Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

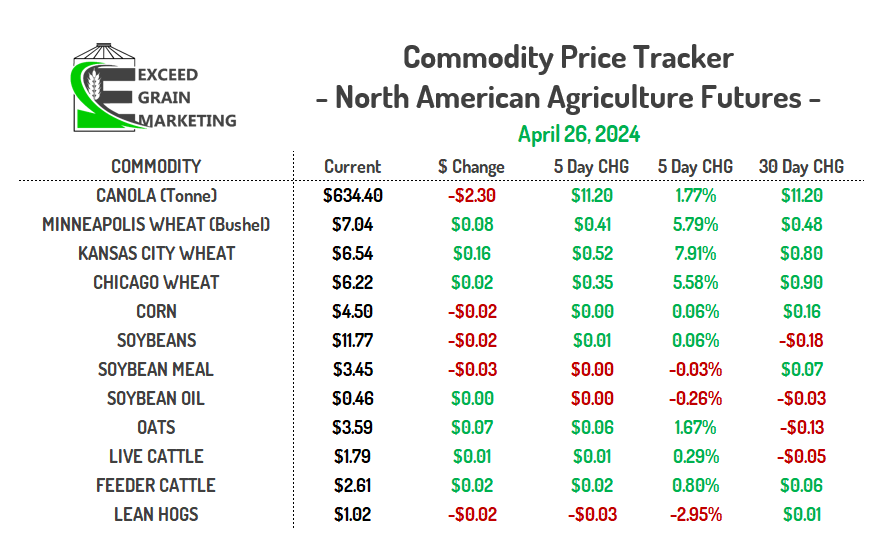

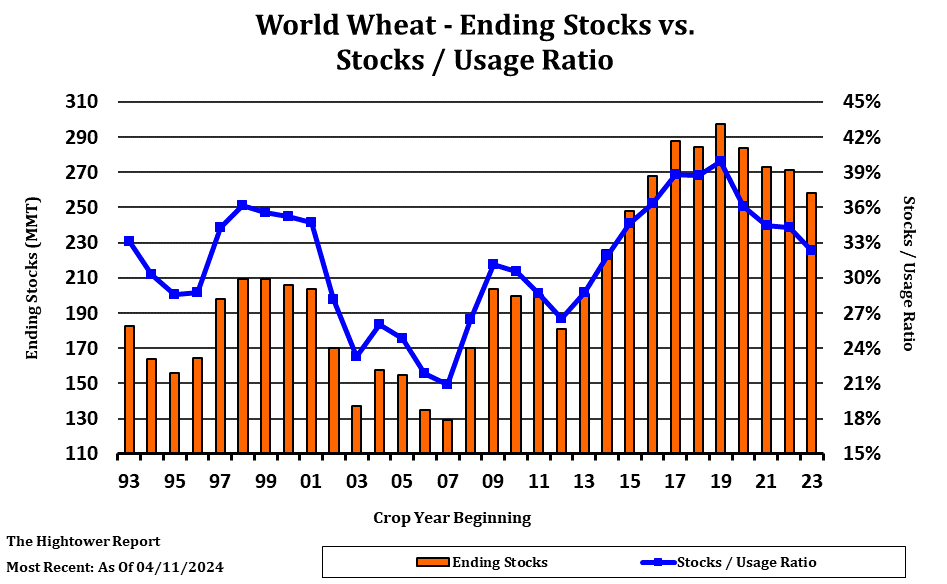

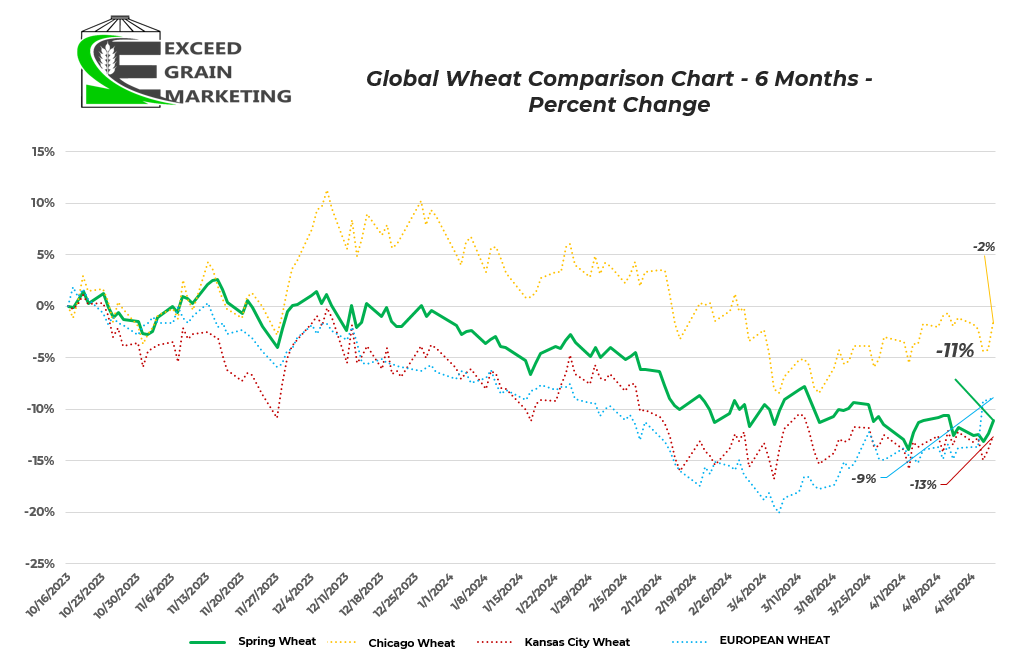

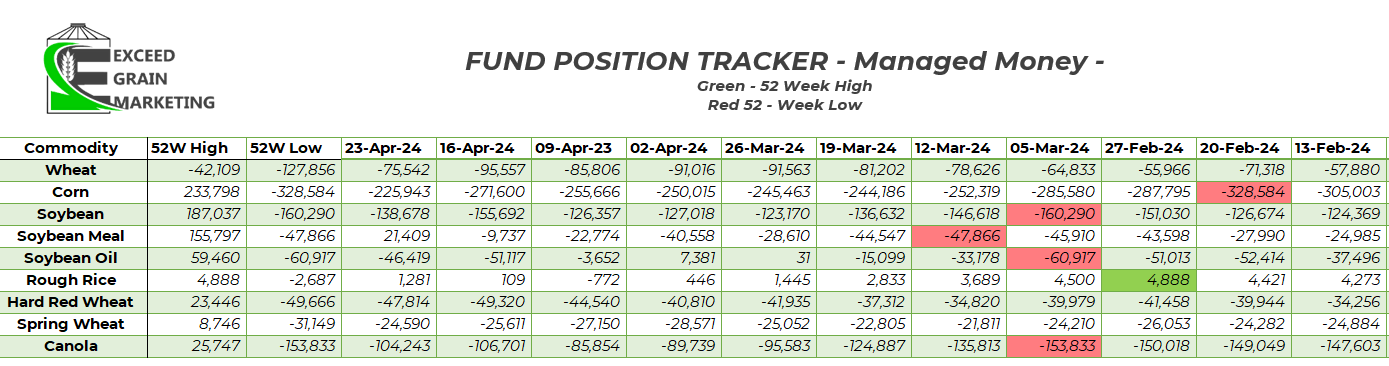

- Wheat was the story of the week. $0.40 to $0.50 gains made in the futures.

- Russian southern wheat cropping regions very dry, limited relief in sight. US winter wheat region quite dry, some relief could come over weekend. Market will be looking to see what falls. Some short covering action this week and end of month roll / squaring up of positions.

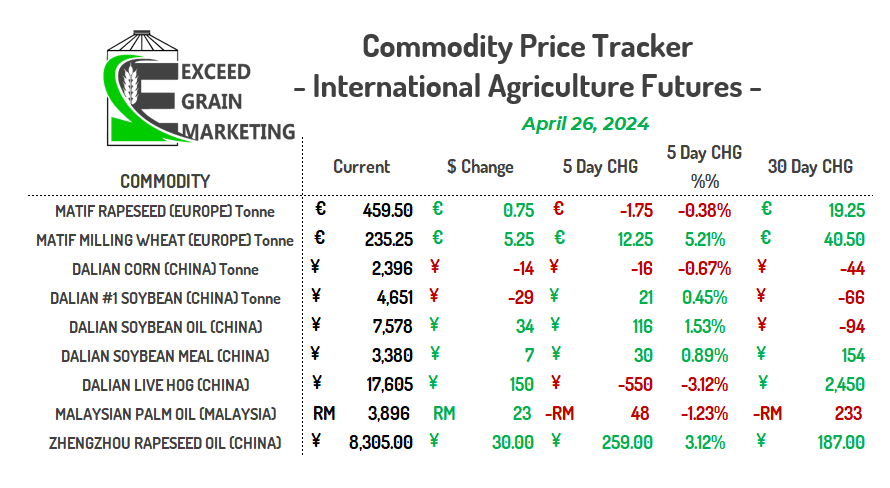

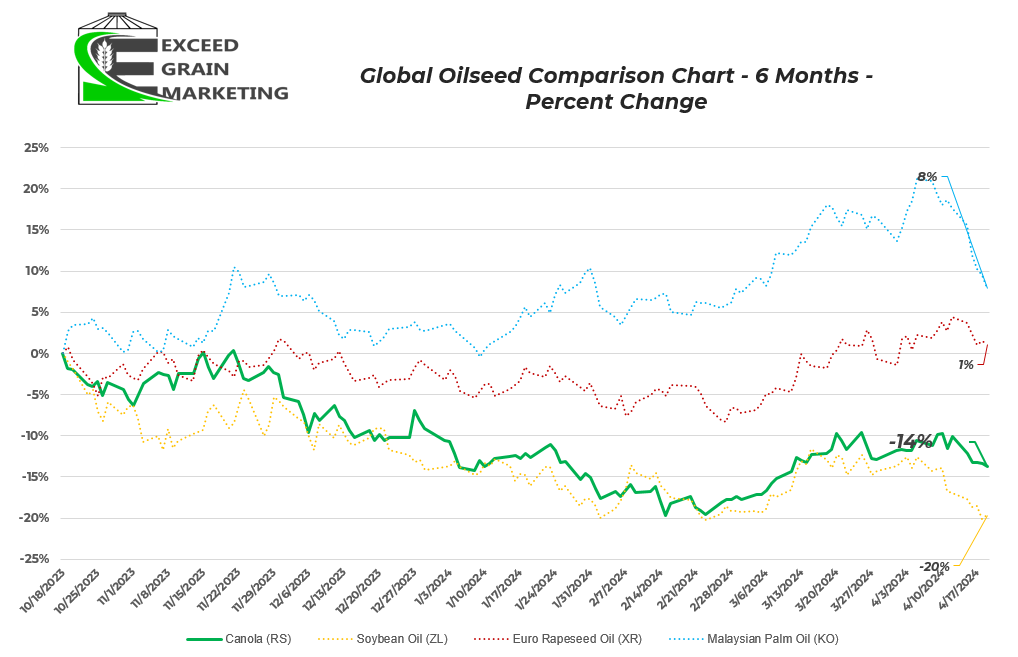

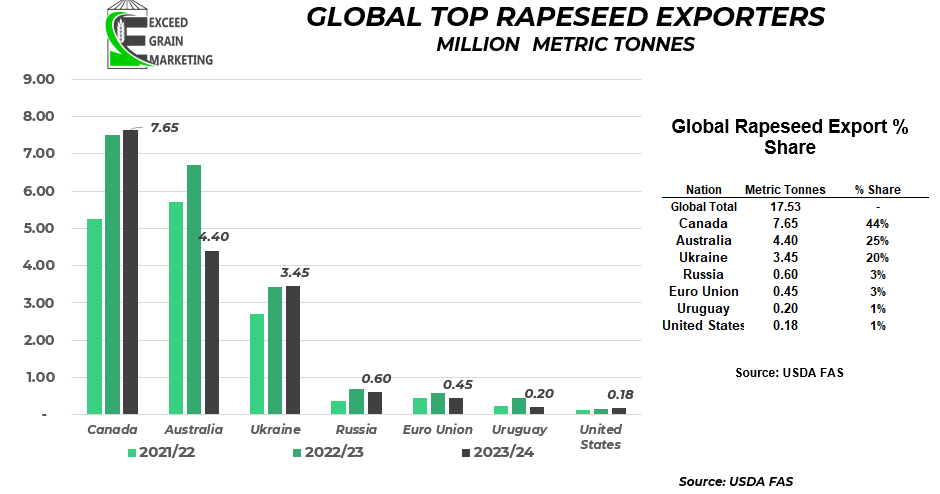

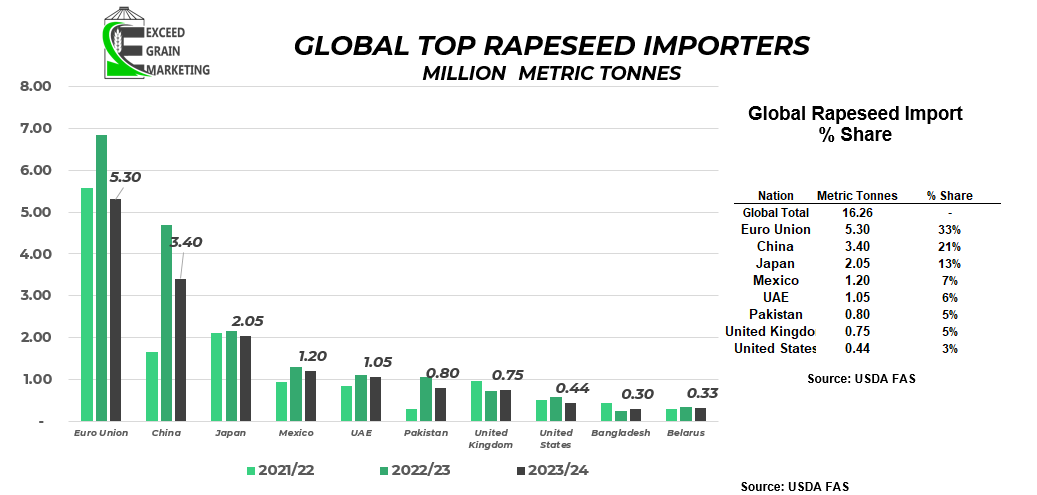

- Veg oil markets (Rapeseed, Palm, Canola) were mixed for the week. July canola did manage to pick up a gain of $11.20 per tonne.

- Planting/Seeding underway across North America.

- US full force underway in areas where fieldwork allows. Some heavy, localized, rains fell across the corn/soybean belt and will keep some planters out of the fields but good progress is being made for the most part.

- Canadian planting will be full speed ahead within the next 10 days.

- Soil Moisture is a mixed bag across North America. Some drenched fields in eastern corn belt, some very dry areas in winter wheat production region. Dryness in US northern plains. Canadian prairies eastern regions have fairly decent soil moisture following an recent widespread precipitation event.

- Could potentially see a rail strike across Canada starting mid to late May. Unions of CPKC and CN rail lines voting on new deal and we will know by as early as next week whether they will strike or not. This could hamper tail end of the export season for grains and would be a detriment.

- French wheat conditions sit at 63% good to excellent, down 1% from last week and down from 94% last year. France is the largest producer of wheat in the European Union, with about 25% of the 134,000 tonnes produced annually.

- Russian wheat regions expected to catch some rains in the 5 day forecast. The dry region of Russia’s wheat production region could see over an inch in the next 5 days, but the precipitation is for the tail end of the forecast, so there is still a chance the forecast does not come to fruition.

- Reported Frost activity in a wide swath of EU rapeseed and winter wheat production region. Lots of rapeseed is in blooming phase so damage is still unknown as it is to early to tell. More will be known in the coming days if this will be a yield reduction event.

- Argentinian soybean harvest currently 23% completed. behind the average pace of 40%. Corn crop harvest also around 24% completed and 30% average. Slower harvest pace due to some weather related delays early on.

- Buenos Aires Grain Exchange announced it is pondering lowering its current 51MMT production estimate of the soybean crop due to low early initial yields from northern cropping regions.

- Brazilian soybean harvest essentially completed.

- Brazilian corn facing some dryness stressors, early harvest should start Mid May and we will get a better idea on how bad the drought has been. Most of the problem areas have been in Southern production regions, and will not be the first crops harvested. Mato Grosso looks to be shaping up alright.

- Western Australia Dry. No major rain events in next 10 days. Needs rain soon or could see risk to main production areas of Canola. Canola crop not in yet, but planting well underway in WA.

- Canadian Federal budget out last week. Big item of top interest is the changes to capital gains and their inclusion rate. Capital gains inclusion rate is moving from 50% to 67%. Speak with your accounting professional regarding this impact it may have on your own farming operation or related business. Different rules apply to individuals vs corporations

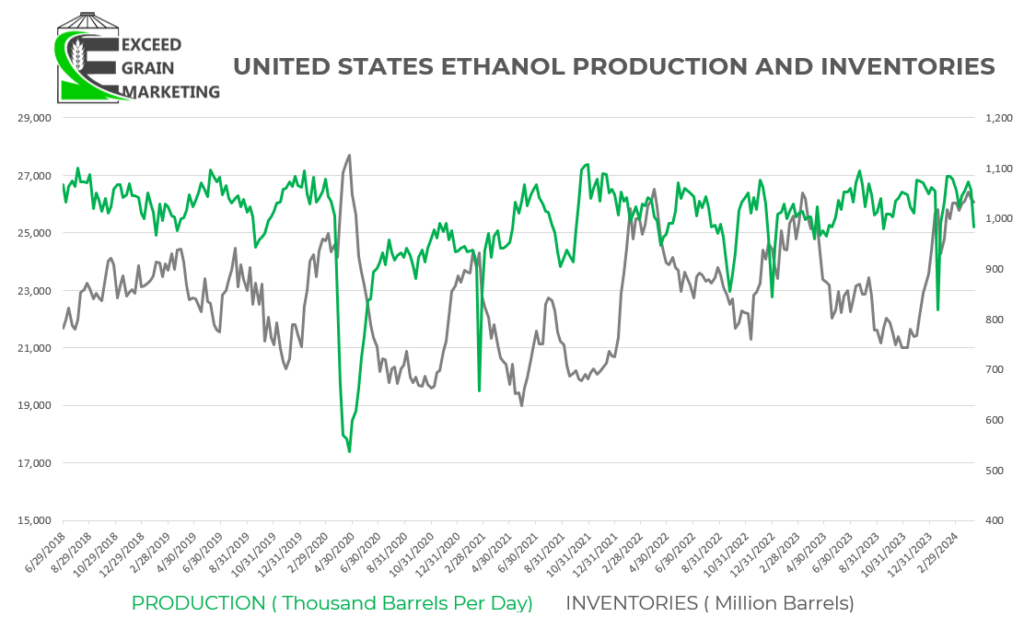

- US EPA announced it will allow 15% ethanol blend for this summer from June 1st to September 15th. Helping boost ethanol demand for the US summer driving season. The hope is to get E15 sales approved for year round usage from here on out. The concern on why it isnt standard allowance is due to extra smog created by E15.

- Chinese hog inventories at 408 million vs 431 a year ago.

- Watch for US crop progress report out on Monday afternoon.

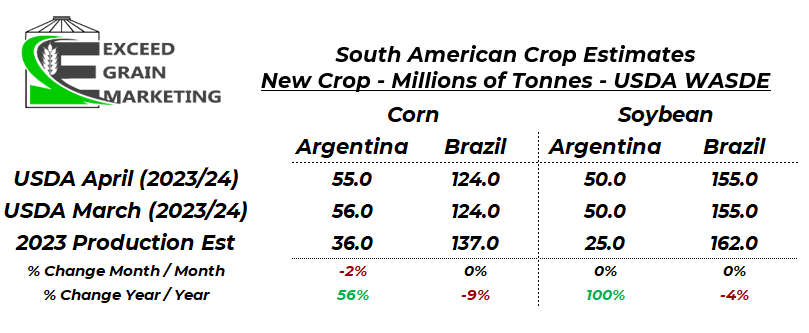

- Last Week, CONAB put Brazilian soybeans at 146.5 mmt corn at nearly 111 mmt, big divergence from the USDA’s figures as you can see in tables below, market not putting much weight into this spread although.

- USDA WASDE April 10th Highlights:

- Tables of the Trade Below

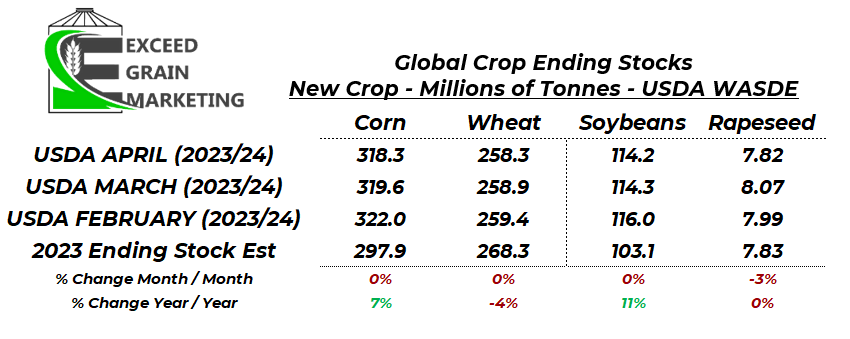

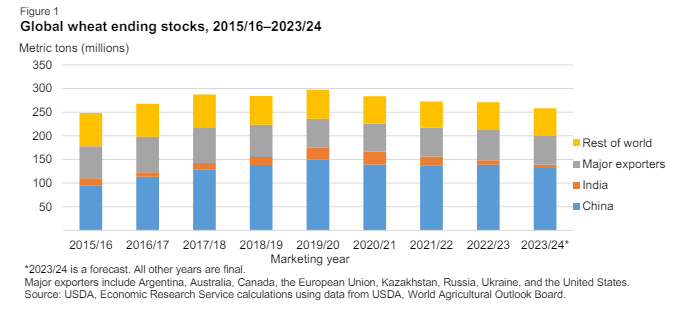

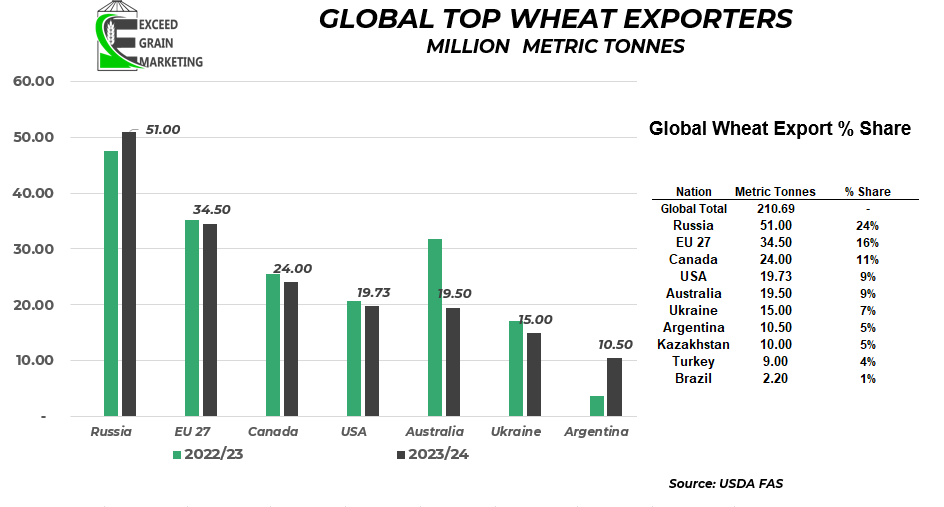

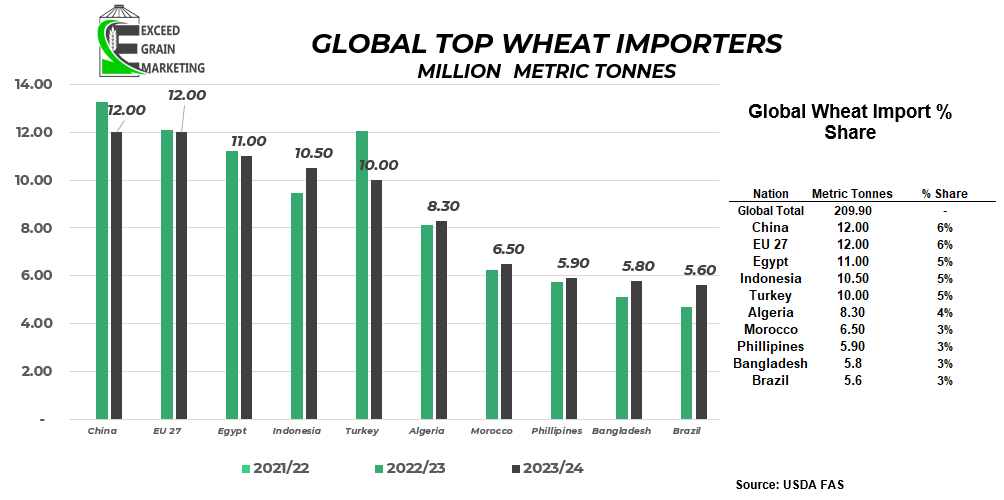

- Global Wheat ending stocks at 258.3MMT vs 258.8 last months and 259.1 pre report estimate

- Global Corn ending stocks at 318.3 mmt vs 319.6 mmt last month and 316.7 mmt pre report estimate

- Global Soybean ending stocks of 114.22 vs 114.27 last month and 113.7 pre report estimate.

- Soybean oil at 5.16 vs 5.01 last month

- Rapeseed/Canola ending stocks of 7.82 mmt vs 8.07 mmt month prior.

- Next month for the May WASDE we get new crop estimates.

- Strategie Grains, French Private Analysts place EU barley up 10% year over year. Rapeseed production at 18.1 mmt vs 18.3 month prior, 19.9 mmt was the production number last year.

- Pea export pace up 15% year over year, due mostly to reduction in Indian tariffs. New crop peas remain strong in Western Canada

- Advance Payment Program payments are now available to Canadian farmers for the 2024 program year. Starting April 1st the advance is available to producers. Often referred to as the CCGA cash advance. The program provides up to a $1 million cash advance with a $250,000 interest free bearing portion.

- European Union proposed new tariffs on Russian grain: 95 Euro per tonne for grains. 50% for other crops. Subject to approval by the 27 member organization. If you are a Flax producer, keep an eye on this.

- Recommendations Page Updated at Bottom of Report

Prior Report Section

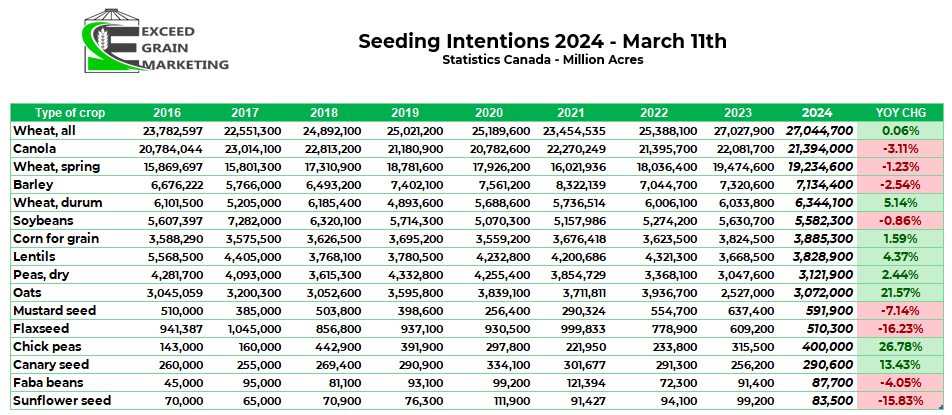

- Statistics Canada Acreage Estimates Analysis (March 11th).

- Canola acres down year over year, Spring wheat and Barley were down as well.

- Chickpeas showing the largest percentage gain year over year and Flaxseed the largest drop.

- Oat acreage came in on the low side of pre report estimates despite a large year over year spike in acres. Oats still running some relatively low acreage numbers compared to years past. Take a look at chart below to see the past few years of acreage

- Canola came in near the bottom end of pre report estimates, but more in line with some longer term averages for acres.

- Stats Canada conducted the survey from December 14th – January 22nd and surveyed 9,600 farms. There have been significant changes in New Crop markets since this time and one can expect that final planted acreage will shake out a tad different than what was reported.

- Prospective Planting Acreage (March 28th, 2024)

-Corn 90.04 million acres vs 94.6 million last year and 91-92 million acres expected pre report

-Soybeans 86.5 million acres vs 83.6 million last year and 86.5 to 87.5 pre report

-Wheat 47.5 million acres vs 49.6 million last year and 47-47.3 pre report

Of the wheat acres 11.3 million are destined to be spring wheat vs 11.2 last year

Corn was the surprise in todays report with limited estimates reaching as low as a 90.04 million acre corn number.

Quarterly stocks report was also released today. Stocks came in fairly close to estimates with some divergence. Corn lower and beans and wheat stocks higher The most notable takeaway from the stocks report is the growth from last years stocks at the same time.

Quarterly Stocks Report:

-Corn 8.35 billion bushels vs 7.4 billion bushels

-Soybean 1.85 billion bushel vs 1.69 billion bushels

-Wheat 1.09 billion bushels vs 0.94 billion bushels - March CONAB Brazil:

- CONAB lowered soybean production estimates from 149.4 to 146.9 mmt. The corn estimate was lowered from 113.7 to 112.8 mmt.

WESTERN CANADIAN CROP NOTES

Canola:

- We hit some important sales targets for our grain marketing clients in past few weeks due to the recent run up in futures from the February lows. See recommendation section below. May Canola has touched the $640 level multiple times here in recent weeks.

- May Canola will be rolling off the board here shortly. Be sure that May Basis contracts priced or rolled depending on your scenario. July will become the front month.

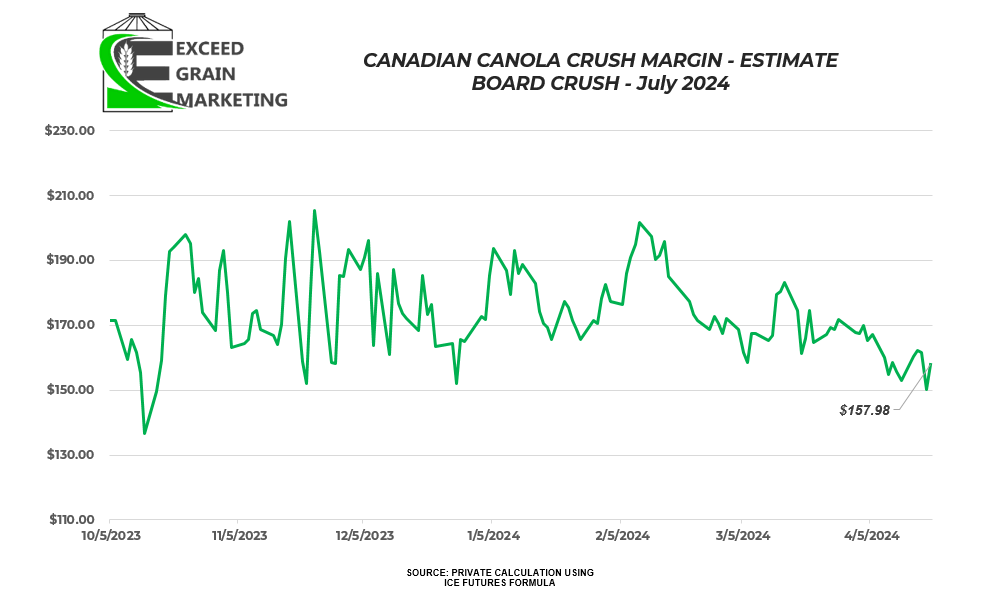

- Crushers filling up domestically for the front months as producer selling took up much of the front month capacity. Most crushers bidding June onwards. If need crusher movement, need to build a plan around that. June/July/August is where most capacity lies within the crush. Be cognizant of export and crush capacity as we get closer to the dates.

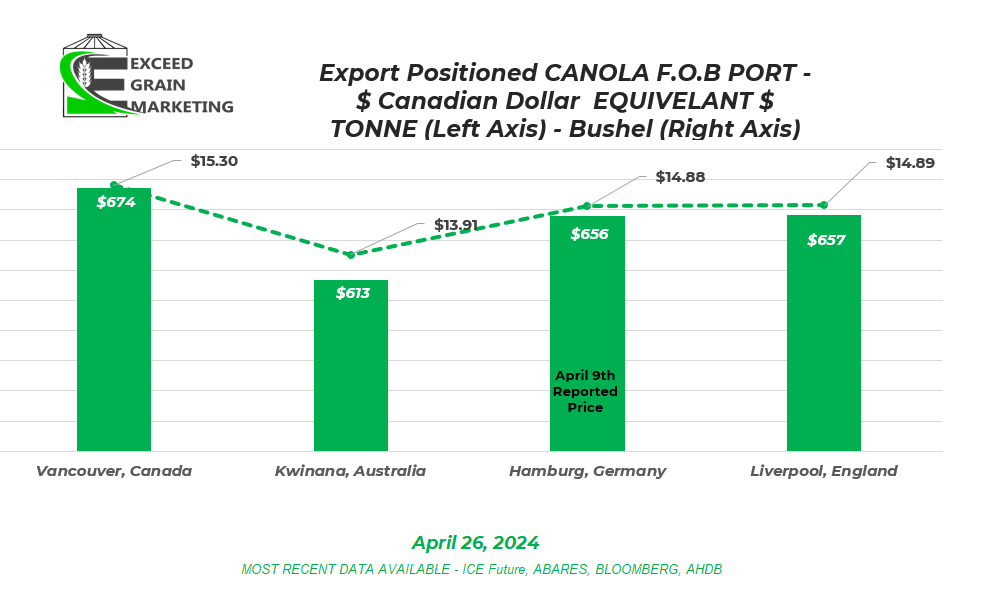

- Canola now once again pricing more expensive than Australian Canola after being cheaper than them in late February and into early March. The difference between exporter bids has narrowed up significantly in recent weeks. Canola carried such a premium to Australian canola and EU canola through the first half of the marketing year. It narrowed up significantly for several week but is showing signs of building that spread again. Chart above shows most recent bids at some key export regions in Canada, Germany, Australia and England.

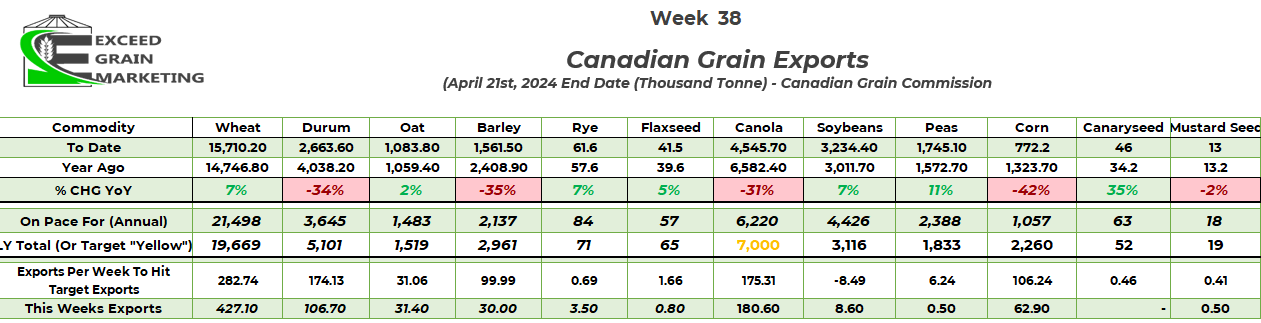

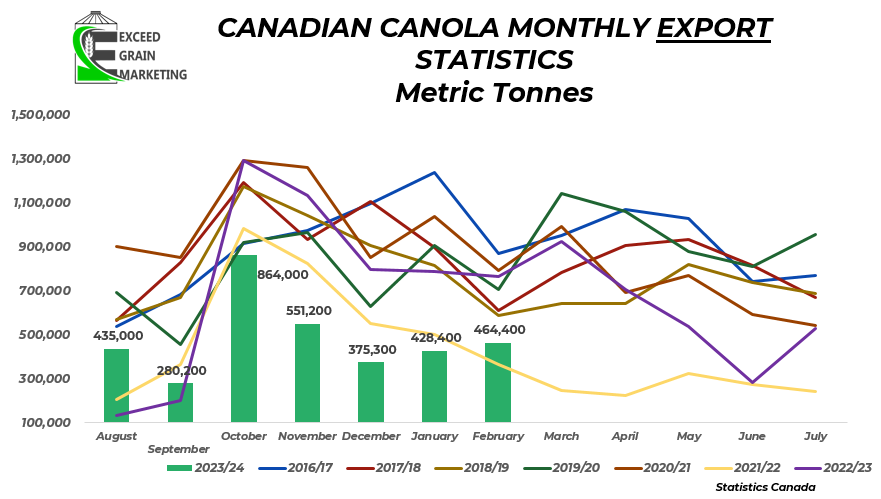

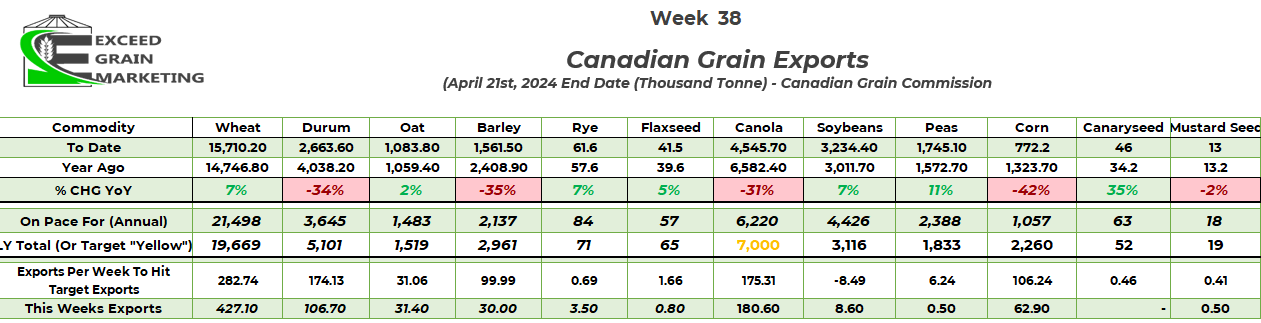

- Canola exports bouncing around. 180,000 Week 38. 128,000 tonnes in Week 37. Good week 36 with 162,000 tonnes leaving Canada, but Week 35 numbers were dismal with what looks to be one ship leaving shorelines, the week prior, almost 250,000 tonnes was moved.

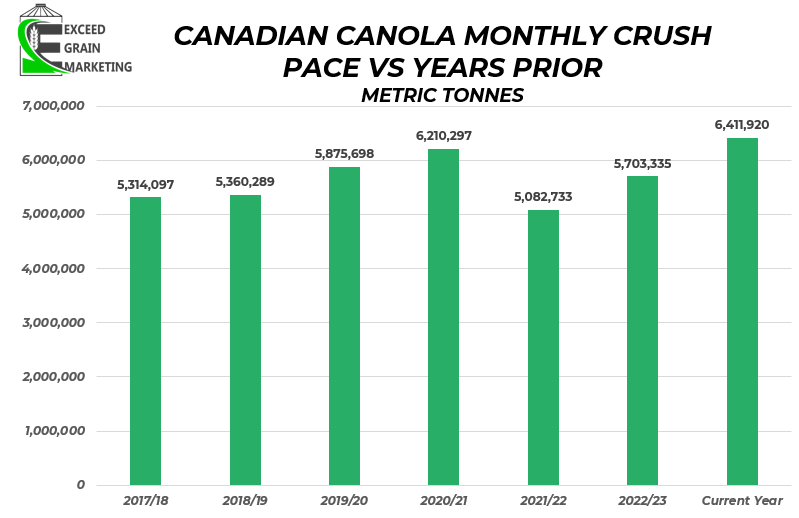

- Current export pace of 6.2+ mmt is not great overall and would be one of the lowest levels of exports in decades. See chart below for reference

- We need to grab exports on the tail end of the marketing year to maintain a reasonable carryout in the market. We have 14 weeks of export left in this marketing year. Need consistent movement here on forwards

- Crush is running at a very impressive pace, looks like we will surpass and hit a 11mmt + record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

- Canola will trade at the mercy of foreign veg oils for the time being (Palm, Soy, Rapa).

- Crusher bids still dominate but are falling closer to exporter prices, depending on the month. Most exporters sit close to the $14.00+ mark today, depending on region and Basis levels. Crushers still hold the leading bids, but the regions are getting fewer and further between and months are getting tighter.

- For a more in depth analysis on Canola Specifically, check out our April 2024 Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – April 2024

Spring Wheat:

- Russia very dry in its main wheat production regions, Indian stockpiles of wheat lowest in 16 years. Very dry winter wheat production area in United States. US winter wheat region to get some rains over the weekend, trade will be watching closely to see what fell over the weekend come Sunday/Mondays open.

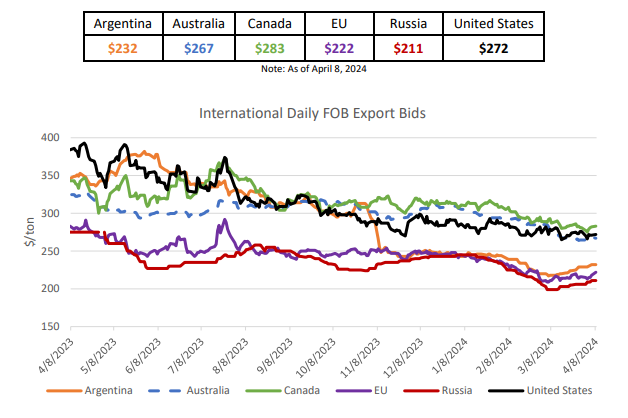

- Russian wheat bids up around $20 per tonne in recent weeks. Was as low as $200 per tonne and now trading closer to the $220 level.

- Russia has been playing games with exporters here since start of April, revoking some export licenses of key exporters and then reinstating them within a few days. Analysts believe the government mostly using this as a way to control exporters and let them know that they still rule the roost if unwilling to comply with government requests.

- Anecdotal reports of Russian farmer selling slowing down due here recently. New crop will be off beginning in July and the anecdotal sentiment is towards producers willing to sit on inventories for the time being.

- Domestic wheat bids in Western Canada touching that $8.75 to $9.00 range for old crop. $7.50 up to $8.50 for new crop. New crop bid spreads very wide.

- Looks like Black Sea regions willing to dump grain here before summer. New crop will be in the system starting July 2024 so exporters looking to keep product moving.

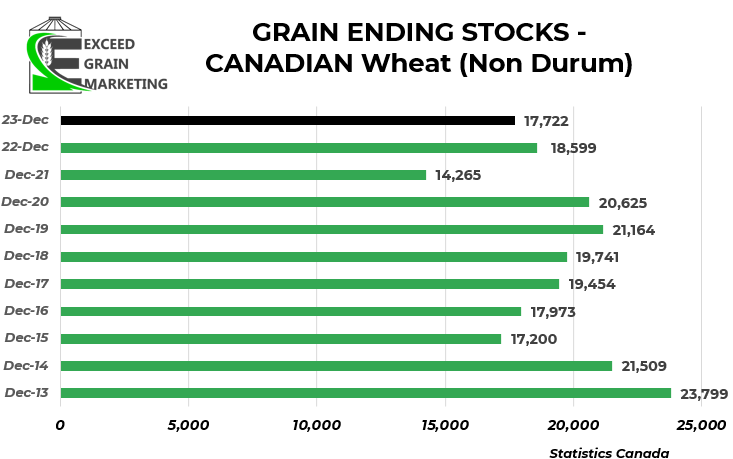

- Canadian Wheat exports and domestic usage is still considered very strong. At the current pace of exports and domestic usage, rationing will be needed. This does not always mean price correlates accordingly, as we have seen in recent weeks. Prices have seen producers selling into them.

- Wheat exports expected to easily surpass last years levels at current pace and are on track for an 8% increase year over year. Likely not able to make that happen although as rationing will supersede this.

- 2023 Old Crop Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part.

- Forecasted wheat global and domestic ending stocks coming in at the tightest levels since the 2015/16 crop year.

- Next thing market will be watching for is crop progress in the US and EU winter wheat crops and Spring Wheat planting conditions.

Special Crops

- Tunisia tendered for old crop Durum Early April. Looks like Viterra picked up some of the business. $30USD per tonne cheaper than a similar tender about 2 months ago.

- Yellow Pea and Lentil Acreage expected to grow in Canada for the marketing year. The pulse crops are showing some excellent return potential for the 2024 cropping season if producers can bring it to yield at harvest.

- Special crop markets closely watched Marchs release on acreage estimates from Stats Canada.

- Barley acreage drops to 7.1 million acres. Fits in line with some trendline averages

- Barley prices lower than last year, as with many crops. Some $5.00+ feed opportunities available central Sask. Greater as you move closer to Feed centers. Add $1.25 to $1.50 for Malting.

- Durum acres up 5% year over year. One of the largest acreage estimates in recent years

- Lentil and Pea acres up year over year but still not out of line with recent history.

- One thing to note from this report is that it was collected from December to January 15th. Lots has changed in this timeframe.

- Canadian peas will face stiffer competition going forwards into China as some Black Sea peas able to price into the region.

- Canadian red lentils also competing with a larger Australian crop. Indian lentil harvest taking place here in the coming weeks and crop is expected to be of a healthy size. Looks like higher availability for global export market

- India reduced Yellow Pea import tariffs from 50% down to 0% was extended for another month until the end of June 2024. Was only in place until end of March but another month, and then another, was added to get exports into the nation. Pea bids did show some strength about two weeks ago but have toned back in recent days as the exporters square up their positions ahead of key deadlines

- Durum exports lagging behind last years pace. Durum exports have somewhat disappointed traders as we missed some key export opportunities early on due to some better than expected Mediterranean/Turkish crops. New crop Durum bids have fell from earlier on. $10.00 was attainable but now sits closer to $9.00. Local variances.

- Durum growing regions of Canada have got some recent precipitation but will be dependent upon some key rains following planting, producers somewhat hesitant to price aggressively on new crop. Some precipitation has came through end of March and into April, producers hesitant to price as bids have fell from earlier on as well.

- Red Lentil reduced import tariffs extended until March of 2025

- Red Lentil new crop sitting around $0.33 and $0.52 for greens. Act of God coverage bids slightly lower

- Yellow Peas – Old crop yellows $12+ on the renewal of the India tariff exemption. Bids are not consistent amongst buyers. New crop $10.00 and upwards of $11.00 range. We will need to see further tariff exemptions to keep premium in the market. **UPDATE: Tariff Exemption extended until end of June 2024**

- Flax Bids in the $16.00+ range central prairies. Some large divergence in bids so please look into where you are pricing. Flax bids have been picking up here recently. Speculation of a sale through the seaway made for spring and concern about Kazakh supplies and whether new EU tariffs against Russian grains will affect supplies.

- Feed Barley has picked up some ground, gaining some traction. $5.25+ bids are commonplace . Still competing heavily with US corn origination. New crop feed barley $5.00 in some cases. Big Spreads depending upon buyers.

- Feed Barley at the mercy of US corn crop prices and Currency.

Latest Key Fundamental Report Highlights

- STATS CANADA ( DECEMBER)

- March 11th we got Principal Field Cropping Areas – See above

- December 5th production estimates. Stats Canada report came in and was mostly as expected but higher than the prior report released pre harvest.

- Canola- 18.3 mmt vs 18.3 mmt pre report estimate

- Spring Wheat – 24.7 mmt vs 24.0 mmt pre report estimate

- Barley 8.9 mmt vs 8.6 mmt pre report

- Oats 2.6 mmt vs 2.6 mmt pre report

- Durum 4.0 mmt vs 4.1 mmt pre report

- Corn 15.1 mmt vs 15.0 mmt pre report

- Soybeans 6.98 mmt

- Lentils 1.7 mmt vs 1.7 mmt pre report

- Peas 2.6 mmt vs 2.6 pre report

- Flax 0.272 vs 0.290 pre report

- Most of the production numbers are higher than they were in the early days of harvest when ideas for the canola crop were floating around a high 17’s number. Same could be said for Durum and a few other select crops.

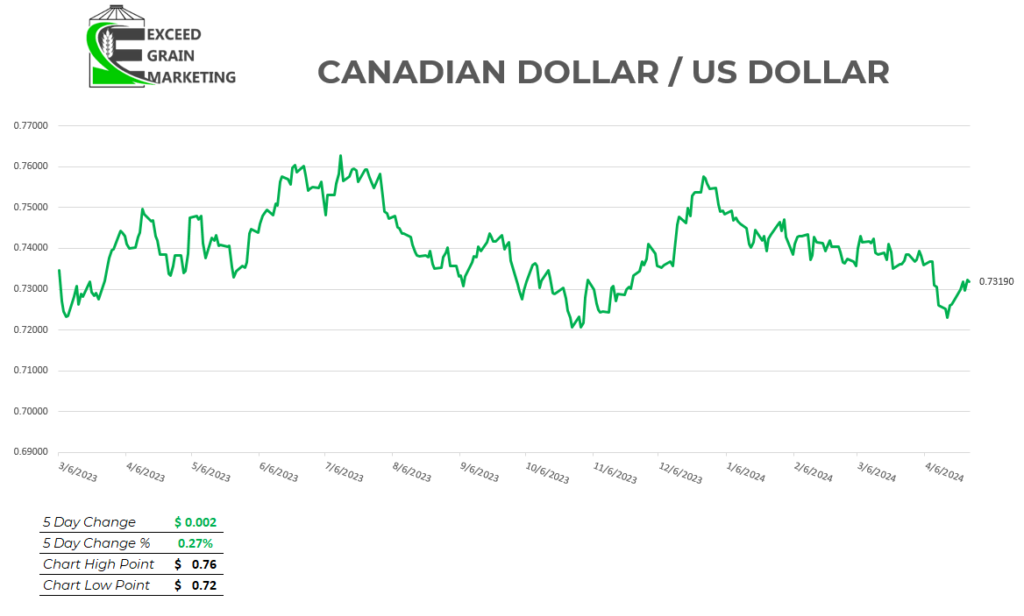

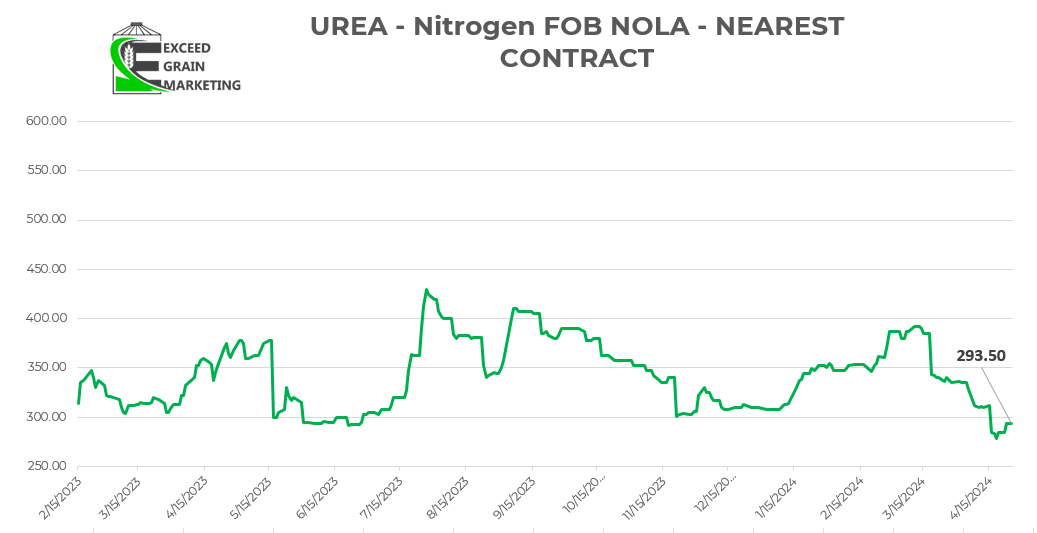

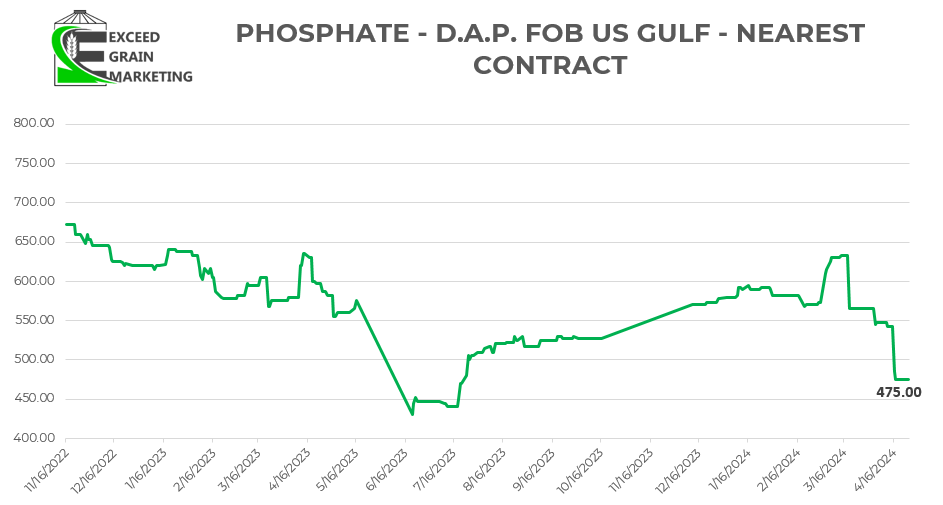

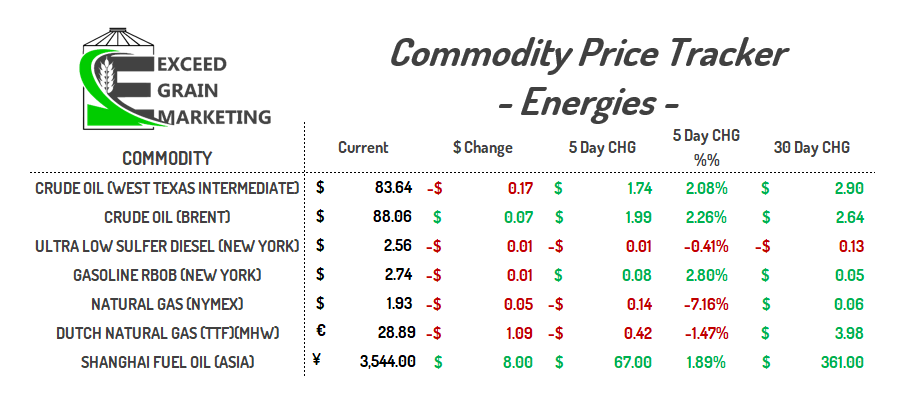

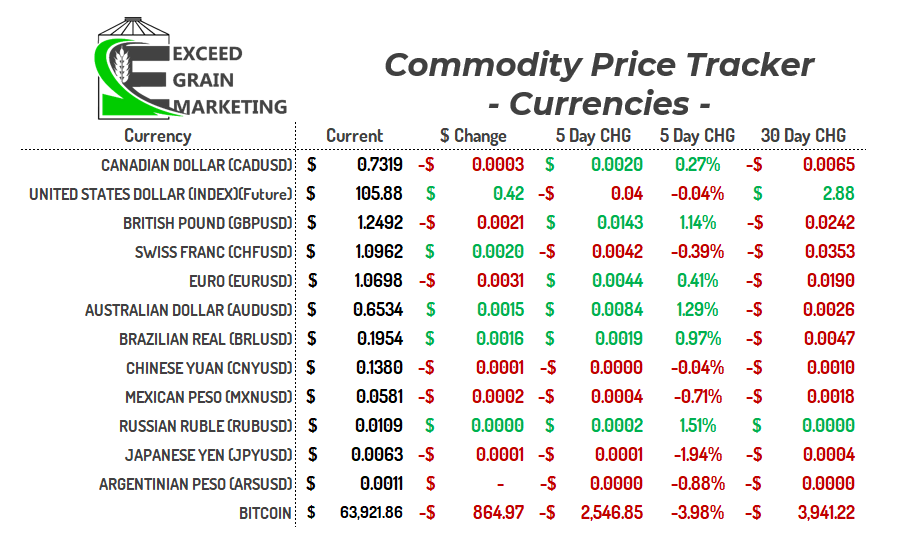

Currency – Energies – Fertilizer

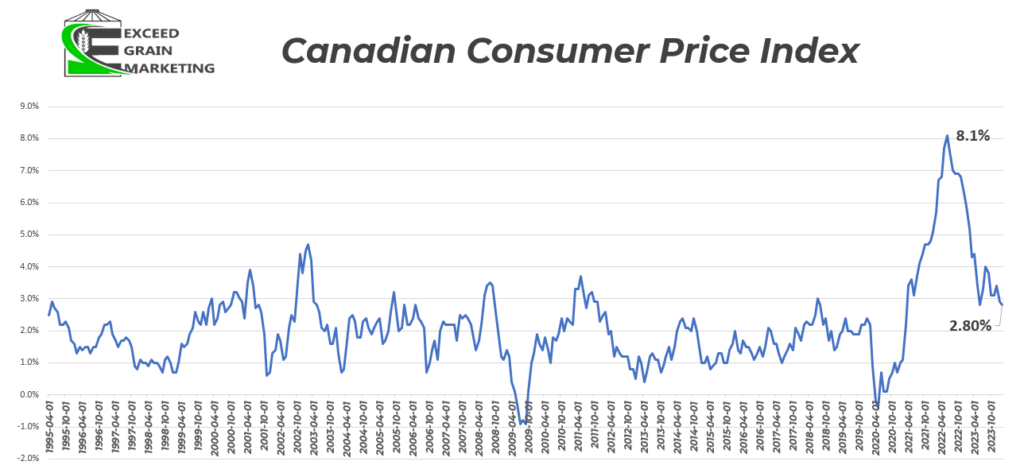

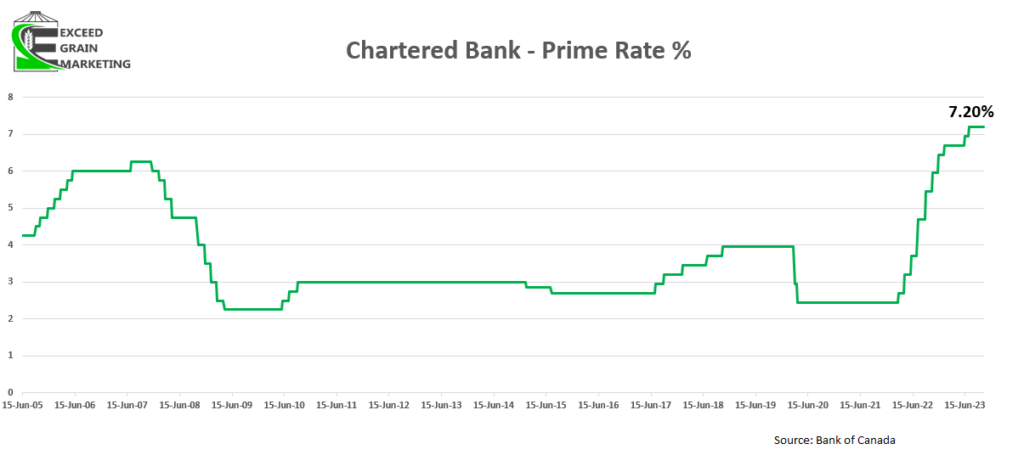

- Bank of Canada Stays Put with current interest rates at the latest interest rate meeting. Prime sits around 7.2% at major Canadian banks. Hinted that we could be higher for longer. Cuts will not be significant if they do come. The Bank of Canada has also recently hinted that one could face another rate hike but it is hesitant to do so given that Canadians are feeling the pinch of higher rates.

- Canadian CPI Still “Sticky” and sits at 2.9% as of the latest announcement in February.