Western Canadian Crop Market Update

Click Here To Access 2024/25 Crop Recommendations

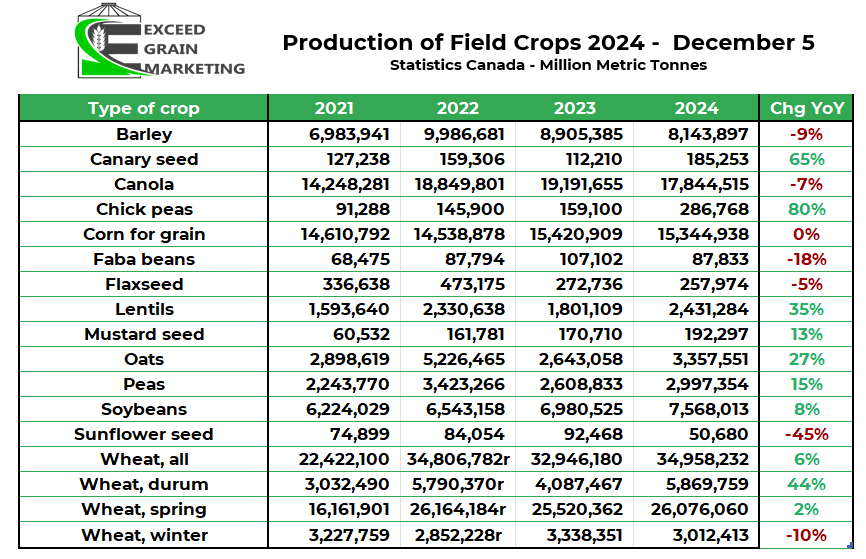

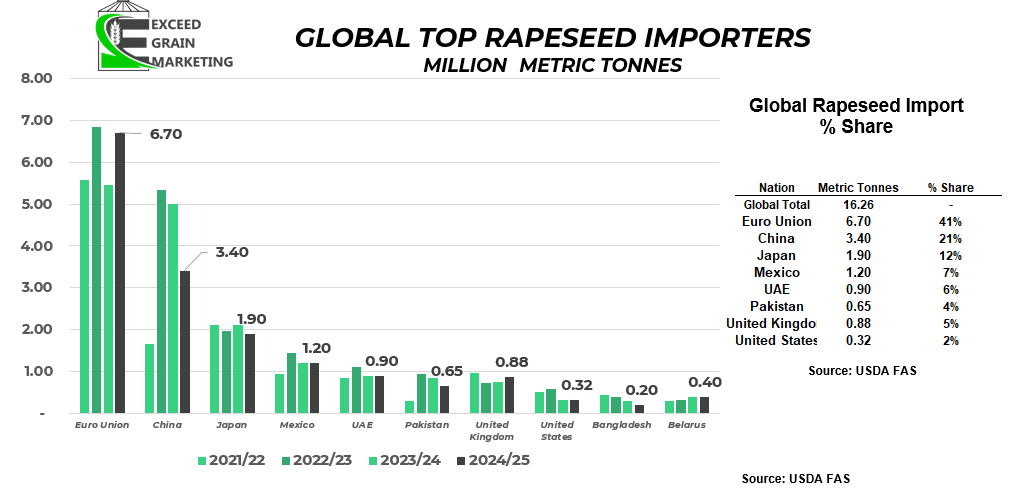

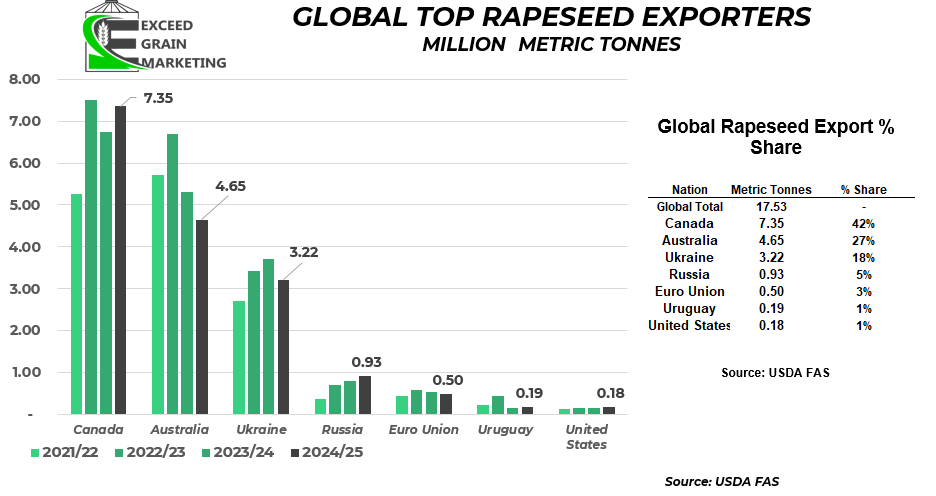

Canola

- Key notes for this week

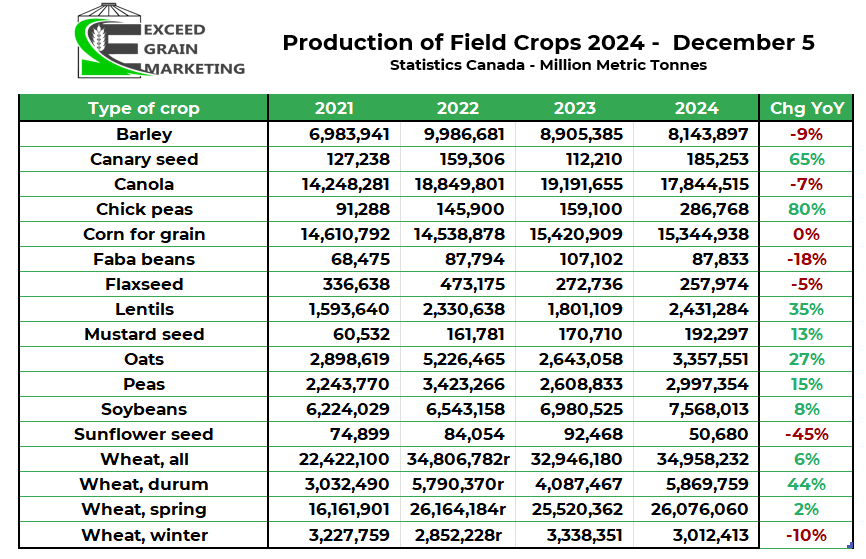

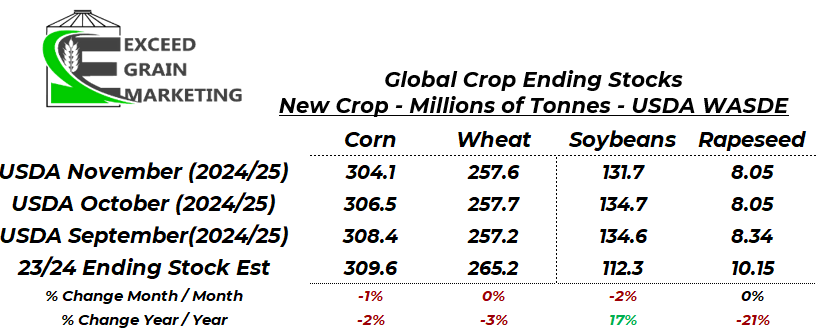

- Statistics Canada posted figures lower than industry estimates pre report. Market was expecting to see an 18.5mmt number from the report and it came in around 600,000 tonnes less than anticipated…

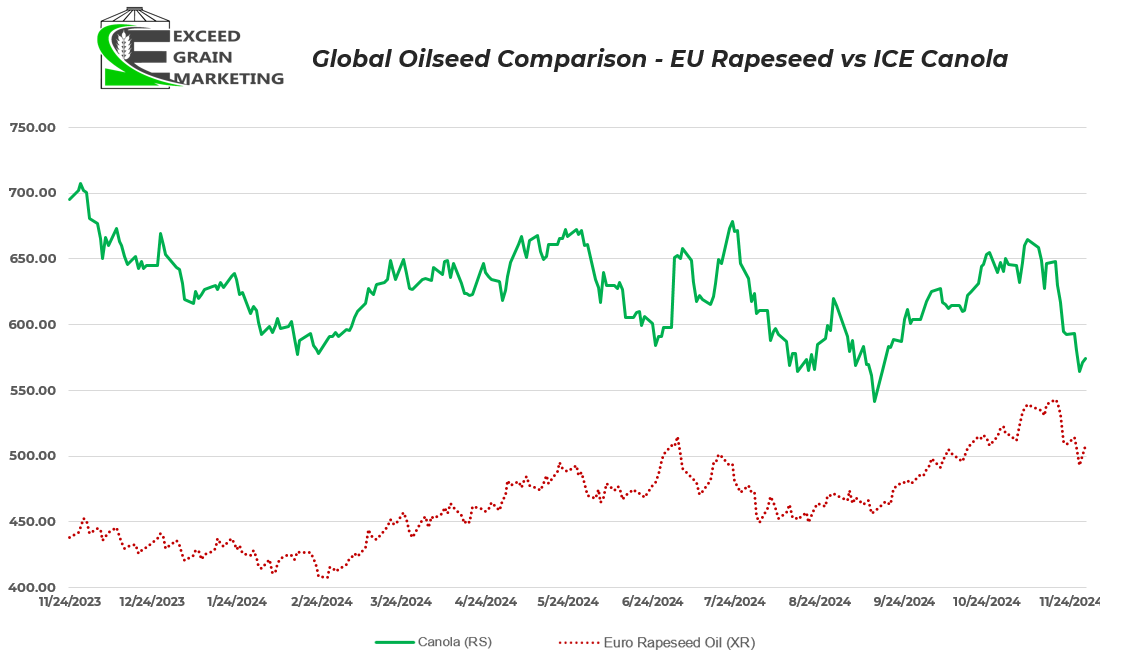

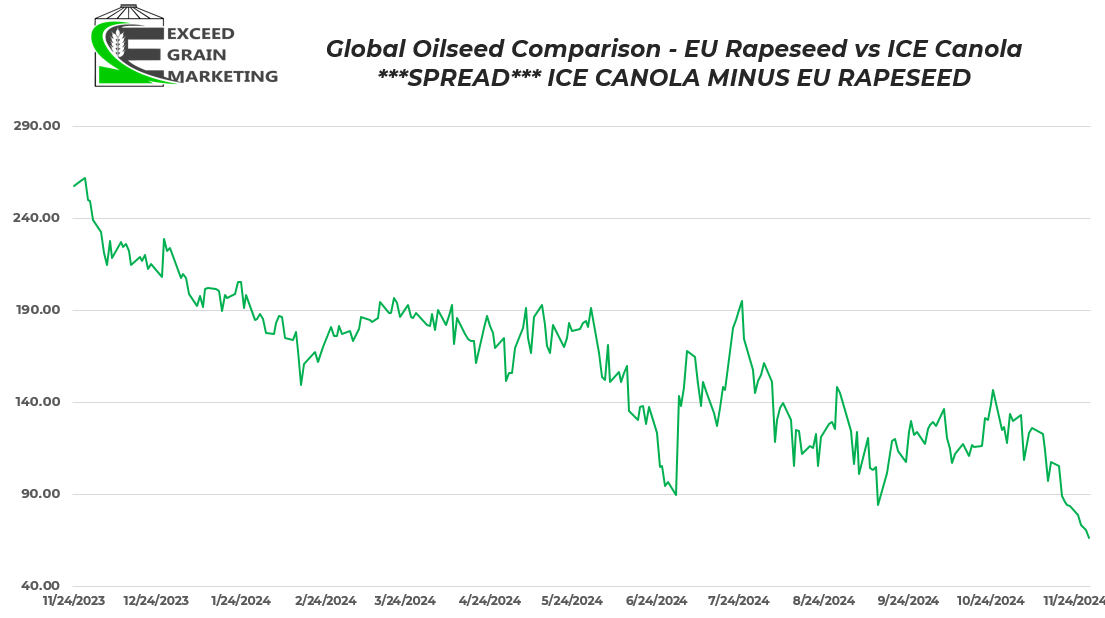

- European Rapeseed

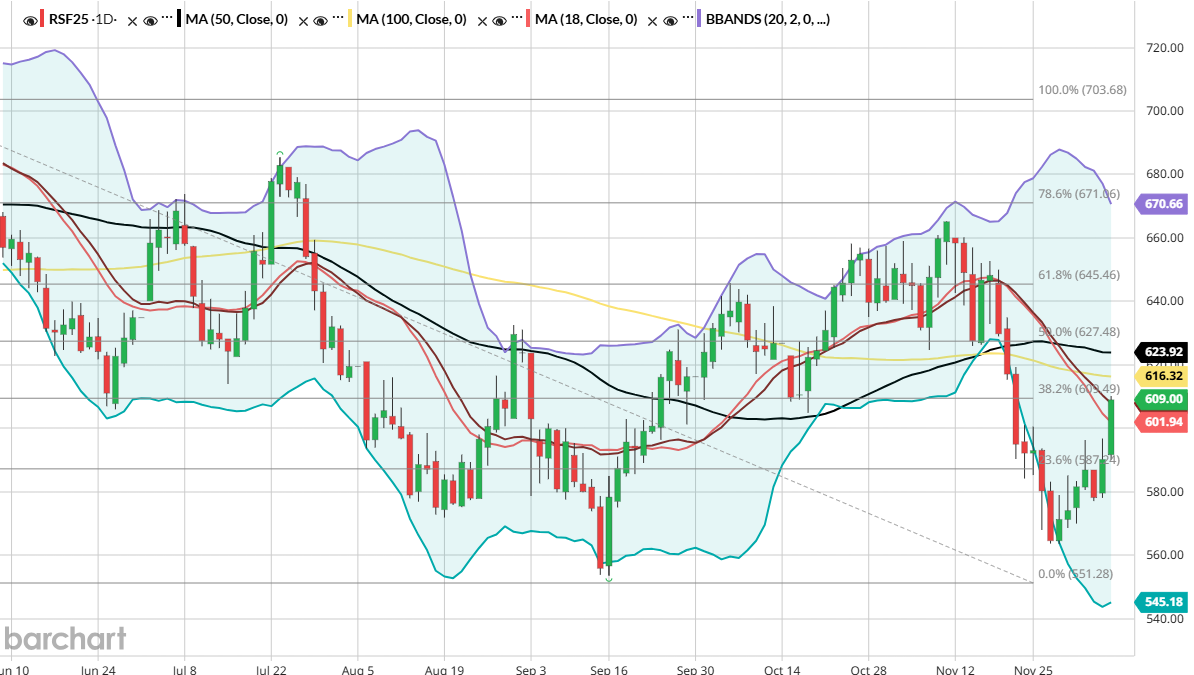

- Canola grabbed $45 per tonne from its November 28th low.

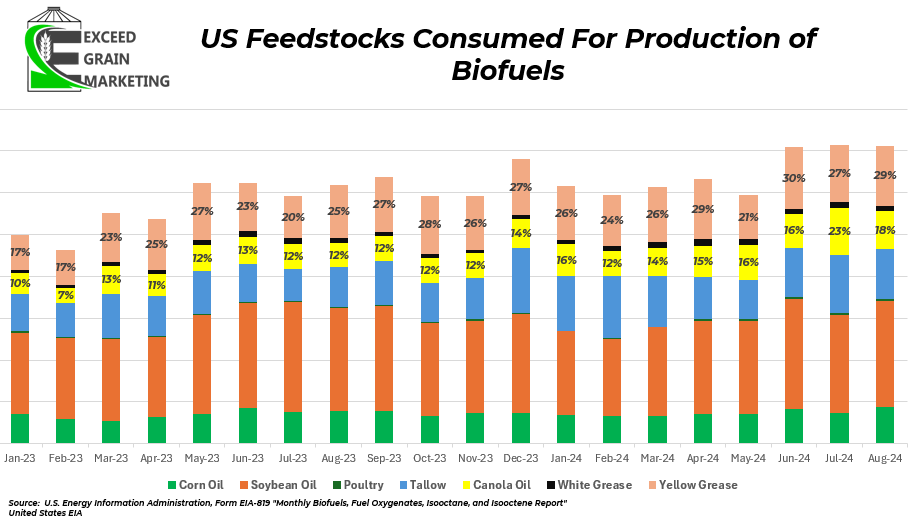

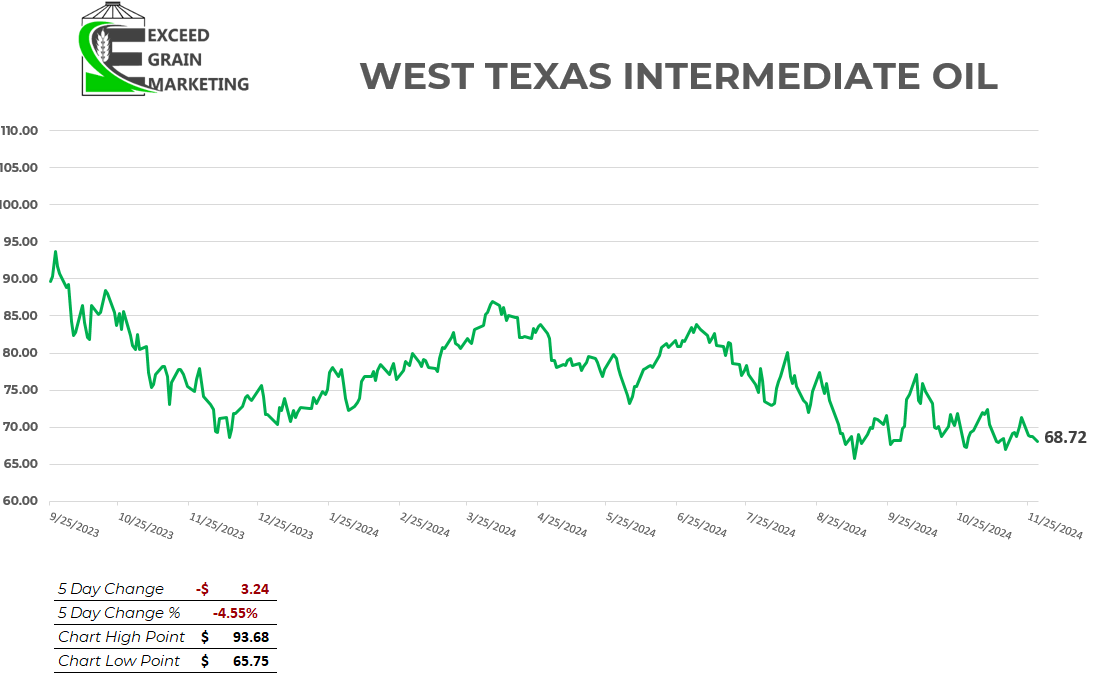

- Most of the drive lower since mid to late November was in line with soybean oils drive lower on US tariff fears and US Biofuel fears with the incoming administration.

- Fears on US tariffs being imposed by President Trump of 25% when inaugurated late January. Majority of Canadian canola oil heads to United States for food, industrial and biofuel production. Over 90% recently exported to US

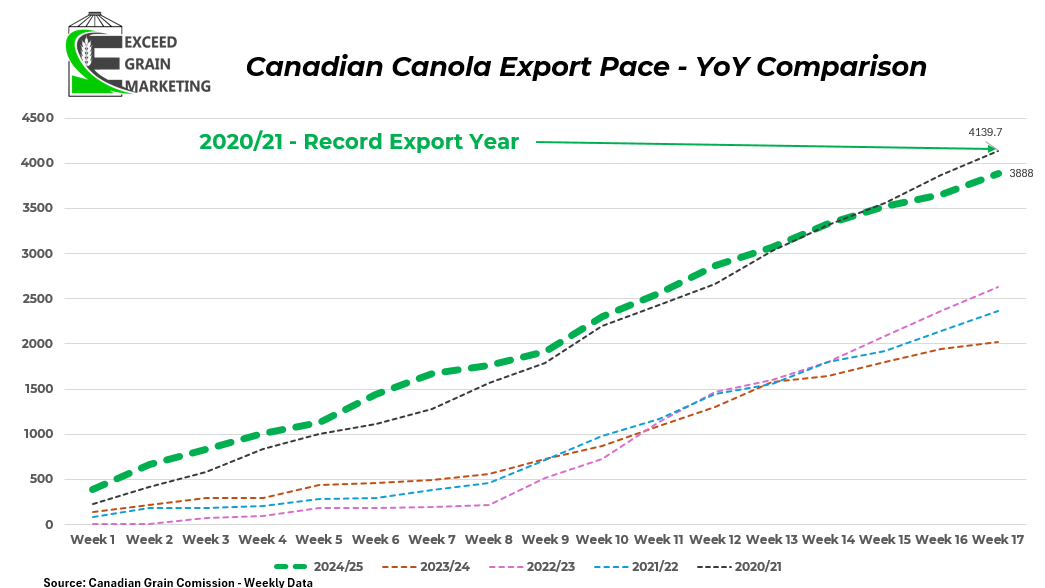

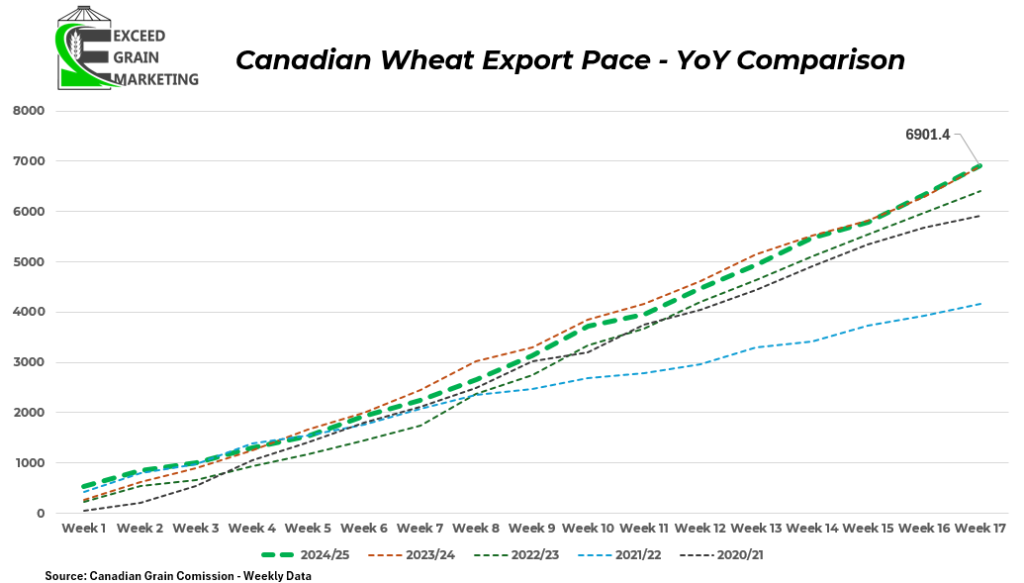

- Need to keep exports strong. Week 17 was another good week just shy of 200,000 tonnes. Export pace very strong just below record pace. Domestic Usage pace very strong.

- Understood that export volumes would slow regardless due to lower exportable volumes and likely front loading of exports by China.

- ABARES Australia out at 5.6 mmt and pre report estimates had a wide range from 5.0 to 6.0. Crop coming off right now

- USDA FAS and WASDE will be out next week

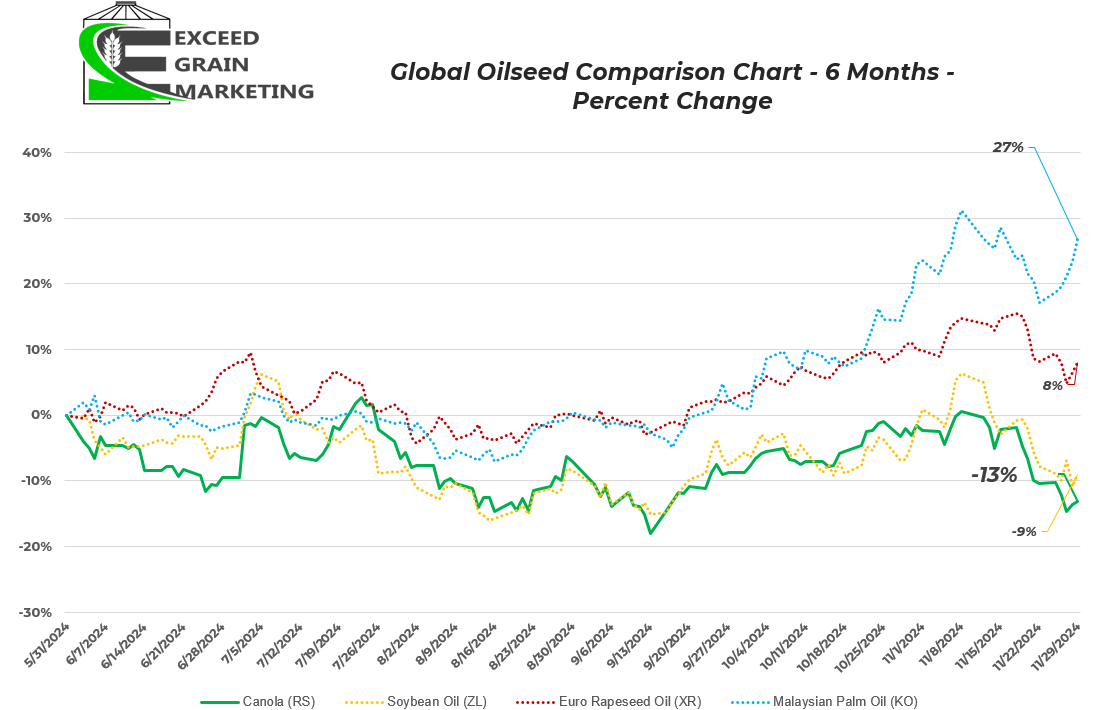

- EU rapeseed and Malaysian Palm Oil Finding Strength again off November lows. Biofuel demand questions and supply issues spar each day with who is taking the headline

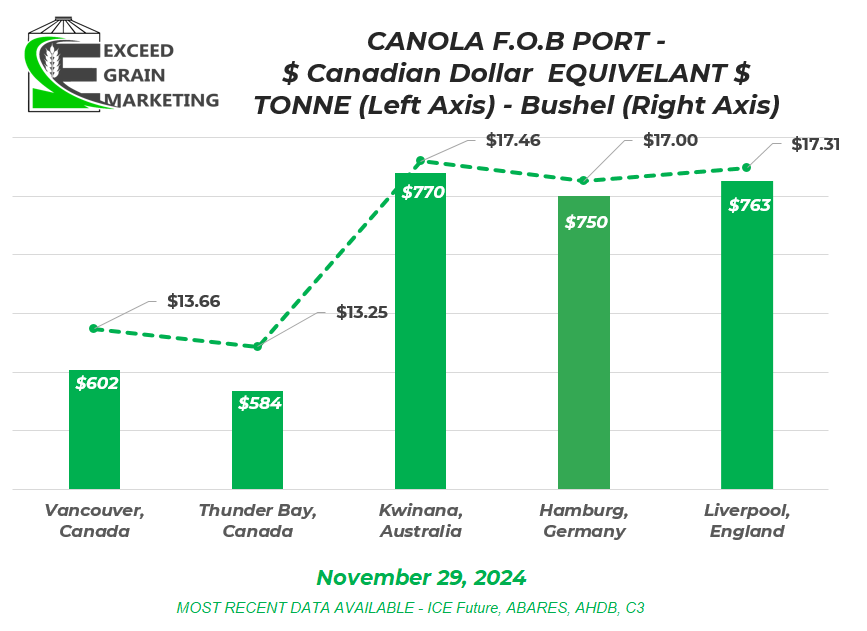

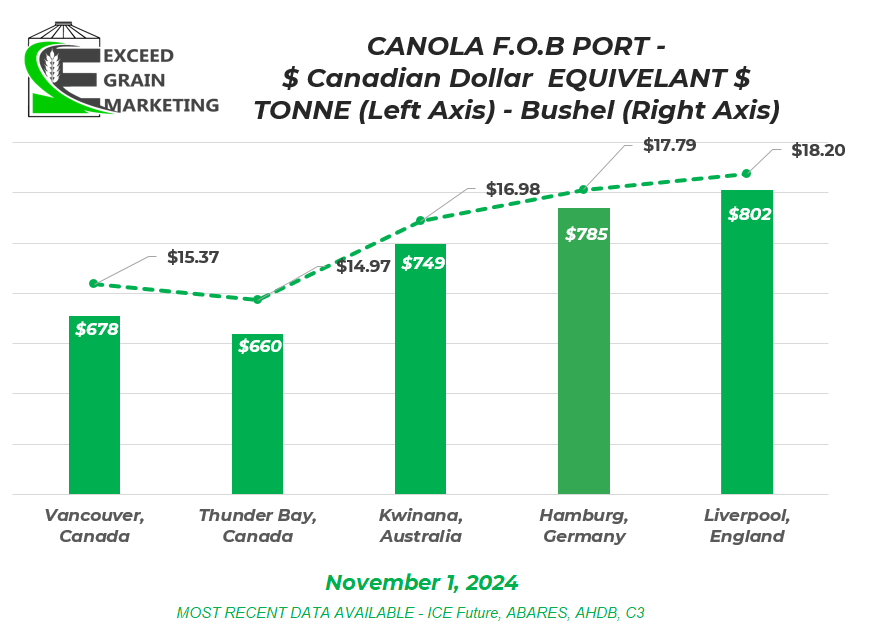

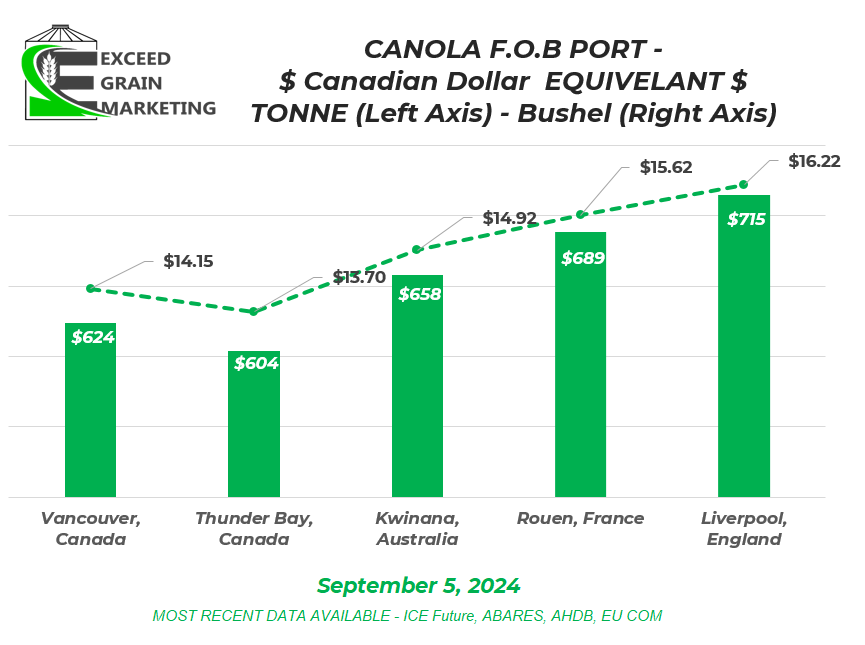

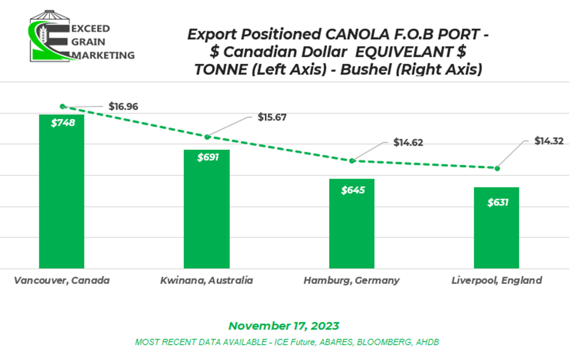

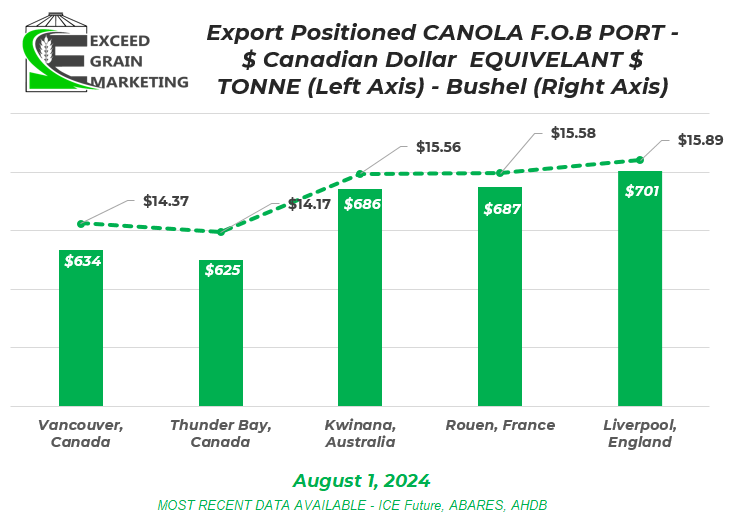

- Canadian Canola values remain discounted to global values.

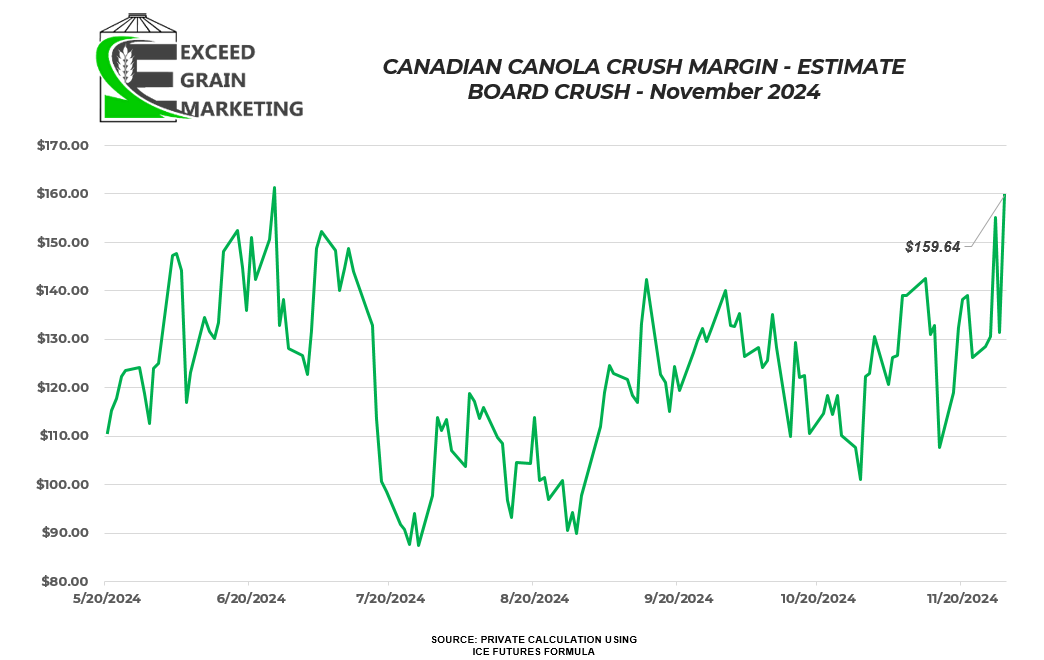

- Board Crush values last update sat at highest since mid June of 2024.

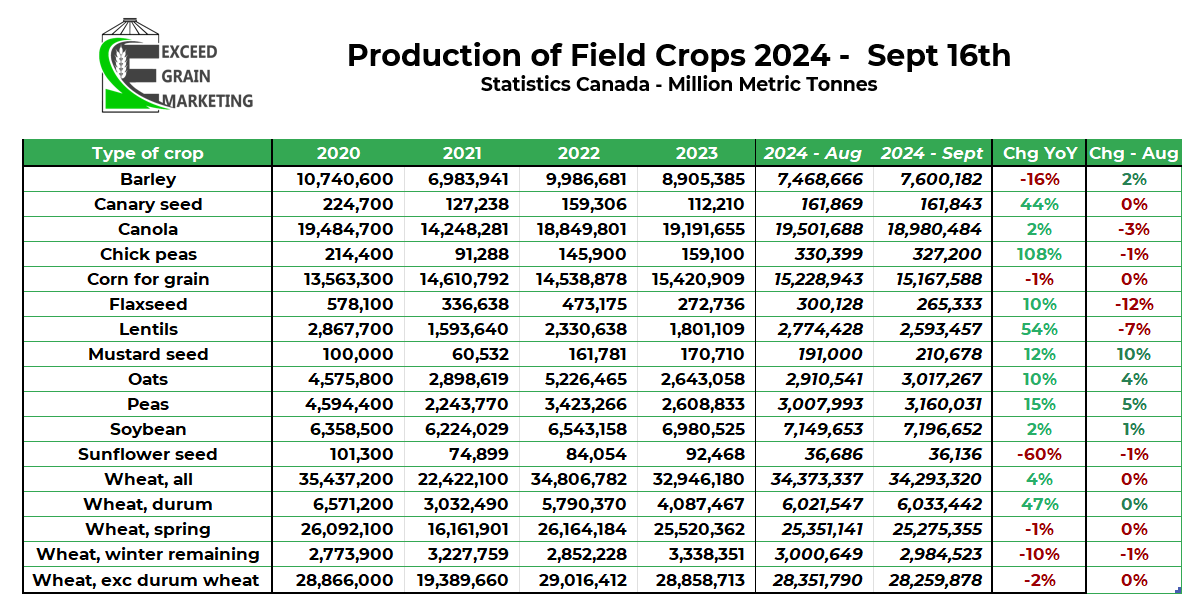

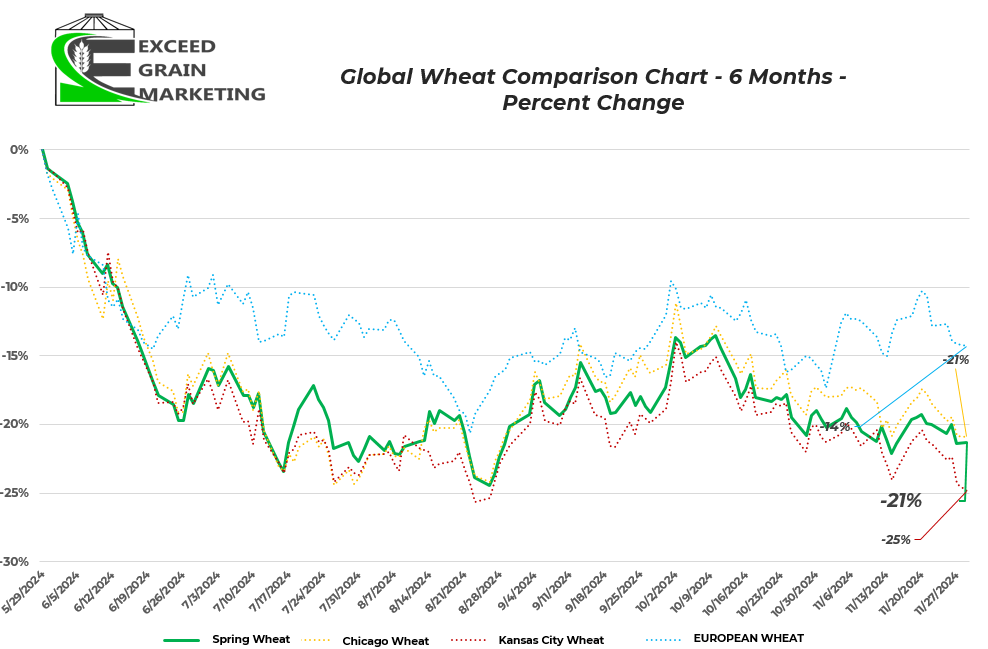

Spring Wheat

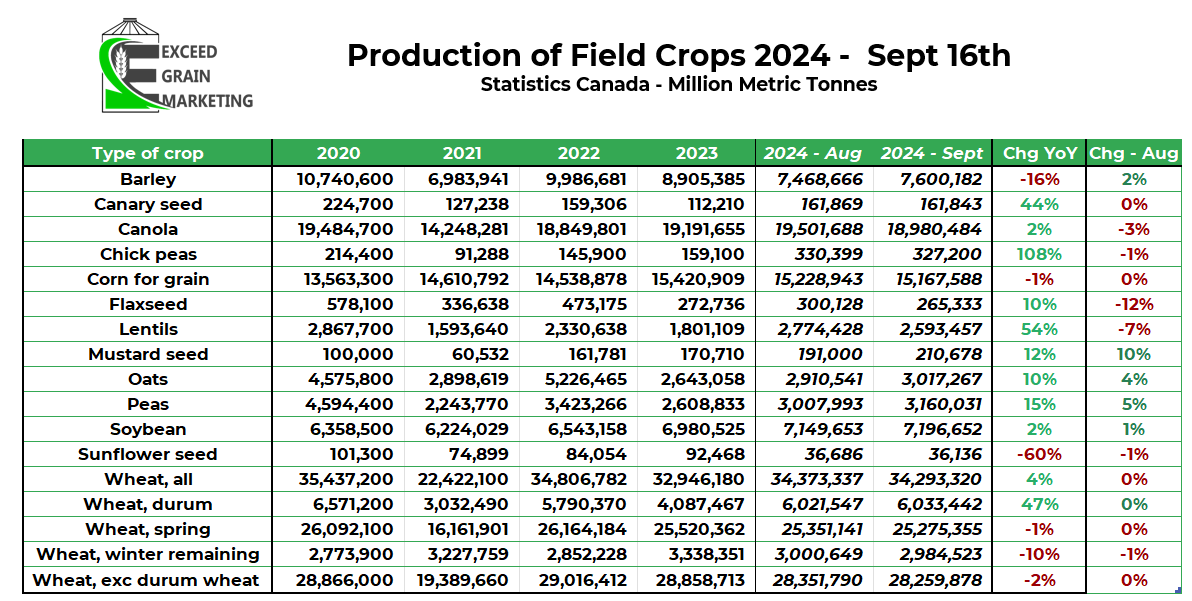

- 800,000 tonnes of spring wheat added to the supply side of the balance sheet from the September update. Durum tonnage was shaved slightly. Nothing far off from the range of expectations.

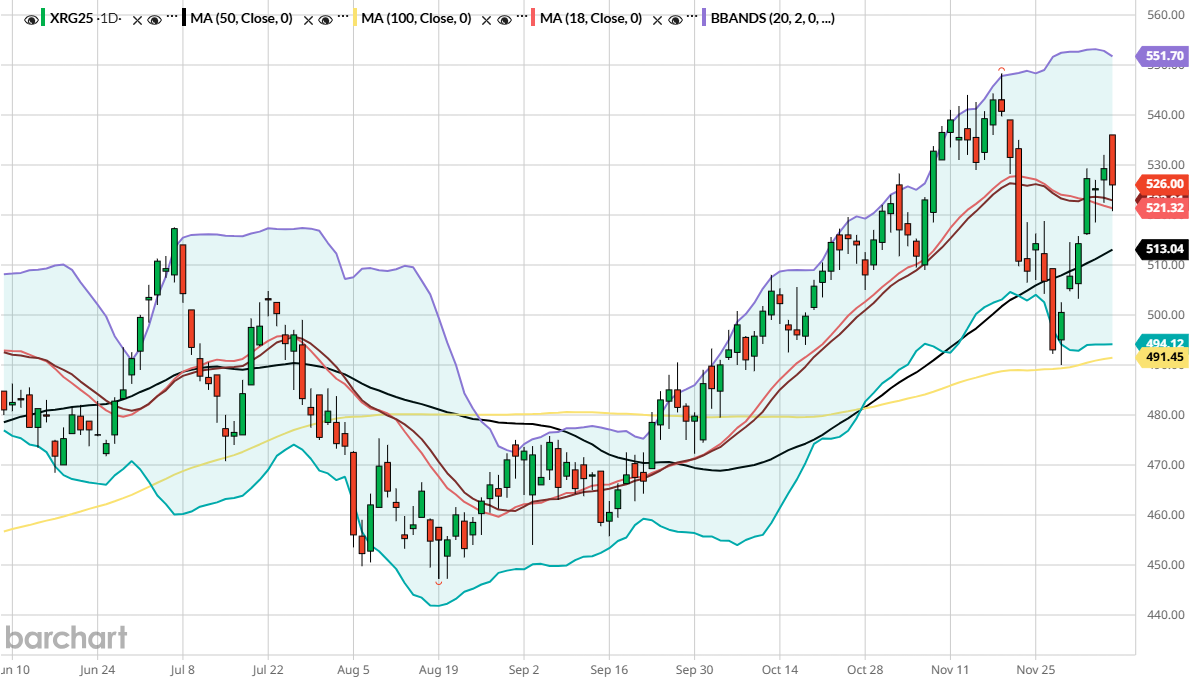

- Western Canadian basis appears to be improving and higher value targets being grabbed later part of the week for nearby delivery. Strong demand remains as wheat export pace is tracking in line with last years record export pace.

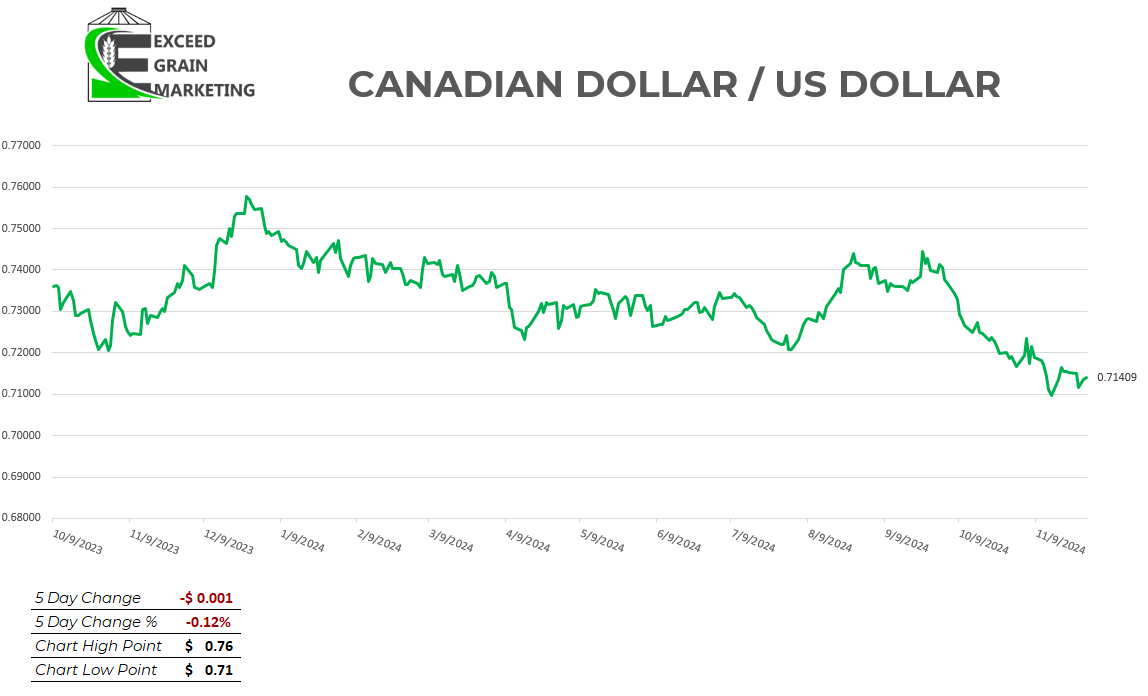

- Weaker CDN dollar helping.

- Russian Ruble very low.

- US wheat futures at the detriment of a High USD values. Russian Ruble values very low making wheat cheaper relative to counterpart

- Stats Can and ABARES this week. USDA FAS week after. Take a look at if any major adjustments. Current balance sheet for the globe looks to be tightest in about a decade. North American supplies a bit more abundant, moreso than EU and FSU regions.

- Some 2025/26 Black Sea wheat crop estimates place it in the 82 – 84 mmt range. So similar to estimates this year but down from the 90+ mmt figures of years past.

- Russia mulling placing export quota of 11mmt for last half of their marketing season. Was 29mmt same time last year.

Corn

Soybeans

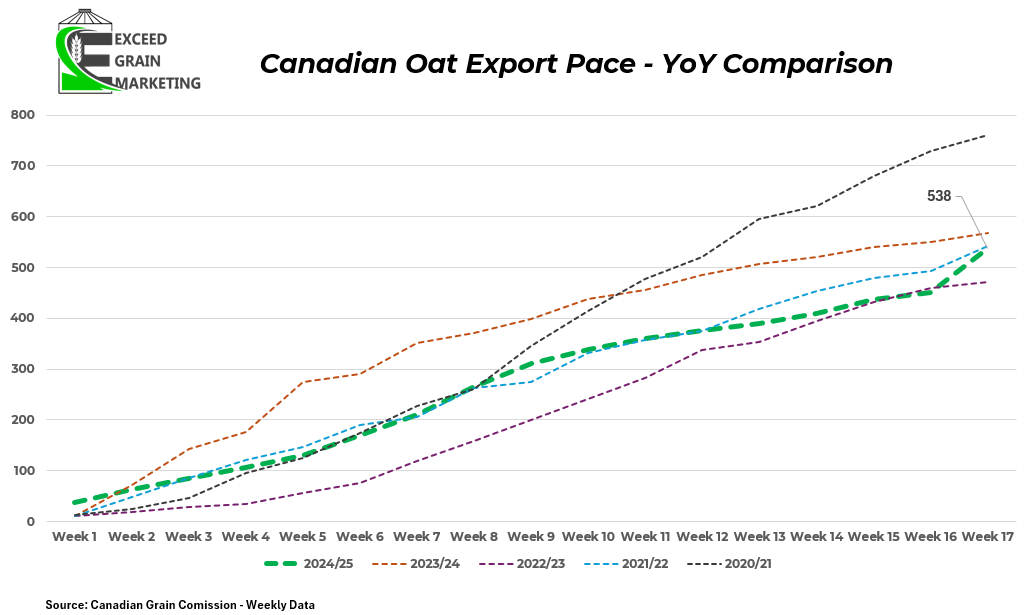

Oats

- Stats Canada figures came in slightly higher than pre report estimates and bumped up from the September figures and August figures.

- Need to keep an eye on demand here in coming weeks and update accordingly. 400,000 tonnes have been added to the supply side of the equation from the spring. Some acreage changes. The number of Quality oats is the real concern. Well understood that oats came in lighter and milling quality risks. So true Milling Quality oat supply is the real question

- Western Canadian oat production came in on the light side. Weight was a concern with this oat harvest having trouble hitting spec for 2CW. 3CW and 4CW is prevalent.

- Oat prices are sit at $4.25 to $4.75 across the prairies. $4.50 quite common and $4.75 moreso for the glyphosate free market but bids have been strengthening. Oats were anticipated to have been heavily sold by producers early in the production year. Seeing bids pick up here in recent weeks due to lack of good quality oats. Oat bids about $0.50 to $0.75 from its lows already.

- North East Sask and Western Manitoba will call the shots on this crops balance sheet, as usual.

- Front end demand is largely covered off for oats although and pricing will depend on post harvest demand and how this crop actually shakes out. Exports will dictate how tight we get. Right now exports are starting to pick up but still a bit behind pace. See chart above.

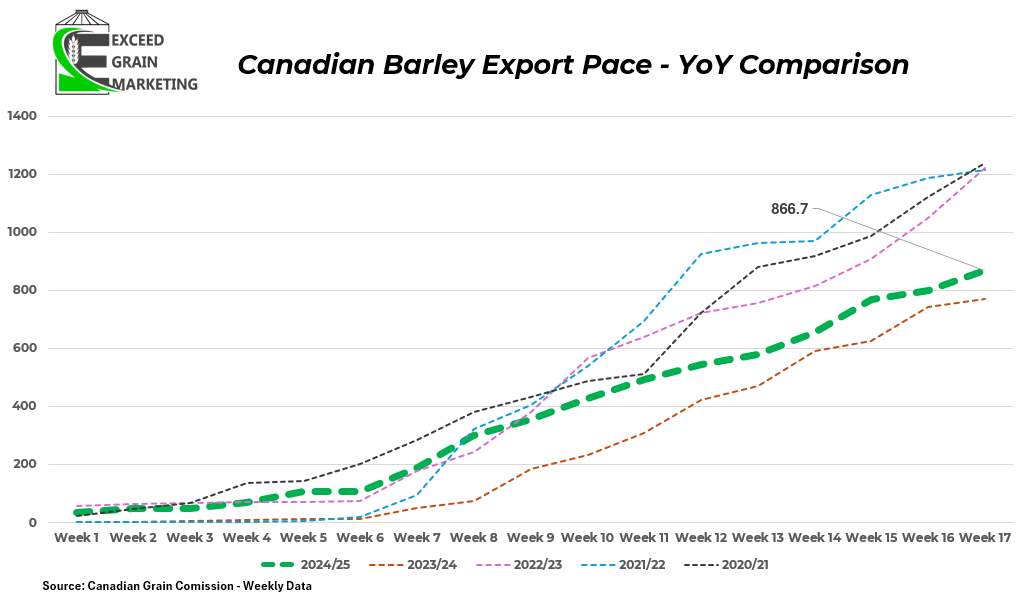

Barley

- Export pace faster than last year but still well behind the 3 years of 2021,2022,2023 when we gained some more Chinese demand as the Australian crop was not moving into China.

- End users / Maltsters came out of the gate early with bids and appear to have covered off front demand. Maltsters still looking for some crop to round out their inventories towards tail end of marketing year. No Exciting moves here lately. Feed pricing $5.00 central prairies. $5.75 south Alta

- Exports are not expected to be anything special as we largely lost a pile of market share to the Australian market exporting into China. Still moving some into China but how many boats we get remains top issue.

- Malt has been the play so far this year and grade will dictate price sentiment. Early malt bids are still holding place, flattening in recent weeks.

Pulses

- Lentils shaved 150,000 tonnes from september

- Peas shaved 150,000 tonnes

- Chickpeas down 40,000 tonnes

- Global demand will be the key factor here. A few key sales to export markets will dictate the balance sheet massively come the end of the marketing year.

- Lentil tariff exemption into India remains into spring 2025. Yellow pea exemption will renew or expire at end of December

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content or forecasting provided within of our reports for making financial decisions without such professional advice is at the sole risk of the user.