Canola Market Supply and Demand

Each day, our team of experts meticulously analyze the latest market fundamental data, giving you a comprehensive understanding of the intricacies of the market. Whether you’re a farmer, investor, or industry stakeholder, our insights are designed to guide your decisions, helping you navigate challenges and capitalize on opportunities. Stay informed, stay ahead, and transform the way you engage with the agricultural market.

Global Canola Market – Supply and Demand Profile

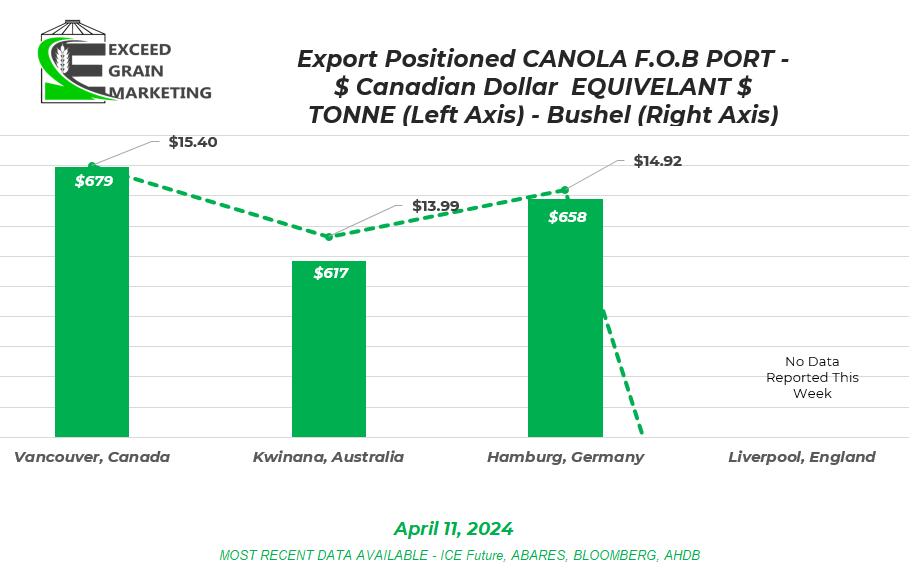

April 11, 2024

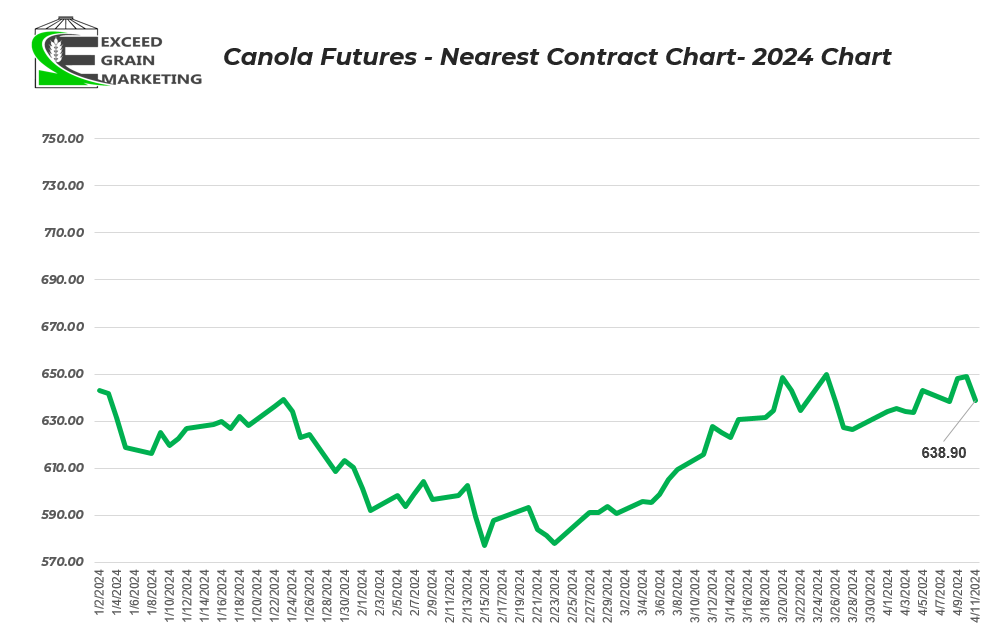

Western Canadian grain markets have faced some incredible volatility in recent months. This report is to serve as a supplement to some of the market factors that have been affecting the commodity. Prices touched a bottom in mid February and have benifited from some recovery in values since them, but still much lower than the prices producers were working with throughout the 2022 and 2023 growing season.

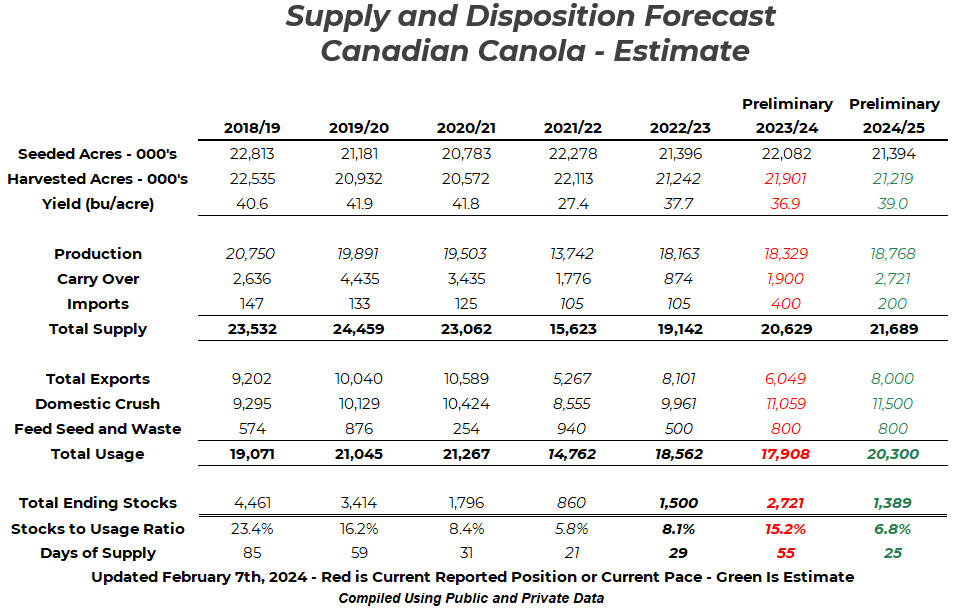

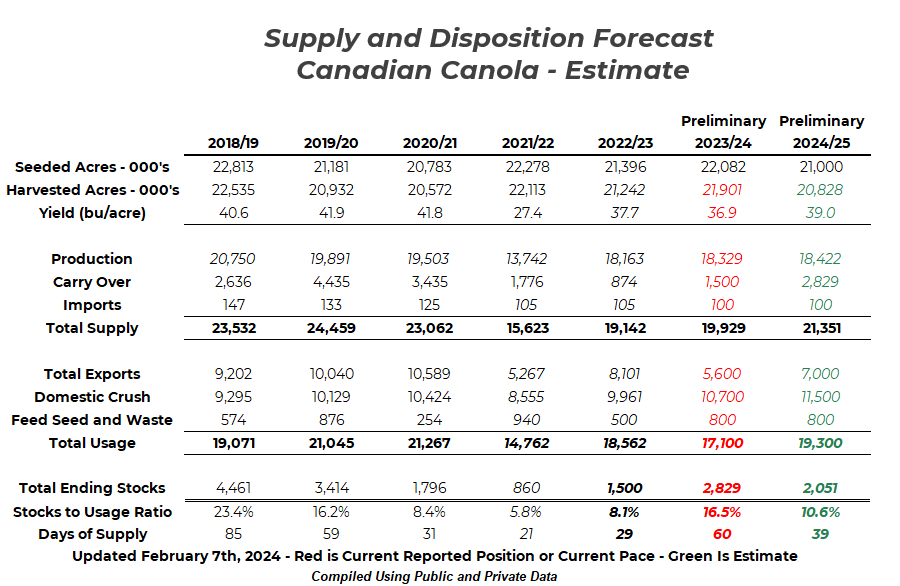

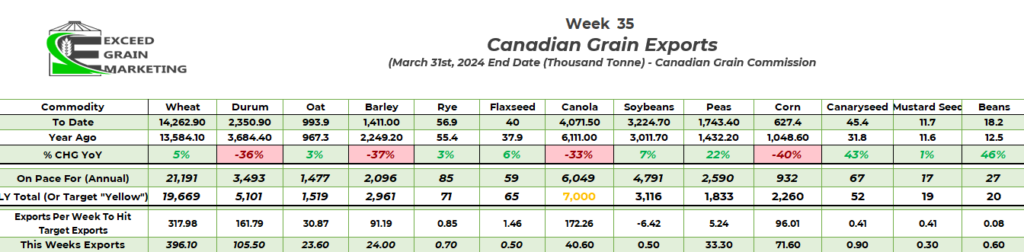

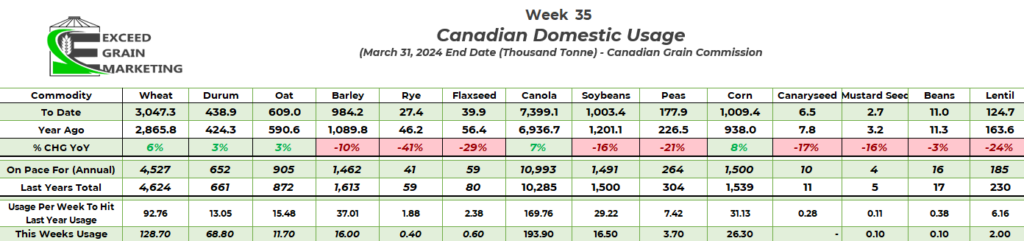

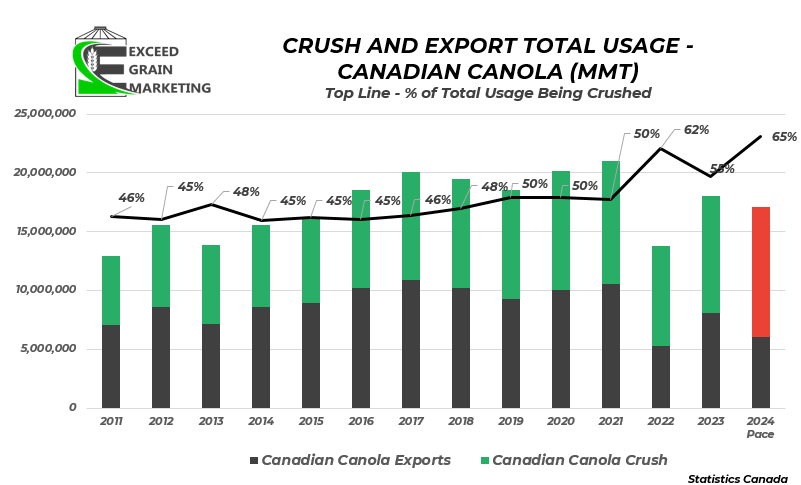

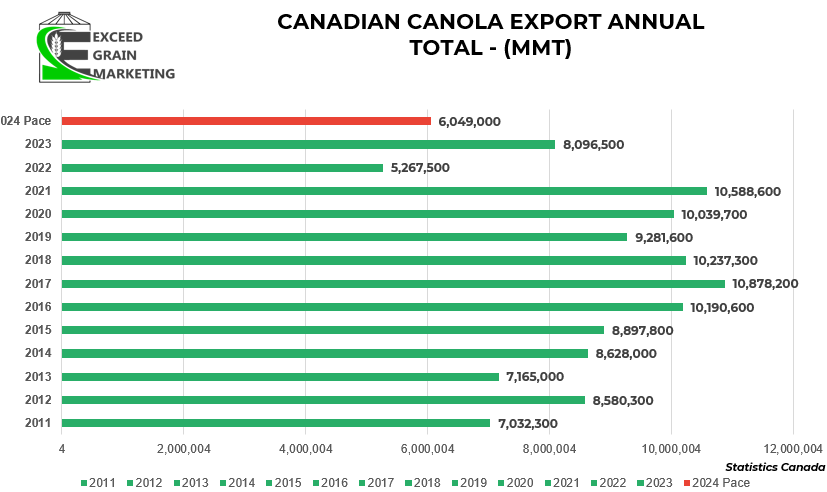

Top image above is our “On Pace” for figures, moreso for context. Bottom image would highlight the tightness if we export the previously forecasted 7.0 mmt. Exports will be the number to watch going forwards

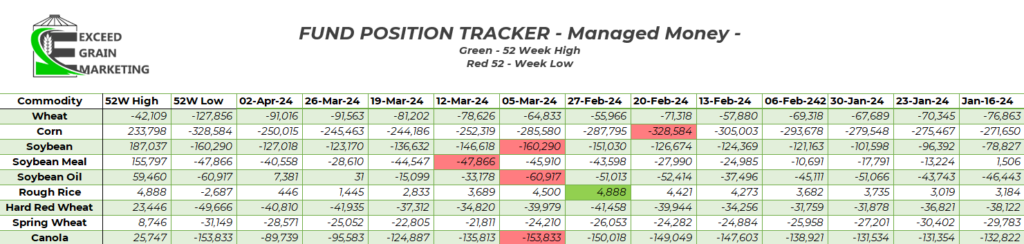

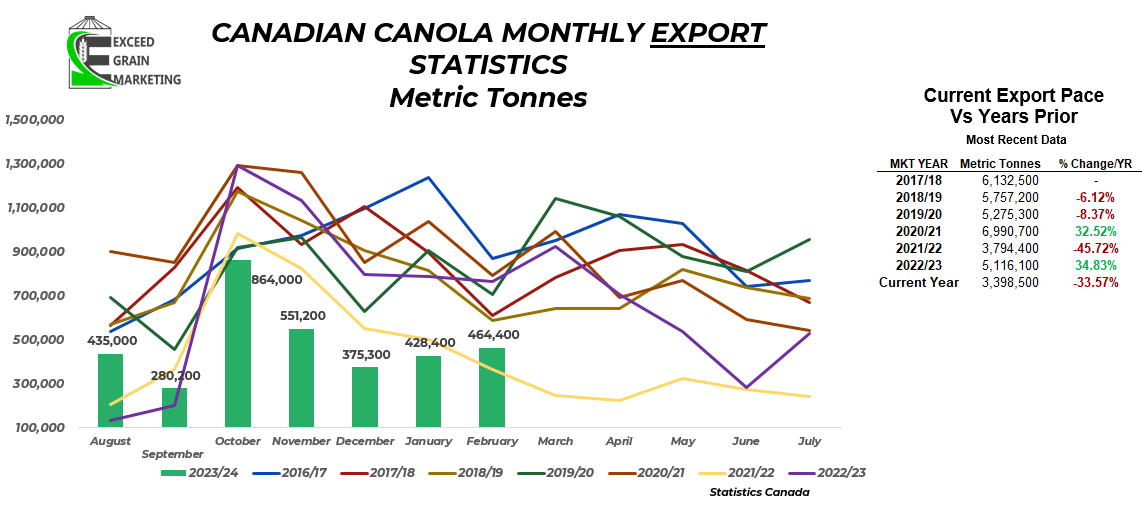

Taking a look at some Supply and Demand estimates we can make a few assumptions. Highlighted in red above are current “On Pace For” figures and are not to serve as a forecast. So as of right now we are on pace for 5.6 mmt of exports from Canada for this years canola crop. Most private analysts at 7.0 mmt and the USDA still sits at 7.25 mmt of canola exports, an optimistic approach to exports but also reasoning why local, boots on the ground, analysis does help in these situations. To get to 7.25 would be considered a huge homerun at this point in the marketing game. We are just well over the halfway point of the marketing year and currently in week 36 of the marketing year. We need to pick up the pace in an aggressive manner and have a strong last 16 weeks of exports to meet early the 7.0mmt + estimates. Statistics Canada’s December export figures came in at the lowest for the month since 2006, nearly 20 years. Some weak winter months will hold us from outperforming this year.

Exports need to be closer to 172,000 tonnes each week in order to hit the 7.0 MMT pace analysts are looking for. We are currently tracking just over 6.0 mmt annual exports. Carryout and market sentiment will shift largely based upon this figure. We have lost some of our traditional export sales to Mexico this year for instance as Australia took some of the business from Canada. But when referring to China, we are on pace to hit sales goals into there. The coming weeks will be very important to watch. Some big port inventories ready to ship out.

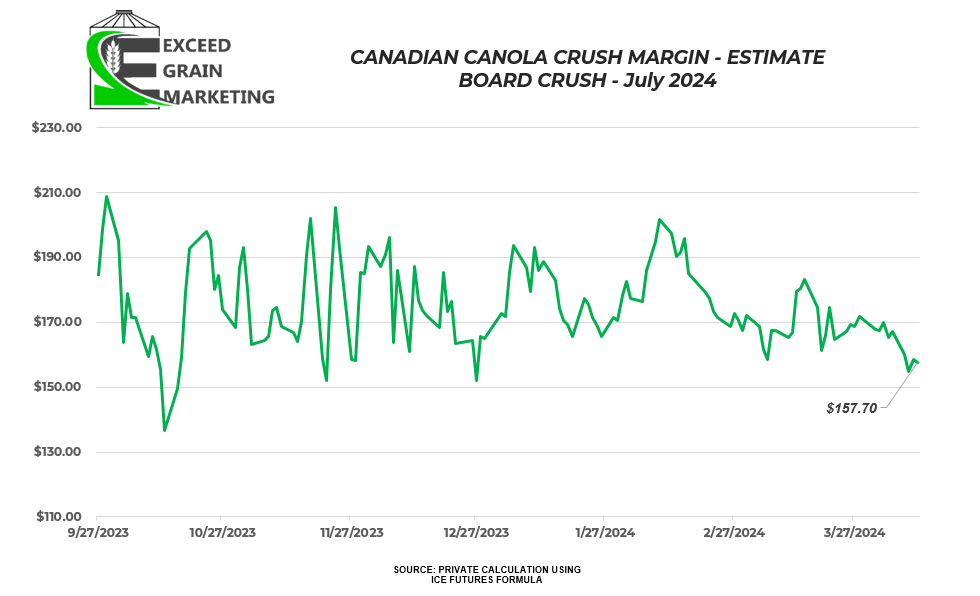

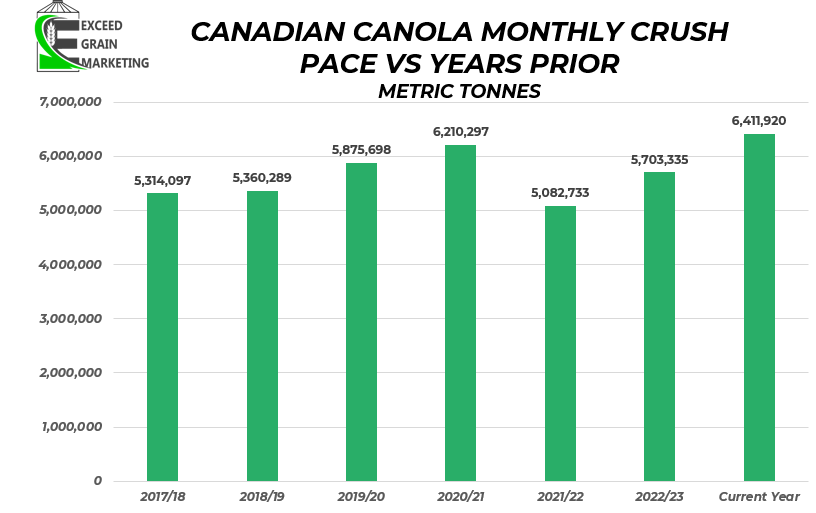

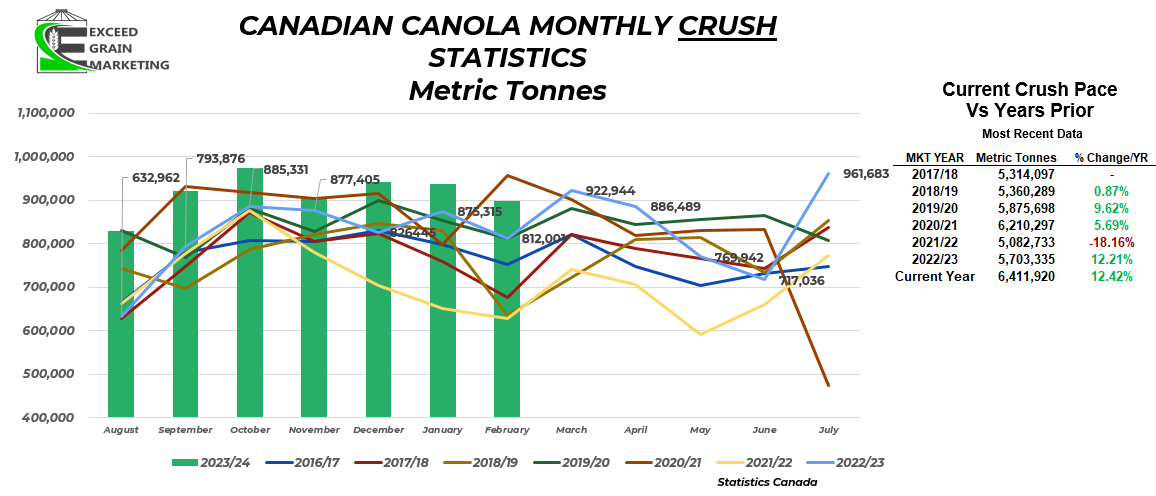

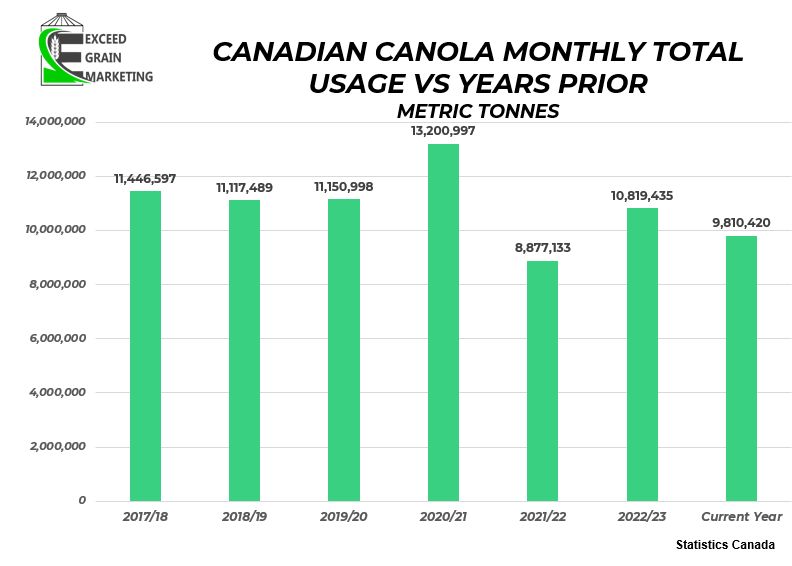

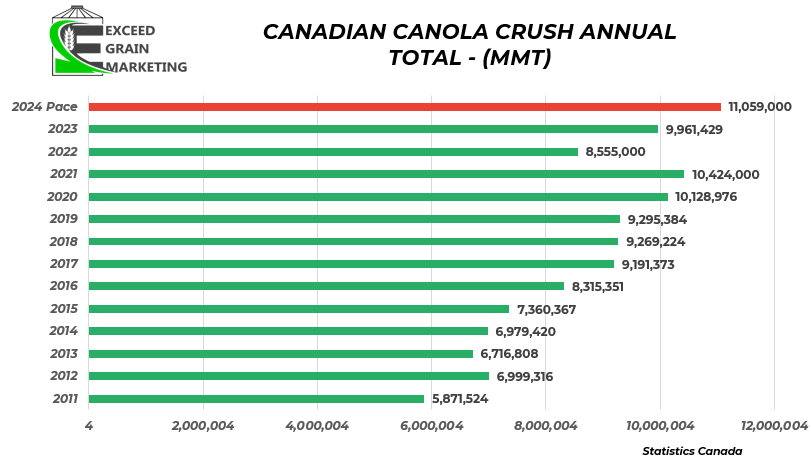

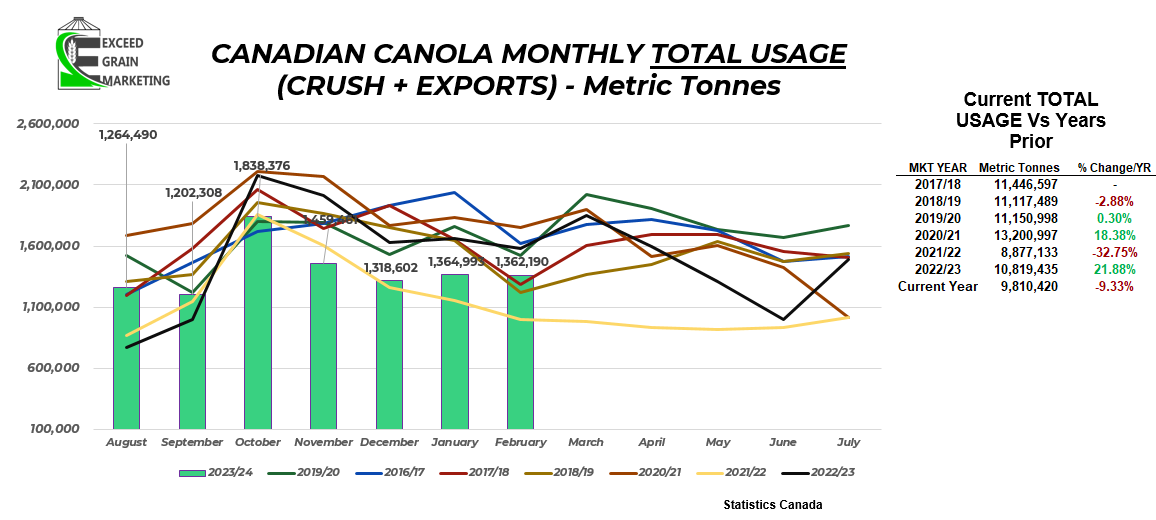

Crush is the strongest figure going and keeping sanity within the marketplace. Crush is on pace for close to 11 million tonnes which would be a record. More crush capacity is slated to be online here shortly with an extra bump by the end of 2024 and into the start of 2025. For next crop year we hope to have a extra 2mmt of crush capacity online.

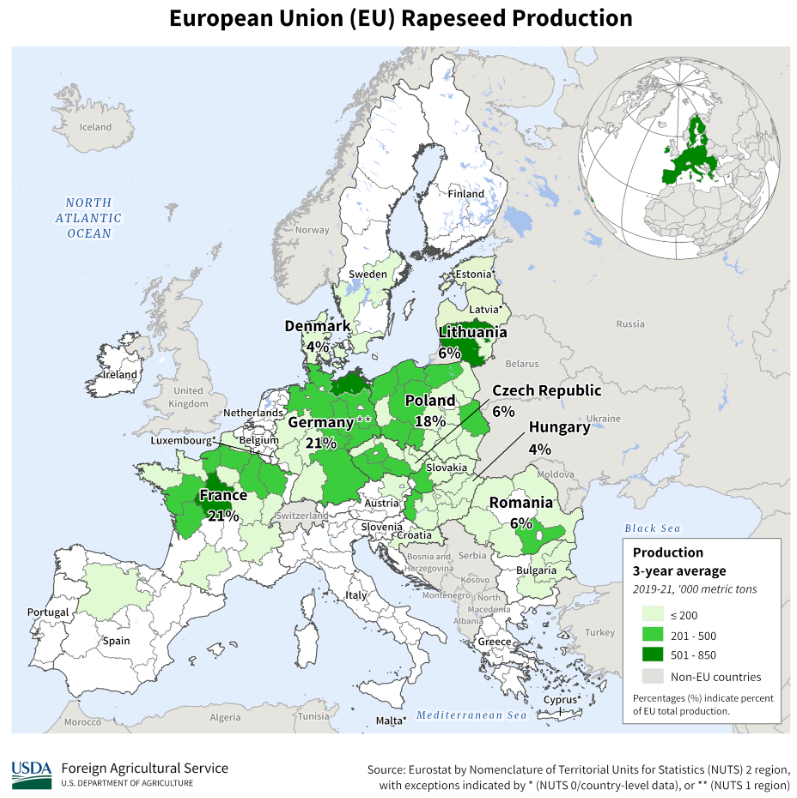

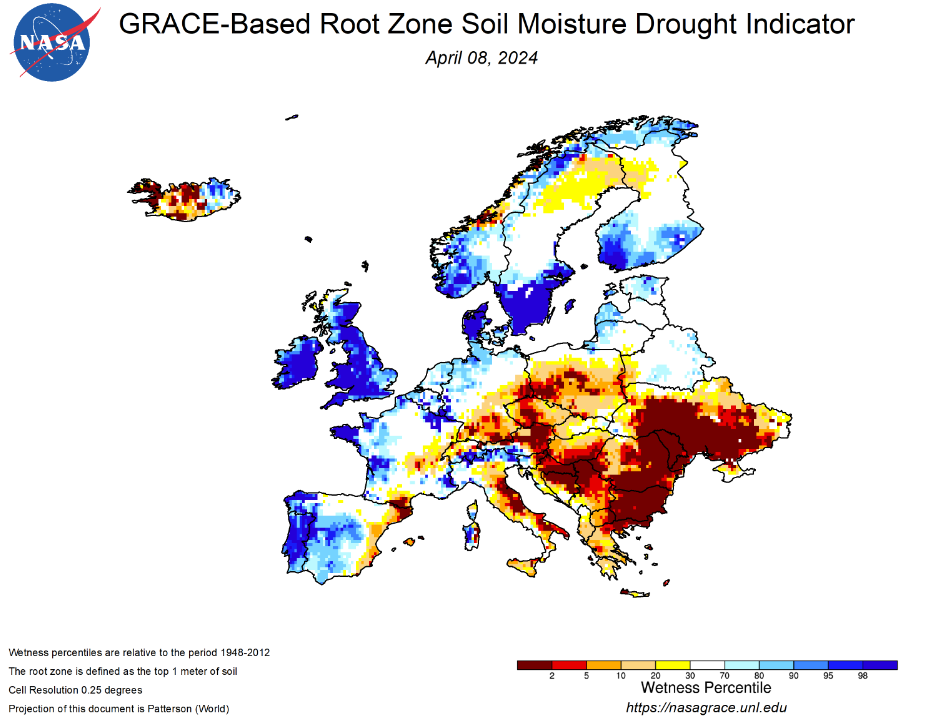

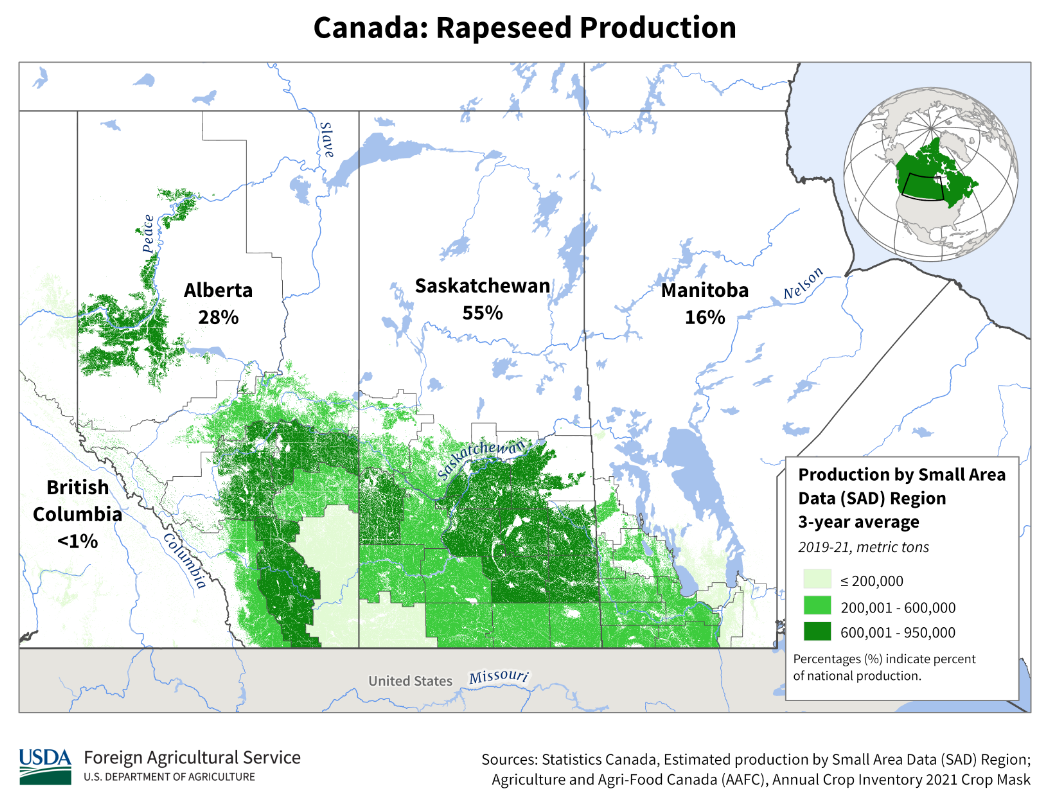

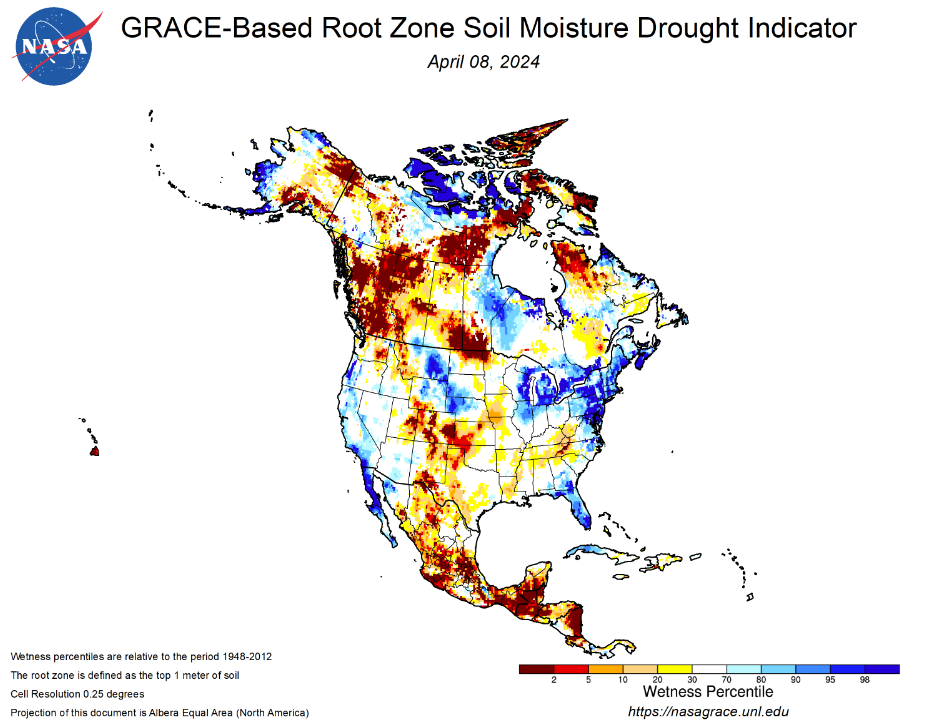

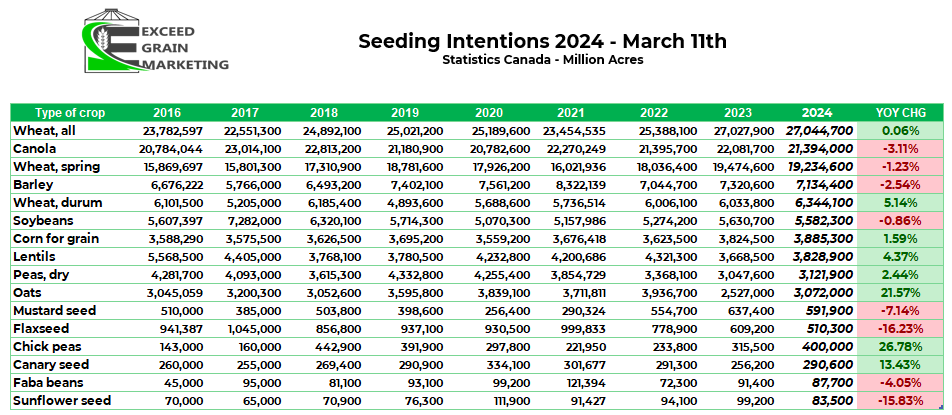

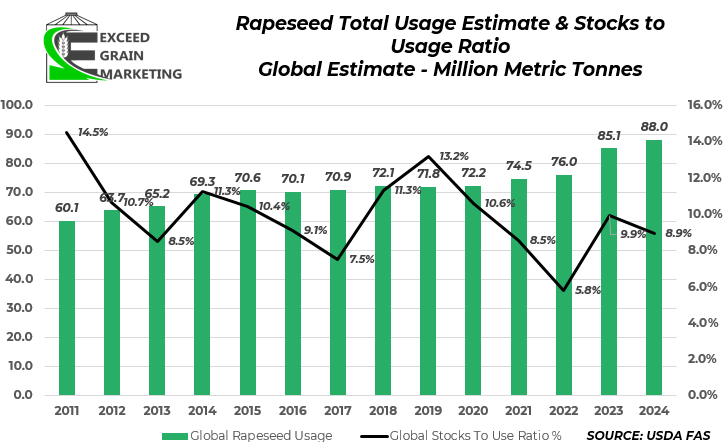

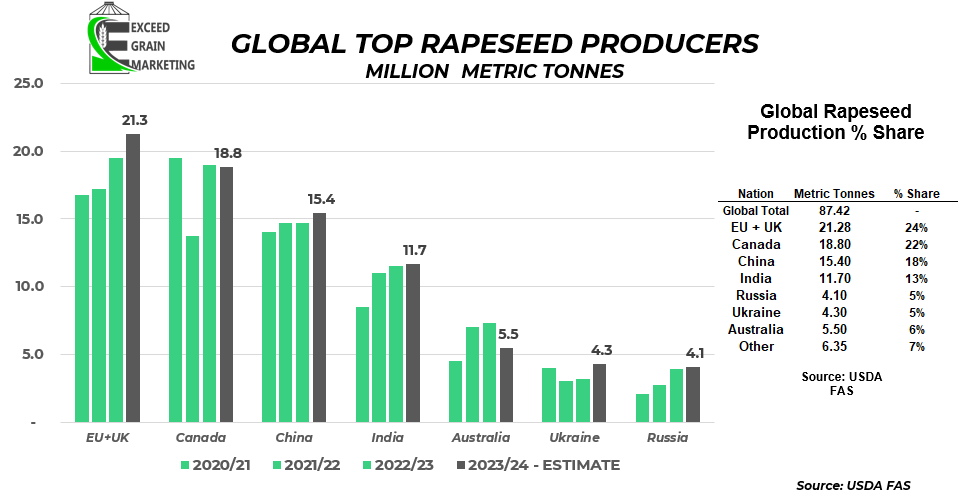

Using current pace estimates, We are likely going to face a carryout of 2.5 mmt or greater of a carryout this year. Current canola acreage forecasts are falling for 2024 crop acres in Canada and private analysts are in the 21.500 million acre camp, Stats Canada posted 21.39 mmt, see chart below. The worlds largest canola producer in recent years has been the European Union, often putting out a crop of a competitive size to Canada. Private analysts have the upcoming crop at 18.5 +- range. Less acres for the winter seeded crop. EU canola will be coming out of dormancy in April. It has been very wet in northern Germany, France and Poland where a majority of the acreage presents itself. See weather maps below.

Outside Markets – Australian And European Commentary

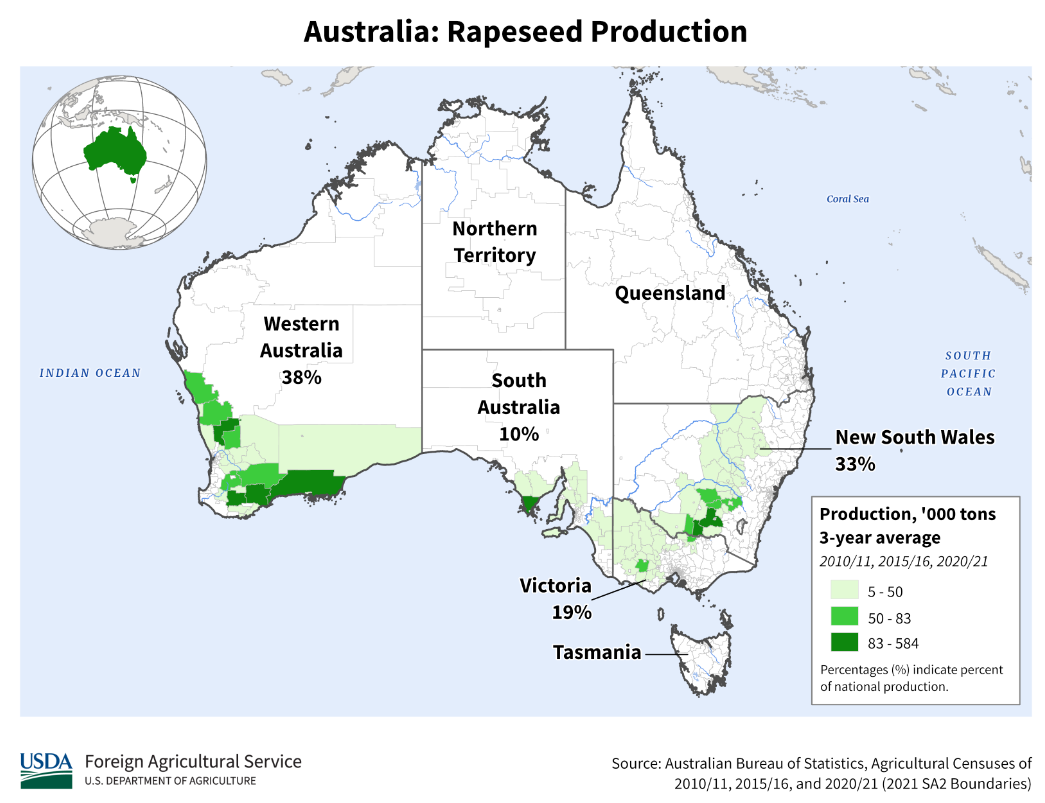

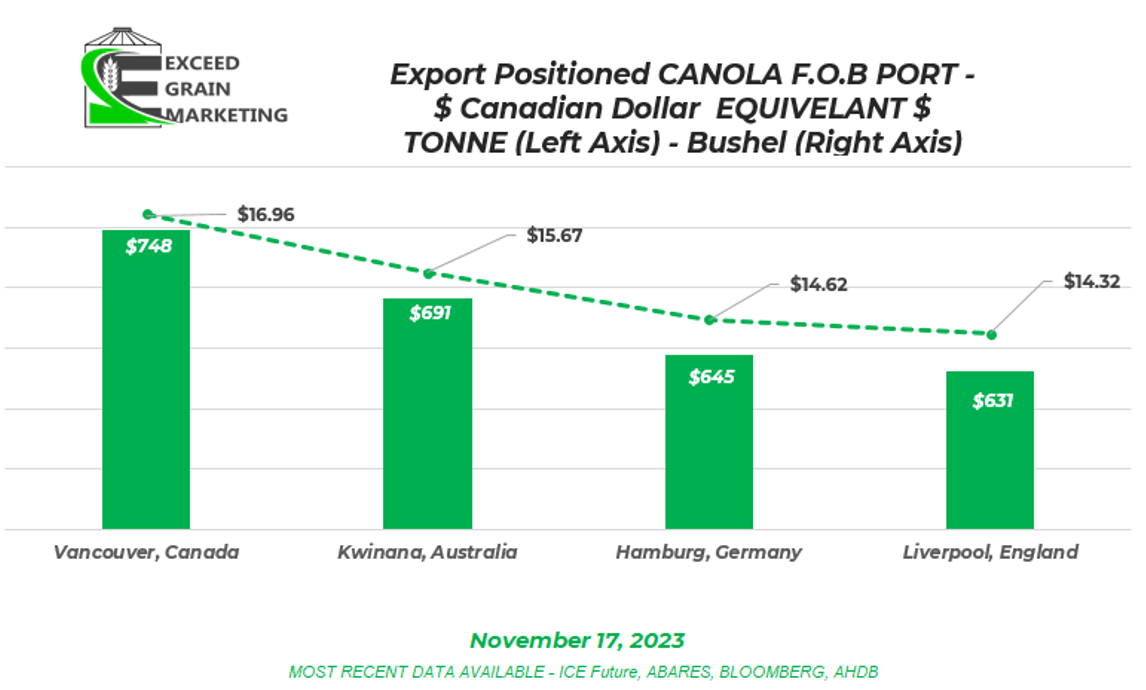

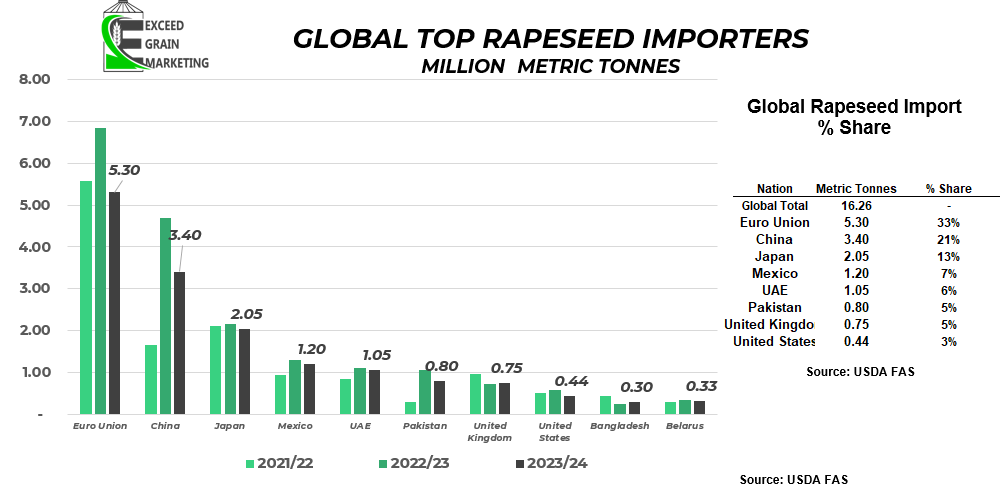

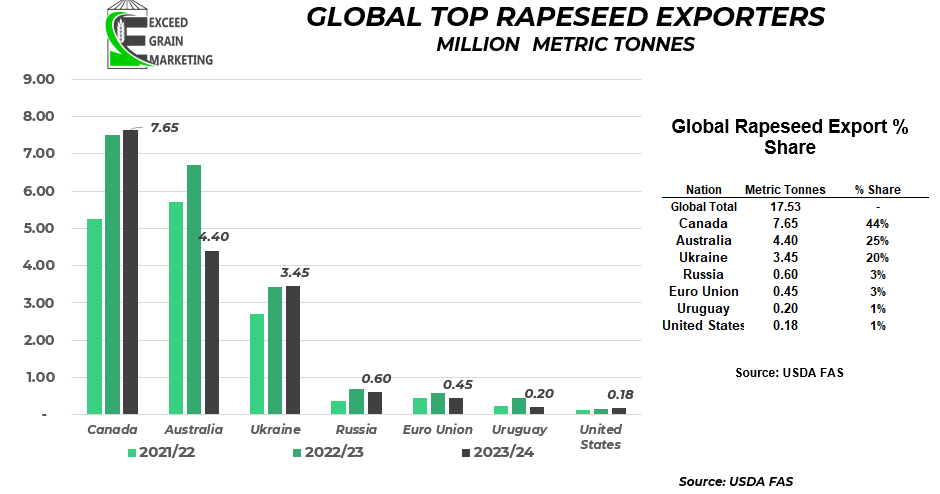

Australia and EU markets have been having a direct influence on Canadian canola throughout the marketing season. Canadian canola has lost export market share to cheaper origin Australian Canola taking some of the trade into our traditional markets such as Japan, Pakistan and Mexico. China has not been a destination for Australian canola mostly due to the tight phytosanitary issues China has on imported canola seed. Canadian exporters have the tools in place at port and inland to clean grain to very low levels of foreign material required to hit the market. This was seen as a boon a decade ago but the investment has paid off.

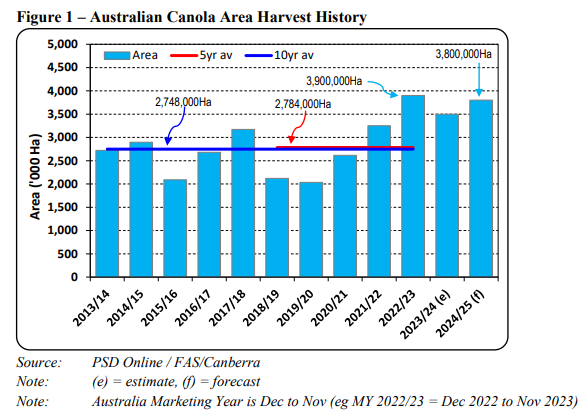

Australia has been an abundant and cheap source of canola for some importers. Limited crush capacity within the nation of only around 1mmt and close proximity for water has the producers more willing to sell and able to get the product to shorelines for much cheaper than Canadian production can do so. Australia has had a few abundant crops in recent years, leaving them to have more product to hit the markets.

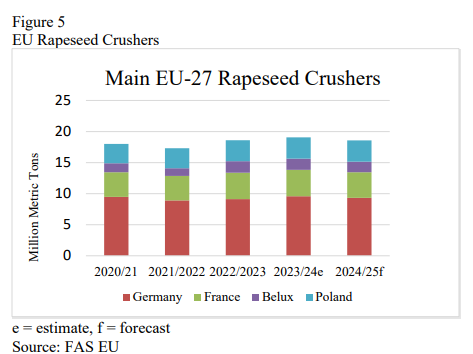

EU has been buying from Australia and the nation has been the EU’s second leading supplier after Ukrainian rapeseed. Ukrainian rapeseed has been abundant and cheap into the EU since the war began. EU crush capacity is around 25 mmt, and the nation only produces around 20 mmt, leaving them as the worlds largest producer of rapeseed but yet still a net importer.

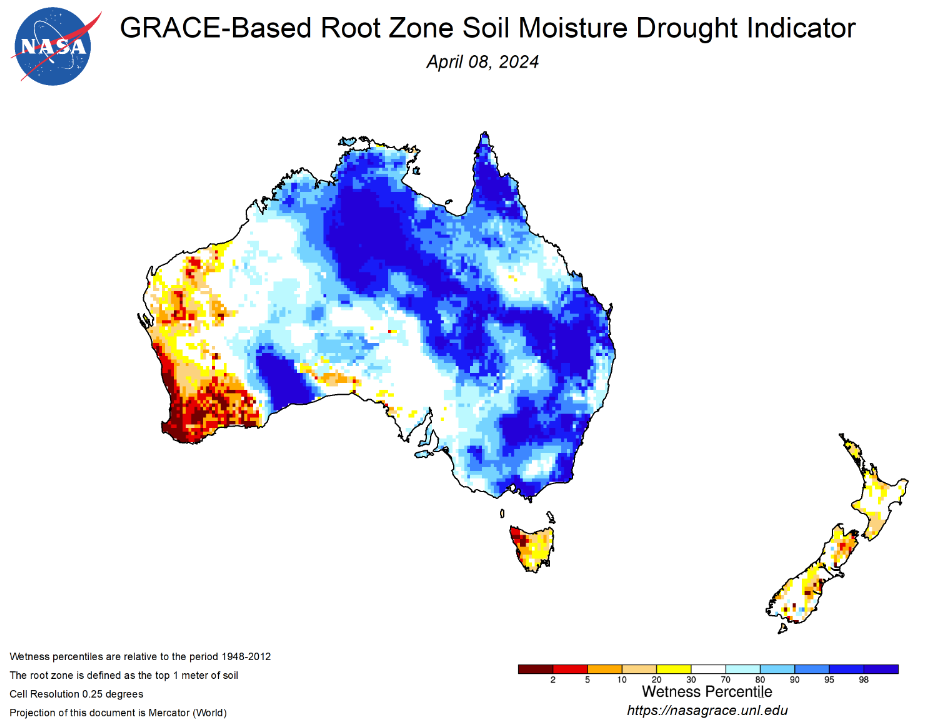

EU rapeseed crop is mostly winter planted and is currently flowering and will be ready for harvest in June/July. Weather is mixed and harvested area is set to be down over last year in the EU. For Australia, the crop is being planted right now. Weather in Australia is a mixed bag as well. Will share some maps for reference. Western regions (where around 50% of the crop is produced) headed into the season with lower than normal rainfall.

Australian Planted Area Estimates – Sourced From USDA FAS Australian Oilseeds Report

Australian Export Destinations – Sourced From USDA FAS Australian Oilseeds Report

EU Crush Capacity – Sourced From USDA FAS EU27 Oilseeds Report

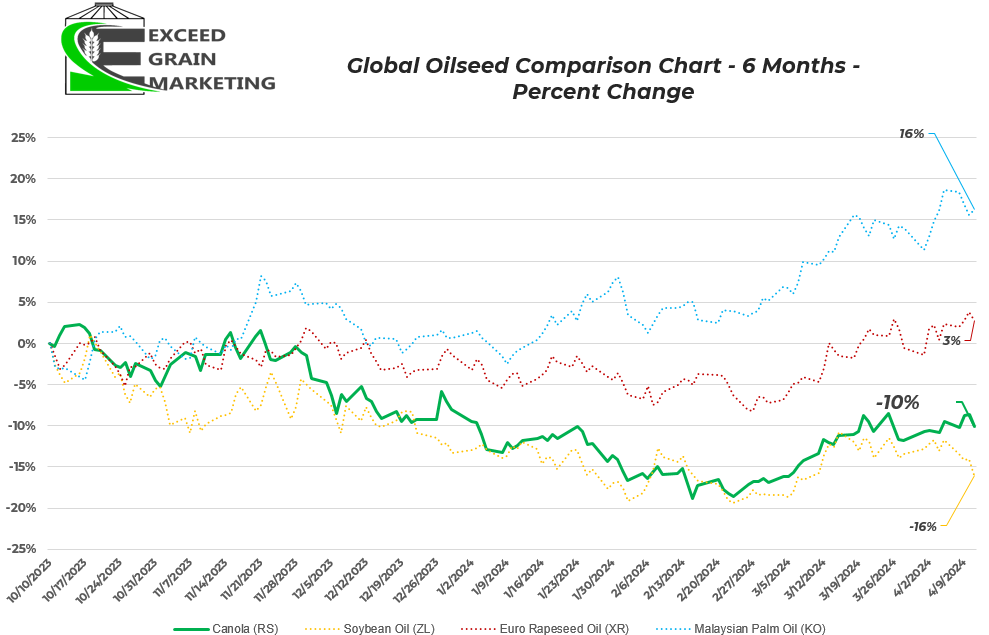

Taking a look at the chart above, Canola has fell 10% from the beginning of October. Soybean oil down 16%. European Rapeseed and Malaysian Palm Oil futures have been faring quite well as the brunt of the damage has been felt within the North American marketplace. Malaysian Palm Oil has went on a very strong run in the same timeframe.

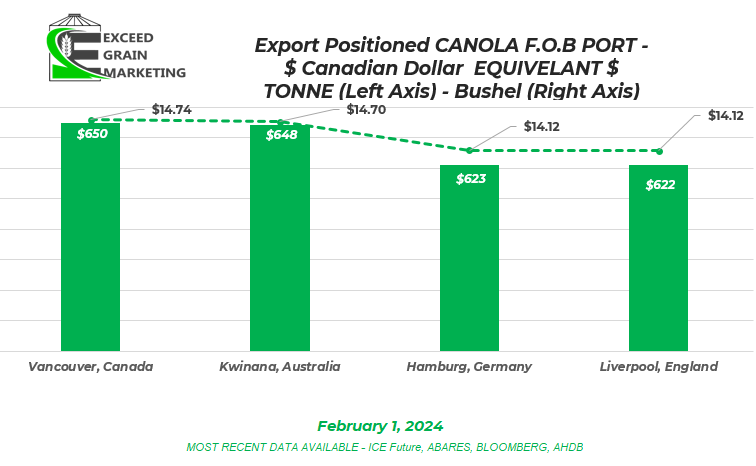

When compared to Canada, Australian canola typically has a freight advantage into Asia vs Canada due to a bit shorter ocean freight, only about $10 per metric tonne although. Canadian canola was often holding a $75 – $100 per tonne premium to Australian canola. Australia keeps the $10 per tonne freight advantage to Canada and the export prices, one needs to read between the lines somewhat. At one point in February, Canadian canola was some of the cheapest export Canola globally, although that has seemed to have been at a short blip when prices were at their lowest.

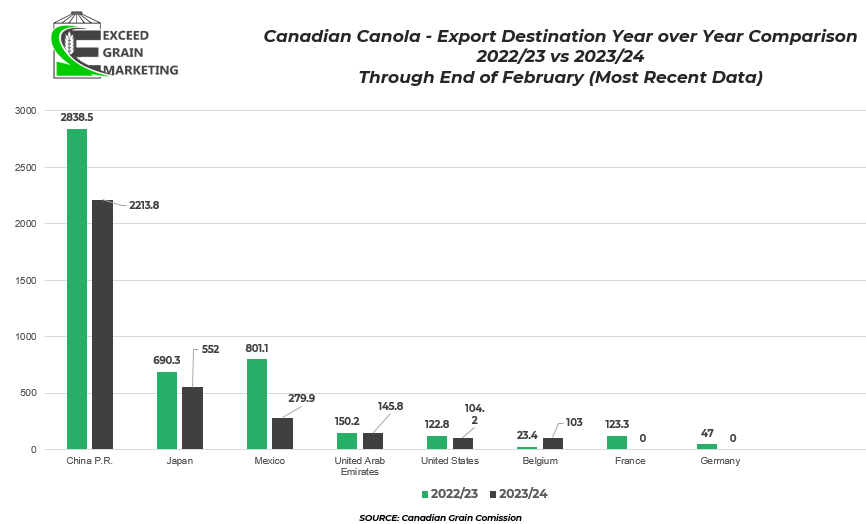

Some Export Charts Below highlighting 2022/23 export Destinations and 2023/24 export destinations so far. We have some fairly delayed data in Canada and most recent full monthly data available is for the end of February. We have weekly CGC data but it does not break it out as nice as the monthly data does. Lastly, a comparison chart from August to February for this marketing year and the previous marketing year. Canadian exporters have missed out so far on all European business with the exception of a few ships into Belgium EU has been getting cheaper eastern European and Australian rapeseed and the German / EU Crop crop was of decent quantity this year as well.

China Mexico and Japan, Our top three importers have took less canola to date for the first few months of the marketing year. Pakistan has been absent from the market so far.

2024 Planting Intentions From Canadian Producers

Crush Pace is running an excellent figure. Crush is currently at a record pace and is taking care of some of the missed exports so far.

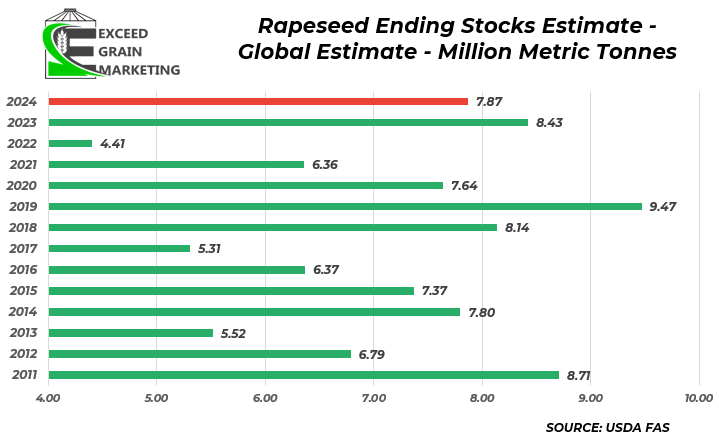

Global Rapeseed Ending Stocks expected to come in slightly below last years figures. Essentially 1 mmt more usage from last year and smaller net production from some of the other smaller rapeseed producers globally will result in the lower ending stocks. Part of the drop, although they still produced a large crop, Australian production falling nearly 3mmt year over year.

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content of our reports for making financial decisions without such professional advice is at the sole risk of the user.