Exceed Grain Marketing’s Client Exclusive report is dedicated to covering the ongoing trends and significant highlights within the local market, while simultaneously offering a perspective on the global landscape. This approach ensures a comprehensive understanding of the factors influencing the market at both local and international levels. Our aim is to deliver current, up-to-date information specifically tailored to the crops impacting your operation. Work with your Exceed Grain Marketing advisor to devise specific strategies that may work for your crop.

MARKET HIGHLIGHTS

- 2024/25 Crop Year Recommendations – Click Link

- New Canola Recommendation for both old crop and new crop in bottom tabs of report.

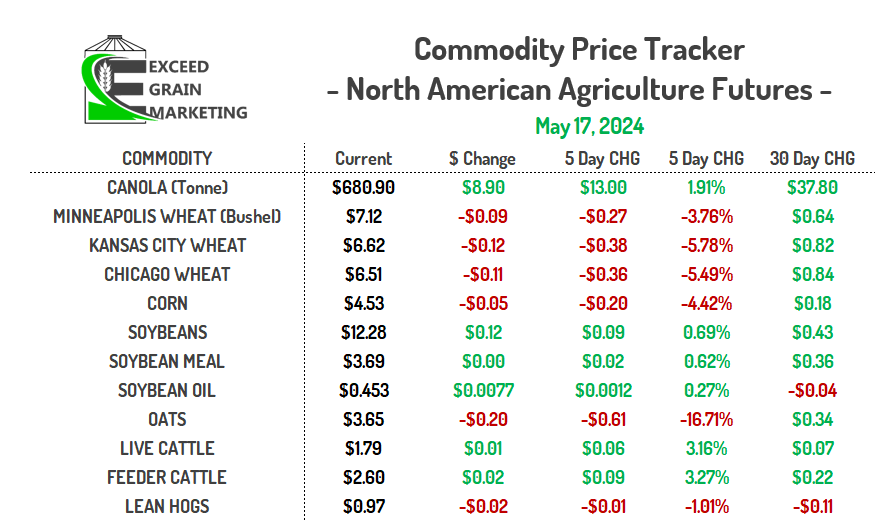

- Markets mixed on the Friday market close:

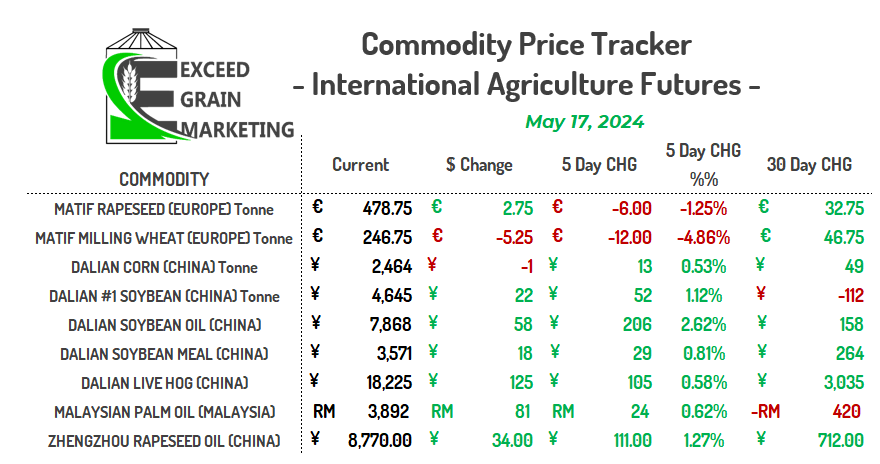

- Vegoils closed out the Friday trade stronger with positive trading days in Soybean Oil, Canola, Palm Oil and European Rapeseed.

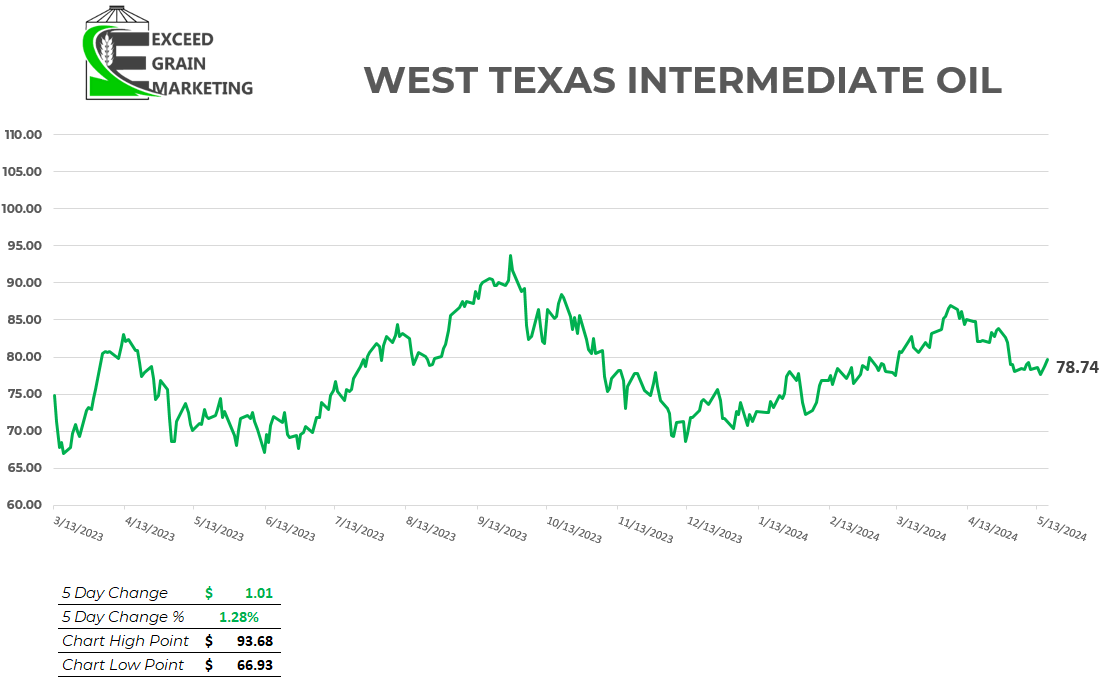

- Rumors once again floating that the US may impose tariffs on Used Cooking Oil into the USA. The market was highly anticipating that we would see UCO on a list of tariffs imposed on Chinese goods during a tariff announcement on Tuesday. The product never made it onto the list and subsequently soybean oil futures dipped.

- Used Cooking Oil has been flooding the US market for renewable diesel and has been the cheapest feedstock in many instances which is keeping demand away from US Soy Oil.

- Reports that the tariffs could potentially come later in the month, but these are backed by little tangible information, so should be approached with caution.

- Roughly 3.2 million tonnes of soybeans yet to be harvested in RGDS state of southern Brazil. Quality reported to be of very poor condition. The tonnage will be there, just the quality is questionable at best after spending significant time in water logged conditions.

- Russia’s ministry of agriculture reporting that 830,000 hectares or over 2 million acres of crop were lost due to the multiple frost events of the first half of May.

- Same regions set to get dry here now. Analysts hinting that the crop size could have more room to shrink vs grow

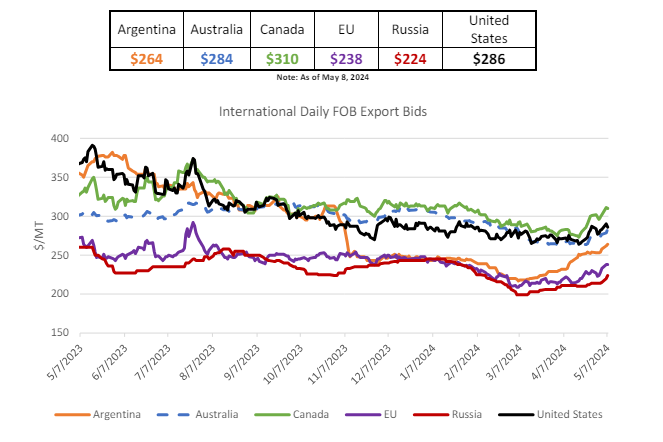

- Seeing Russian wheat FOB values increasing. 12.5% Protein bidding around $240 per tonne, up $5 since the start of the week. For refference, this was $215/tonne late April and closer to the $200 level mid winter.

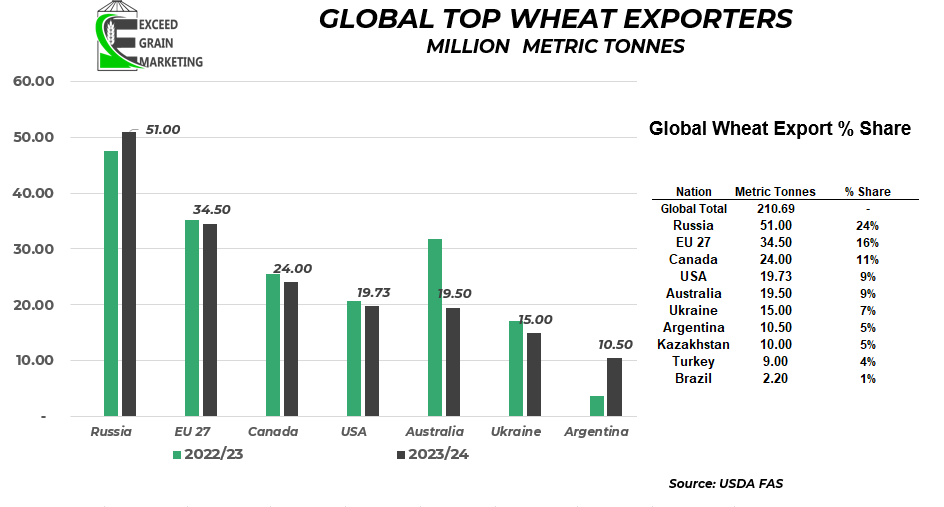

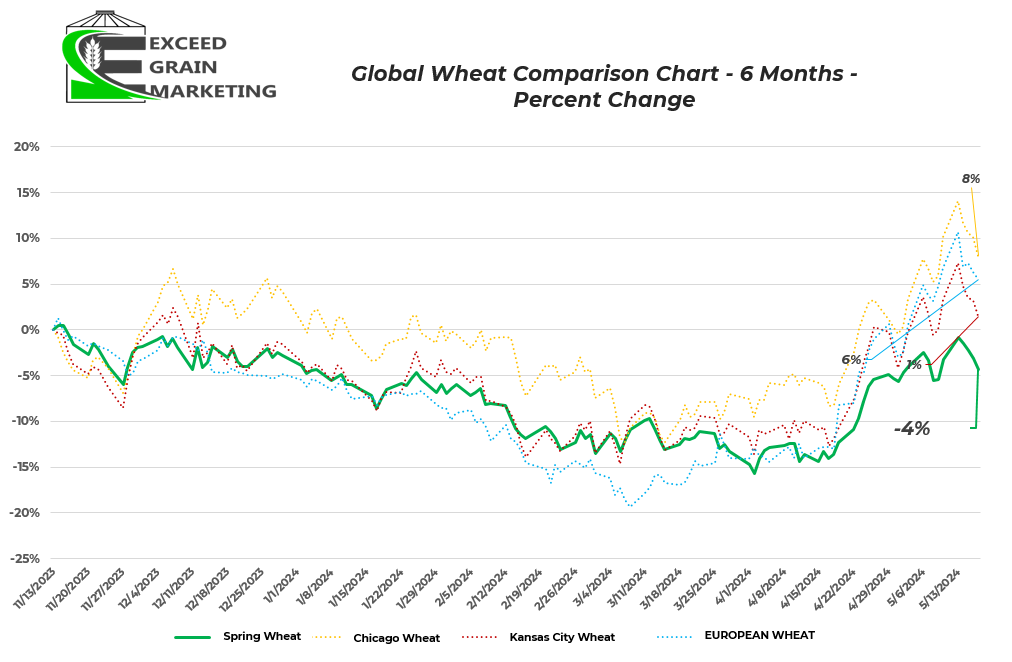

- Private analysts have the Russian winter wheat crop at 85-87 mmt vs the 93 mmt earlier in the growing season. Wheat markets have been reacting accordingly to this and this has been the main driving force of futures in recent weeks.

- Crops that are severely damaged can still be planted to a spring crop, but at a yield drag and would typically be looking to target a higher protein market. None the less, it would mean less quantity of wheat if a few of the presented scenarios come to play.

- Kansas wheat tour wrapped up on Thursday posting an estimated yield potential of 46.5 bushel per acre. This would put the Kansas winter wheat crop at 290 million bushels vs the 268 million bushels the USDA had in its latest estimate. Five year average is 44.2 bpa for the Kansas crop.

- CONAB, Brazil’s crop reporting agency, earlier this week increased their estimate of the nations crop harvest size to 147.7, up from 146.5 mmt.

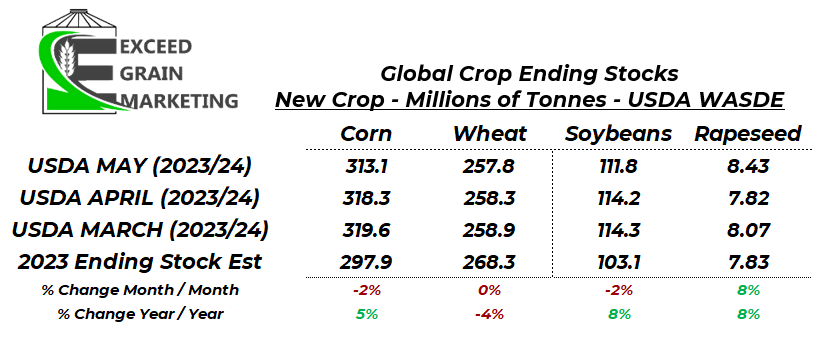

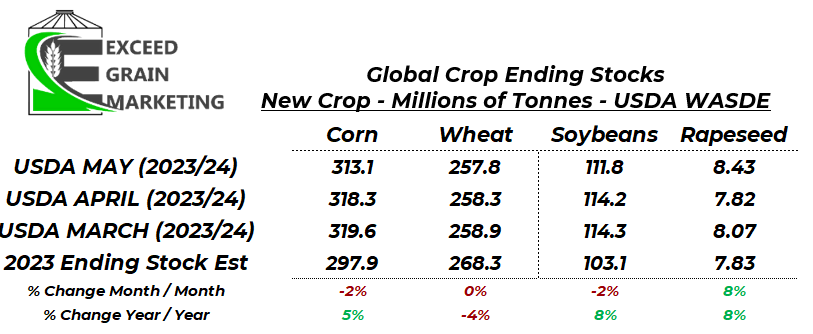

- USDA WASDE May Edition: Charts are above but we will list a few of the key takeaways of the report:

- This was the first report with crop production estimates for the 2024/25 crop report.

- South American crop production trimmed 4mmt off of the corn estimates, but came in fairly close to market estimates prior to the report. For the soybean crop, USDA cut 1mmt off the Brazil crop and left Argentina untouched. The pre report estimates were actually estimating around about 2.5 mmt cut, so came in higher than pre report estimates.

- Global Rapeseed ending stocks came in higher than the month prior. 8.43 vs 7.83 mmt last month.

- 2024/25 New Crop global estimates for the crop came in at 7.82 mmt

- 2024/25 World Ending stocks were published for the first time this year:

- 312.3 mmt corn

- 128.5 mmt soybean

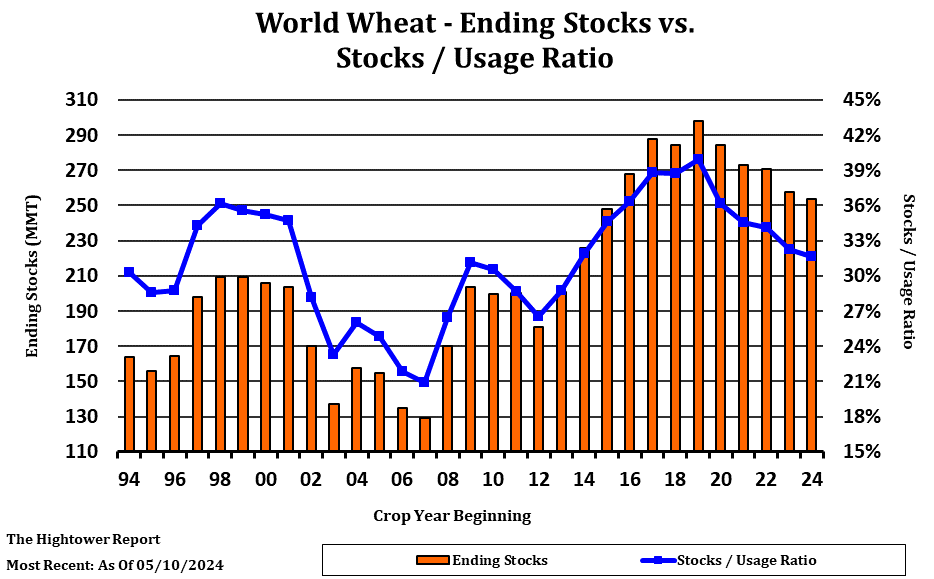

- 253.6 mmt wheat

- Corn came in about 5mmt less than pre report estimates, albeit the first report of the marketing year

- Wheat came in about 4mmt less than pre report estimates.

- CN and CPKC railway employees, Canada’s two major rail systems have voted to start striking as of May 22nd if their contract is not renewed to their standards. This would be very significant to export movement if not resolved before that time.

- Federal Government Minister Seamus O’Regan has asked the Canadian Industry Relations Board to look into the safety implications of the strike. A strike can not begin until a decision has been made.

- North American producers will welcome India’s extension of the Yellow Pea tariff exemption. Yellow pea imports will remain exempt from import duties until October 31st, 2024. Moving the exemption into the new crop season. Domestic yellow pea bids have increased as a result.

- Desi chickpeas will now be exempt from tariffs until March 2025.

- US Midwest dryness has been shrinking in recent weeks. Significant heavy rains in recent weeks has slowed planting pace but still close to the longer term averages.

- Corn pace within most expectations 49% planted vs 54% 5 year average

- Spring Wheat within / slightly behind expectations. 61% planted vs 48% average

- Soybeans came in slower than most market expectations – 35% planted vs 34% average. Market was hoping to see closer to a 39% planted figure.

- Winter Wheat conditions came in within expectations and is rated as 50% good to excellent vs 50% last week and 29% last year.

- Frost in parts of Germany and Poland late April / Early May has private analysts down to around 18.0+ MMT. USDA FAS Put out a 19.0 MMT number for the crop in todays report, their first stab at crop size. Many privates look at the crop getting smaller, not larger.

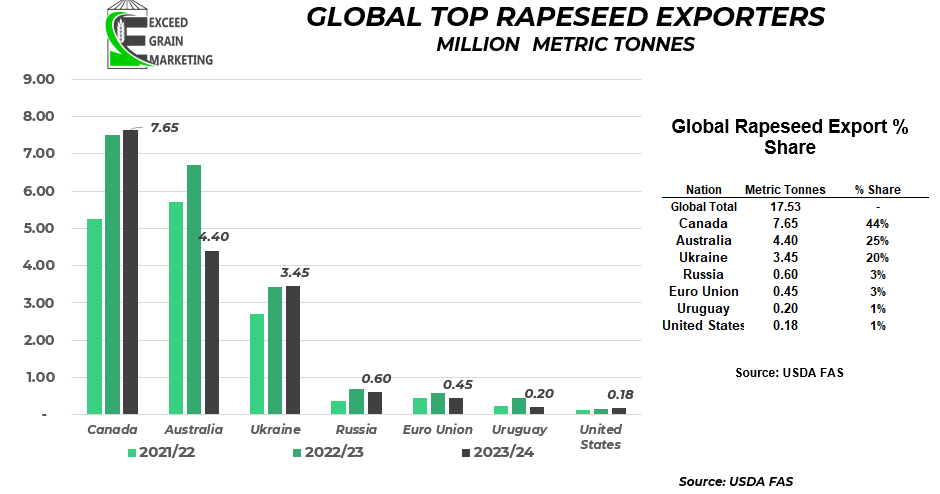

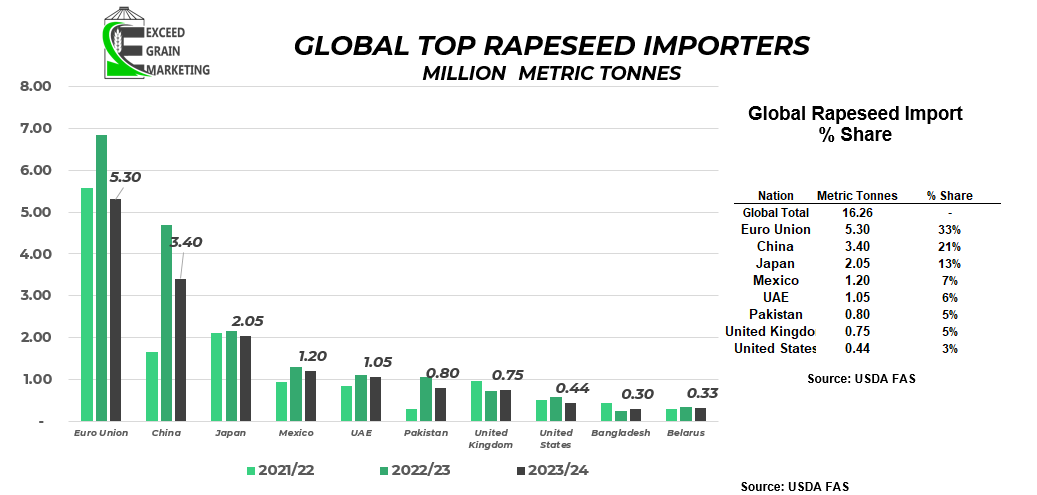

- The narrative has already begun that EU will need to import around 6mmt of Rapeseed/Canola for the upcoming campaign. This past year Canada missed out on most EU business in favor of Ukraine and Australian origin of cheaper origin. Market will be watching this closely as to how it will develop from here forwards.

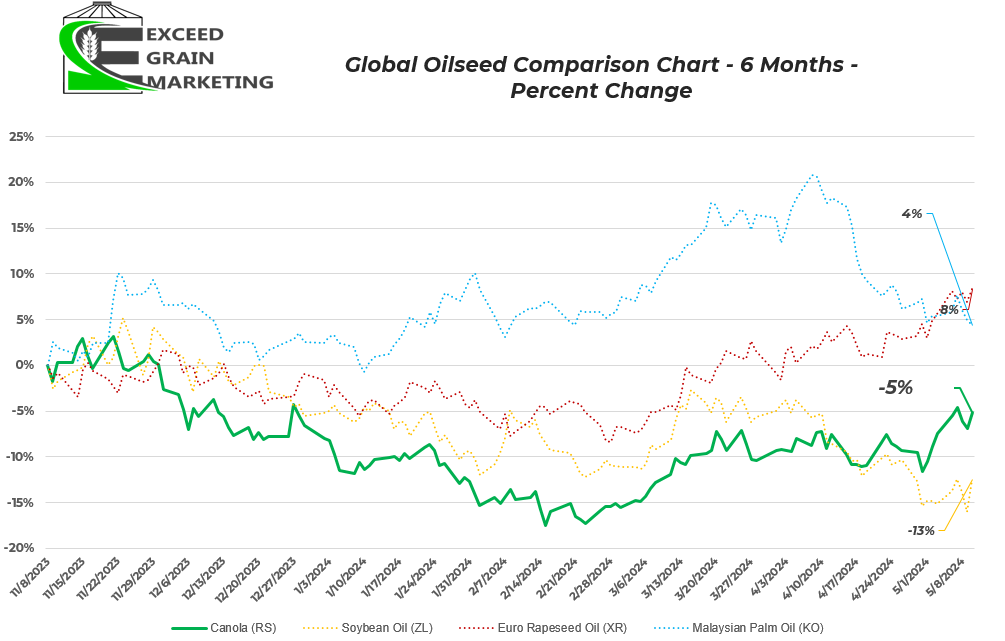

- Canola and Soybean oil appears to have broke its close spread relationship about mid April. See chart below of “Global Veg Oils” but canola and soybean oil had been trading in lockstep with each other for most of winter. This should be noted and followed.

- French wheat conditions sit at 64% good to excellent, up 1% from last week and down from 93% last year. France is the largest producer of wheat in the European Union, with about 25% of the 134,000 tonnes produced annually.

- Western Australia Dry, much drier than at the same time last year. No major rain events in forecast for western Regions. Needs rain soon or could see risk to main production areas of Canola.

- Strategie Grains, French Private Analysts place EU barley up 10% year over year. April estimated Rapeseed production at 18.1 mmt vs 18.3 month prior, 19.9 mmt was the production number last year.

- European Union proposed new tariffs on Russian grain: 95 Euro per tonne for grains. 50% for other crops. Subject to approval by the 27 member organization. If you are a Flax producer, keep an eye on this. Sounds like Flax Tariffs might be phased in over a period of a few years vs all at once.

- Recommendations Page Updated at Bottom of Report

WESTERN CANADIAN CROP NOTES

Canola:

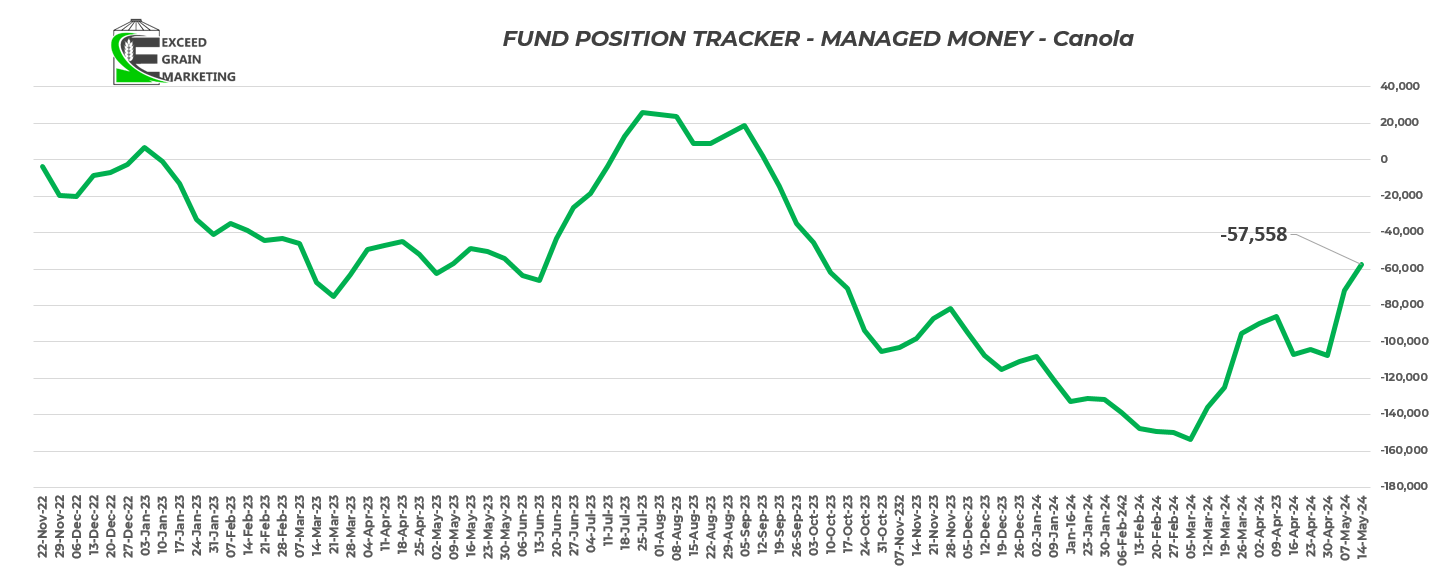

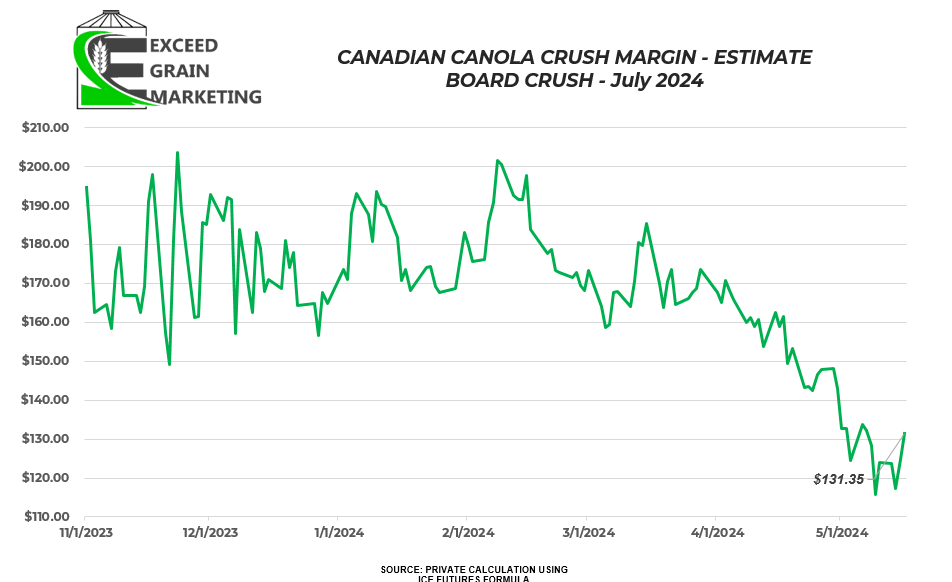

- Crush margins narrowing up. Vegoil values have took a hit and the oil share of the crush is worth less, significant for canola as that’s traditionally where most of the crush value sits. Crush margins were close to $200 per tonne February 2024 vs $130 range today.

- We hit some important sales targets for our grain marketing clients in past few weeks due to the recent run up in futures from the February lows. See recommendation section below. July Canola is now the front month for marketing purposes.

- Be sure to be looking at important dates for rolling forward any basis if required. Mid June is often when many grain buyers need to know if rolling or pricing.

- Crushers filling up domestically for the front months as producer selling took up much of the front month capacity. Most crushers bidding July onwards. If need crusher movement, need to build a plan around that. July/August is where most capacity lies within the crush. Be cognizant of export and crush capacity as we get closer to the dates.

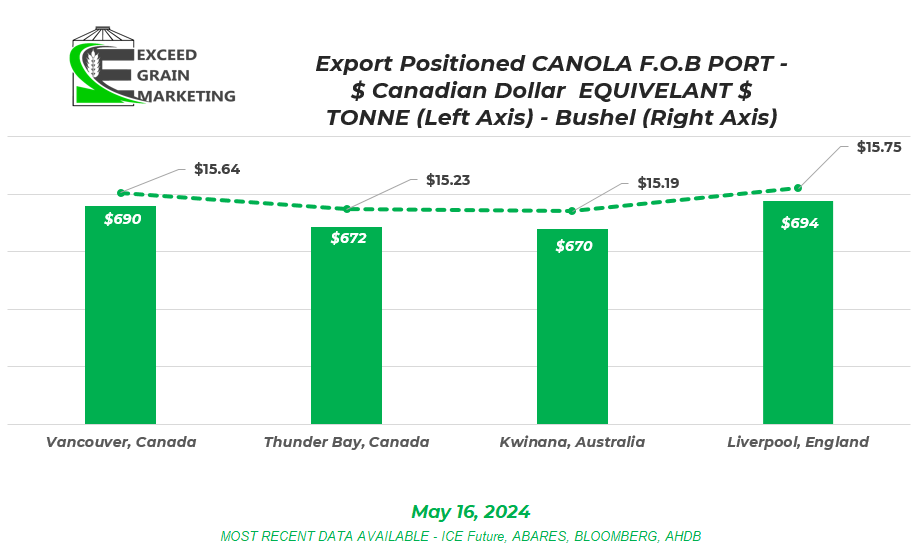

- Canola now once again pricing more expensive than Australian Canola after being cheaper than them in late February and into early March. The difference between exporter bids has narrowed up significantly in recent weeks. Canola carried such a premium to Australian canola and EU canola through the first half of the marketing year. It narrowed up significantly for several week but is showing signs of building that spread again. Chart above shows most recent bids at some key export/import regions in Canada, Germany, Australia and England.

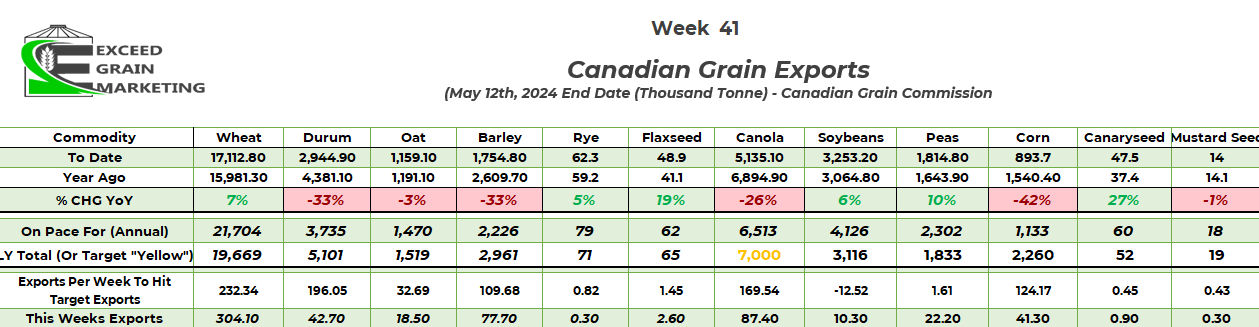

- Canola export was a very healthy 322,000 tonnes this past week.

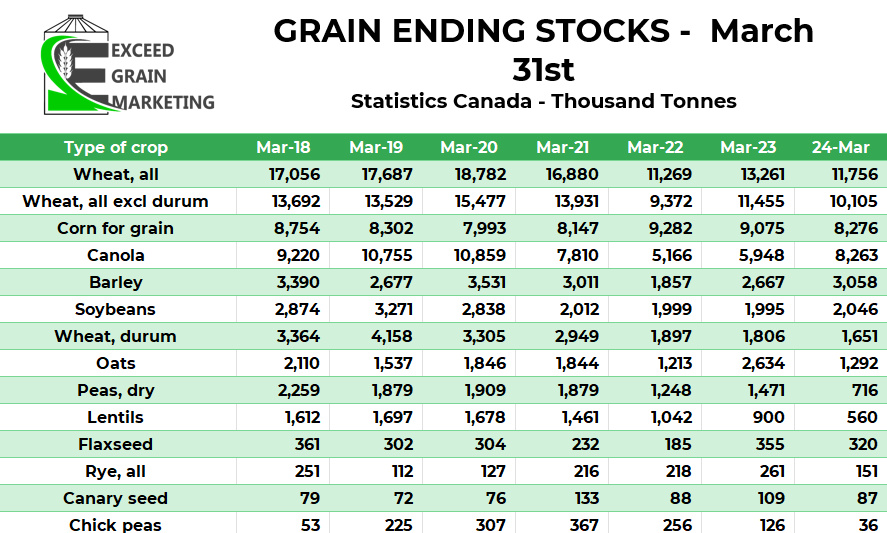

- Current export pace of 6.5+ mmt is not great overall and would be one of the lowest levels of exports in decades. See chart below for reference

- We need to grab exports on the tail end of the marketing year to maintain a reasonable carryout in the market. We have 11 weeks of export left in this marketing year. Need consistent movement here on forwards

- Crush is running at a very impressive pace, looks like we will surpass and hit a 11mmt + record. Markets need to see exports pick up to get any sort of strength into the domestic trade (Basis).

- Crusher bids still dominate but are falling closer to exporter prices, depending on the month. Crushers hold the winning bid for new crop 2024 harvest

- For a more in depth analysis on Canola Specifically, check out our April 2024 Canola Fundamental report by clicking here: Canadian Canola Market Fundamentals – April 2024

Spring Wheat:

- Russia is keeping part of this weather story alive. Some significant frosts in Russia in first half of May causing some havoc with crop conditions.

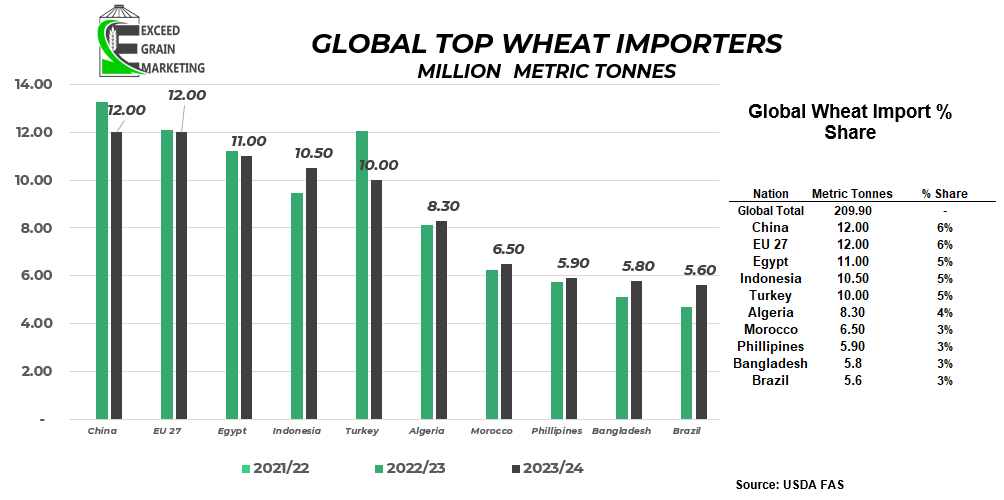

- Indian stockpiles of wheat lowest in 16 years will need to import wheat to bridge gap between shortfall and new crop.

- Kansas wheat tour wrapped up on Thursday posting an estimated yield potential of 46.5 bushel per acre. This would put the Kansas winter wheat crop at 290 million bushels vs the 268 million bushels the USDA had in its latest estimate. Five year average is 44.2 bpa for the Kansas crop.

- Russia’s ministry of agriculture reporting that 830,000 hectares or over 2 million acres of crop were lost due to the multiple frost events of the first half of May.

- Same regions set to get dry here now. Analysts hinting that the crop size could have more room to shrink vs grow

- Seeing Russian wheat FOB values increasing. 12.5% Protein bidding around $240 per tonne, up $5 since the start of the week. For reference, this was $215/tonne late April and closer to the $200 level mid winter.

- Private analysts have the Russian winter wheat crop at 85-87 mmt vs the 93 mmt earlier in the growing season. Wheat markets have been reacting accordingly to this and this has been the main driving force of futures in recent weeks.

- Crops that are severely damaged can still be planted to a spring crop, but at a yield drag and would typically be looking to target a higher protein market. None the less, it would mean less quantity of wheat if a few of the presented scenarios come to play.

- Russia has been playing games with exporters here since start of April, revoking some export licenses of key exporters and then reinstating them within a few days. Analysts believe the government mostly using this as a way to control exporters and let them know that they still rule the roost if unwilling to comply with government requests.

- Reports of Russian farmer selling slowing down due here recently. New crop will be off beginning in July and the anecdotal sentiment is towards producers willing to sit on inventories for the time being.

- Domestic wheat bids in Western Canada touching that $9.00 to $9.50 range for old crop. $8.50 up to $9.25 for new crop, best bids in prairies found in Alberta. Worst basis levels found eastern Saskatchewan and Northern Manitoba New crop bid spreads very wide and wide spreads across the prairies.

- Canadian Wheat exports and domestic usage is still considered very strong. At the current pace of exports and domestic usage, rationing will be needed. This does not always mean price correlates accordingly, as we have seen in recent weeks. Prices have seen producers selling into them.

- Wheat exports expected to easily surpass last years levels at current pace and are on track for an 7% increase year over year. Likely not able to make that happen although as rationing will supersede this.

- 2023 Old Crop Canadian wheat of good quality. 97% graded as either a #1 or #2 HRSW

- 80% had falling number above 350 seconds

- Wheat trade right now is mostly demand based. We have a good idea on global supplies for the most part.

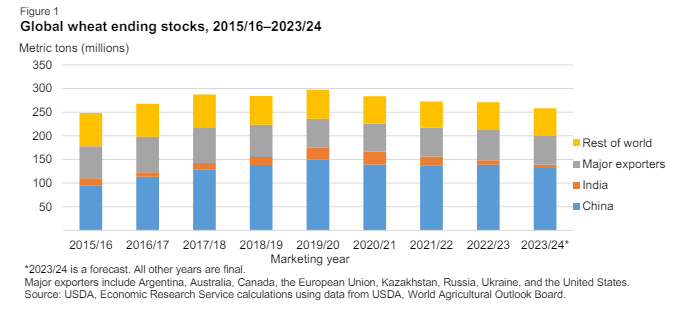

- Forecasted wheat global and domestic ending stocks coming in at the tightest levels since the 2015/16 crop year.

- Next thing market will be watching for is crop progress in the US and EU winter wheat crops and Spring Wheat planting conditions.

Special Crops

- Turkey tendered for durum early May. Looks like Viterra grabbed some of the business $328 USD per tonne.

- Minimal stocks of Canary Seed in Thunder Bay has markets reduced hopes for a spring export sale

- Yellow Pea and Lentil Acreage expected to grow in Canada for the marketing year. The pulse crops are showing some excellent return potential for the 2024 cropping season if producers can bring it to yield at harvest.

- Special crop markets closely watched Marchs release on acreage estimates from Stats Canada.

- Barley acreage drops to 7.1 million acres. Fits in line with some trendline averages

- Barley prices lower than last year, as with many crops. Some $5.00+ feed opportunities available central Sask. Greater as you move closer to Feed centers. Add $1.25 to $1.50 for Malting.

- Durum acres up 5% year over year. One of the largest acreage estimates in recent years

- Lentil and Pea acres up year over year but still not out of line with recent history.

- One thing to note from this report is that it was collected from December to January 15th. Lots has changed in this timeframe.

- Canadian peas will face stiffer competition going forwards into China as some Black Sea peas able to price into the region. Some of these peas were affected by early May frosts.

- India reduced Yellow Pea import tariffs from 50% down to 0% was extended for several months and now sits at October 31st, 2024. Was only in place until end of March but another month, and then another, was added to get exports into the nation.

- Durum growing regions of Canada have got some recent precipitation but will be dependent upon some key rains following planting, producers somewhat hesitant to price aggressively on new crop. Crop is around 50% Planted as of mid May. EU prices are rising for the crop but Canadian bids appear to have plateaued for short term.

- Red Lentil reduced import tariffs extended until March of 2025

Latest Key Fundamental Report Highlights

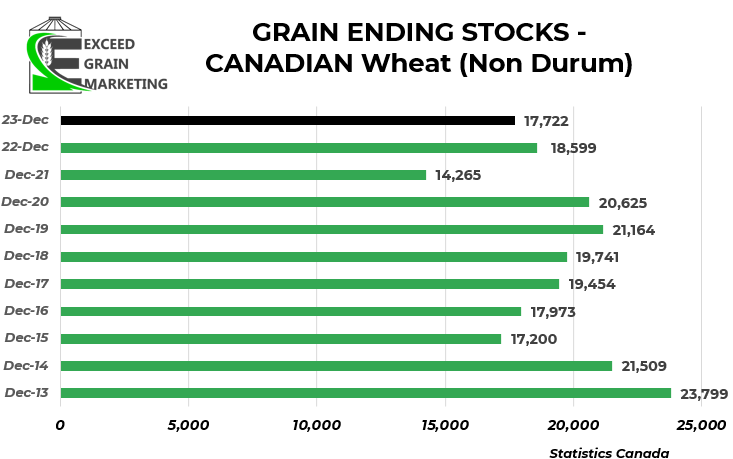

- STATS CANADA ( DECEMBER)

- March 11th we got Principal Field Cropping Areas – See above

- December 5th production estimates. Stats Canada report came in and was mostly as expected but higher than the prior report released pre harvest.

- Canola- 18.3 mmt vs 18.3 mmt pre report estimate

- Spring Wheat – 24.7 mmt vs 24.0 mmt pre report estimate

- Barley 8.9 mmt vs 8.6 mmt pre report

- Oats 2.6 mmt vs 2.6 mmt pre report

- Durum 4.0 mmt vs 4.1 mmt pre report

- Corn 15.1 mmt vs 15.0 mmt pre report

- Soybeans 6.98 mmt

- Lentils 1.7 mmt vs 1.7 mmt pre report

- Peas 2.6 mmt vs 2.6 pre report

- Flax 0.272 vs 0.290 pre report

- Most of the production numbers are higher than they were in the early days of harvest when ideas for the canola crop were floating around a high 17’s number. Same could be said for Durum and a few other select crops.

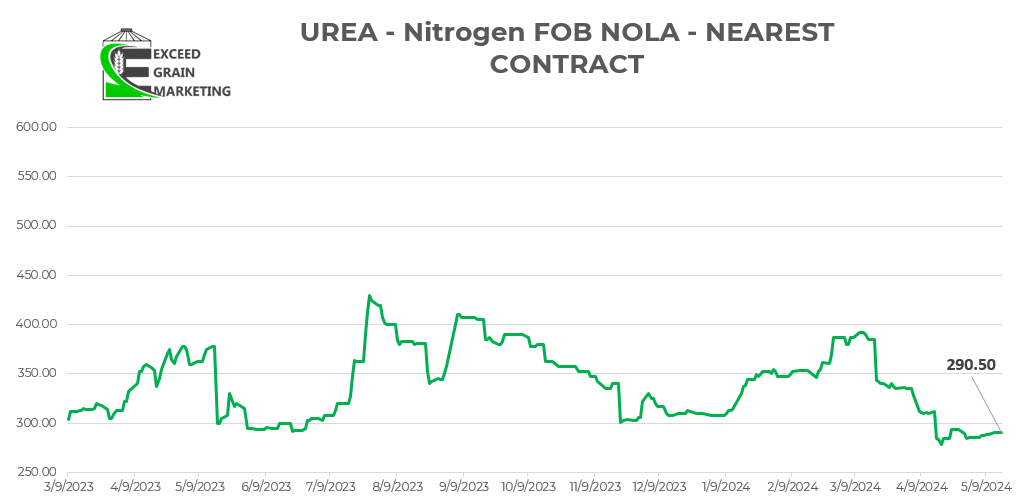

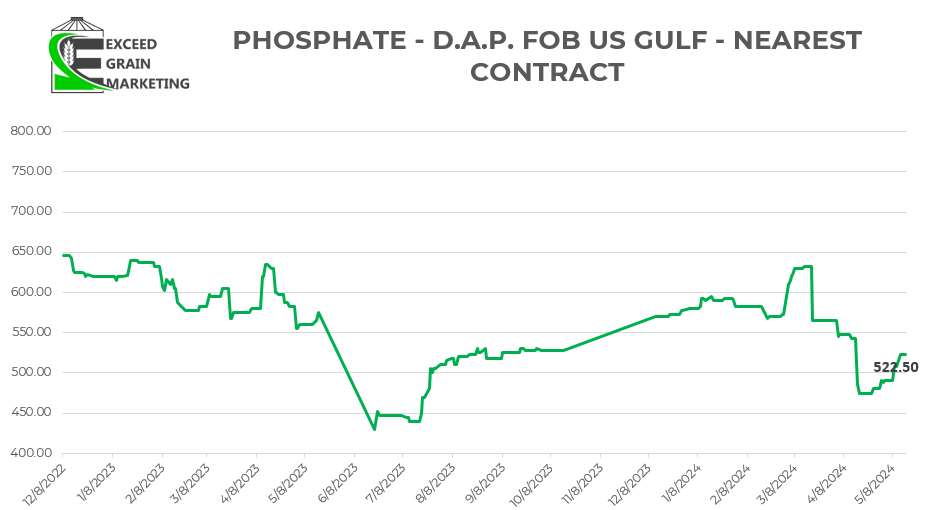

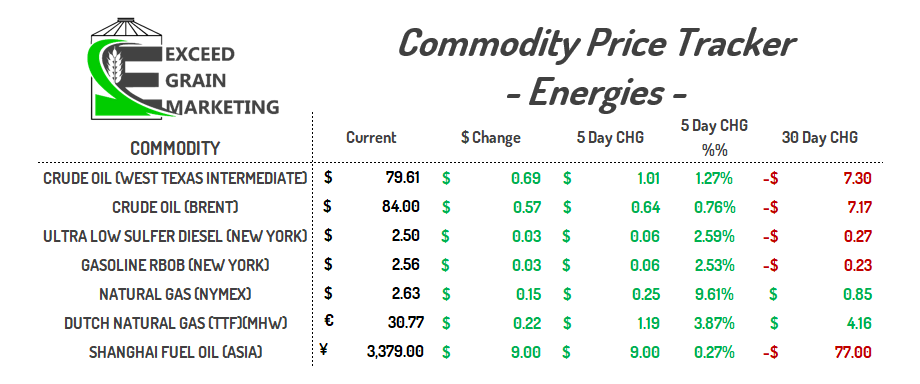

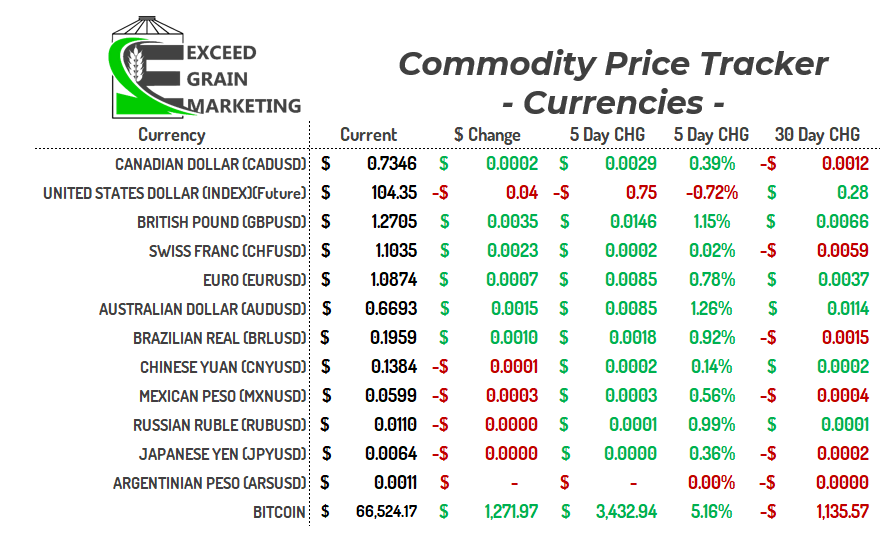

Currency – Energies – Fertilizer

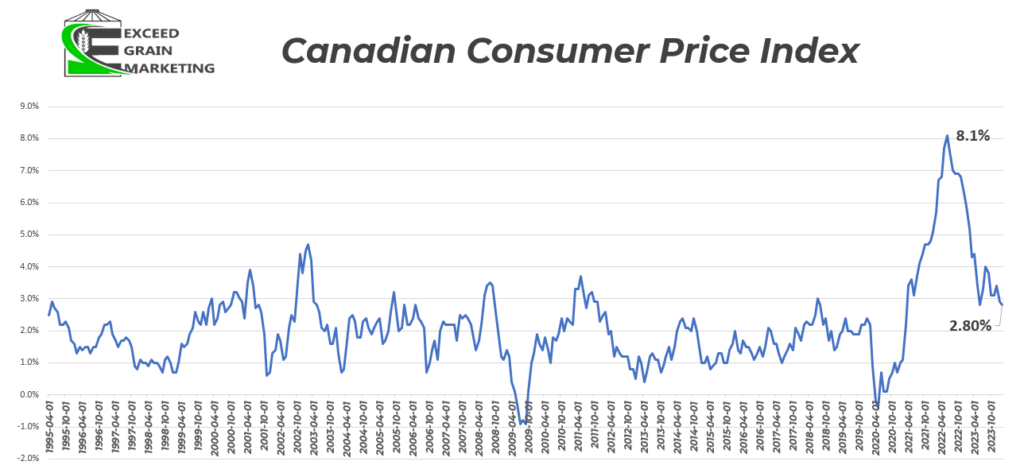

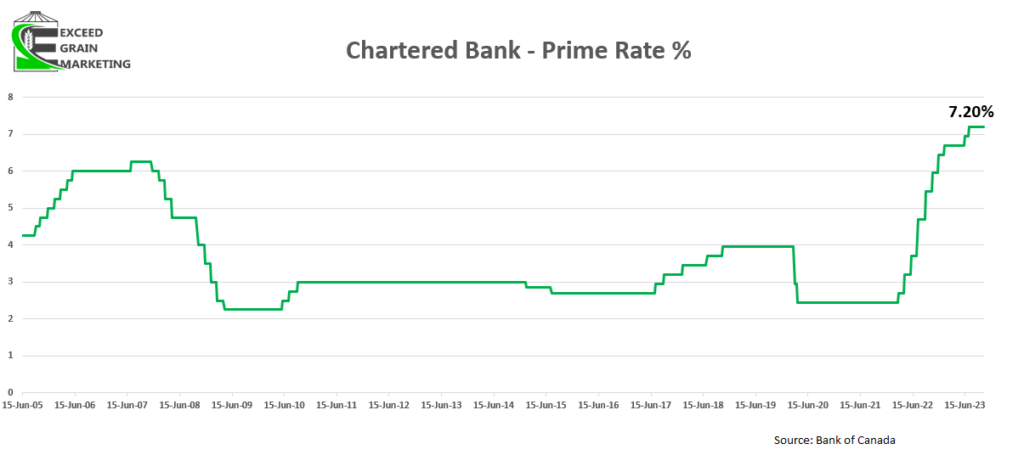

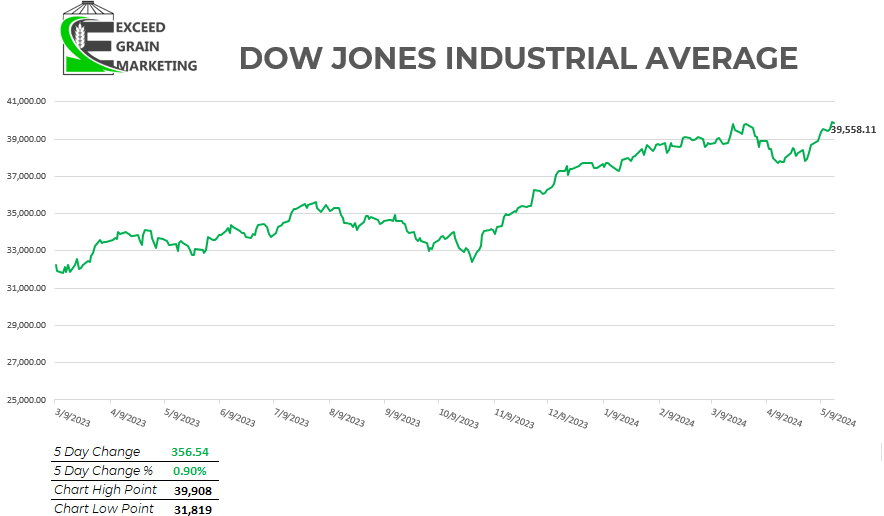

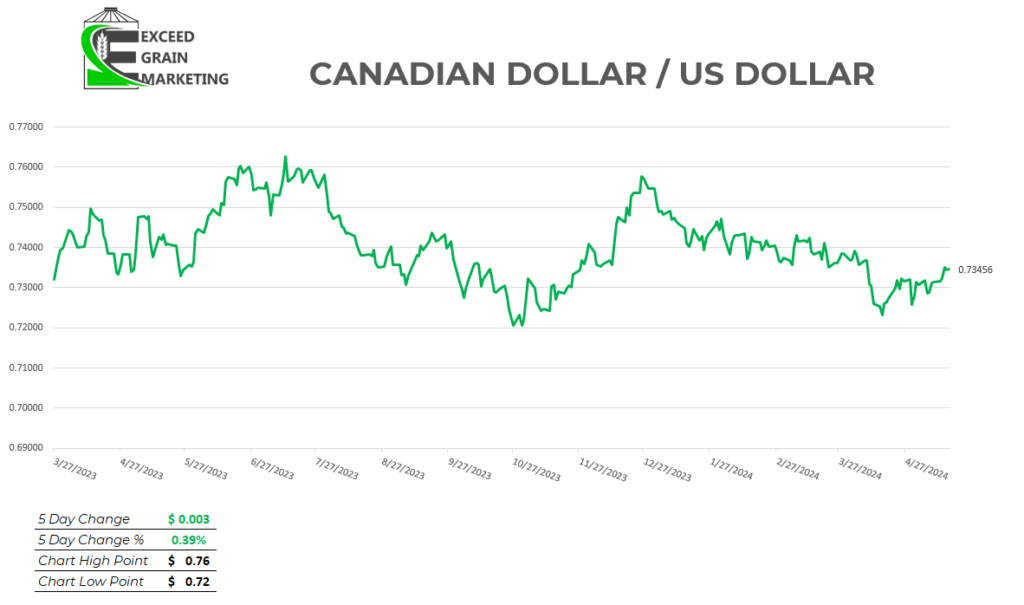

- Bank of Canada Stays Put with current interest rates at the latest interest rate meeting. Prime sits around 7.2% at major Canadian banks. Hinted that we could be higher for longer. Cuts will not be significant if they do come. The Bank of Canada has also recently hinted that one could face another rate hike but it is hesitant to do so given that Canadians are feeling the pinch of higher rates.

- Canadian CPI Still “Sticky” and sits at 2.9% as of the latest announcement in February.