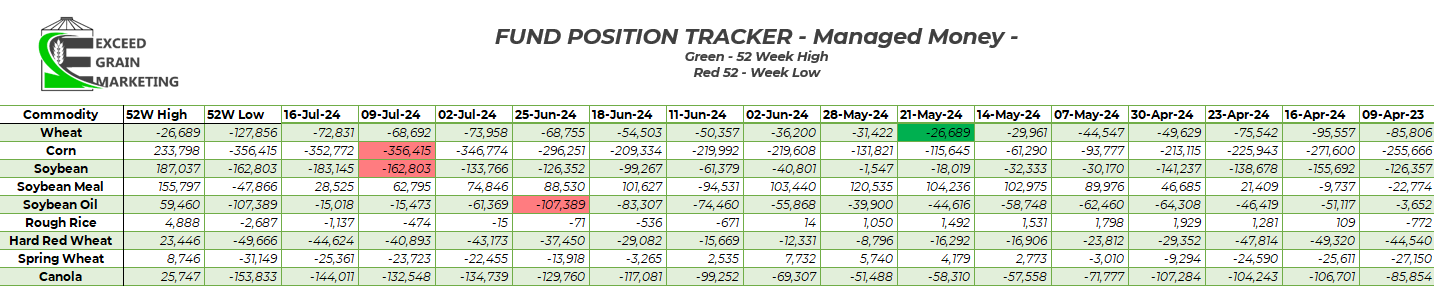

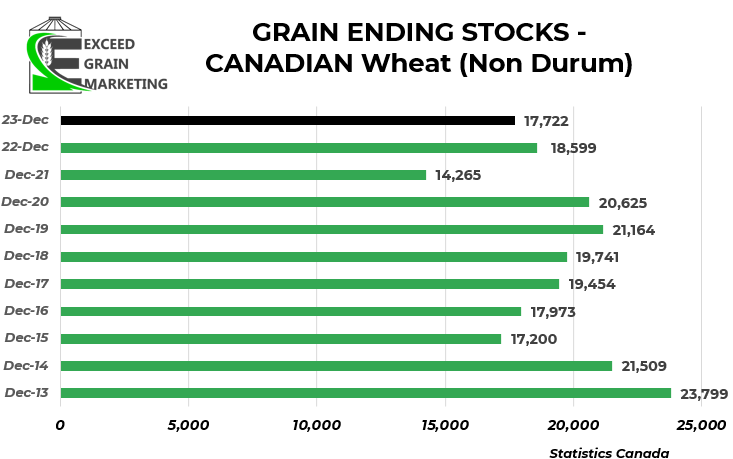

- Big moves in the wheat side of the report was a 1mmt bump in Canadian wheat production to 35.0 mmt and US wheat production up a massive 3.5 mmt. Funds are massively short many markets, particularily Corn and Soybeans although, see chart below. Canola short positions not quite as low as February/March but would be record short for the time of year.

- Corn and Soybean futures prices sitting at 4 year lows. Wheat sitting in a simular spot but some of the contracts found lower values in recent months.

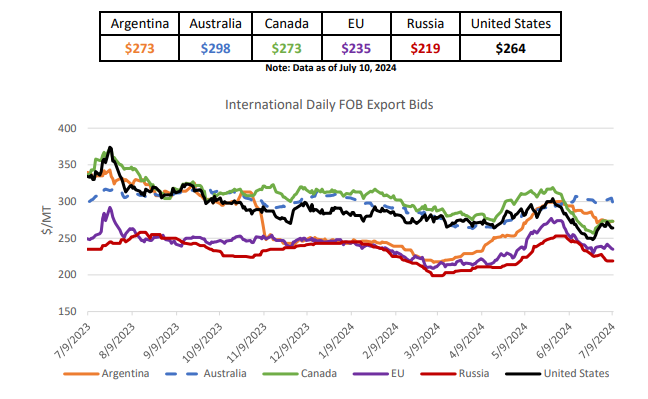

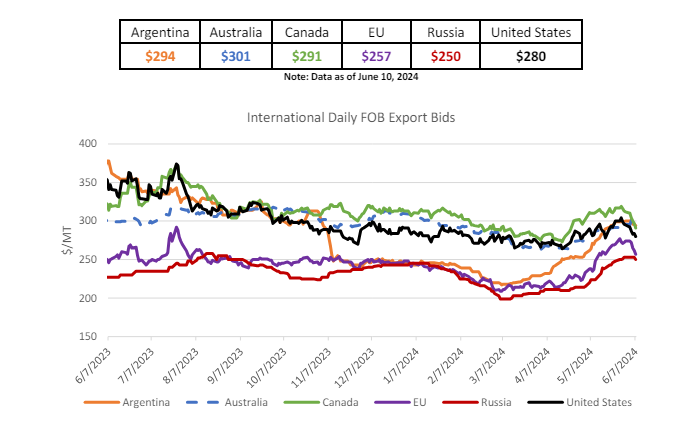

- Global wheat prices lower. Russian wheat $31 per tonne lower month over month.

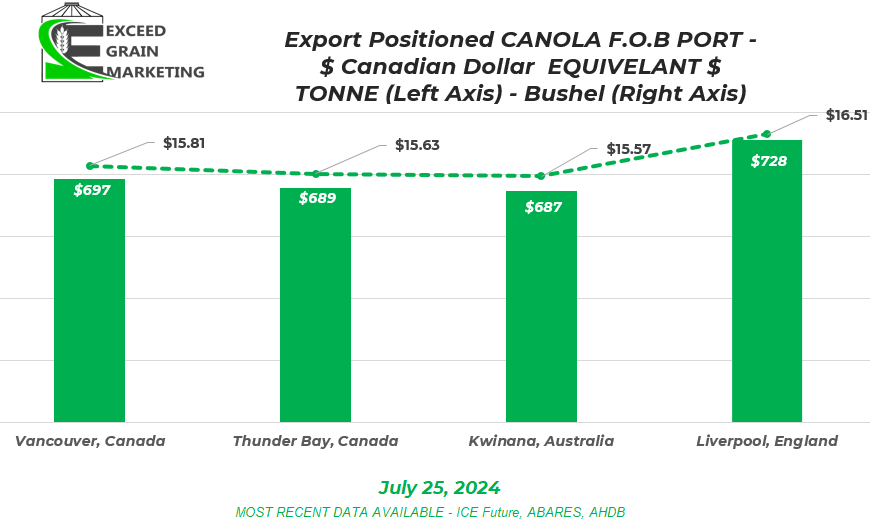

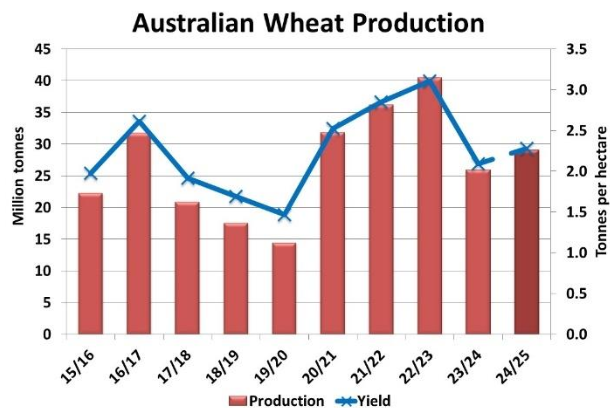

- Australian wheat pricing more expensive than Canadian wheat right now, same story for Australian canola. See charts below. Typically Canada has been carrying a premium to Australian canola in recent years and has caused Canada to lose out on some key sales this past year due to cheaper foreign supply.

- Market has a big crop prices in and it will be difficult to get a rally unless there is a demand story to be built or there is a sudden onset supply scare of some substance.

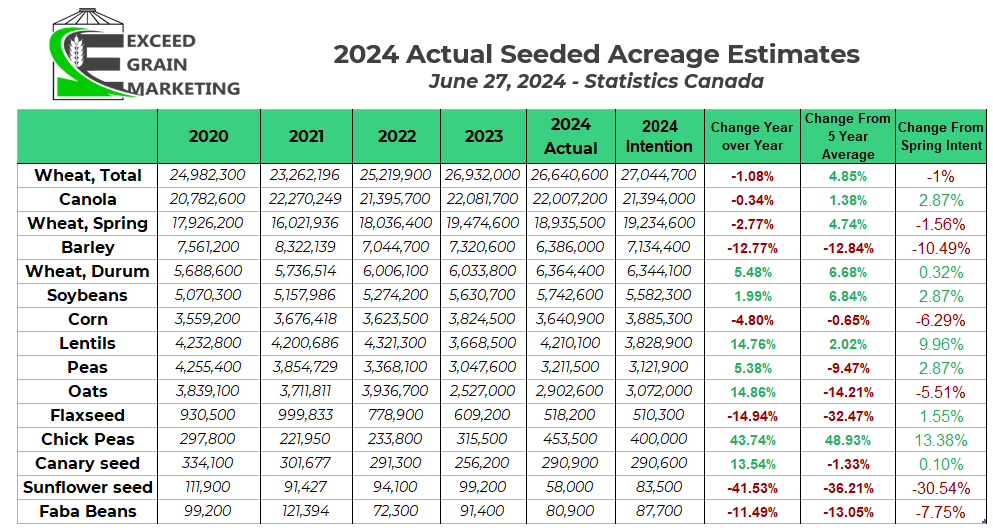

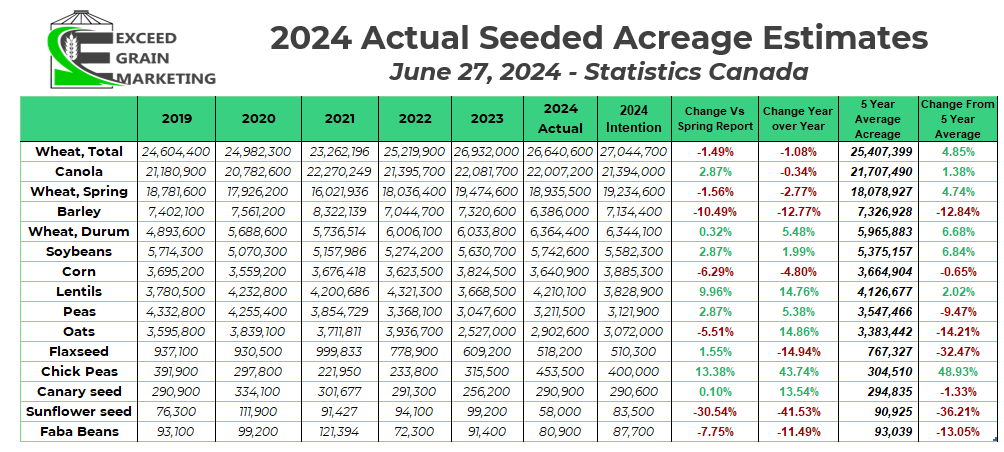

- USDA and Stats Canada acreage reports below

- USDA Crop Acreage Report released June 28th 2024 – Highlights:

- Corn Acreage came in higher than expected. 91.5 million acres vs 90.34 pre report estimates

- Soybean Acreage came in lower than expected. 86.1 Million Acres vs 86.75 pre report estimates

- Wheat acreage came in slightly lower than expected 47.24 Million Acres vs 47.66 pre report estimates. Spring wheat was 11.3 million acres of this total and right near expectations.

- For Some Smaller, less covered crops by the news wires:

- Canola area came in at 2.663 million acres for US plantings vs 2.344 million acres last year.

- North Dakota is essentially where all the canola is grown. 2.05 million acres in North Dakota alone. Washington and Montana make up the rest of acreage.

- Flax Acres in at 140,000 all in Montana and North Dakota. 178,000 last year

- Pea acres up 1.03 million acres vs 966,000 last year

- Chickpea acres 502,000 acres vs 372,000 last year

- Lentil acres 836,000 vs 546,000 last year

- Other notes from the report: June Stocks

- June 1st stocks all came in above estimates but not far off from expectations. June 1st corn stocks at 4.99 billion bushels vs 4.10 last year. Soybean stocks 970 million bushels vs 796 million bushels last year. wheat at 702 million bushels vs 570 million bushels last year.

- Overall June 1st stocks look fairly heavy, but the market has been working with this notion all year in United States, so none of this comes as much of a surprise

- Turkey banning wheat imports until October to help control domestic prices. Turkey is typically Russia’s largest wheat importer.

- European Union released their tariff guidelines in May for Russian and Belarussian grain imports. As of July 1st it is being reported that cereal crops (wheat, barley, ect) will be subject to a 95 euro per tonne tariff into the EU and oilseeds will be 50% tariff.

- North American producers will welcome India’s extension of the Yellow Pea tariff exemption. Yellow pea imports will remain exempt from import duties until October 31st, 2024. Moving the exemption into the new crop season. Domestic yellow pea bids have increased as a result.

- Desi chickpeas will now be exempt from tariffs until March 2025.

- Australia has turned to planting more Desi Chickpeas this year, especially in Western Australia. Acres up 80%

- Australia is expected to plant a record 885,000 acres of lentils

WESTERN CANADIAN CROP NOTES

Canola:

- Canada will be working hard to pick up some of the shortfall in the European crop, much of this business we lost out on last year to Australian canola due to us being overpriced in to our secondary markets. EU needs to import around 6mmt of Canola this year partly due to the shortfall in their own crop. EU rapeseed crop atleast 1.1 mmt smaller than last year. Recent commentary sounds like it could be getting smaller. Many government agencies calling it 19mmt crop but more privates and some others calling it closer to 18mmt. Last year the crop was 20mmt in size.

- Canadian crop has been hit hard by some extreme heat last two weeks above 30’s

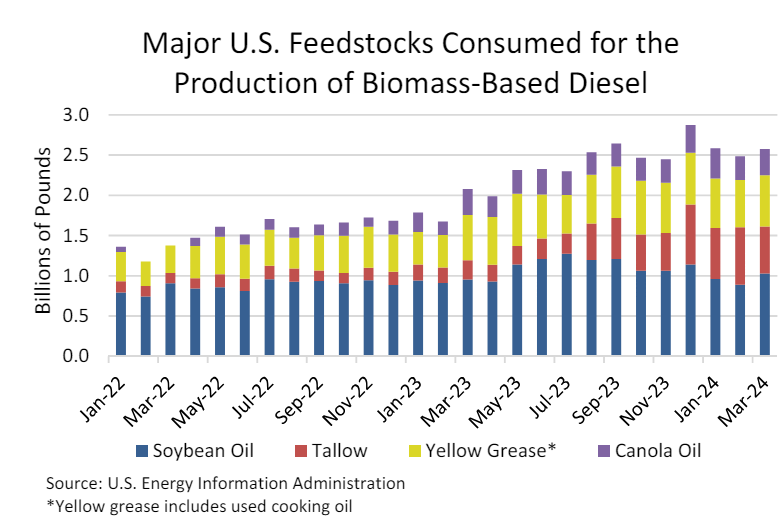

- USDA moved Canadian canola production to 20 mmt. One of the largest crops in recent years according to the government agency. Global canola production down about 1mmt from last year. Some privates calling the CDN crop smaller due to recent heat wave. Canadian Supply and Demand will all shake out depending upon final production and how the export game starts up

- Canola has moved seasonally lower since seeding, but found a short term bounce the start of July and again this week. In general Markets appear satisfied with the state of the current Western Canadian crop despite some late season dryness and high temperatures low to mid 30’s on the flowering canola

- Canola global pricing below. Canadian Canola and Australian Canola competitive with each other. CDN slightly more expensive.

- Canola export current pace of 6.9+ mmt is not great overall and would be one of the lowest levels of exports in decades. See chart below for reference. We have moved closer to that 7.0 mmt mark in recent weeks as some strong exports on the tail end of the marketing year so far. Only 1 more weeks left of export reporting for the crop marketing year. Important to note the massive legwork on the export side in recent weeks although as mid winter we were on pace for a 6.0mmt crop export pace

- Crush is running at a very impressive pace, looks like we will surpass and hit a 11mmt + record.

- Crushers hold the winning bid for new crop 2024 harvest.

- For a more in depth analysis on Canola Specifically, check out our June 2024 Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – June 2024

Wheat:

- US Winter wheat harvest wrapping up and spring wheat harvest will take place in the United States by mid August. US wheat associates spring wheat tour calling for a record breaking spring wheat crop in North Dakota where the lions share of United States spring wheat is planted.

- Wheat prices sitting near 4 year lows after a spike seen in mid to late May. For the Majority of May, Russia / Black Sea weather was the driver of wheat markets. Some significant frosts in Russia in first half of May causing some havoc with crop conditions. Now dryness in the same regions have been drying and lack of rainfall during some critical crop growth periods. The wheat crop harvest has begun and initial yields are mixed. Some of the very first early yields were higher than expected but now trending lower as harvesters get into the later crops.

- USDA July placed the Russian wheat crop at 83mmt, unchanged from the June report. Ukraine 19.5mmt, down from 23 mmt last year.

- USDA July put Canadian wheat up by 1mmt to 35mmt and US wheat up around 3.5 mmt to just shy of 54.7 mmt

- Private analysts calling the crop anywhere from 79 to 85 mmt. Was closer to 93mmt earlier in the year. The USDA posted 91.5 mmt last years crop, the year prior was argued to have been higher and closer to that 100 mmt mark unofficially. So important context when looking to compare crop sizes.

- Russia’s ministry of agriculture reported mid June that 830,000 hectares or over 2 million acres of crop were lost due to the multiple frost events of the first half of May. Privates saying at least double this. Russia called a state of emergency in many states to help producers have easier access to funding.

- Forecasted wheat global and domestic ending stocks coming in at the tightest levels since the 2015/16 crop year.

Special Crops

- More Durum acres in Canada and United States but we know some issues with the Durum crop overseas. Lots of the global durum pricing waiting to see how Canadian crop plays out. Durum prices down from early spring on anticipation of a good North American crop. Durum tonnage will likely be high in western Canada, its the quality that will be the deciding factor. Heat hitting at the wrong time for durum. Some producers reporting the crop “going backwards” recently. Tonnes should be there. Quality will be the deciding factor.

- Yellow Pea and Lentil tonnage expected to grow in Canada for the marketing year. The pulse crops acreages were higher spring 2024 due to some profitable selling opportunities. Pulses still some of the more profitable crops out there, bids have slid from spring due to good farmer selling but remain profitable. Lentils being ready to be harvested here in the coming weeks.

- Canadian peas will face stiffer competition going forwards into China as some Black Sea peas able to price into the region. Some of these peas were affected by early May frosts. Canadian peas will need to see good export demand off the hop to keep prices supported.

- India reduced Yellow Pea import tariffs from 50% down to 0% was extended for several months and now sits at October 31st, 2024. Was only in place until end of March but another month, and then another, was added to get exports into the nation. No word yet on if this tariff exemption will be kept in place, a consideration to be made when marketing this years crop.

- Red Lentil reduced import tariffs into India extended until March of 2025

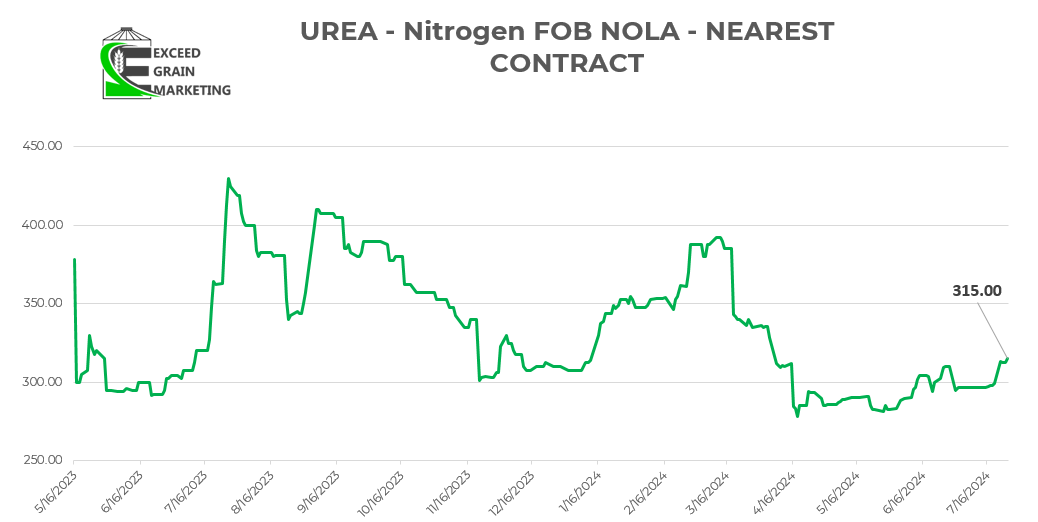

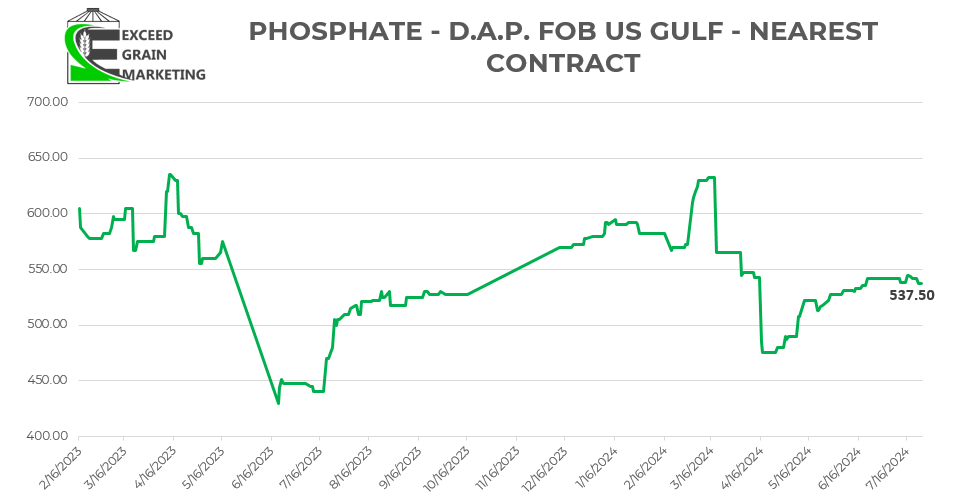

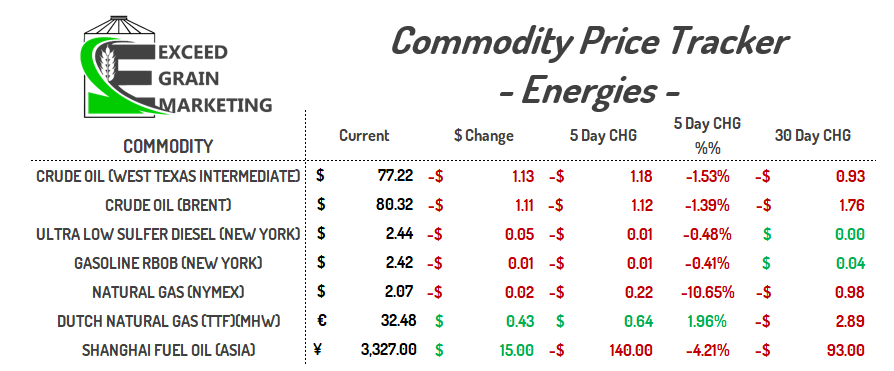

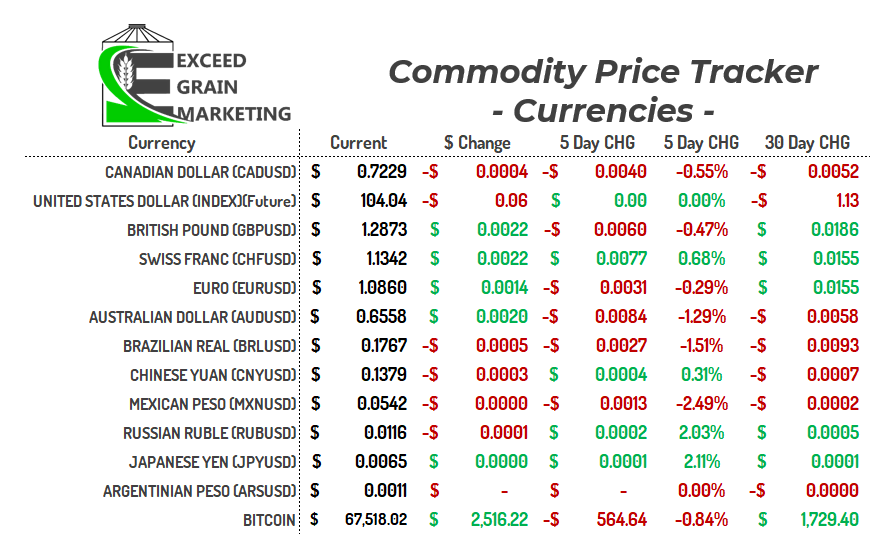

Currency – Energies – Fertilizer

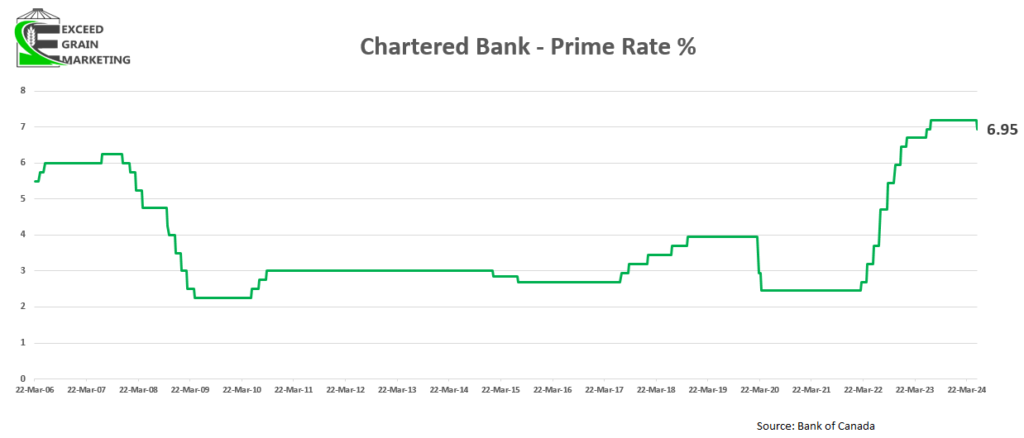

- Prime sits around 6.95% at major Canadian banks.