Wheat Market Supply and Demand

Each day, our team of experts meticulously analyze the latest market fundamental data, giving you a comprehensive understanding of the intricacies of the market. Whether you’re a farmer, investor, or industry stakeholder, our insights are designed to guide your decisions, helping you navigate challenges and capitalize on opportunities. Stay informed, stay ahead, and transform the way you engage with the agricultural market.

Global Wheat Market – Supply and Demand Profile

February 21, 2024

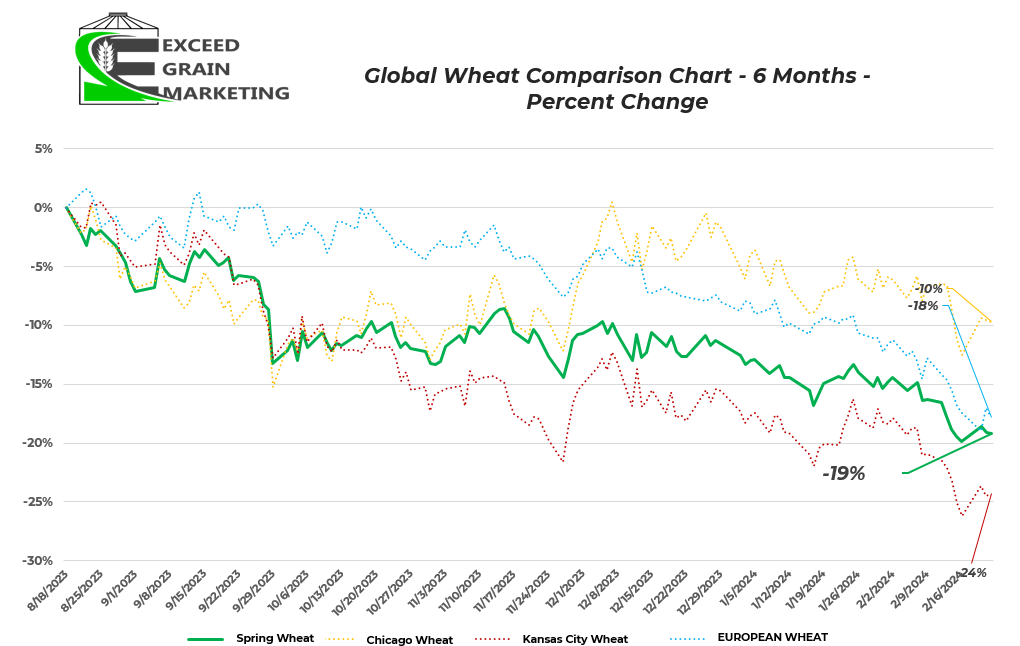

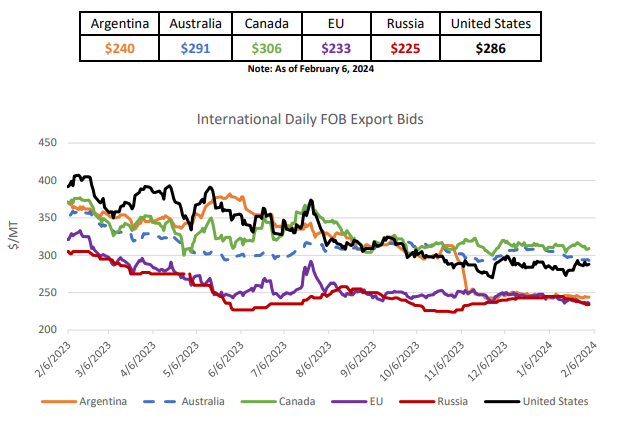

Global wheat bids remain soft amidst softening values in North American futures. EU wheat values remain soft. Markets down around 20% on the futures in the past 6 months. Basis levels domestically were helping keep milling wheat well supported earlier in the year but we have seen basis domestically widen out.

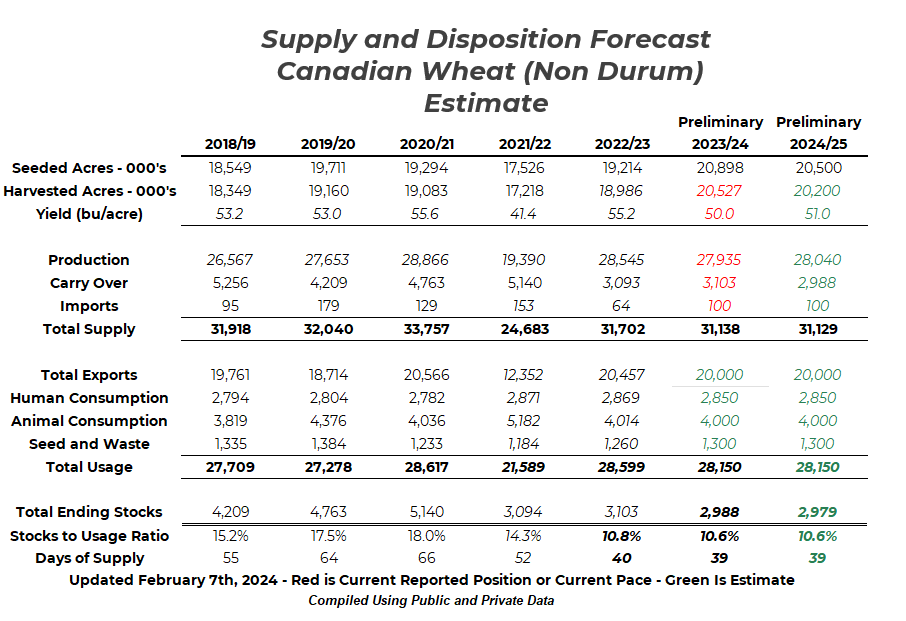

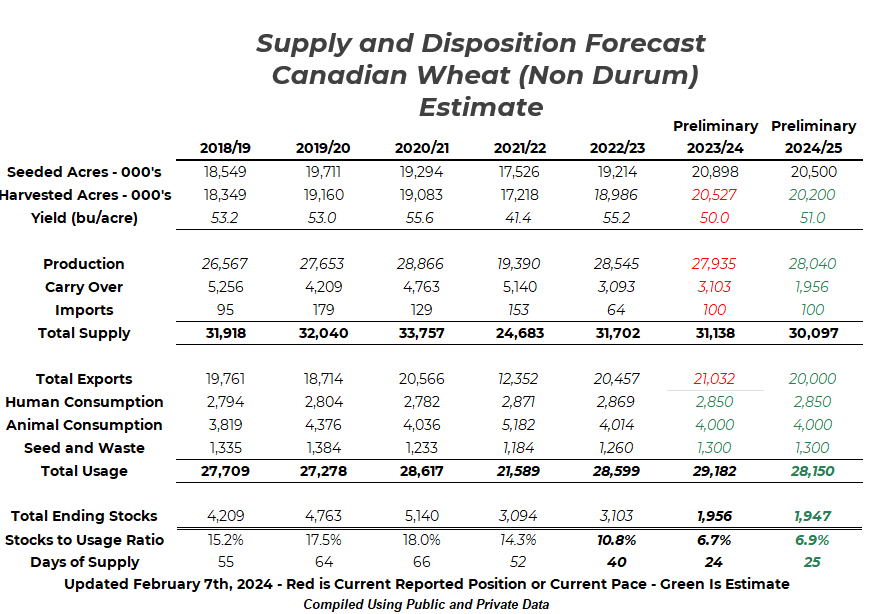

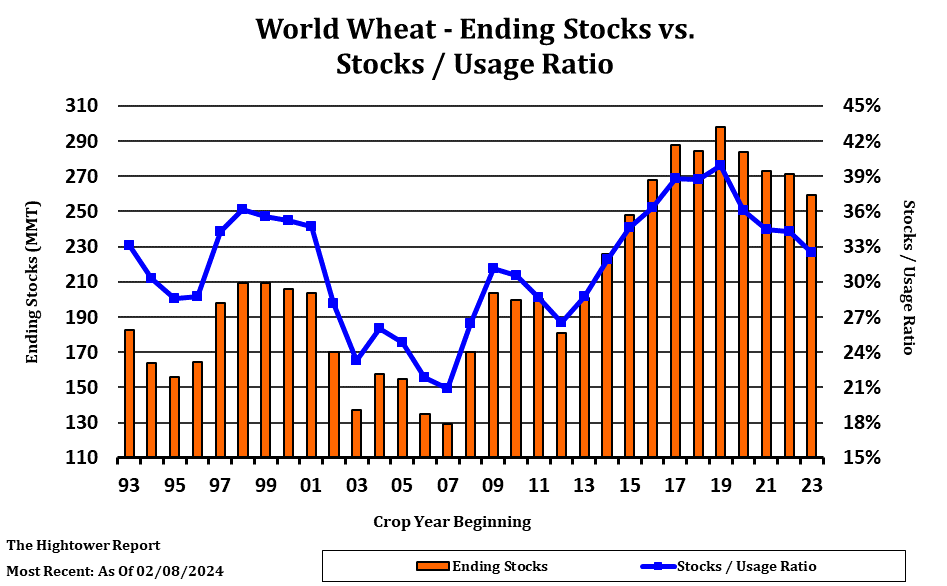

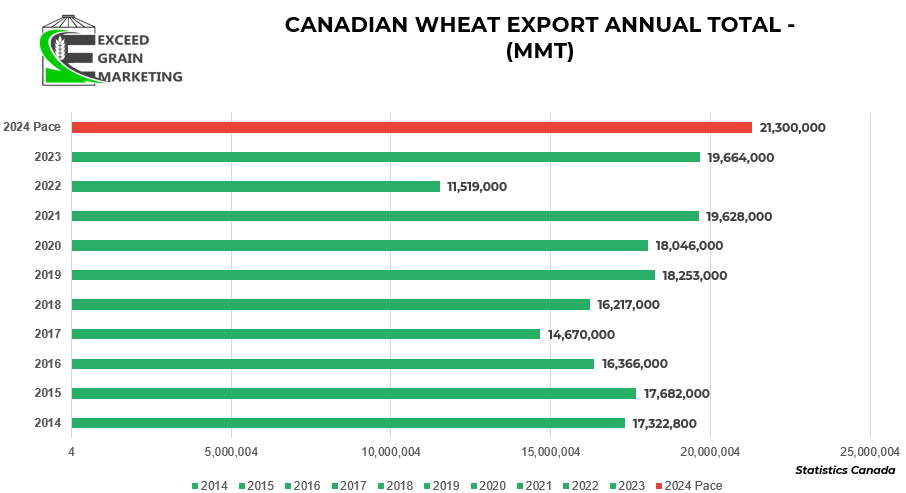

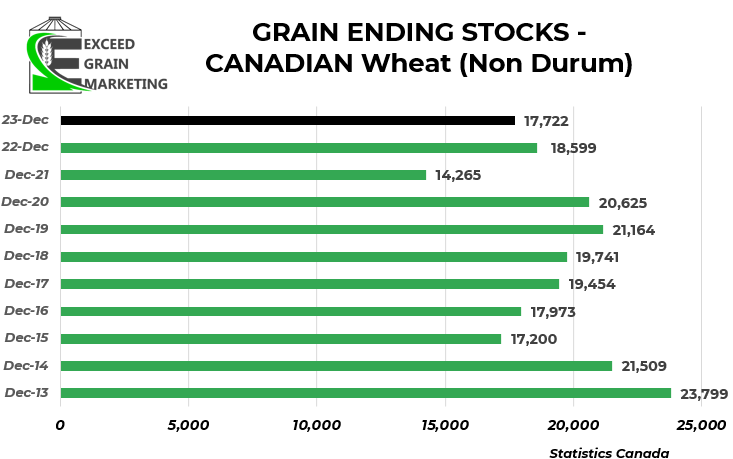

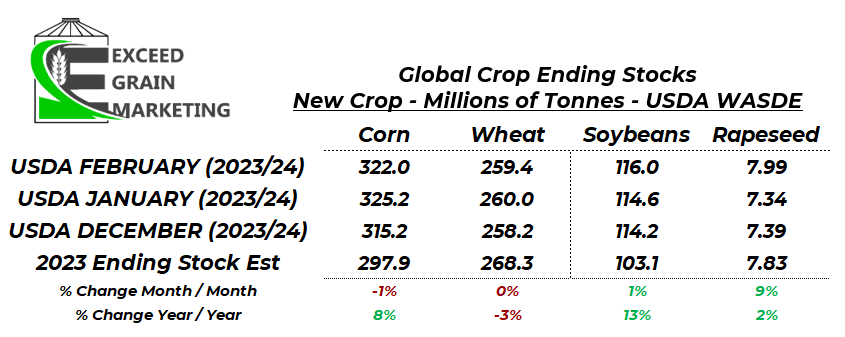

When we take a look at the Supply and Demand estimates listed below, it appears we are headed for a tight carryout for Canadian wheat supply. We are on pace for a record export year for wheat and could be headed for one of the tightest carryout’s of wheat domestically since about 2015 and the same thing for global wheat. At the current pace it appears exports will need to be rationed as 4 mmt is considered a relatively tight carryout for wheat and exporting towards a sub 2 million carryout likely would be hard to make work. Global Carryout’s are likely to reach a 9 year low, the tightest levels since 2015. Charts Below.

Aside from 2021, Most recent December stocks were tightest in about 9 years within Canada.

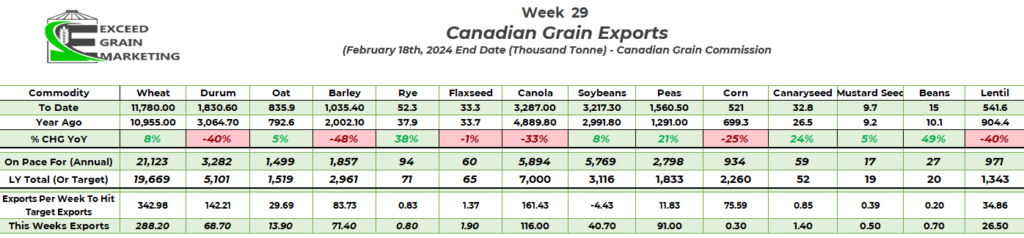

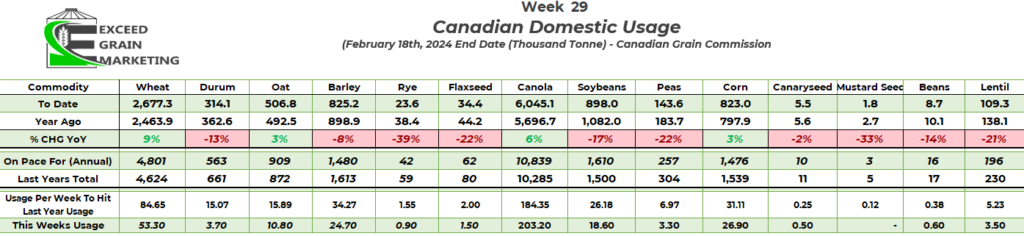

Most recent Canadian export pace highlights that domestic usage and exports well above last year. Paints the Narrative for good and tight carryout. Now just because there is a tight carryout does not exactly mean one should prepare for a strong rally. The globe has shown itself to be full of cheap sellers recently who just want to move grain (Black Sea). Another thing to keep in mind is Canadian wheat will command a different market than say most Black Sea or European wheats. Canadian wheat is generally of higher protein and can be used for higher quality baking characteristics or blended into a lower quality wheat to stretch the bushels.

As mentioned above, Canada commands a premium for its export wheat, we need to be careful as that premium can erode on us and we fit into less markets at the price point we are in.

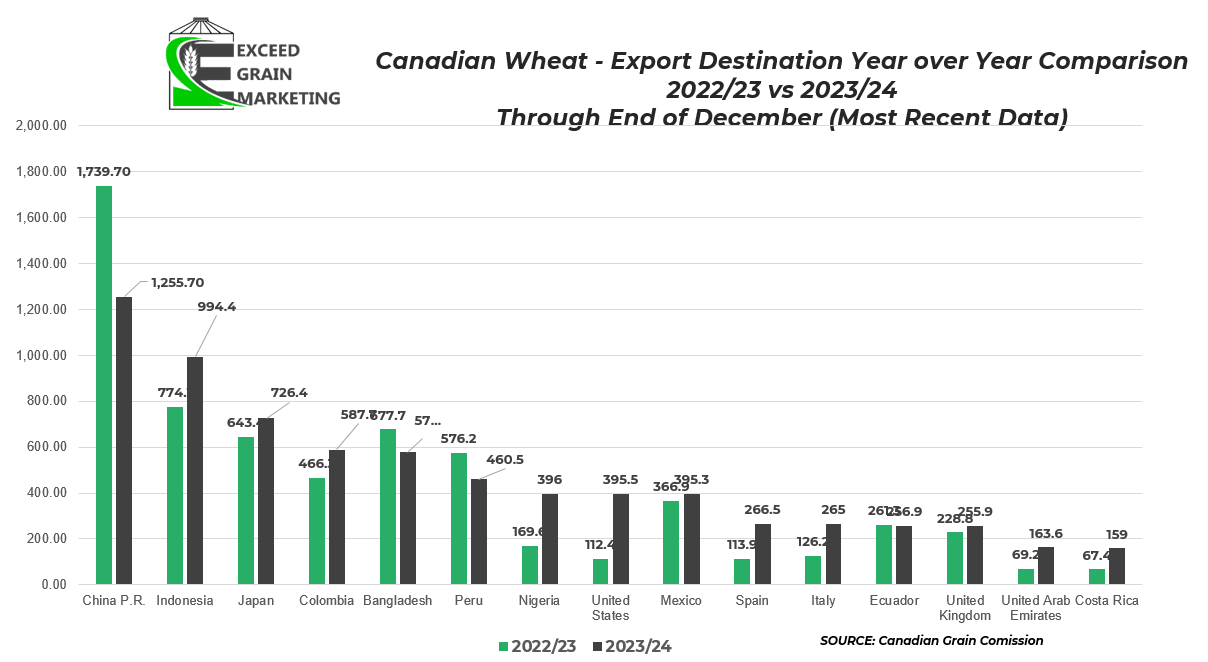

Some Export Charts Below highlighting 2022/23 export Destinations and 2023/24 export destinations so far. We have some fairly delayed data in Canada and most recent full monthly data available is for the end of December. We have weekly CGC data but it does not break it out as nice as the monthly data does.

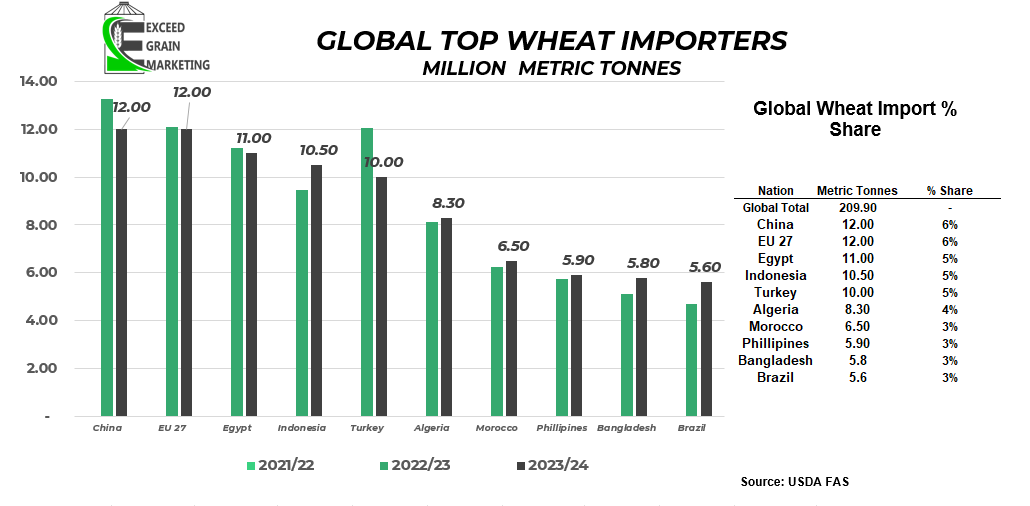

We are lagging in sales to China right now for our wheat but picked up some solid ground into other Asian nations such as Indonesia and Japan.

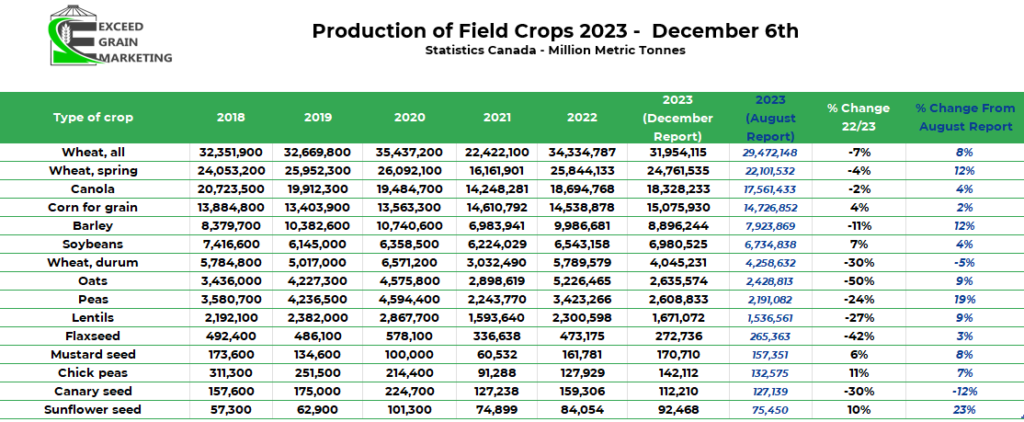

Production of Field Crops as of December 6th

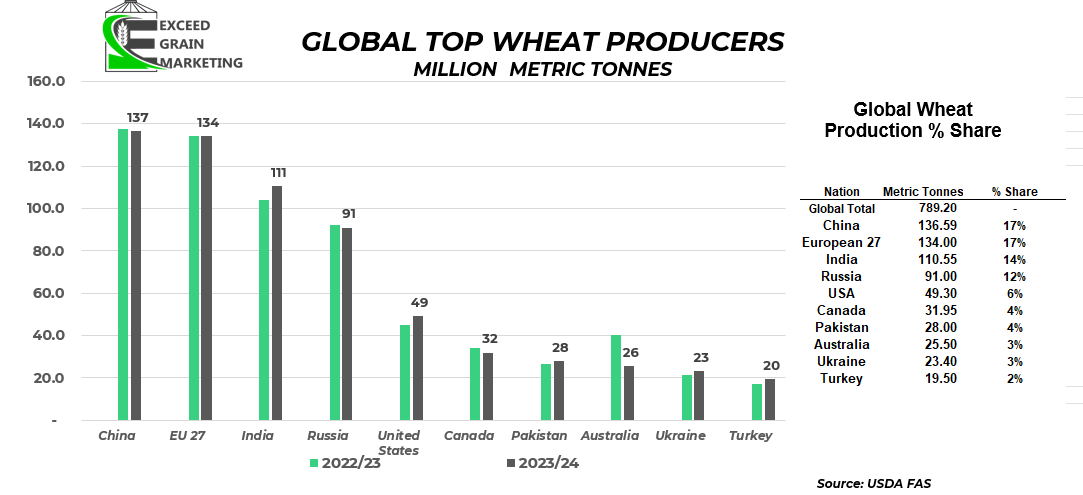

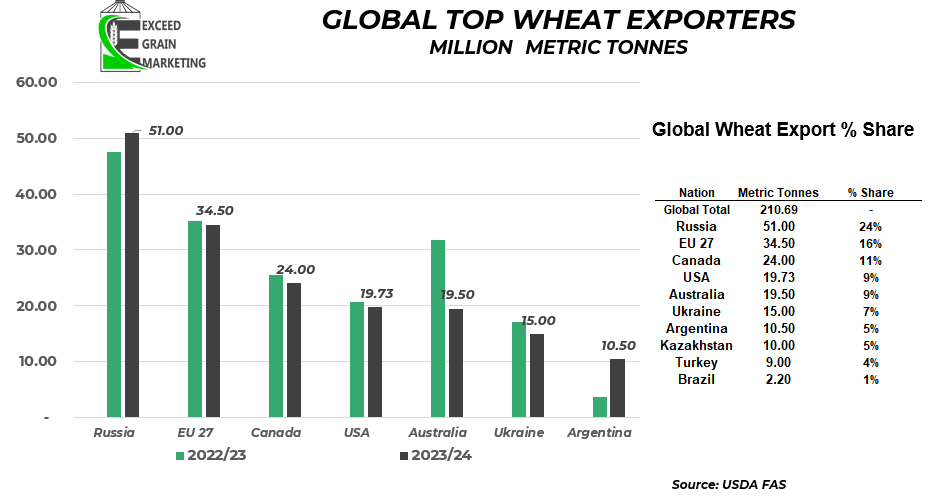

Some Charts Highlighting the Top Global Wheat Producers, Importers and Exporters

USDA Figures for the latest WASDE REPORT. Next WASDE our March 8th

Our market intelligence reports incorporate information obtained from various third-party sources, government publications, and other outlets. While we endeavor to maintain the highest standards of accuracy and integrity in our reports, we acknowledge that the information provided may contain inadvertent errors or omissions. As such, we accept no liability for any inaccuracies or missing information in the data presented. Furthermore, these reports are not intended to serve as standalone investment or financial advice. We strongly advise that any financial or investment decisions be made in consultation with a professional market advisor. Reliance on the content of our reports for making financial decisions without such professional advice is at the sole risk of the user.